AaronAmat/iStock by way of Getty Pictures

Introduction

Hims & Hers Well being (NYSE:HIMS) is a digitally-native, fully-verticalized telehealth platform that gives customers entry to high-quality medical care.

The corporate’s mission is to assist the world really feel nice by means of the ability of higher well being, by connecting sufferers to a highly-qualified supplier community in addition to enabling entry to therapies for a broad vary of situations primarily within the basic wellness, sexual well being, skincare, and hair care classes.

H&H simply posted Q2 earnings outcomes with a triple beat on analyst estimates. The inventory responded nicely at first, surging 15%+ on the open.

Nevertheless, the inventory turned for the more serious, reversing all its positive factors, and ended the day ~6% within the pink.

Triple beat and but it is down 6%?

That is unjustified.

This text discusses why HIMS inventory is silly whereas H&H, as a enterprise, is much from that. The truth is, it is the exact opposite.

That mentioned, this is the principle takeaway of this text:

Whereas H&H continues to outperform expectations and ship wonderful monetary efficiency, the inventory goes within the different course. This divergence between fundamentals and valuation gives an exquisite alternative for buyers to purchase shares of a fast-growing, high-margin, and well-managed telehealth large within the making.

Progress

Progress has been simply phenomenal.

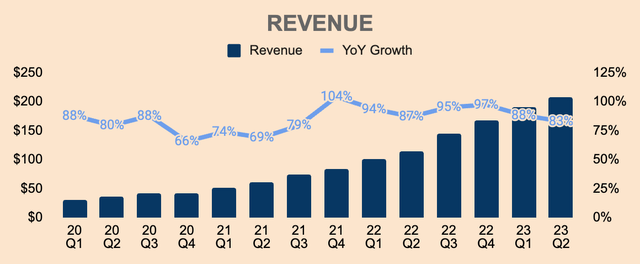

Q2 Income was $208M, which is up 83% YoY. This can be a beat on analyst estimates by $3M.

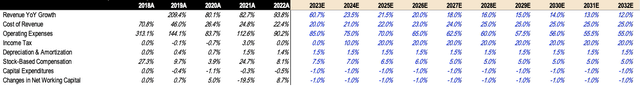

Writer’s Evaluation

As you’ll be able to see, time after time, quarter after quarter, Hims continues to develop at excessive double digits with no indicators of slowing down.

Nevertheless, I don’t anticipate the corporate to maintain on rising at these charges indefinitely. The truth is, I anticipate development to decelerate over the subsequent few quarters as the corporate grows over a bigger base.

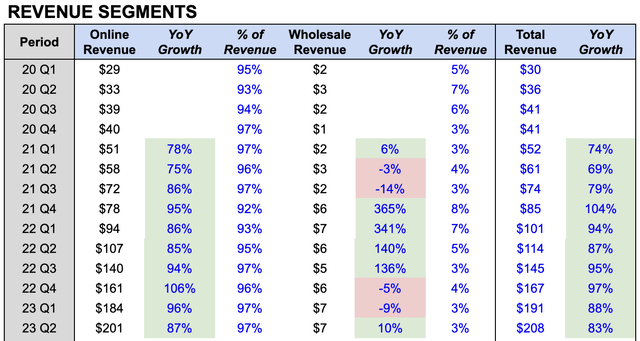

With that mentioned, sturdy Income development was largely because of strong efficiency in On-line Income, which elevated 87% YoY to $201M, pushed by the expansion in Subscribers, Common Order Values (AOV), and Internet Orders.

Writer’s Evaluation

The great thing about the H&H enterprise mannequin is that the corporate focuses on treating situations that require medicine on a recurring foundation and ongoing care from healthcare suppliers, and that’s the reason over 95% of Income comes within the type of recurring On-line Income.

However, Wholesale Income remained secure with no materials development however that is not a priority because it solely makes up about 3% of Income as of Q2.

I wouldn’t fear an excessive amount of concerning the fluctuation in Wholesale Income as this section solely makes up lower than 5% of complete Income. Apart from, I’m extra within the development of On-line Income because it has increased margins and stability as a result of recurring nature of Income from subscriptions.

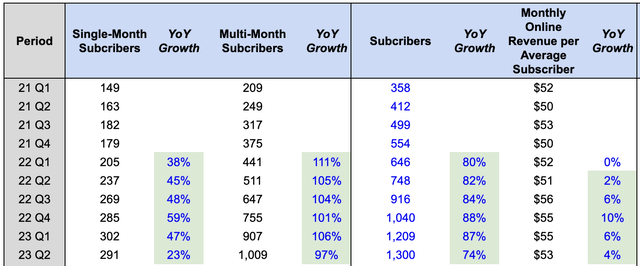

As talked about earlier, On-line Income development was as a result of growing variety of Subscribers on the platform.

