JHVEPhoto

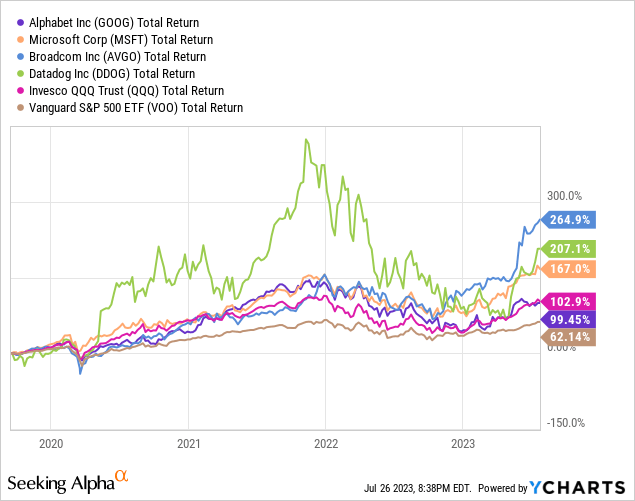

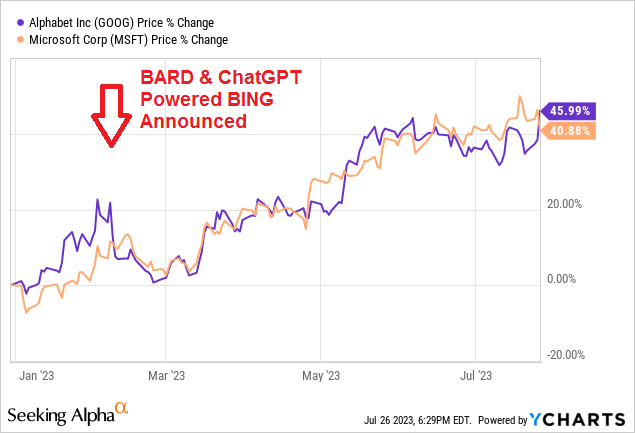

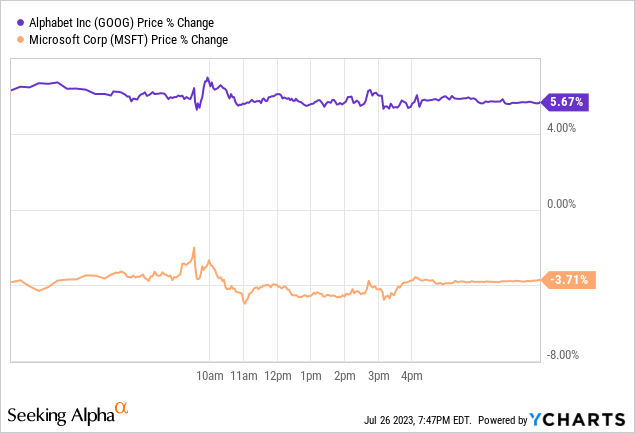

Again in February, Microsoft (MSFT) introduced the supply of a brand new AI powered BING and Edge browser by integrating the identical expertise underpinning ChatGPT. That was solely a day after Google (NASDAQ:GOOG) (NASDAQ:GOOGL) had introduced its AI chatbot BARD. By observing the favored commentary put forth by monetary and expertise sector analysts (together with some on Searching for Alpha), you’ll have thought MSFT’s announcement meant the top of Google Search. Certainly, GOOG inventory suffered a extreme sell-off (see chart under), dropping ~18% over the following two weeks. Nevertheless, I reminded my followers in feedback and discussions that Google had been engaged on AI for a few years and was arguably a frontrunner within the subject – if not the chief. I additionally suggested them to purchase extra shares in GOOG when it dropped into the low $90s (as I did). That being the case, I used to be not shocked within the least when Google introduced robust Q2 earnings this week and truly generated $2 billion extra in quarterly free money stream as in comparison with Microsoft. This text will evaluate the 2 corporations’ newest quarterly outcomes and make some observations in regards to the normal AI/cloud funding thesis going ahead. Meantime, and regardless of all of the headlines MSFT has gotten this 12 months on account of ChatGPT, Google has really outperformed Microsoft by 5% year-to-date:

Searching for Alpha YCharts

Word: within the quarterly comparisons under, and with the intention to cut back confusion, I seek advice from Microsoft’s calendar Q2 as “Q2” regardless that it really corresponds to MSFT’s fiscal This fall FY23 outcomes.

