Jay Yuno

Why Anta?

International sportswear leaders like Nike (NKE) and Adidas (OTCQX:ADDYY) have been in a position to generate excessive ROICs (>20%) of their peak years. I made a decision to analyse the Chinese language footwear market to see if the same development may play out there and I discovered that ANTA Sports activities Merchandise Restricted (OTCPK:ANPDY) is the perfect positioned to be a long run compounder given its robust execution observe document and multi-brand technique. Macro-wise, that is additionally an business I view favourably in China provided that it has enormous progress potential (USD 40 per capita consumption in China vs sub 100 in different developed Asian nations), is propelled by nationalism and can also be supported by governmental insurance policies – an important think about investing in China.

Introduction

Anta is a designer and producer of sportwear style with 99% of income from China. The corporate’s product line contains operating, cross-training, basketball, climbing, athleisure footwear and attire that are supplied via its multi-branded technique.

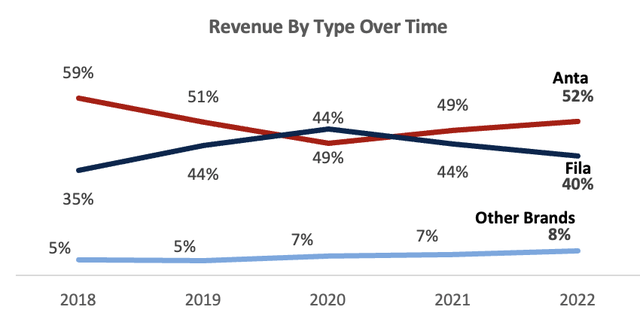

Revenues are break up into three most important segments (1) Core Anta Model – Established in 1991, the most important income driver is its namesake Anta model, which produces sports activities footwear and attire and is positioned in direction of the Chinese language mass market (2) Fila Manufacturers – Acquired in 2009, Fila manufacturers is Anta’s 2nd largest income. Manufacturers right here embody Fila, Fila Fusion and Fila Children. Fila manufacturers supply athleisure merchandise and are positioned in direction of younger, prosperous and classy people. (3) Different Manufacturers – These manufacturers have been acquired by Anta over time and primarily goal the premium marketplace for outside sports activities. Manufacturers embody Descente, Kolon Sports activities in addition to the just lately acquired Amer Sports activities of manufacturers which incorporates Arc’teryx and Salomon.

Anta Income Cut up Over Time (Annual Studies)

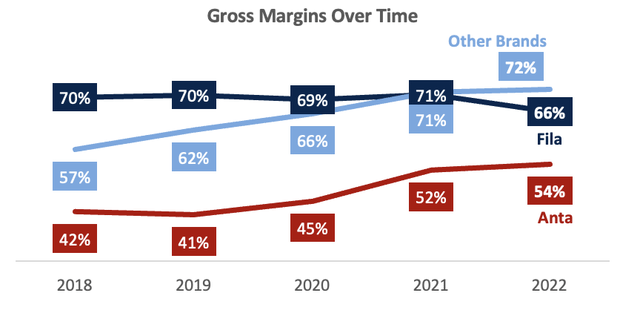

In ascending order of gross margins, now we have Anta model at 54% in FY22, Fila at 66% and different manufacturers at 72%. The upper margin of acquired manufacturers are testomony of Anta’s multi model technique – most important model stays mass market whereas different manufacturers may have greater ASPs and goal extra premium segments.

Anta Gross Margins Over Time (Annual Studies)

Trade Overview

Based on Euromonitor, China’s home sportwear business will develop at a 9% CAGR from CNY363 bn in 2022 to CNY 551bn in 2027. This progress is facilitated by (1) financial progress, (2) rising public consciousness of health & well being and (3) supportive authorities insurance policies. For instance China’s dedication in direction of sports activities, the Chinese language authorities has laid down sports-related targets of their 14th 5 12 months Plan (2021 – 2025). For instance, it units the target of getting 38.5% of the inhabitants participating in common bodily exercise by 2025, up from 37.2% in 2020. There are additionally aggressive targets in sports activities space per capita, sports activities instructors per 1000 folks and the nation has been quickly including sports activities services to help this progress.

Breaking down sportswear, athleisure & winter sports activities are two quickly rising segments, particularly amongst greater tier cities. Athleisure has grown round 10 proportion factors greater than the broader market the previous three years, as evident by Lululemon (LULU) & Fila, and is pushed by the rising acceptance of athleisure as on a regular basis put on and a society which begins to prioritize each day health. Based on BCG, luxurious athleisure is rising extra widespread in China with high Three causes being athleisure is socially accepted in additional events (48%), can exchange formalwear (31%), and is extra snug (21%).

Then again, the expansion of winter sports activities has been accelerated by the 2022 Winter Olympics because it caused consideration and new services which was once the limiting issue. In 2022 alone, China already exceeded their 2025 300mn customer goal to winter sports activities places, with most guests being younger, prosperous urbanites. The winter sports activities market is anticipated to be value $150 mn by 2025, representing a surprising 46% CAGR from $48 mn in 2022, with attire being one of many most important beneficiaries, in accordance with China Briefing.

Aggressive Positioning

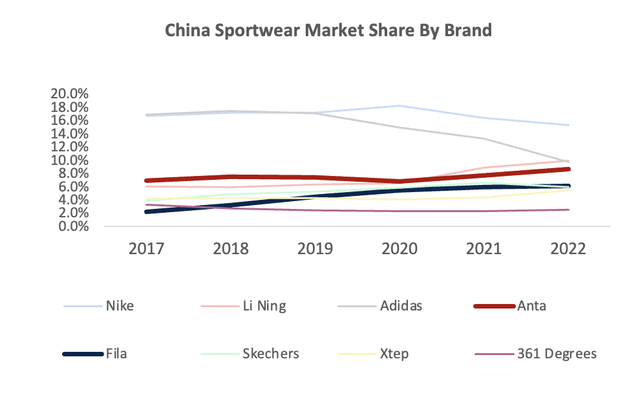

In comparison with world markets, China sportswear is extra consolidated with an organization CR5 of 69%, vs CR5 of 36% in US and CR5 of 49% in Japan. The market is dominated by world friends like Nike, Adidas in addition to native manufacturers like Anta, Li Ning (OTCPK:LNNGF), Xtep (OTCPK:XTEPY) and 361 Levels (OTCPK:TSIOF). Whereas Nike & Adidas was once the market leaders, the bettering high quality of home choices fueled by nationalism has allowed home manufacturers like Anta and Li Ning to achieve market share from international leaders and propel into 2nd and 4th (by firm) respectively in 2022. Notably, Nike & Adidas market share have fallen since 2020 attributable to their stance on the Xinjiang cotton controversy and has not recovered since. Based on the Economist, this nationalistic sentiment is right here to remain, which proceed propelling Chinese language manufacturers ahead in the long run. Particularly for Anta, a part of their market share progress got here from publish 2020 positive aspects of their namesake Anta, a broadly in style home model, in addition to the tripling of Fila’s share within the athleisure market. As we speak, Anta owned manufacturers mixed have 18.6% market share, the place core Anta model is 4th, barely behind Nike, Adidas & Li Ning, whereas Fila ranks fifth.

China Sportswear Market Share By Model, 2022 (Euromonitor)

Funding Thesis

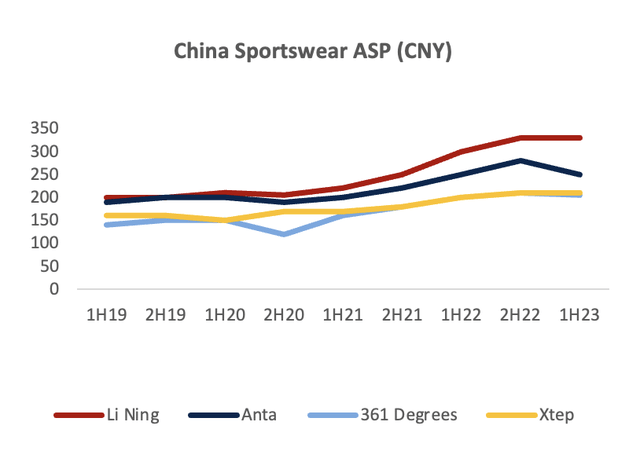

#1: Market Is Overlooking Anta’s Profitable Enhancements In Model Fairness Which Will Help Extra Premium Merchandise In Prime Tier Cities, Main To ASP Growth

Following the 2012 extra stock saga of Chinese language sportswear, Anta’s picture was often known as a “decrease high quality”, mass market shoe whereas Li Ning is often thought to be the highest quality home model which instructions a premium. Over the previous decade, Anta has doubled down on R&D & advertising and marketing to make greater high quality footwear that customers would resonate with. In FY22, Anta spent 12.7% of income on advertising and marketing (10.3%) and R&D (2.4%) mixed, much like friends on a relative foundation however 1.4x greater than the subsequent closest peer on an absolute foundation, showcasing its dedication to model constructing. I consider this attracts some parallels to Li Ning’s model constructing efforts within the early 2010, the place they always outspend friends by virtually 2x on advertising and marketing, and this transfer had efficiently given Li Ning a branding premium in China.