As of Q2, the variety of Subscribers was 1.Three million, which is up 74% YoY.

The rise in Subscribers was primarily because of elevated advertising bills, increased visitors to its platforms, in addition to increased conversion charges because of improved onsite and buyer onboarding expertise.

On-line Income development additionally benefited from increased Month-to-month On-line Income per Common Subscriber, which was up 4% YoY to $53. This not solely exhibits sturdy model loyalty but additionally clients’ willingness to spend extra on the platform.

Writer’s Evaluation

I additionally need to level out that despite the fact that Multi-Month Subscribers make up the bigger proportion of the overall Subscriber base, their development is far quicker than Single-Month subscribers. That is necessary because it signifies that the corporate shouldn’t be rising due to one-time patrons, however as an alternative, due to extra severe patrons who rely on H&H merchandise for an extended time period.

As well as, discover that the variety of Single-Month Subscribers dropped sequentially from Q1, to about 291Okay Subscribers. This is because of extra customers signing up for Multi-Month Subscriptions because of worth cuts that administration initiated “throughout longer length and sexual well being and Hims hair loss subscription plans.”

As such, Multi-Month Subscribers grew 97% YoY, to simply over 1M.

The worth modifications additionally negatively impacted On-line Income by $5M in Q2, which is why Month-to-month On-line Income per Common Subscriber additionally dropped 4% QoQ, to $53.

The rationale behind the worth cuts was that administration wished to cross on the financial savings it achieved from economies of scale to customers, in addition to to make longer-duration subscriptions extra engaging for customers.

That mentioned, I imagine this transfer will drive much more high-quality, loyal Subscribers to the platform.

Already, we have now acquired a number of sturdy alerts that these modifications have the potential to speed up adoption of personalised options, throughout a broader set of customers on our platform. Over 35,00zero present subscribers, switched to an extended length or personalised providing within the second quarter. We imagine personalised options mixed, with our total sturdy worth proposition, will allow us to retain our customers for many years.

(Yemi Okupe – Hims & Hers FY2023 Q2 Earnings Name)

The shift to Multi-Month Subscriptions, in my view, has three main advantages for H&H:

- Increased AOVs than Single-Month Subscriptions, that are paid upfront, which H&H can use to reinvest into the enterprise.

- Subscribers mechanically keep longer on the platform, which will increase their publicity to different H&H merchandise, which will increase cross-sell potential.

- Extra price financial savings from product packaging and transport as there is a lesser must ship out merchandise each single month.

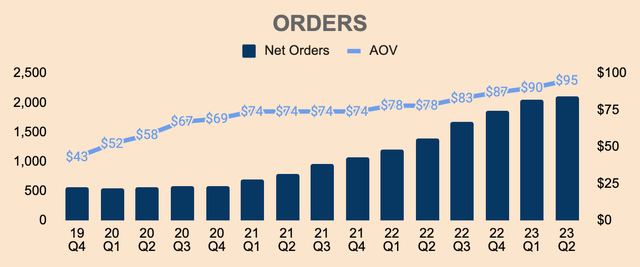

On account of this dynamic, we are able to see that AOV accelerated in Q2 to $95, which is up 22% YoY, as in comparison with Q1’s 15% development. The rise in AOV was pushed by increased worth factors from higher-priced gadgets and longer-duration Subscriptions.

Conversely, Internet Orders decelerated in Q2 to 2.1M, which is up 52% YoY, versus Q1’s 70% development.

Writer’s Evaluation

In brief, H&H is rising at an unbelievable tempo, rising excessive double-digits persistently for the previous few years. This can be a testomony to the corporate’s distinctive worth proposition in addition to administration’s high-level execution.

Not solely is the corporate buying extra Subscribers, however the firm can be retaining higher-quality clients within the type of Multi-Month Subscriptions. I imagine administration’s change in pricing technique and deal with longer-duration plans will repay in the long term.

Profitability

Taking a look at profitability, Q2 Gross Revenue was $170M, which represents a report Gross Margin of 82%.

Gross Margin has been enhancing over the previous couple of quarters because of:

- decrease product prices

- elevated effectivity throughout its supplier base

- the shift to longer-duration plans

- increased order achievement quantity from Affiliated Pharmacies

- a better share of On-line Income relative to Wholesale Income

Regardless of the already excessive Gross Margins, we may anticipate margins to proceed to enhance shifting ahead. Because it stands, H&H fulfills 70%+ of its orders by means of Affiliated Pharmacies. Thus, as H&H transitions to 100% in-house achievement, I anticipate incremental enchancment in Gross Margins within the subsequent few quarters.