Funding Thesis

As most of you already know, Google is the undisputed chief in search and in addition operates robust promoting segments on YouTube and Google Networks. As well as, Google Cloud is usually thought to be a rising No. Three in that area, trailing solely Amazon’s (AMZN) Internet Service (“AWS”) and Microsoft’s Azure.

Nevertheless, hidden underneath the “Different Bets” has been Google’s AI Lab. In December 2020, I highlighted a significant medical breakthrough by AI Lab’s Deep Thoughts when it cracked the code on the “protein-folding drawback” (see Google’s Subsequent Cease: $2,100). Deep Thoughts made the momentous breakthrough utilizing a neural-network based mostly algorithm referred to as Alpha Fold. On the time, the invention was thought of to be a significant breakthrough – one which evolutionary biologist Andrei Lupus instructed Nature was:

… a recreation changer. This can change medication. It would change analysis. It would change bioengineering. It would change all the pieces.

Keep in mind, this was virtually three years in the past. So, clearly GOOG had robust AI experience and solely a idiot would suppose the corporate was not leveraging that experience all through its operations – together with its largest phase: Search, and its quickest rising phase Google Cloud.

Anecdotally, I’ve a number of pals which have performed round with ChatGPT, and had been, typically, very impressed. Nevertheless, after I requested them in the event that they had been altering the search engine on their browser to BING, each considered one of them stated one thing alongside the traces of “no means, I like Google!”

With that as background, let’s check out the Q2 outcomes of Google (OK, technically it is actually “Alphabet,” however I am old-school and can name the corporate “Google” all through this text) and Microsoft and draw some conclusions.

Earnings

Google launched its Q2 earnings report after the market closed on Tuesday, and it was a humdinger. Highlights on the highest line:

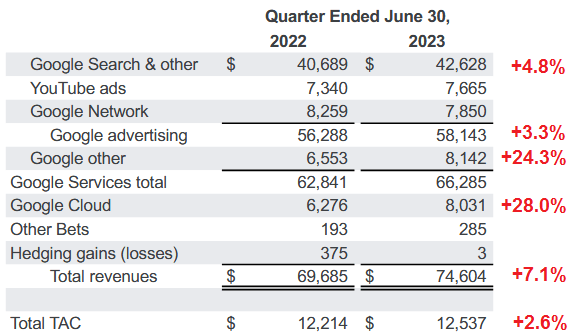

Alphabet

As could be seen within the graphic, Google Search income grew 4.8% year-over-year, which can not appear that spectacular – but it surely was a lot better than anticipated and demonstrated an precise acceleration of development. Google “Different” income grew a whopping 24.3% year-over-year and was a nice shock for shareholders.

Google Cloud continued its robust momentum by rising income 28% yoy, a close to doubling of Cloud income over simply the previous two years. On the Q2 convention name, Google CEO Sundar Pichai commented on how integrating AI into Google Cloud is driving that enterprise:

Our AI-optimized infrastructure is a number one platform for coaching and serving generative AI fashions. Greater than 70% of gen AI unicorns are Google Cloud clients, together with Cohere, Jasper, Typeface and lots of extra. We offer the widest alternative of AI supercomputer choices with Google TPUs and superior NVIDIA (NVDA) GPUs, and lately launched new A3 AI supercomputers powered by Nvidia’s H100. This permits clients like AppLovin to realize practically two occasions higher worth efficiency than trade alternate options.

Our new generative AI choices are increasing our whole addressable market and successful new clients. We’re seeing robust demand for the greater than 80 fashions, together with third-party and widespread open supply in our Vertex, Search and Conversational AI platforms with quite a lot of clients rising greater than 15x from April to June. Amongst them, Priceline is bettering journey planning capabilities. Carrefour is creating full advertising and marketing campaigns in a matter of minutes. And Capgemini is constructing tons of of use circumstances to streamline time-consuming enterprise processes. Our new anti-money laundering AI helps banks like HSBC determine monetary crime threat. And our new AI-powered Goal and Lead identification suite is being utilized at Cerevel to assist allow drug discovery.

I apologize for the relatively lengthy quote from the convention name, but it surely’s essential for traders to know the dynamics driving Google’s Gen-AI/Cloud enterprise going ahead. Certainly, because the feedback above confirmed, Google is leveraging its AI experience now.

