Tim Boyle

In March, I asserted that Hanesbrands (NYSE:HBI) had issues however that they’re fixable, whereas in June I adopted up on the title noting that whereas there have been some inexperienced shoots of enchancment, that its points received’t be mounted in a single day. The inventory is up modestly since my unique write-up and up over 16% since my most-recent write-up. Let’s catch-up on the title.

Firm Profile

As a refresher, HBI is an attire firm identified for its Hanes branded undergarments in addition to its Champion branded activewear. The corporate owns a number of manufacturers however these two are its largest and most essential. Hanes focuses on important gadgets equivalent to t-shirts and underwear, whereas Champion is most acknowledged for its mesh shorts and observe uniforms.

The overwhelming majority of HBI’s merchandise are offered via the wholesale retail channel, with below 20% of its gross sales coming from the DTC channel. The corporate manufactures over 70% of the attire it sells at its personal services or devoted contractors.

Q2 Progress

As a reminder, HBI acquired in bother final 12 months when it didn’t determine that wholesalers had been stocking up on stock resulting from earlier provide chain points associated to Covid. This situation definitely wasn’t distinctive to HBI, and even this previous quarter photo voltaic inverter firm SolarEdge (SEDG) noticed this situation hit it. Whereas this situation was fairly prevalent within the attire house final 12 months, HBI’s vertically built-in mannequin the place is runs its personal manufacturing crops, led to extra ache than most within the house.

Stock has been one of many large points I’ve been monitoring, and on the entrance, the corporate was capable of cut back stock by -12%, or $255 million, 12 months over 12 months and -7% sequentially to $1.84 billion. The corporate is focusing on to have stock right down to $1.5 billion by fiscal 12 months finish.

The Hanes model has clearly been the stronger of HBI’s two manufacturers, with Innerwear gross sales up practically 3% in Q2 to $705.Eight million. Nonetheless, activewear sells fell -19% to $267.5 million, with Champion gross sales down -25% within the U.S. and -15% total in fixed currencies. General gross sales decreased -5%, or -4% in fixed currencies.

At this level, the Champion model is clearly a difficulty and struggling to bounce again. On the decision, CEO Stephen Bratspies mentioned:

“Within the U.S., Champion is just not the place we anticipated it to be at this cut-off date. That is clear in our outcomes and our outlook. And because of this, we’re actively taking steps that we imagine will drive the long-term success of the model. We introduced in new management, which is driving new expertise in design, merchandising and gross sales. We have coordinated and launched our new model function of Champion a greater tomorrow. We have accomplished our first full world product line from the brand new workforce, which is predicated on our disciplined world segmentation method and shall be obtainable for the 2024 fall/winter promoting season. In whole, practically 1/Three of our 2024 product and material platforms shall be world versus zero at present. This can cut back SKU complexity and drive further price financial savings starting subsequent 12 months. … Along with the pure margin restoration we anticipate subsequent 12 months from decrease enter prices and the advantages of utilizing world product platforms, we have additionally taken latest further actions to enhance Champion’s efficiency within the U.S. We shortly opened 7 pop-up Champion shops to maneuver via extra stock in a method that preserves margins and model fairness. We have established partnerships with industry-leading licensees for teenagers attire and outerwear with the potential for added classes. We’re additionally starting to leverage our profitable efficiency within the collegiate channel by utilizing our fast flip graphics capabilities to drive incremental income alternatives in our wholesale enterprise. We’re doing lots to place Champion for achievement. We’re making progress, and we’re persevering with to adapt to the atmosphere. We stay extremely assured within the potential of the model. Nonetheless, we anticipate Champion gross sales within the U.S. to proceed to be pressured all through the remainder of the 12 months.”

Margins continued to be pressured for the corporate however are exhibiting some indicators of restoration. Adjusted gross margins of 33.6% fell by -425 foundation factors 12 months over 12 months however had been up 90bps sequentially. The corporate is projecting that it’ll exit the fiscal 12 months with gross margins within the excessive 30% vary.