Hims & Hers FY2023 Q2 Investor Presentation

Having mentioned that, the excessive Gross Margin is a significant cause why H&H has ample room to chop costs with out placing pointless strain on its backside line. And regardless of slicing costs, Gross Margins truly improved sequentially, which shows stable effectivity positive factors inside the enterprise.

Given elevated Gross Margin ranges, I anticipate H&H to chop costs throughout its complete product portfolio, which will increase affordability, and will consequently allow H&H to realize much more market share.

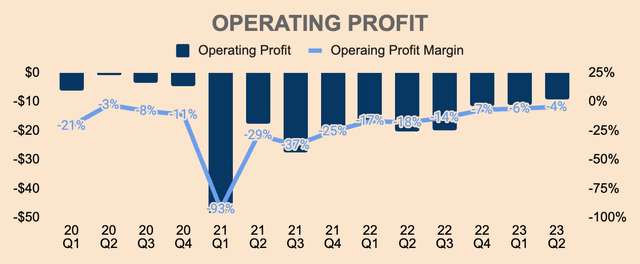

Shifting on, Working Loss for Q2 was $(9)M, which is a (4)% Working Margin. As you’ll be able to see, Working Margin is trending in the appropriate course.

Writer’s Evaluation

Though Working Margins have been enhancing over the previous couple of quarters, I do need to level out that Advertising Bills elevated 77% YoY, which implies quite a lot of development is dependent upon elevated advertising spend.

This displays administration’s precedence to extend model consciousness and maximize new Subscriber development. A part of the explanation why administration is sustaining excessive Advertising Bills is because of the truth that the corporate has a payback interval of lower than a 12 months, which permits H&H to shortly reinvest the proceeds again into the enterprise for development.

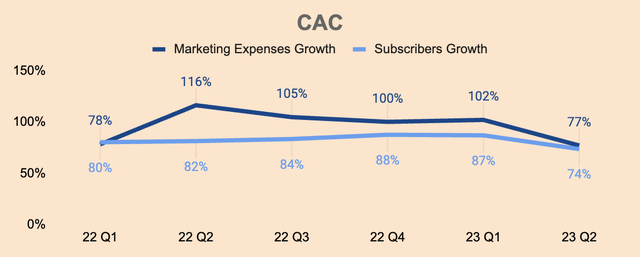

Nonetheless, you’ll be able to see how a lot the corporate has to spend on Advertising to amass new Subscribers. As of Q2, YoY Progress in Advertising Bills stays increased than Subscribers Progress, which is 77% and 74%, respectively. Ideally, we need to see the alternative, as seen in Q1 final 12 months.

Writer’s Evaluation

Administration did point out throughout the earnings name that buyer acquisition was slower than regular:

Advertising, as a proportion of income was flat quarter-over-quarter at 51%. And Advertising investments have been extra closely weighted towards the again finish of the quarter, because of the timing of latest product launches, strategic pricing actions and huge model campaigns.

Buyer acquisition was slower firstly of the quarter, because of these dynamics in a considerably tougher advertising atmosphere, relative to the primary quarter. We anticipate that investments made on the finish of the second quarter, will present significant buyer acquisition tailwind within the third quarter.

(Yemi Okupe – Hims & Hers FY2023 Q2 Earnings Name)

As highlighted by administration, we may see stronger internet new Subscriber development shifting ahead as Advertising investments choose up within the subsequent few quarters – however once more, it’s going to be good to see Income or Subscribers rising quicker than Advertising Bills.

No matter it’s, given the expansion of the enterprise in addition to the market alternative forward, sustaining excessive Advertising Bills to amass as many purchasers as doable appears prudent.

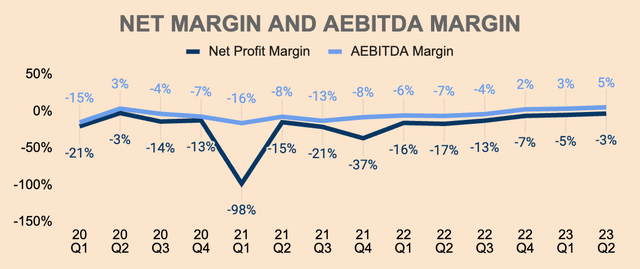

With that being mentioned, the trail to sustained profitability is nicely underway for H&H as the corporate achieves AEBITDA profitability.

In Q2, Adjusted EBITDA was $11M, which is a 5% AEBITDA Margin.

As you’ll be able to see, AEBITDA margins have been enhancing over the previous couple of quarters, which exhibits working leverage for the corporate.

Internet Margins ought to observe go well with – it will not be lengthy earlier than H&H achieves GAAP profitability. As of Q2, Internet Loss was $(7)M, which is a (3)% Internet Margin.

Writer’s Evaluation

That mentioned, there are two issues that I actually like about H&H’s enterprise mannequin:

- Gross Margin of 80% is exceptionally excessive, indicating excessive earnings potential.

- Profitability metrics throughout the board are all enhancing, which exhibits working leverage.

With these two parts, I imagine H&H has a really scalable enterprise mannequin and that ought to reward shareholders in the long term.

Monetary Well being

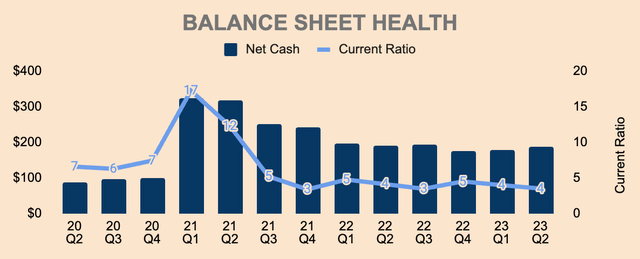

H&H has a robust stability sheet. The corporate has $193M of Money and Quick-term Investments with nearly zero debt. As well as, its Present Ratio is at 4x which is liquid and wholesome.

Writer’s Evaluation

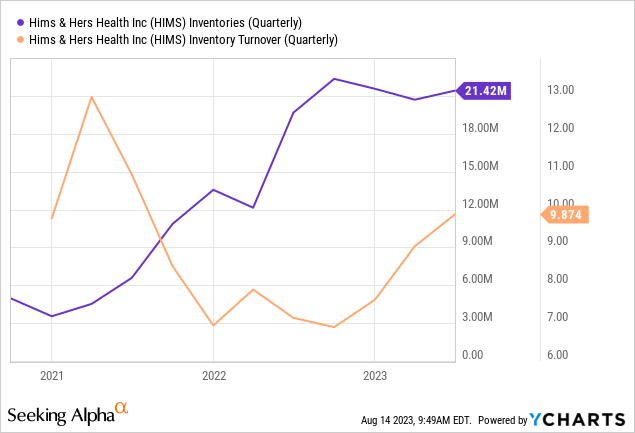

Stock seems to be wholesome as nicely with Stock just about flat QoQ. As you’ll be able to see, Stock has grown over the previous couple of years – that is anticipated as the corporate scales.

However discover that Stock Turnover Ratio is almost 10 and is growing over the previous couple of quarters. Which means the corporate is promoting Stock quicker, which additionally means sturdy demand for H&H merchandise.

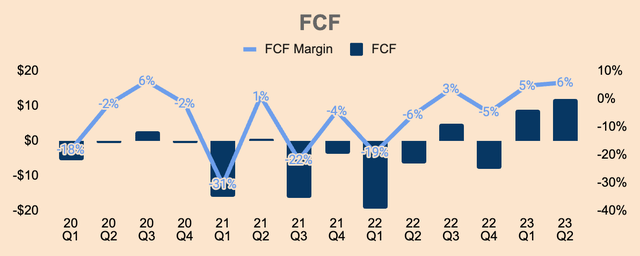

Furthermore, H&H is now specializing in profitability and money movement positivity, which is why we see a Free Money Move of $12m in Q2, which is a 6% FCF margin. For my part, I feel we’ll see FCF proceed to enhance from right here as the corporate achieves economies of scale and working leverage.

Writer’s Evaluation

All in all, H&H has a stable stability sheet. And now that H&H is FCF optimistic, the corporate is basically self-sufficient without having for fairness or debt raises, which eliminates the chance of main shareholder dilution.

The corporate can be allocating capital simply because it ought to, reinvesting all its gross sales and earnings again into the enterprise as a way to seize the fast-growing telehealth market.

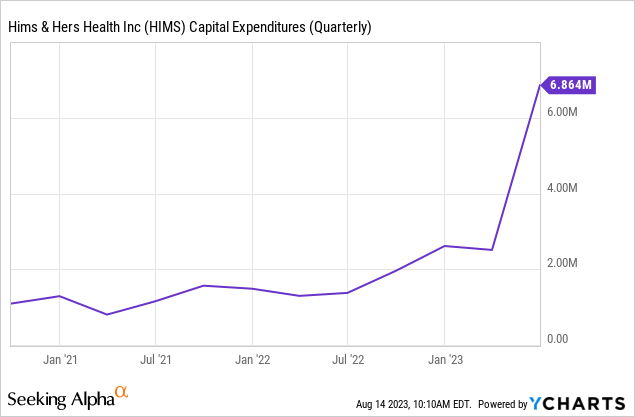

With a pristine stability sheet and an enhancing FCF profile, I anticipate Capex to select up over the subsequent few quarters as the corporate invests in further achievement facilities and Affiliated Pharmacies to have the ability to fulfill orders quicker in addition to acquire full management of distribution and order achievement. The truth is, it is already taking place.

