alexsl

The MPW Funding Thesis Has Misplaced Its Bullish Help Right here

We beforehand coated Medical Properties Belief (NYSE:MPW) in Could 2023, discussing the brief sellers assault by Viceroy Analysis. The report had triggered its inventory costs to drastically decline, due to the allegation that the REIT “buys property at inflated costs from tenants.”

At the moment, we maintained our optimistic MPW funding thesis, since its auditor, PwC, had verified the REIT’s conformation with the US GAAP accounting rules since 2008. Due to the depressed inventory costs, we had been additionally tempted by the wealthy dividend yields, naturally clouding our judgement.

For now, it seems that now we have been confirmed incorrect after 4 MPW Purchase articles since October 2022, since it’s lastly obvious that the inventory lacks bullish help, with the inventory valuations/ costs persevering with to say no, negating a lot of its future dividend incomes.

MPW Inventory Costs Since 2008

Buying and selling View

Market sentiments surrounding MPW has been bearish since January 2022, with the inventory subsequently dropping a lot of its worth to retest the 2008 lows, proper when the earlier recession occurred.

A lot of the pessimism is de facto attributed to a possible dividend reduce, which has but to be introduced, however nonetheless, priced in each by Mr. Market and long-term shareholders alike.

This sentiment might be worsened by the MPW administration asserting a narrowed FY2023 AFFO per share steerage vary of between $1.53 and $1.57, matching consensus estimates of $1.55 on the midpoint.

You will need to notice that this vary has been lowered twice, in comparison with the earlier FQ1’23 steerage vary of between $1.50 and $1.61, and FQ4’22 steerage vary of between $1.50 and $1.65.

For now, based mostly on MPW’s annualized dividend of $1.16, it seems that the administration remains to be in a position to maintain its present payout ratio of ~74%.

Nevertheless, with the inventory additionally dropping -$2.60 or the equal of -25.7% of its worth for the reason that latest earnings name on August 08, 2023, it’s obvious that long-term shareholders have misplaced a lot of their unique capital as nicely.

We’ve noticed the same cadence with many underperforming earnings shares, the place long-term shareholders opted to drip and greenback value common, with the thesis that capital positive aspects or losses are solely recorded if the shares are bought.

Buyers should additionally notice that MPW’s drastic correction has triggered a ahead dividend yield of 15.47%, expanded in comparison with its 4Y common of 6.96% and sector median of 4.89%.

Then once more, with so many different shares that provide both capital acquire via inventory value appreciation, or sustainable earnings with secure inventory efficiency, we’re unsure if MPW is a smart funding for brand spanking new buyers, particularly resulting from its battleground inventory standing. The latter recommend sustained volatility for the foreseeable future, with it remaining to be seen when the inventory might encounter bullish help.

For now, MPW has reported a blended FQ2’23 earnings name as nicely, with decreased revenues of $349.92M (-3.4% QoQ/ -15.7% YoY) attributed to divestitures.

That is on prime of the accelerated web losses of -$42M (-228.2% QoQ/ -122.1% YoY), attributed to the $286M of amortization and $95M of rental write off, partially offset by $160M tax profit from the UK REIT and $68M curiosity income from PHP.

Nevertheless, we imagine that the FQ2’23 numbers might have painted a extra pessimistic outlook than it really is, since these solely mirror the influence of divestures and the CommonSpirit lease, all of which have been disclosed in earlier earnings name.

Whereas MPW might have been concerned with Steward’s latest refinancing efforts, we aren’t overly involved as nicely, for the reason that train offers the operator with “vital incremental liquidity.”

MPW has been in a position to derisk this funding as nicely, by promoting off $105M of its pursuits. Whereas the phrases of the credit score sale haven’t been disclosed, we suppose the REIT’s prospects might elevate henceforth, resulting from Steward’s improved functionality of assembly hire.

Subsequently, with the puzzles slowly falling into place, we imagine the pessimism surrounding MPW might have (virtually) bottomed right here.

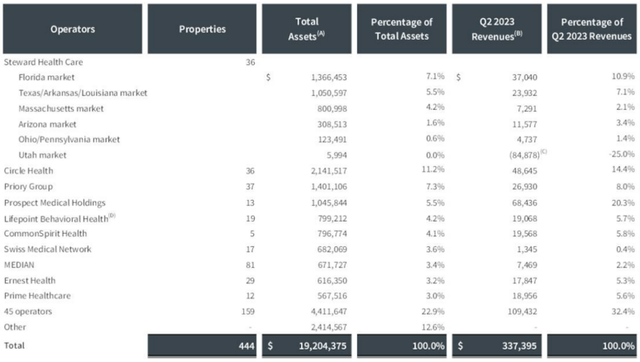

MPW’s Revenues By Operator

Looking for Alpha

Nonetheless, we should additionally spotlight these are speculative conjectures, provided that Prospect Medical Holding and Steward Well being Care have but to completely resolve their monetary well being points, whereas additionally requiring sure debt refinancing.

With each operators comprising 45.2% of MPW’s FQ2’23 rental revenues, the lingering pessimistic sentiments might not elevate within the close to time period, in our opinion, till these two operators are within the clear.

So, Is MPW Inventory A Purchase, Promote, or Maintain?

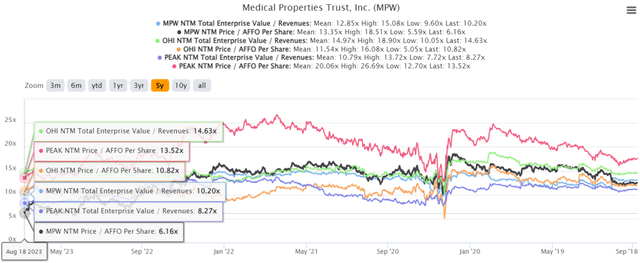

MPW 5Y EV/Income and Worth/ AFFO Per Share Valuations

S&P Capital IQ

For now, MPW is buying and selling at NTM EV/ Revenues of 10.20x and NTM Worth/ AFFO Per Share of 6.16x, decrease in comparison with its 1Y imply of 10.82x/ 8.03x and 3Y pre-pandemic imply of 11.83x/ 12.70x.

The pessimism embedded in its valuations is clear certainly, in comparison with its healthcare REIT friends akin to Omega Healthcare Buyers (OHI) at 14.63x/ 10.82x and Healthpeak Properties (PEAK) at 8.27x/ 13.52x, respectively.

Whereas the MPW inventory might seem low cost based mostly on its historic valuations, we aren’t so sure to formulate one other purchase funding thesis based mostly on a rearview mirror outlook.

For this reason we’re now not sure about our earlier value goal of $14.44, since it’s beforehand based mostly on the REIT’s FQ1’23 steerage of AFFO per share of $1.55 on the midpoint and 1Y Worth/ AFFO Per Share of 9.32x, with it remaining to be seen if the inventory’s valuations might get better to historic ranges.

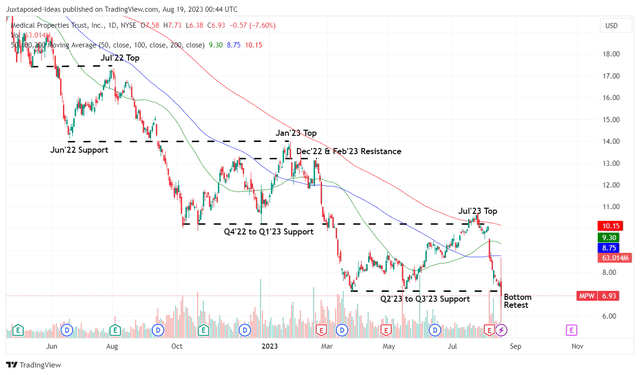

MPW 1Y Inventory Worth

Buying and selling View

Mixed with the elevated brief curiosity of 21.07% on the time of writing and the inventory’s present retest of the Q2’23/ Q3’23 help ranges, the MPW funding thesis is just not for the fainted hearted certainly, since a ground has but to be noticed.

This volatility additionally means that it could be tougher to peg a good worth to the inventory, attributed to its drastic decline of -39.9% YTD and -70.7% for the reason that January 2022 prime.

Because of its blended prospects, we want to charge the MPW inventory as a Maintain (Impartial) right here.

Whereas there could also be dangers to this maintain ranking, particularly for long-term buyers with excessive conviction seeking to greenback value common, they need to solely accomplish that if the portfolio is sized appropriately, because of the potential volatility.

For one, we imagine that the a lot wanted bullish help might not return within the close to time period, with market analysts already pricing in a dividend reduce.

For instance, this lack of help is already seen within the MPW inventory’s decline after the discharge of the Prospect information on August 18, 2023, with it dropping one other -7.6% of its worth inside a day.

In consequence, whereas some SA analysts might iterate their double down Purchase ranking, we want to err on the facet of warning whereas staying off the unstable journey forward.