stockarm/iStock by way of Getty Photographs

Abstract

Following my earlier protection on Sirius XM Holdings (NASDAQ:SIRI), I beneficial a maintain ranking on account of my expectation that the outlook goes to be bleak given the restricted alternative for SIRI to develop income on this weak auto market pushed by excessive charges, weak conversion charges, and an unsure promoting backdrop. This put up is to offer an replace on my ideas on the enterprise and inventory. I proceed to advocate a maintain ranking for the inventory as I imagine SIRI isn’t in the most effective place to proceed changing extra subs regardless of the optimistic auto outlook for FY23. As well as, my valuation mannequin suggests the inventory is pretty valued.

Funding thesis

I nonetheless discover SIRI’s 2Q23 outcomes disappointing when it comes to self-pay web provides and ARPU, even supposing they have been barely higher than consensus expectations for income and adjusted EBITDA. The earnings report revealed a notable optimistic side, particularly the efficiency of promoting revenues, which exceeded my expectations. This was primarily pushed by a higher-than-anticipated progress in Advert income per impression, reaching $97.13, which will be attributed to a stronger promoting market. The outperformance of adjusted EBITDA will be attributed to a mixture of surpassing income expectations and a lower in gross sales and advertising bills, which the corporate has proactively lowered in anticipation of its upcoming product launch scheduled for later this yr.

Whereas my bearish view on the promoting outlook has turned barely higher given 2Q23 efficiency, the opposite two adverse elements I discussed beforehand stay a priority of mine: (1) being unable to develop income on this weak auto market (i.e., web provides are going to be weak); and (2) weak conversion charges.

In relation to the primary level, it’s noteworthy that SIRI, as anticipated, reported self-paid web additions within the second quarter of 2023 that have been beneath expectations. This was accompanied by a churn of 133,000 self-pay subscribers (self-pay churn price was recorded at 1.54%). In the course of the convention name, the administration expressed their anticipation of observing a modest enhance in self-pay web additions throughout the latter half of the yr. Moreover, they anticipate to witness a gradual enchancment on this regard because the yr progresses. It’s price noting that administration had beforehand indicated its anticipation of a modestly adverse enhance in self-pay web additions for the yr 2023. From my perspective, it may be argued that there’s a sure diploma of validity to the administration’s outlook, on condition that the projected gross sales of sunshine autos in the USA appear to be surpassing what I’d have anticipated given the prevailing excessive rates of interest. Though there’s a optimistic pattern in auto gross sales, you will need to spotlight to readers that a rise in auto gross sales doesn’t essentially assure a corresponding enhance in SIRI’s income. It simply means there are extra alternatives for conversion.

This results in the following level relating to conversion. Based on the administration’s assertion, the conversion charges have exhibited stability, implying that they’ve constantly remained throughout the low-30%s vary for brand new vehicles and the low-20%s vary for used vehicles. These figures point out a deviation from historic patterns (excessive 20s to 30s% for used vehicles and excessive 30s to low 40s% for brand new vehicles). The absence of a rebound in SIRI’s conversion price means that the corporate could also be reaching a juncture the place the perceived worth of their choices in relation to the fee incurred by shoppers is diminishing. For my part, conversion charges have dropped as SIRI has gotten extra ingrained within the auto base and begun specializing in the extra price-sensitive clients. The aforementioned phenomenon, coupled with intensified competitors within the realm of high-quality audio providers, particularly within the area of streaming, will persistently exert affect on the method of conversion. Administration expresses optimism relating to the potential conversion advantages related to initiatives similar to 360L. Nevertheless, I keep a priority relating to the heightened aggressive depth throughout the premium audio sector and the elevated availability of functions within the dashboard, each of which can exert strain on subscriber tendencies.