Meantime, visitors acquisition prices (“TAC”) grew solely 2.6% yoy in Q2. TAC refers to funds GOOG makes to associates to direct visitors to the corporate. To place TAC into perspective, GOOG’s Q2 TAC grew solely $323 million yoy whereas top-line whole income grew by $4.9 billion yoy: Not too shabby.

Total, top-line income of $74.6 billion (+7.1 yoy) beat consensus estimates by $1.84 billion. On the underside line, GOOG delivered GAAP earnings of $1.44/share – which was a $0.10 beat.

Higher nonetheless, GOOG’s free money stream era in Q2 was very robust: $21.78 billion, or 29.2% of whole income. That compares to FCF of $12.59 billion in Q2 of final 12 months, which was 18.1% of whole income. The purpose is that this: Google is turning into a way more environment friendly firm at turning income into free money stream.

Wanting additional via the report – and as I’ve been declaring for years on Searching for Alpha – Google maintains a large money hoard. That enormous money place enabled GOOG to earn curiosity earnings of a whopping $892 million in the course of the quarter – up from $486 million in final 12 months’s Q2. Word that GOOG ended the quarter with $118.Three billion in money, money equivalents, and marketable securities. That is an estimated $9.24/share in money based mostly on the typical of 12.764 million shares excellent on the finish of the quarter (-3.8% yoy). Additional, GOOG’s money place is up $5.Four billion since Dec. 31, 2022, regardless of spending $29.5 billion in share repurchases to date this 12 months.

Curiosity Charges: The Finest Of Each Worlds

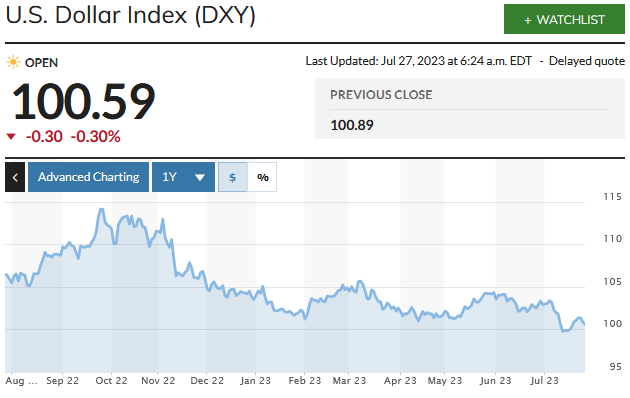

That enormous money place means GOOG is definitely a beneficiary of rising rates of interest – and the Federal Reserve elevated the Fed Funds fee by one other 0.25% simply this week. Nevertheless, traders ought to perceive that, regardless of the Fed’s fee will increase, the U.S. greenback has really been on a downward pattern since final fall:

MarketWatch

The purpose right here is that from an rate of interest standpoint, Google is benefiting from the most effective of each worlds: Comparatively excessive rates of interest permits it to obtain robust curiosity earnings on its massive money place, whereas the falling U.S. greenback is eradicating the extreme overseas change headwind that it confronted for many of final 12 months – an FX headwind that was one massive motive for the 2022 bear-market in expertise shares.

Microsoft

Now let’s evaluate Google’s outcomes to Microsoft’s This fall FY23 outcomes, highlights of which had been:

- Income was $56.2 billion, +8.3% yoy and a $710 million beat.

- Diluted EPS was $2.69 (+21% yoy) and a $0.14 beat.

- Azure and different cloud providers income development was 26%.

- Total, “Clever Cloud” Phase income grew $3.2 billion, or 15% yoy.

Total, Microsoft’s prime and backside line development was a bit stronger than Google.

And, like Google, Microsoft is also money wealthy and ended the quarter with $111.262 billion in money, money equivalents, and marketable securities. That is an estimated $14.90/share based mostly on the typical excellent shares of seven.467 billion on the finish of the quarter. Consequently, MSFT is also benefiting from greater rates of interest and a decline within the FX headwind that has negatively impacted its top- and bottom-line outcomes final 12 months.

Within the This fall presentation, Microsoft reported it generated $19.Eight billion of free money stream (see slide 5). That was +12% yoy and equated to 35.2% of whole income. Compared, Google grew its FCF by 73% yoy and its FCF margin in Q2 was 29.2%.