Outlook

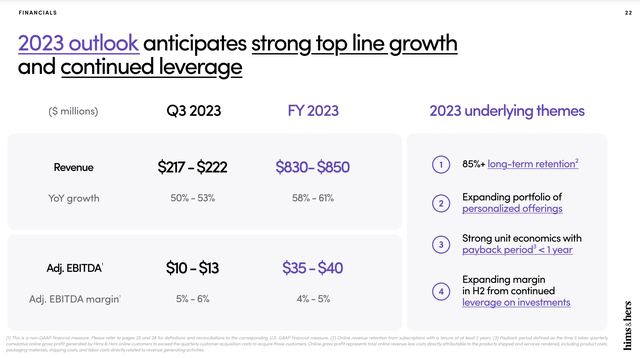

Turning to the outlook of the enterprise, administration offered the next outlook:

Hims & Hers FY2023 Q2 Investor Presentation

As you’ll be able to see, Q3 Income is anticipated to be $222M on the excessive finish, which is a 53% YoY. That is fairly a deceleration from Q2’s development of 83%. I am guessing powerful YoY comps and worth cuts as the main contributors to this slowdown.

Equally, FY2023 development can be anticipated to decelerate from FY2022’s development of 94%. That mentioned, administration expects FY2023 Income to be $850M on the excessive finish, which is a 61% YoY – nonetheless spectacular contemplating powerful YoY comps.

It is also necessary to notice that FY2023 steering was raised by $20M, which was beforehand $810M to $830M. On the identical time, FY2023 steering beat analyst estimates of $831M. This beat and lift simply goes to point out how sturdy demand and execution have been.

However, H&H additionally raised FY2023 AEBITDA steering by $10M, to $40M on the excessive finish, which is a 5% AEBITDA Margin, because of continued effectivity positive factors throughout the enterprise.

Administration additionally offered further particulars on Income steering:

No materials contributions from Weight Administration or Cardiovascular Well being are assumed in 2023. Usually, we anticipate new classes to take a minimum of 12 to 18 months from launch earlier than they meaningfully contribute to the enterprise.

Mirrored in our steering is an assumption that the extraordinarily favorable advertising atmosphere that emerged within the again half of 2022 doesn’t repeat within the again half of 2023.

Moreover, our steering incorporates a destructive affect of between $12 million and $18 million within the second half of the 12 months for each income and adjusted EBITDA, because of the strategic pricing modifications beforehand mentioned.

(Yemi Okupe – Hims & Hers FY2023 Q2 Earnings Name)

With that in thoughts, if 1) H&H’s new merchandise carry out higher than anticipated and a couple of) the advertising atmosphere seems higher than anticipated, H&H may as soon as once more blow previous analyst estimates and inside steering.

In different phrases, administration is EXTREMELY conservative with their steering – as they’ve all the time been…

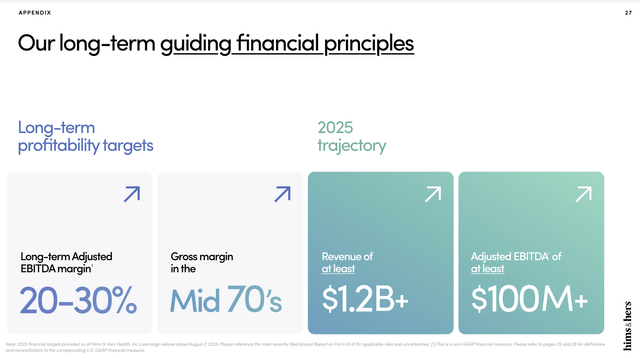

Additionally of necessary be aware, administration maintained its long-term guiding monetary ideas, as proven under. Given its present development trajectory and numerous beats and raises, I would give a excessive chance for H&H to realize these long-term targets.

Hims & Hers FY2023 Q2 Investor Presentation

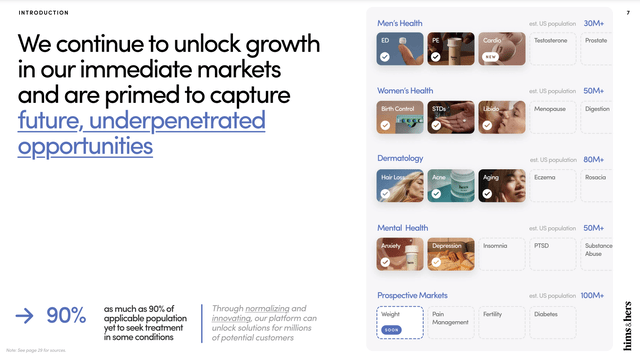

Regardless, H&H has a protracted development runway forward.