The clearest sign of the aggressive setting will be seen within the ARPU metric. SIRI just lately disclosed an ARPU of $15.66, and this determine exhibits solely slight fluctuations in comparison with the earlier yr, regardless that they raised costs on sure full-price plans in March. I imagine that, within the coming yr, Sirius XM might face constraints in its skill to extend costs and ARPU on account of macroeconomic circumstances and powerful competitors. It’s possible that Sirius XM should keep reductions to enchantment to cost-conscious shoppers.

Valuation

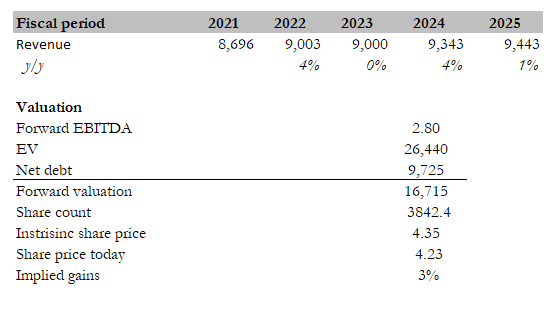

Personal calculation

I imagine the honest worth for SIRI primarily based on my mannequin is $4.35. My mannequin assumptions are that progress will mainly be muted for FY23 given all of the adverse headwinds and likewise simply as administration guided. FY24 will see a progress acceleration to 4% given the straightforward comps in FY23, however decelerate again to 1% (utilizing the consensus estimate). My take is that SIRI will now not see historic progress given the saturation of its goal shoppers and rising competitors.

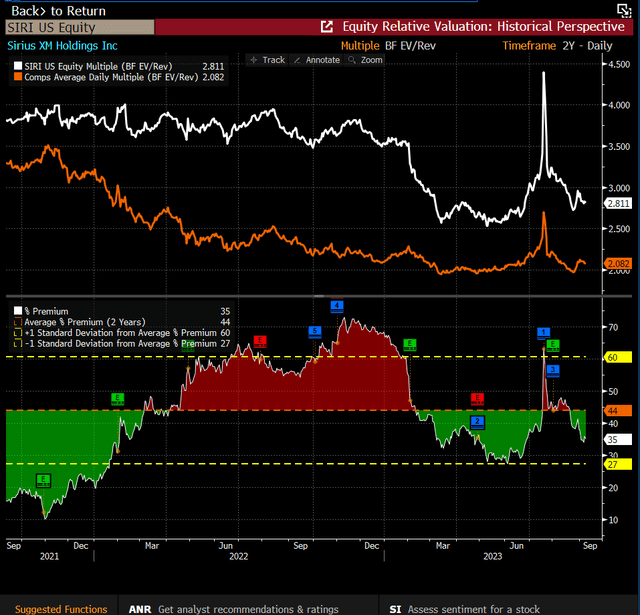

As Spotify (SPOT) isn’t producing significant earnings, I used a income a number of to match friends. SIRI is at present buying and selling at 2.8x ahead income, which is a premium to its friends. This hole exists probably as a result of SIRI is essentially the most worthwhile participant among the many group and continues to be exhibiting optimistic progress to date. I anticipate this hole to stay for the foreseeable future. Friends embody Spotify and IHeartMedia (IHRT). The common ahead income a number of friends are buying and selling at is 2, and the common EBITDA margin between them is 8%, which is manner decrease than SIRI.

Bloomberg

Conclusion

Regardless of a optimistic efficiency in promoting revenues and the anticipation of elevated self-pay web additions within the latter half of 2023, SIRI faces vital challenges. The soundness in conversion charges at decrease ranges in comparison with historic patterns suggests diminishing perceived worth amongst shoppers. Moreover, heightened competitors within the premium audio sector and the supply of dashboard functions might additional influence subscriber tendencies. The ARPU metric stays a vital indicator of SIRI’s aggressive setting, with restricted ARPU progress regardless of value will increase. Within the upcoming yr, financial circumstances and powerful competitors might constrain SIRI’s skill to lift costs, probably necessitating reductions to draw cost-conscious shoppers, in my opinion.

General, I keep my maintain ranking on SIRI, as the corporate faces ongoing challenges in a dynamic market panorama.