Microsoft spent $5.7 billion on share repurchases in the course of the quarter. Nevertheless – and in contrast to Google – MSFT’s buybacks are barely maintaining with dilution through worker inventory grants. I say that as a result of Microsoft’s common excellent share depend solely shrank by an estimated 0.5% over the previous 12 months whereas GOOG’s common share depend was down by 3.8%.

Each corporations carried out very properly in the course of the quarter. Nevertheless, as talked about earlier, the favored narrative set expectations very excessive for Microsoft and fairly low for Google. Consequently, Microsoft’s outcomes – regardless of being a beat on each the highest and backside traces – was considerably of a disappointment as in comparison with overly optimistic “whisper numbers.” Meantime, Google outperformed expectations and shocked analysts to the upside. That being the case, the shares moved in reverse instructions Wednesday:

Valuation

The next chart compares Google and Microsoft on a number of valuation metrics:

|

TTM P/E |

Fwd P/E |

Q2 FCF |

Q2 FCF Margin |

Yield | |

| GOOG | 29.5x | 22.9x | $21.Eight billion | 29.2% | N/A |

| MSFT | 36.6x | 31.9x | $19.Eight billion | 35.2% | 0.78% |

Clearly, Microsoft presently instructions a premium valuation as in comparison with Google and I suppose an additional 6 share factors of FCF margin is value a better valuation. One additionally may argue that MSFT’s subscription-based mannequin deserves a premium vs. GOOG’s promoting centric enterprise. However is it value a 20% greater valuation on a TTM foundation and a ~30% premium on a ahead P/E foundation? That is not as clear to me – particularly contemplating that GOOG’s share repurchase plan is having a way more vital influence on decreasing its excellent share depend as in comparison with Microsoft’s (-3.8% versus -0.5% on a yoy foundation). As well as, Google administration undoubtedly bought the message with regards to boosting its general effectivity: FCF margin elevated 11 full share factors (29.2% vs. 18.1% on a yoy foundation).

Observations

Going ahead, each corporations might be beneficiaries of AI: Each of their base companies and within the development of their cloud companies. We’ve not heard from Amazon but, however one message traders ought to obtain from Google and Microsoft’s Q2 earnings report is that migration to the cloud continues to be strong – and that is more likely to proceed for the foreseeable future. I say that as a result of AI is comparatively ineffective with out massive language fashions (“LLMs”) and mega knowledge units to run the AI algorithms on – and all that info might want to reside on the cloud. That being the case, any firm desirous to get the total advantages of AI must migrate their firm’s databases to the cloud. Consequently, count on Amazon, Microsoft, and Google to proceed robust momentum of their cloud choices for years to return – and for them to additional combine AI instruments into these cloud companies.

Abstract and Conclusions

Each Google and Microsoft delivered robust Q2 outcomes. Nevertheless, as a consequence of a little bit of AI/ChatGPT-based over enthusiasm, MSFT’s inventory and valuation had run too far too quick and expectations for the quarter had been very excessive. Then again, expectations for Google had been low, and the corporate considerably cleared the low bar that had been set for it.

Backside line: Google is without doubt one of the greatest expertise corporations on the planet, generates tons of FCF, and is excellently positioned to leverage AI in each its Search and Cloud companies. Certainly, as proven earlier – Google is also leveraging AI.

GOOG is a Purchase and ought to be thought of a core long-term expertise holding inside a well-diversified portfolio. The identical could be stated about Microsoft, though – in my view – at the moment GOOG seems to be the higher worth.

As well as, the bullish funding thesis in AI/cloud can also be relevant to corporations like Broadcom (AVGO) and DataDog (DDOG). Broadcom makes the very best efficiency networking tools on the planet (i.e. excessive bandwidth, low latency) that is required to rapidly transfer enormous volumes of knowledge to/from the cloud. Broadcom inventory is +61% this 12 months. DataDog focuses on knowledge aggregation, monitoring, and analytics. DDOG shares is +24.7% since my Purchase advice in February (see Datadog And a pair of Different Certain-Hearth Winners In The AI Arms Race).

I will finish with a five-year whole returns chart evaluating the 4 corporations mentioned on this article as in comparison with the broad market averages as represented by the Invesco Nasdaq-100 Belief (QQQ) and the Vanguard S&P 500 ETF (VOO) and be aware that – in my view – we’re nonetheless within the very early innings of each the cloud and AI: