gorodenkoff

Microsoft (NASDAQ:MSFT) is poised to profit materially as firm IT spend shifts to AI-enabled software program. Its robust stability sheet helps the elevated funding value essential to underpin the event of AI-embedded purposes. While AI Co-Pilot initiatives are solely simply beginning to be rolled out and the last word adoption price amongst purchasers is unknown, these new merchandise may add probably 22.5% to run-rate EBITDA. The cloud hyperscalers have grown in disciplined vogue and corporations globally are nonetheless within the early phases of migrating on-premise workloads into the general public cloud. With the AI theme in its infancy, we’re in a interval of extraordinary innovation pushed by each enterprise and client curiosity. With the potential to be a key beneficiary, MSFT is attractively valued on a 29.7x ahead P/E ratio.

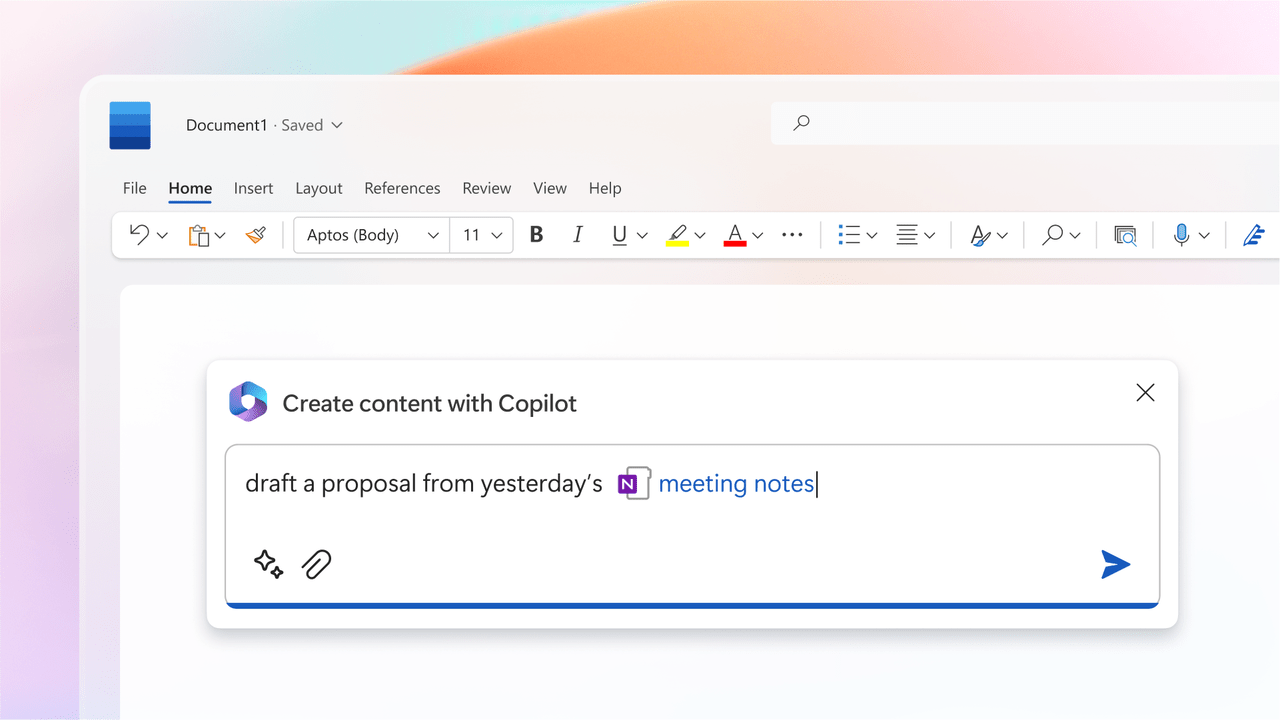

One in all Microsoft’s principal but most understated aggressive benefits is its distribution throughout its enterprise enterprise and the flexibility to up-sell into its present shopper base. Data staff and builders are key beneficiaries of Microsoft’s generative AI primarily based toolkit, primarily the Co-Pilot suite of options which will be adopted and built-in into buyer’s present work-flows to enhance performance throughout the applying layer.

Workplace 365 Co-Pilot has been priced at $30 per person monthly on high of a normal E3 / E5 workplace license. Take into account that the common MSFT Home windows person pays solely $180 every year and a Groups premium account prices $10 monthly.

Given the infusion of AI into the Microsoft Workplace suite of merchandise provides important productiveness advantages, the potential income enhancement is huge. It is going to be fascinating to see what take-up will probably be throughout the present 345 million Workplace 365 person base however a 25% penetration price by 2026 would end in an extra $31 billion in run-rate income.

