joecicak/iStock through Getty Photographs

Introduction

Zynex (NASDAQ:ZYXI), a Nevada-based company, is the father or mother firm of varied energetic and inactive subsidiaries. The important thing energetic subsidiaries embody Zynex Medical, Inc. (ZMI) and Zynex Monitoring Options, Inc. (ZMS), each primarily based in Colorado. ZMI designs, manufactures, and markets medical units for continual and acute ache administration, as nicely as muscle rehabilitation utilizing electrical stimulation, with NexWave as their main product. ZMS, alternatively, develops non-invasive affected person monitoring units, notably the CM-1500 monitoring system and the upcoming CM-1600. In 2021, Zynex acquired Kestrel Labs, integrating its noninvasive affected person monitoring know-how into ZMS. ZMI at the moment drives many of the firm’s income.

Latest developments: Zynex has acquired FDA clearance for its non-invasive, wi-fi fluid quantity monitoring gadget, the CM-1600, and plans to hunt FDA approval for a laser-based pulse oximeter within the fourth quarter of the yr. Moreover, Zynex has efficiently priced a non-public providing of $52.5M price of 5% convertible senior notes due 2026. In a transfer that led to an roughly 8% improve in inventory worth, Zynex’s board permitted a $10M widespread inventory buyback program.

Q1 2023 Earnings

Within the first quarter of 2023, Zynex reported a 36% year-over-year improve in income, reaching $42.2 million. The corporate additionally noticed a 14% year-over-year improve in internet revenue, amounting to $1.6 million. The quarter marked the very best variety of orders within the firm’s historical past for the fourth consecutive time, with a 61% year-over-year improve. Zynex’s working capital stood at $44.1 million as of March 31, 2023, and money readily available amounted to $16.Eight million. The corporate generated $1.9 million in money from operations, a 10% improve from the primary quarter of 2022. Zynex additionally repurchased $3.Four million of its widespread inventory in the course of the quarter.

For the total yr 2023, the corporate reiterates its steerage of income between $180 – $200 million and EPS between $0.40 – $0.50. The second quarter orders elevated by 51% from 2022, and the corporate confirms its estimates for Q2 income of $43.5 – $45.5 million.

ZYXI Inventory Evaluation

Per Searching for Alpha knowledge, ZYXI demonstrates sturdy profitability and progress potential. The corporate has a formidable gross revenue margin of almost 80% and a considerable return on fairness of 24.58%. The agency additionally boasts a internet revenue margin of 10.19%, indicating environment friendly value management. Income progress is regular, with YoY progress of 23.31% and a three-year CAGR of 48.67%. This stable progress efficiency is projected to proceed, with anticipated YoY gross sales progress of over 21% till 2025.

Nonetheless, Zynex’s earnings per share [EPS] estimates reveal a possible space of concern. The YoY EPS exhibits a decline of -4.83%, however projections point out a restoration, with a 52.59% improve by 2024 and an extra 31.80% improve by 2025. Nonetheless, the agency’s valuation could also be thought of excessive, with a ahead non-GAAP P/E of 20.69 and an EV/EBITDA of 13.98.

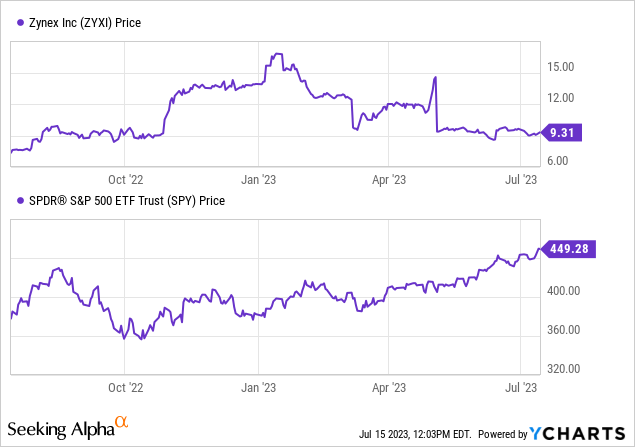

Zynex’s inventory has been underperforming within the quick time period, down 22.03% within the final three months and 44.58% up to now six months. However, it is proven optimistic momentum over the previous yr, up by 26.49%.

