Morgan Stanley (NYSE:MS) offers monetary providers all through the globe. It operates by means of Institutional Securities, Wealth Administration, and Funding Administration segments and has a popularity as being extra conservative than its opponents. When in comparison with Goldman Sachs which I additionally not too long ago wrote about right here, Morgan Stanley looks as if the extra mature older sibling. By specializing in wealth administration over derivatives since 2011, MS has opted for a decrease beta methodology of getting cash and it reveals within the outcomes.

Morgan Stanley isn’t afraid to combine it up with a bit of danger by underwriting within the dangerous however profitable know-how sector and has underwritten a few of techs most well-known names together with Fb and Google. This has been a boon to MS prior to now and may very well be one sooner or later.

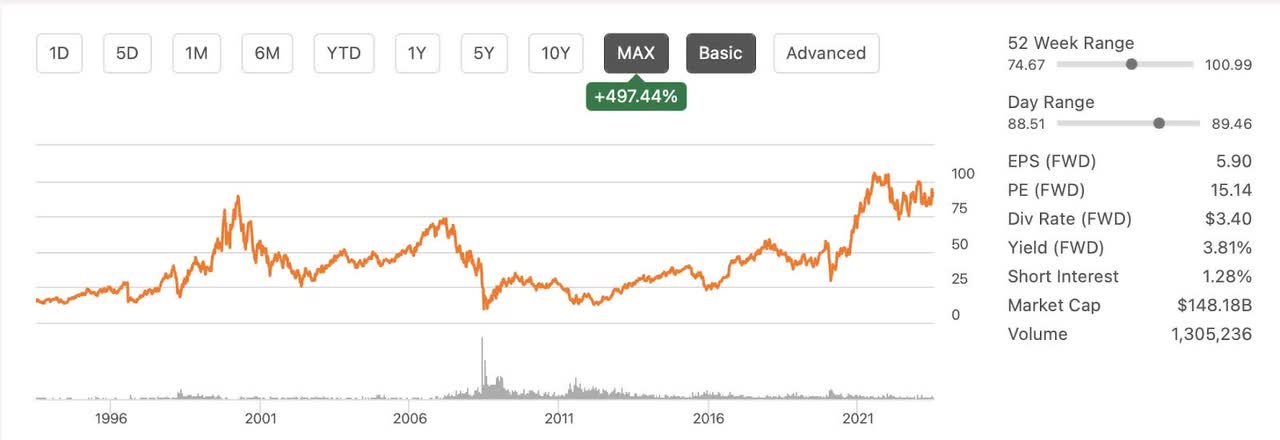

MS Max Chart (Looking for Alpha)

The corporate suffered massive losses in 2000 and 2008. Whereas Goldman Sachs determined to proceed enterprise as traditional after these occasions, Morgan Stanley made vital modifications to the enterprise in 2011 and 2012 specializing in the extra conservative mannequin outlined above.

MS 10 Yr Chart (Looking for Alpha)

As we will see within the chart above these modifications have led to sluggish however constant development and fewer danger to the draw back.

Valuation

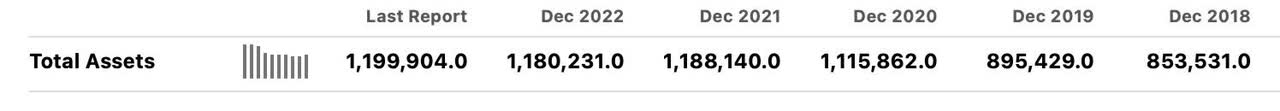

Looking for Alpha

Looking for Alpha

Morgan Stanley controls over a trillion {dollars} in belongings making it a titan of the monetary business. Since 2018, they grew belongings by about $347 billion {dollars} and liabilities solely elevated by $325 billion {dollars}. At this level their large dimension means development has to come back a bit of slower, however they’re nonetheless rising.

Income and EPS (Looking for Alpha)

Their income development has been comparatively flat which is mirrored of their share worth remaining comparatively secure. The earnings per share have come again to 2019 ranges. These components would lead us to consider that there won’t be vital worth appreciation in 2023 or past. The perfect you’ll be able to hope for is a sluggish and regular rise. Morgan Stanley seems to be valued pretty on the present time and we price it a maintain.