Microsoft 365 Co-Pilot

Microsoft Co-Pilot (Microsoft)

Contemplating the migration of Workplace On-Premise to Workplace 365 reached 20% penetration inside two years, the potential for the same adoption sample with Co-Pilot isn’t unrealistic. The following query is what sort of margin can we count on Co-Pilot to ship? Generative AI Options should have related margins as to the cloud enterprise or round 70% gross margin. While AI is a computationally intensive resolution, the prices ought to come down sooner or later and the margin shouldn’t be overly dilutive. Github’s AI Co-Pilot writes programming code to help builders. This can be a excessive worth resolution which can generate important advantages for customers and instructions a worth level of $10 monthly or $100 every year per person. There are 100m Github customers and assuming 20% undertake Co-Pilot yields an extra $2bn in run-rate income.

The following alternative to contemplate is inside Azure. Most start-ups and lots of established firms lease their computational energy from a handful of cloud distributors who successfully promote workload capability or infrastructure for different companies to utilise. The principle hyperscalers – Google Cloud Platform, Microsoft Azure and Amazon AWS – get pleasure from round 66% world market share and have exercised self-discipline in including capability.

But, round 90-95% of world IT spend nonetheless stays on-premise which signifies we’re nonetheless within the early innings of cloud adoption.

International IT expenditure totaled $4.43tri in 2021 and while the three important cloud suppliers are set to generate round $185 billion in revenues in 2023, this nonetheless equates to solely round 4% of the full. Microsoft Azure is nicely positioned to seize share in enterprise software program ($1.2tri market in 2021); IT providers, a $1trillion market; and communication providers, a $1.3trillion market.

AI provides a brand new layer of development as a result of substantial computational energy required and the lack of organisations to develop their very own massive language fashions. Given developments in machine studying and huge language fashions, massive enterprises are prone to wish to leverage their inside information to drive differentiation and construct their very own options reasonably than undertake packaged software program purposes. While firms are asserting AI initiatives, it is going to take time for pilot tasks to maneuver into manufacturing and for cloud AI expenditure to inflect.

Inside the cloud eco-system, Amazon developed an early lead by leveraging first mover benefits which enabled AWS to draw SMEs and digital natives by means of a powerful worth proposition and broad resolution portfolio stressing their worth proposition. MSFT entered later primarily based on their energy of present buyer relationships and present infrastructure inside on-premise programs. MSFT has extra clients utilizing their Platform as a Service (for PaaS) infrastructure and are bigger throughout the database layer. As an example, Amazon’s combine is 70% Infrastructure as a Service (IaaS) and 30% PaaS while MSFT is 65% PaaS and 35% IaaS. As soon as the cloud build-out matures, the hyperscalers will reap annuity / utility-like advantages for a few years to come back.

We don’t understand how a lot an AI Generative workload will eat which makes forecasting margins difficult. We are able to count on the amount of workloads utilized to speed up pushed by expanded performance enabled by Generative AI. Microsoft ought to have the ability to monetize these workloads and it’s potential Azure may seize as much as 50% of those workloads. Safety Co-Pilots could possibly be an extra development vector. Microsoft’s safety enterprise at the moment generates round $20bn of income. Their Sentinel resolution has ramped faster than consensus expectations and there’s a important alternative to leverage its place in safety analytics.

The capital expenditure related to constructing out these AI capabilities will probably be substantive – maybe within the order of $40-50bn every year. This represents a 50-75% enhance in cap ex and is indicative of the potential uplift in cloud income the place MSFT is main the market.

Dangers

The IT spend atmosphere is presently constrained and the flexibility to maneuver the needle on a big put in base requires endurance. There may be uncertainty across the near-term income like and the AI ramp will take time because the expertise remains to be very new. It’s going to take enterprises some time to push purposes into manufacturing.

Valuation

MSFT trades on a 29.7x ahead P/E ratio. The corporate is in a internet money place and is ready to accumulate Activision Blizzard topic to UK CMA approval. Primarily based on the aforementioned Co-Pilot and safety AI initiatives, the corporate may generate c. $33bn incremental income from AI initiatives over the following 2-Three years. Making use of a 70% margin would add $23bn to EBITDA or an additional 22.5%.

Conclusion

Microsoft is a world main supplier of human productiveness software program set to reap the advantages of integrating Generative AI into its platform. Builders will entry open AI providers by means of the Azure platform to construct purposes and implement Gen AI options, whereas enterprise and particular person clients will profit from a collection of Co-Pilot merchandise throughout Workplace365, Github (the largest utiliser of enormous language fashions), Bing and Groups Premium. In essence, Microsoft builds AI applied sciences for customers to leverage or implement, but additionally infuses AI into its personal merchandise which improve clients’ productiveness. The core enterprise mannequin could be very sticky and the use case of AI in areas comparable to coding have already been clearly demonstrated by Microsoft’s Github Co-Pilot initiatives. As these productiveness enhancements turn out to be extra demonstrable and uptake inflects, the inventory may even see additional a number of enlargement than the 10% already evident this yr pushed by the prospect of structurally increased profitability.