The corporate’s capital construction is price watching with a complete debt of $24.37M and money readily available of $16.79M (values are previous to convertible notice providing), resulting in an enterprise worth of $343.36M.

Brief curiosity in Zynex is excessive at 27.75%, which might point out a possible threat of a brief squeeze, however it’s considerably offset by an Altman Z Rating of seven.88, suggesting the corporate isn’t at the moment susceptible to chapter.

Zynex Raises ~$50 Million in Convertible Notes Providing for Strategic Development

Zynex lately accomplished a non-public providing of convertible notes, elevating roughly $50.Zero million. If the preliminary purchaser workout routines its possibility to purchase further notes, this quantity might attain $57.2 million. The corporate intends to allocate round $8.5 million from this funding to repay its current time period mortgage of $16.Zero million, which is able to support in decreasing its present debt burden.

The remaining funds shall be utilized for common company functions and to help working capital. This strategic choice is important for Zynex as it should improve its money reserves. We had beforehand recognized the corporate’s modest money readily available as a priority. By repaying a portion of the time period mortgage, Zynex will lower its curiosity bills, thereby positively impacting its total monetary efficiency. Furthermore, using the proceeds for working capital will present the corporate with further assets for its day-to-day operations, an important side of its ongoing progress technique.

However, you will need to contemplate that convertible notes could contribute to potential dilution sooner or later. Upon conversion into fairness, the variety of excellent shares will improve, probably diluting the worth of current shares. Traders ought to stay aware of this chance when evaluating Zynex. General, this motion displays Zynex’s proactive strategy to managing its stability sheet, strengthening its monetary place, and supporting its progress targets.

Zynex’s Technique for Development

Zynex is at the moment pursuing the ache administration market, experiencing a considerable year-over-year income improve of 36% on this division in the course of the latest quarter. The corporate attributes this progress to the constant and worthwhile efficiency of its increasing gross sales crew.

Methods for progress embody enhancing gross sales productiveness, which they’ve already seen a rise of 24% on a per-rep annualized foundation over the primary quarter of 2022. Zynex has centered on integrating new hires extra rapidly into the group and optimizing efficiency via an applied gross sales administration construction. Regardless of going through labor market challenges, the corporate is dedicated to recruiting and retaining a high-quality gross sales and company crew.

Zynex can be increasing into further gross sales territories, aiming to achieve round 525 to 550 gross sales representatives by the tip of the yr to capitalize on the rising orders. Its potential to work with all payer varieties and insurance coverage suppliers, processing all orders it receives and dealing straight with sufferers and their insurers, is seen as a key differentiator from opponents.

Zynex anticipates one other worthwhile yr for the ache administration division and plans to offer updates on its market expansions in future calls.

My Evaluation & Advice

In conclusion, Zynex demonstrates sturdy progress and profitability, significantly in its ache administration division. The corporate’s spectacular gross revenue margin, substantial return on fairness, and constant income progress point out a stable market place and operational effectivity. The agency’s ongoing enlargement of its gross sales crew and deal with bettering gross sales productiveness additional emphasize its strong progress technique.

Nonetheless, there are some issues to contemplate concerning Zynex’s monetary place and inventory efficiency. Whereas the corporate has managed to keep away from speedy dilution, its restricted money reserves and rising debt burden increase potential vulnerability, particularly throughout an financial downturn. From my perspective, Zynex may very well be seen as a “home of playing cards” within the sense that any financial hardship might considerably impression its monetary stability. Moreover, the excessive quick curiosity in Zynex could replicate market skepticism, presumably attributable to its comparatively excessive valuation and up to date underperformance.

Regardless of these issues, Zynex’s sturdy progress technique, dedication to operational effectivity, and increasing market presence point out a promising outlook. Subsequently, as an investor, I’d advocate sustaining a ‘Maintain’ place on Zynex. Whereas legitimate issues exist concerning monetary stability and inventory efficiency, the corporate’s progress trajectory and potential profitability present a counterbalance, making it worthwhile to observe intently within the close to time period. Continuous and cautious monitoring of efficiency shall be essential for adjusting the funding technique accordingly.