mysticenergy

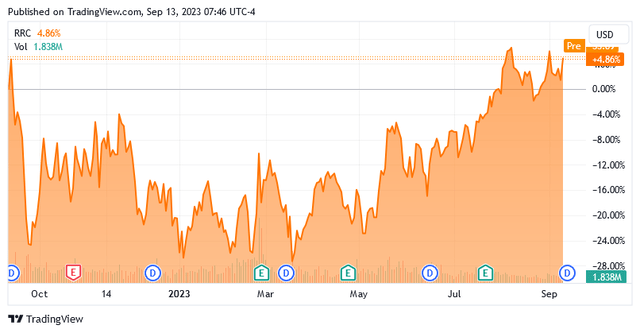

Vary Assets Company (NYSE:RRC) is a pure gas-focused impartial exploration and manufacturing firm that operates primarily within the extremely resource-rich Appalachian area. The corporate is among the largest producers of pure gasoline in the USA, and it is among the few upstream firms whose manufacturing is totally targeted on pure gasoline or pure gasoline liquids. Sadly, this has not been the very best place to be just lately, as pure gasoline at Henry Hub costs are down 66.79% over the previous twelve months. This has not had a very unfavourable impression on Vary Assets’ inventory value, although, as its shares are literally up 4.86% over the identical interval:

Searching for Alpha

We do see that the inventory has been risky, although and there have been instances over the winter months when the corporate’s share value was down far more considerably. One motive for the latest market surge within the inventory value is nearly actually that the pure gasoline provide glut available in the market is exhibiting indicators that it might abate within the close to future. As I mentioned in a weblog publish earlier this 12 months, American producers of pure gasoline have been reducing their manufacturing to keep away from pumping pure gasoline into an oversupplied market. As well as, the truth that Freeport LNG is operational as soon as once more has added a big quantity of demand to the market. Total, then, issues might be wanting up for Vary Assets.

The probably enchancment within the pure gasoline market just isn’t the one factor that Vary Assets has going for it proper now. As I discussed in my earlier article on this firm, Vary Assets has a really robust steadiness sheet and a gorgeous valuation. This stays the case immediately, as Vary Assets nonetheless seems to be undervalued regardless of the run-up within the firm’s inventory value over the previous three months. After we mix this with the robust fundamentals for pure gasoline, there are actually some good causes to contemplate taking a place on this firm immediately.

About Vary Assets Company

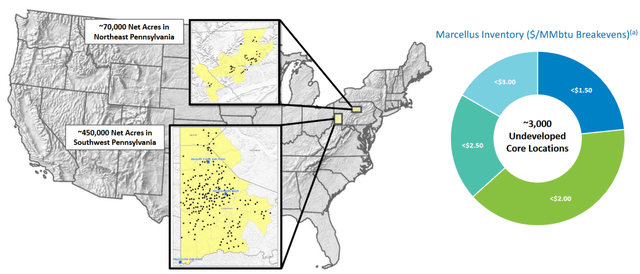

As acknowledged within the introduction, Vary Assets is a pure gas-focused exploration and manufacturing firm that primarily operates within the Appalachian area of the USA. There are two main hydrocarbon-producing basins on this area (the Marcellus and the Utica Shale), however Vary Assets is generally energetic within the Marcellus. The corporate controls roughly 450,000 internet acres in Southwest Pennsylvania and roughly 70,000 internet acres within the Northeastern a part of the state:

Vary Assets

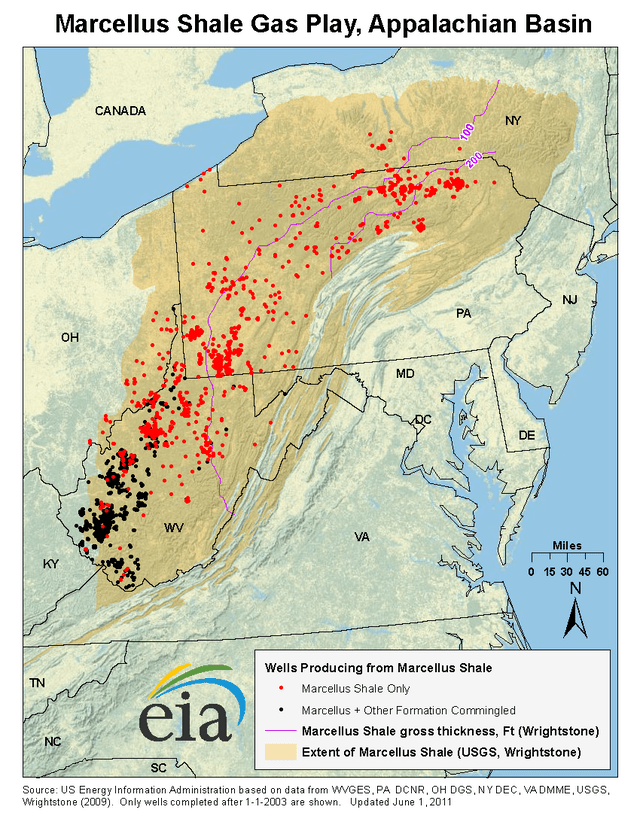

That is usually an excellent place to function, particularly within the Southwest Pennsylvania area surrounding town of Pittsburgh, PA. As I identified in earlier articles, the Marcellus Shale is the biggest supply of pure gasoline in the USA with proved reserves most just lately estimated at 148.7 trillion cubic ft of pure gasoline. Naturally, Vary Assets doesn’t have all this. In spite of everything, the Marcellus pure gasoline pattern covers many of the state of West Virginia, practically all of Western Pennsylvania, and an excellent portion of New York:

U.S. Power Info Administration

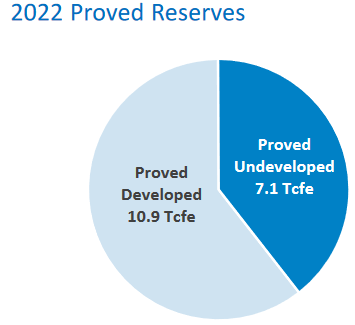

Vary Assets solely operates in a comparatively small portion of that basin. Nevertheless, the corporate’s sources are nonetheless substantial. As of December 2022 (the newest date for which knowledge is presently out there), Vary Assets had whole proved reserves of eighteen trillion cubic ft of pure gasoline equal, with a good portion of them nonetheless undeveloped and unexploited:

Vary Assets

In my earlier article on Vary Assets, I made the next assertion:

“An vitality firm’s reserves are ceaselessly missed by buyers, however they’re critically necessary. It is because the manufacturing of pure gasoline is by its nature an extractive course of. Vary Assets actually obtains the product that it sells by pulling it out of reservoirs within the floor. As these reservoirs solely include a finite amount of sources, an organization should regularly uncover or purchase new sources of sources, or it can ultimately run out of merchandise to promote. As that is in no way assured, the corporate’s reserves decide how lengthy it may proceed to supply with none success on this endeavor.”

Through the second quarter of 2023, Vary Assets produced a median of two.080752 billion cubic ft of pure gasoline equal per day. Which means that its present confirmed reserves whole roughly 8,650.72 days of manufacturing on the firm’s second-quarter degree. That’s about 23.7 years, which supplies this firm one of many highest reserve lives round. Actually, that is considerably increased than many of the upstream firms working within the Permian Basin, and it’s even increased than the supermajor vitality firms. As such, we actually shouldn’t have to fret about Vary Assets operating out of sources anytime quickly. This firm can proceed to supply for a really very long time without having to find or receive new sources of sources.

One factor that we be aware right here is that Vary Assets’ second-quarter manufacturing was decrease than the corporate’s manufacturing within the first quarter of this 12 months.

|

Q2 2023 |

Q1 2023 |

|

|

Common Every day Manufacturing (Billion cfe/d) |

2.081 |

2.12 |

This suits in with the narrative that I offered within the introduction. There was a considerable glut within the American pure gasoline marketplace for most of this 12 months, which has been attributable to two elements:

- An unusually heat winter in many of the nation induced shoppers to burn a lot much less pure gasoline than regular to warmth their properties and companies.

- The Freeport LNG plant was shut down till February 2023. That plant consumes a substantial quantity of pure gasoline, so its shutdown eliminated a big quantity of provide from the market.

Numerous pure gasoline producers have been shutting down or throttling their manufacturing so as to keep away from feeding pure gasoline into this provide glut. Vary Assets is perhaps actively collaborating on this as effectively, though the corporate made no point out of a aware effort to scale back manufacturing output in its second-quarter press launch. The corporate additionally stored its steering flat, which means that it isn’t deliberately protecting manufacturing down in response to the oversupply available in the market. Vary Assets presently expects that its 2023 common day by day manufacturing will probably be between 2.12 and a pair of.16 billion cubic ft of pure gasoline equal per day, which is sort of a bit above the corporate’s second quarter (though according to its first-quarter degree). In an effort to obtain this aim, it might want to considerably improve its output within the second half of this 12 months. Personally, I’d reasonably the corporate not do this, as it’s most likely higher for it to overlook its manufacturing steering than produce and promote pure gasoline at immediately’s low costs.