For one, as a lot as 90% of the inhabitants has but to hunt remedy for some situations, which signifies that the healthcare market is very underpenetrated, – I am not shocked given how disfigured the legacy healthcare business has been. That mentioned, inefficiency inside the healthcare system is an enormous alternative for H&H.

As well as, H&H can broaden to different classes, together with testosterone boosters, insomnia, weight administration, and so forth, and this could not solely broaden the corporate’s market alternative but additionally encourage present Subscribers to spend extra on the platform, which ought to improve Income per Subscriber.

Hims & Hers FY2023 Q2 Investor Presentation

One other factor price mentioning is that there have been just a few phrases that administration emphasised throughout the earnings name:

- Customized therapies

- Multi-category therapies

On the primary level, over 35% of On-line Income in Q2 got here from personalised therapies, reflecting shopper need for custom-made therapies.

On the second level, H&H is specializing in growing “single tablet therapies for multi-category situations”. That is evident from its just lately launched Coronary heart Well being by Hims, which goals to deal with cardiovascular well being and erectile dysfunction with one tablet.

Combining these two factors with H&H’s transfer to 100% in-house order achievement by means of its Affiliated Pharmacies, we have now H&H’s final development story: offering high-quality, personalised, multi-category medical care on the click on of a button.

This is a brief instance that will help you visualize.

Maybe you are a first-time H&H buyer on the lookout for therapies for hair loss, erectile dysfunction, and nervousness.

As an alternative of getting three separate tablets, you’ll be able to have an H&H licensed supplier prescribe you a single tablet that treats all three situations, fulfilled by none apart from H&H… on demand.

Though it is a lengthy shot, it could possibly be the place H&H (and the way forward for healthcare) is heading. This is CEO Andrew Dudum to elaborate:

Our mission is to make the world really feel nice by means of the ability of higher well being. An usually underappreciated facet of this mission is the need of guaranteeing our platform can attain as many individuals as doable.

The extent of scale that we have now mixed with the effectivity of our affiliated pharmacies permits us to orient customers to a mannequin with a treatment-based assemble versus a pill-based assemble at distinctive worth to them.

This can proceed to develop into extra significant, as we transfer additional away from subscribers with one remedy to subscribers with multi-category remedy.

(Andrew Dudum – Hims & Hers FY2023 Q2 Earnings Name)

Valuation

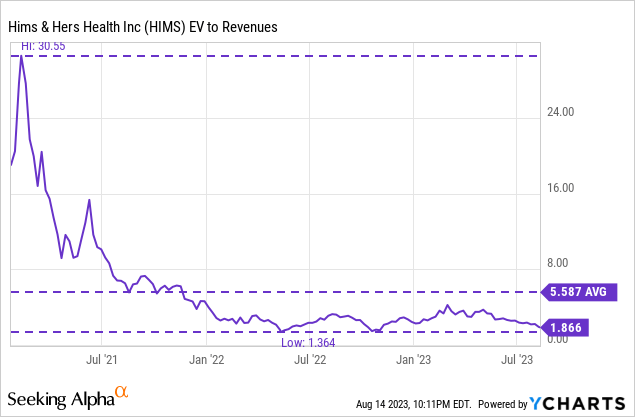

Turning to valuation, HIMS trades at an EV/Income a number of of simply 1.9x, which is manner under its peak of 30.6x and its common of 5.6x.

In essence, HIMS is buying and selling cheaper than it was again when it went public 2.5 years in the past (Q1 2021), regardless of

- Rising Income by 297%, from $52M to $208M

- Rising Subscribers by 263%, from 358Okay to 1.3M

- Enhancing Gross Margins by 500bps, from 77% to 82%

- Turning AEBITDA Worthwhile, from $(9)M to $11M

Two years in the past, buyers wished HIMS at $20 a share.

Right this moment, buyers are dumping HIMS at $7 a share, regardless of being a a lot bigger, extra worthwhile, and basically stronger firm.

Generally the inventory market simply amazes me…

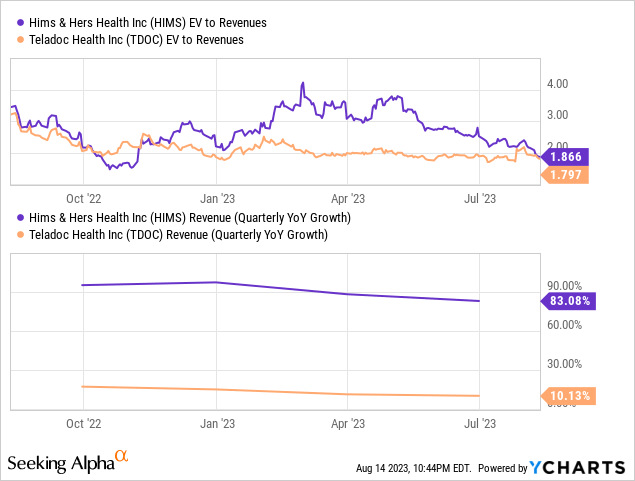

This is one other.