HBI’s debt stage is one other situation the corporate is coping with and it ended the quarter with leverage of 5.6x. Decreasing stock helped the corporate generate $88 million in working money move in Q2, and it paid down $100 million in debt within the quarter. HBI remains to be projecting OCF of round $500 million for the 12 months and free money move of $450 million. The corporate plans to pay down $200 million in debt this 12 months.

Trying ahead, the corporate is forecasting gross sales of between $5.8-$5.9 billion, adjusted working revenue of between $425-$475 million, adjusting EPS of between 16-30 cents. For Q3, it’s searching for income to say no by barely lower than -8% with an adjusted working revenue of between $130-150 million.

General, HBI continues to make progress fixing its enterprise by lowering stock and paying down debt. Its Hanes model is doing pretty effectively, whereas it’s actively trying to stabilize its Champion model. This can proceed to take time to play out, however the firm is slowly trending in the proper course.

Activist Investor

Earlier this month, Barrington Capital despatched a letter to the HBI calling for change on the firm, writing:

“We imagine that Hanesbrands at the moment sits at a vital juncture and should instantly deal with money era and debt discount with a view to create long-term worth for shareholders. We imagine that administration’s largely ineffective response to latest market challenges is liable for the Firm’s quickly deteriorating outcomes. Additional, Hanesbrands’ extreme debt burden seems to amplify the influence of poor working efficiency on Hanesbrands’ potential to create worth for shareholders.”

Barrington is trying to improve the corporate’s board, and maybe even implement a brand new CEO. The corporate, not surprisingly, wasn’t very receptive, however did say it was “open-minded.”

Barrington has not disclosed how massive its place is with HBI.

Whereas I don’t suppose Barrington is pushing something that HBI administration doesn’t already know, I do like their presence within the inventory. Matthews Worldwide (MATW) has rebounded strongly this 12 months after Barrington known as them out final December, and I believe HBI has the identical potential.

Valuation

HBI at the moment trades round 11.5x the 2023 consensus EBITDA of $541.7 million and about 8.2x the FY2024 consensus of $719.9 million.

It trades at a ahead PE of 26.2x the 2023 consensus of 21 cents and seven.8x the 2024 consensus of 69 cents.

Income development is anticipated to be -6% this 12 months, after which develop by practically 2% in 2024. Margin enchancment is thus the most important driver of EPS development from 2023 to 2024.

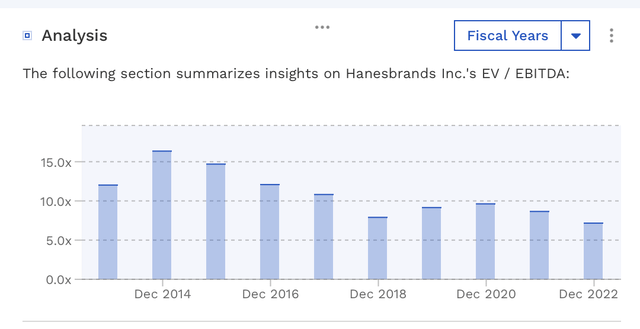

If HBI can cut back its debt by ~$800 million by the tip of 2024, then it could solely be buying and selling at 7.1x 2024 EBITDA, which for a model is fairly enticing. The corporate has typically seen between a 10-12x trailing a number of up to now.

HBI Historic Valuation (FinBox)

Conclusion

There may be nothing at this level that claims that HBI’s points aren’t fixable, and activist investor Barrington seems to agree. Nonetheless, the corporate must proceed to clear up its stock points and cut back debt, as these ought to be its prime priorities.

The Hanes model is in strong form, so I don’t see any situation there. Champion, alternatively, is struggling, and whereas a brand new workforce and initiatives are in place, solely time will inform how profitable they’re. Champion had a resurgence in reputation a number of years in the past, however at this level HBI simply must stabilize the model. A rebound in Champion gross sales isn’t at the moment in 2024 numbers, and would simply be a bonus at this level.

I proceed to fee HBI inventory a “Purchase” for aggressive buyers.