Sturdy Margins And Free Money Circulation

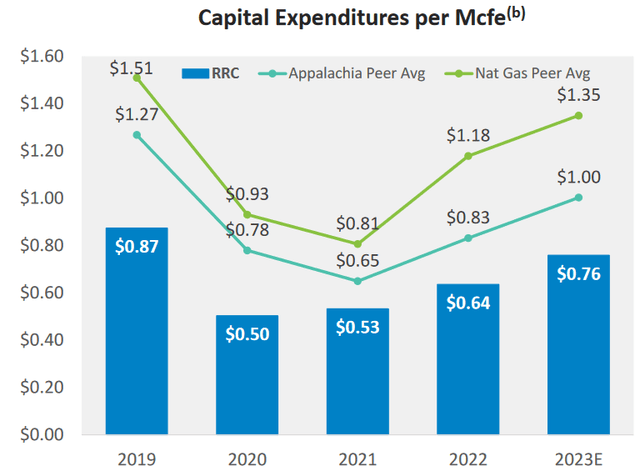

Happily, Vary Assets is ready to produce profitably even with pure gasoline at immediately’s low costs. The corporate’s common manufacturing value year-to-date has been $0.76 per thousand cubic ft of pure gasoline, which is considerably under the corporate’s friends:

Vary Assets

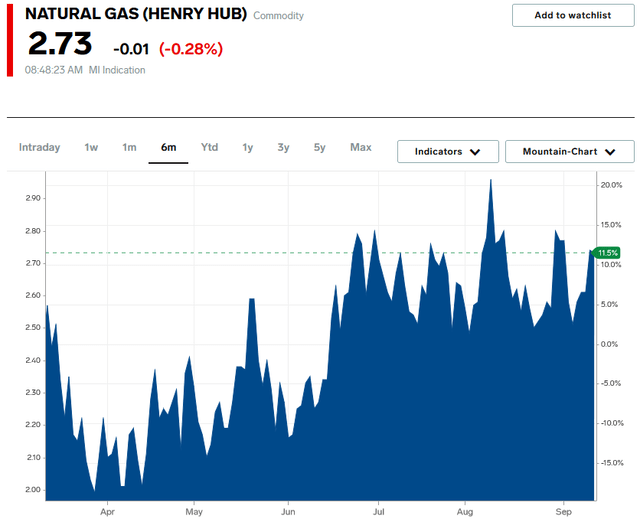

As of the time of writing, pure gasoline at Henry Hub is buying and selling at $2.73 per thousand cubic ft. That is fairly near its six-month excessive, but it surely has been range-bound over the previous three months or so:

Enterprise Insider

As Vary Assets is ready to produce pure gasoline for considerably lower than the present market value, this has allowed the corporate to earn pretty excessive margins even in immediately’s local weather. Dennis Degner, CEO of Vary Assets, apparently agreed with this conclusion within the firm’s earnings press launch:

“Second quarter outcomes replicate the resilience and sturdiness of Vary’s enterprise. Vary’s aggressive value construction, low relative capital depth, liquids optionality, and considerate hedging allowed us to generate wholesome full-cycle margins and preserve our trajectory in direction of our goal capital construction, regardless of what we count on is a cyclical low in commodity costs. The Vary crew stays targeted on effectively growing our Marcellus belongings to create worth for shareholders into what we consider is an bettering macro outlook for pure gasoline and pure gasoline liquids.”

The truth that Mr. Degner instructed that the corporate is reaching wholesome full-cycle margins implies that he agrees with my conclusion that the corporate’s low prices are permitting it to climate the present surroundings fairly effectively.

This conclusion concerning the firm’s robust margins is strengthened by taking a look at its free money stream:

|

Q2 2023 |

Q1 2023 |

This fall 2022 |

Q3 2022 |

Q2 2022 |

Q1 2022 |

This fall 2021 |

Q3 2021 |

Q2 2021 |

|

|

Levered Free Money Circulation |

($5.1) |

$241.6 |

$198.8 |

$273.9 |

$38.1 |

$491.7 |

($49.1) |

$223.8 |

$153.9 |

|

Unlevered Free Money Circulation |

$13.1 |

$260.4 |

$220.6 |

$296.7 |

$61.2 |

$519.2 |

($16.0) |

$257.3 |

$187.5 |

(all figures in tens of millions of U.S. {dollars}.)

As we will rapidly see, Vary Assets solely had a really restricted variety of quarters by which its free money stream went unfavourable. This can be a marked enchancment from the corporate’s monitor document previous to the COVID-19 pandemic, significantly from early final decade when the shale vitality growth was simply starting to realize traction. Clearly, the truth that the corporate is ready to generate free money stream even with pure gasoline costs at immediately’s very low ranges is an efficient factor as a result of free money stream is the cash that the corporate has out there to make use of for duties that profit the shareholders. The truth that it’s usually producing optimistic free money stream now signifies that it has cash to make use of to pay down debt, purchase again shares, or pay a dividend.