HIMS and fellow telehealth firm Teladoc (TDOC) are mainly buying and selling on the identical valuation a number of despite the fact that HIMS is rising 8x quicker than Teladoc.

That is fairly perplexing…

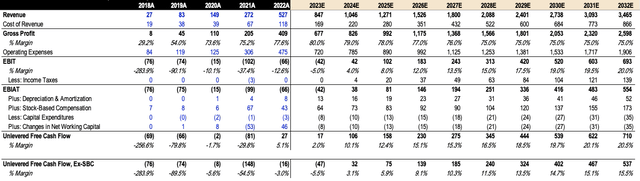

I did a DCF mannequin on HIMS as nicely and listed here are my key assumptions:

- Income: For the primary three years, I observe analyst estimates, and progressively dropped Income development charges to simply 12% by 2032 as the corporate grows over a bigger base. By 2025, HIMS will obtain $1.27B of Income which is in keeping with administration’s long-term steering of $1.2B+.

- Gross Margin: I will be pessimistic right here – I am projecting Gross Margins to say no over time from 82% right now to simply 75% by 2032 because of elements corresponding to competitors, product combine, and pricing. Regardless, a 75% Gross Margin remains to be very excessive and additionally it is nonetheless in keeping with the mid-70s degree guided by administration.

- FCF Margin: I will use AEBITDA as a proxy for my FCF projections. Of their investor presentation, administration estimated a long-term AEBITDA Margin of 20% to 30% – I will take the bottom finish of the vary simply to be additional conservative.

Writer’s Evaluation

With these assumptions, I arrive at a Income of $3.5B and an FCF Margin of 20.5% by 2032, which is extraordinarily conservative.

Writer’s Evaluation

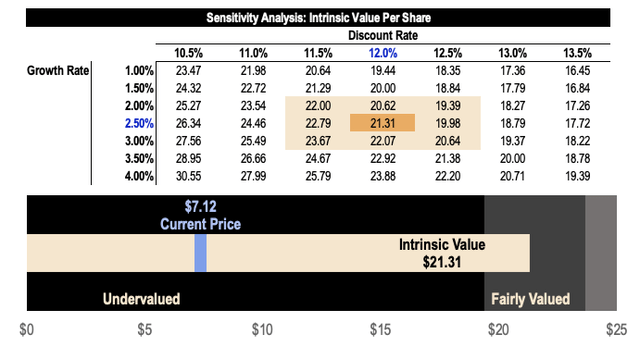

Primarily based on a reduction charge of 12% and a perpetual development charge of simply 2.5%, I get a truthful worth estimate of $21.31 a share for HIMS, which is far increased than the common analyst worth goal of $12.90.

This represents an upside potential of ~200% primarily based on the present worth of $7.12.

Writer’s Evaluation

Clearly, I’ve a robust view that HIMS inventory is extraordinarily undervalued.

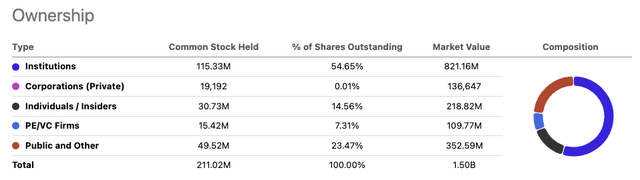

In different information, it is nice to know that insiders personal 14.5% of shares excellent with CEO Andrew Dudum proudly owning ~9.5% of the corporate, so it is an important signal that insiders have pores and skin within the sport.

In search of Alpha

It is also price noting that there’s a inventory choice award for the CEO to take care of share costs above $10 a share.

In February 2022, the compensation committee accepted a grant of a inventory choice award to buy 2,085,640 shares of our Class A Frequent Inventory to Mr. Dudum, with an train worth of $5.01 per share that vests in 4 equal tranches. On every annual anniversary date after February 24, 2022, 25% of the shares topic to the choice will vest and develop into exercisable offered that (i) Mr. Dudum remains to be employed on the anniversary date and (ii) the closing worth of our Class A Frequent Inventory is greater than $10.00 per share in 20 of the 30 buying and selling days prior to every anniversary date. Vesting of a efficiency situation will be achieved in subsequent years throughout the efficiency interval if it was not beforehand met. If the inventory worth goal shouldn’t be achieved by February 24, 2026, then the efficiency choice wouldn’t vest.

(Supply: Hims & Hers FY2023 Proxy Assertion)

In different phrases, it’s CEO Andrew Dudum’s greatest curiosity to maintain share costs above $10 a share for a minimum of the subsequent 4 years, to ensure that his inventory choices to be exercisable. That mentioned, I feel the draw back is kind of restricted from right here.