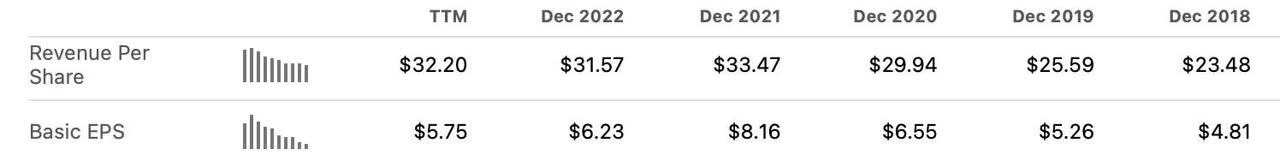

The Dividend

Morgan Stanley has a superb historical past of elevating the dividend since they restructured the enterprise mannequin in 2011. They doubled the dividend in late 2021.

Looking for Alpha

If I used to be a dividend development investor, I’d be all in favour of Morgan Stanley primarily due to the spectacular price of dividend development during the last 5 years.

Looking for Alpha

What would possibly concern me a bit of is the chance that the dividend may not be protected. The present payout ratio of 52.75% is excessive. Not as excessive as Washington Belief’s (WASH) which I wrote about right here, however in all probability nonetheless too excessive for consolation. We don’t suppose the dividend is essentially in danger as a result of as a extra conservative monetary establishment Morgan Stanley had some cushion, however the current drop in earnings should have caught them barely unexpectedly or they seemingly wouldn’t have elevated the dividend so aggressively in 2021.

Dangers

Like several titan within the monetary panorama, Morgan Stanley contends with an array of dangers. Market danger looms massive, with fluctuating rates of interest, change charges, commodity costs, and fairness valuations posing threats to their funding portfolio and buying and selling actions. Credit score danger additionally stays a key concern, because it hinges on debtors and counterparties assembly their obligations, affecting the agency’s lending ventures and holdings in company and sovereign debt. It will be a mistake to miss liquidity danger, a pivotal issue of their short-term funding reliance and the potential lack of ability to liquidate belongings swiftly to satisfy obligations.

As a worth investor, I am keenly conscious of the ever-present operational dangers stemming from inner processes, system failures, and human error, which may reverberate by means of the establishment’s monetary well-being and popularity. Complying with stringent rules provides one other layer of danger, one which Morgan Stanley should tread cautiously to keep away from regulatory penalties and reputational injury. I presently consider Morgan Stanley’s dedication to low beta earnings ought to assist them keep away from the worst dangers, however you’ll be able to’t neglect the systemic danger, a menacing specter that haunts the soundness of your entire monetary realm, and cyber threats, which current formidable challenges in safeguarding delicate knowledge and stopping cyber-attacks. Navigating these dangers calls for strong danger administration practices, a steadfast dedication to monetary prudence, and transparency.

Conclusion

Whereas Morgan Stanley faces an array of dangers in its pursuit of economic excellence, as a worth investor, I consider there may be a lot to admire about this stalwart of the monetary business. Should you like sluggish and regular development, Morgan Stanley has what you want. Should you like dividend development, Morgan Stanley has what you want. In case you are in search of capital appreciation, I’d look elsewhere or look ahead to a decrease entry.

As we navigate the ever-changing monetary markets, it’s essential to strategy the potential dangers with a measured perspective, protecting in thoughts that with danger comes alternative. The reality is Morgan Stanley simply doesn’t take sufficient dangers to offer many alternatives. At the least in my ebook.

What Morgan Stanley does supply is a longtime observe document, world presence, and dedication to strong danger administration practices that ought to place it effectively to climate challenges and capitalize on profitable prospects sooner or later.

As a worth investor, I stay optimistic in regards to the long-term prospects of this monetary titan and will likely be protecting a watchful eye on its trajectory, all the time able to seize alternatives that current themselves on the horizon. I presently price Morgan Stanley a maintain, however I’d have an interest if the inventory drops precipitously. As all the time, please do your due diligence earlier than shopping for any shares and thanks for studying and commenting.

Nikada