Monetary Issues

As I identified in my final article on Vary Assets:

“It’s at all times necessary to analyze the best way that an organization funds its operations earlier than investing in it. It is because debt is a riskier solution to finance an organization than fairness as a result of debt have to be repaid at maturity. That’s sometimes achieved by issuing new debt and utilizing the proceeds to repay the maturing debt since only a few firms are capable of utterly repay their debt with money because it matures. As new debt is issued with an rate of interest that corresponds to the market rate of interest on the time of issuance, this may trigger an organization’s curiosity expense to extend following the rollover in sure market circumstances. As of the time of writing, rates of interest are on the highest degree that we now have seen in additional than twenty years, so it appears sure that any debt rollover immediately will trigger an organization’s curiosity bills to go up. Along with interest-rate danger, an organization should make common funds on its debt whether it is to stay solvent. As such, an occasion that causes an organization’s money stream to say no might push it into monetary misery if it has an excessive amount of debt. After we think about the impression that risky commodity costs can have on Vary Assets’ income and money flows, this can be a danger that we should always not overlook.”

One ratio that we will use to investigate an organization’s monetary construction is the online debt-to-equity ratio. As of June 30, 2023, Vary Assets had a internet debt of $1.6287 billion in comparison with whole shareholders’ fairness of $3.3876 billion. This offers the corporate a internet debt-to-equity ratio of 0.48 immediately. This can be a pretty robust ratio that’s effectively under the 1.Zero most that I sometimes prefer to see an upstream exploration and manufacturing firm possess. Vary Assets’ ratio can also be barely improved over the 0.49 ratio that the corporate had on the finish of the primary quarter of this 12 months. That is good because it exhibits that the corporate just isn’t solely sustaining however really bettering its monetary energy even if pure gasoline costs have been very low through the second quarter of 2023.

Right here is how Vary Assets’ monetary construction compares to that of its friends:

|

Firm |

Web Debt-to-Fairness Ratio |

|

Vary Assets Company |

0.48 |

|

EQT Company (EQT) |

0.29 |

|

CNX Assets (CNX) |

0.58 |

|

Antero Assets (AR) |

0.67 |

|

Comstock Assets (CRK) |

1.03 |

As we will rapidly see, Vary Assets’ internet debt-to-equity ratio compares pretty effectively to its friends. This can be a good signal for our functions because it clearly signifies that the corporate just isn’t utilizing an extreme quantity of debt to finance its operations. It additionally signifies that the corporate just isn’t significantly reliant on debt as a supply of financing, which may be very good contemplating each the rising rate of interest surroundings and the market’s common dislike for something associated to the fossil gasoline business.

Valuation

Based on Zacks Funding Analysis, Vary Assets will develop its earnings per share at a 28.40% charge over the following three to 5 years. This offers the corporate a price-to-earnings development ratio of 0.56 on the present inventory value. As we now have mentioned earlier than, any ratio beneath 1.Zero might be an indication {that a} inventory is undervalued relative to the corporate’s ahead earnings per share development. Clearly, Vary Assets suits into this class.

Nevertheless, just about all the pieces within the conventional vitality sector has been undervalued by most metrics for fairly a while. As such, it might be a good suggestion to check Vary Assets to its friends so as to see which inventory presents probably the most engaging relative valuation:

|

Firm |

PEG Ratio |

|

Vary Assets Company |

0.56 |

|

EQT Company |

1.11 |

|

CNX Assets |

2.56 |

|

Antero Assets |

N/A |

|

Comstock Assets |

N/A |

It seems that Vary Assets is the one one in all these pure-play pure gasoline producers that’s undervalued relative to its earnings per share development. That is even if the inventory has delivered a fairly robust efficiency over the previous a number of months. Thus, it would nonetheless make sense so as to add to a place in Vary Assets immediately.

Conclusion

In conclusion, Vary Assets may be very effectively positioned to deal with each immediately’s low pure gasoline surroundings and prosper because the market returns to regular. The corporate’s low prices make sure that it may produce profitably with costs at immediately’s ranges. Certainly, the corporate has nonetheless had optimistic free money stream over the previous twelve months. This can be a large enchancment over the scenario that the corporate was in previous to the COVID-19 pandemic. Vary Assets additionally has monumental reserves that might be exploited because the rising use of pure gasoline as a complement to renewables pushes world demand up. After we mix this with a powerful steadiness sheet and a gorgeous valuation, there is perhaps some causes to buy the corporate’s inventory immediately.