With that being mentioned, I feel there is a divergence in fundamentals and valuation for HIMS inventory – whereas fundamentals get higher, the inventory will get worse.

And as an alternative of rallying after its Q2 triple beat, the inventory bought off.

As well as, HIMS has a excessive brief curiosity of practically 14%, suggesting pessimism amongst market individuals.

For these causes, I declare HIMS inventory silly.

Not the enterprise although.

And that is the place the chance lies for buyers – shopping for shares of high-quality companies when others are appearing irrationally in addition to when the inventory is indifferent from its fundamentals.

Dangers

Competitors

In my opinion, competitors is the largest danger for H&H.

H&H primarily sells generic medication with no mental property safety. As such, there are low obstacles to entry and it is simple for different corporations corresponding to Ro, Teladoc, and Amazon (AMZN) to launch related merchandise.

Lately, Amazon introduced the nationwide rollout of Amazon Clinic, the corporate’s very personal digital healthcare market.

Because it stands, Amazon has three totally different healthcare choices:

- One Medical, which Amazon acquired for $3.9B in February this 12 months. One Medical provides major care in individual or by way of video name.

- Amazon Pharmacy, which is the corporate’s on-line pharmacy.

- Amazon Clinic, which gives digital take care of frequent situations.

Because it pertains to H&H, Amazon may leverage its large scale and community, which may take market share away from H&H. As well as, Amazon can afford to promote prescriptions at decrease costs, which may result in a worth struggle with different gamers together with H&H.

Ro additionally provides very related services as H&H, which may make it troublesome for customers to decide on one firm over the opposite. On the identical time, it meant that H&H does not actually have a technological or product edge over Ro.

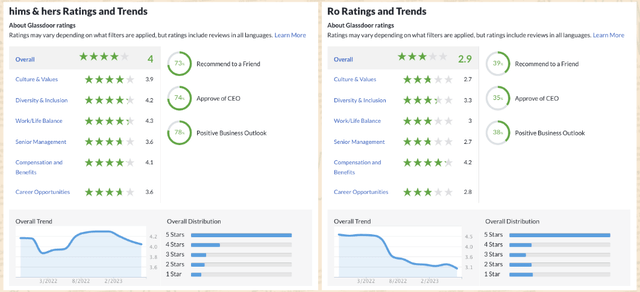

However I do need to level out that Ro appears to be coping with quite a lot of challenges internally. As you’ll be able to see Ro’s Glassdoor ranking collapsed from 4.5 stars just a few months in the past to simply 2.9 right now.

Tradition performs an enormous position within the long-term success of an organization, and plainly H&H has a robust tradition as seen from its excessive Glassdoor ranking of 4.zero stars, which remained secure YoY.

That mentioned, this could possibly be a possibility for H&H to develop additional whereas Ro offers with its personal company-specific points.

Glassdoor

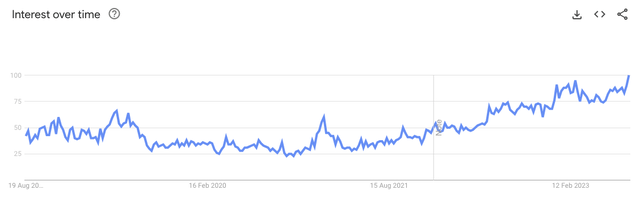

Happily, competitors – corresponding to Ro and Amazon – has but to place a dent in H&H’s enterprise. As you’ll be able to see under, Google Developments present that curiosity in “Hims” is at an all-time excessive.

Nevertheless, it is nonetheless price contemplating aggressive dangers because it may result in points corresponding to slowing development, worth competitors, in addition to well being supplier provide issues.

Google Developments

Different Dangers

- Tightening rules for telehealth practices

- Lawsuits in opposition to H&H

- Undesirable unintended effects from H&H’s prescriptions

Thesis

H&H is a kind of uncommon corporations that’s run by nice administration, rising quickly within the rising telehealth sector, and has sturdy aggressive benefits.

I’m assured that H&H goes to be a dominant participant within the healthcare area within the subsequent decade, given its progressive telehealth platform, unbelievable worth proposition, and wonderful branding.

Whereas the enterprise continues to outperform expectations, the inventory is getting crushed, most likely because of a change in pricing technique in addition to the intensification of competitors corresponding to Amazon.

That being mentioned, HIMS inventory is extremely low-cost for a corporation that’s rising 80%+, has a excessive gross margin profile of 80%+, and is about to show worthwhile.

The selloff is unjustified – particularly after the Q2 triple beat.

The inventory is silly, the enterprise shouldn’t be – reap the benefits of this irrational conduct.