Likewise, I consider that Anta’s investments will begin to bear fruits within the coming years. First, Anta’s on-line advertising and marketing methods have centered on movie star ambassadors and sponsoring the nationwide group for Olympics, which they’ve achieved so each version since 2010. On Weibo, person engagement for Anta’s model collaborations far exceeds that of Li Ning, with Anta topping Three mn posts and a couple of.Four bn views per subject, in comparison with Li Ning’s 1mn posts and 85mn views. On-line customers have appear to shifted their model choice in direction of Anta, with Anta overtaking Li Ning and Nike’s Weibo followers in 2022. Moreover, net scraping from Eight on-line boards present that customers have an overwhelmingly optimistic opinion on Anta, with high two key phrases related being “worth for cash” and “high quality”, whereas Li Ning was dominated by adverse opinions on pricing and high quality.

|

Key phrase |

Hits |

Key phrase |

Hits |

|

Anta |

52 |

Li Ning |

28 |

|

Worth For Cash |

11 |

-ve View on Value Hikes |

8 |

|

High quality |

10 |

Poor Qlty |

5 |

|

Good Design |

5 |

Robust Model |

6 |

Supply: Analyst Estimates

Anta’s optimistic model picture can also be mirrored in a 2023 on-line model rating survey by Maigoo which mixes key metrics like votes, opinions and on-line retailer recognition. With over 150okay votes, Anta tops the sportswear charts, forward of Li Ning and international manufacturers. Key social metrics comparable to likes & shares are additionally trending upwards for Anta, suggesting that Anta is efficiently bettering its model imaging.

Prime 5 Sports activities Shoe Model Rating In China (Maigoo)

As Anta goals to proceed increasing in Tier 1 cities and add extra premium merchandise, I consider that Anta’s newfound power in branding will help rising ASPs, and allow them to shut the “perceived high quality” and ASP hole to Li Ning within the medium time period, one thing the market isn’t pricing in.

China Sportswear Footwear ASP (Market IDX)

#2: Anta’s Multi Model Technique Makes It Finest Positioned For China’s Okay-Formed Restoration Therefore I Anticipate Increased Close to Time period Income Development

China will possible expertise a Okay-shaped consumption restoration within the close to time period. Increased-end consumption remained sturdy, with attire like Nike & Lululemon reported double digit gross sales progress in 1H22, in accordance with Jing Every day. Then again, broader consumption rebound is really fizzling out, with China’s yoy retail gross sales progress lacking expectations from Could to July, reaching simply 2.5% in July 2023, in comparison with a publish lockdown excessive of 18.5% in April. As consumption urge for food weakens, Chinese language customers are more and more turning to high quality and worth for cash merchandise of their buy, per McKinsey.

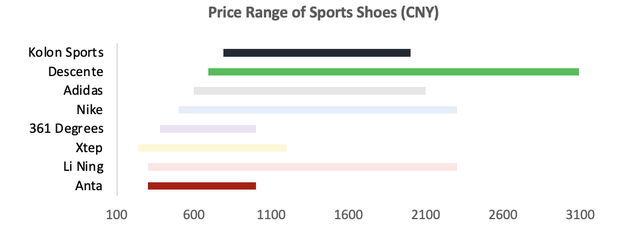

Amongst home China sportswear, Anta is the perfect positioned to learn from divergent spending developments as it’s the solely firm with a multi model technique. The core Anta model targets the mass market and has footwear priced as little as RMB299 whereas Fila, Descente & Kolon are manufacturers positioned in direction of the premium market.

Value Vary of Sports activities Footwear In China (Tmall)

I consider Anta can win the “downshifting” mass market customers attributable to their “worth for cash” and “high quality” proposition, and on the similar time have sizable publicity to the fast-growing premium market, a progress driver that friends lack. Therefore, I forecast the next FY23E income progress charge of 16.3% (vs avenue at 15.6%) and better 23E-25E CAGR of 16.8% (vs avenue at 15%).

#3: Anta’s Examined & Confirmed New Model Incubation Methodology Will Flip Amer Sports activities Into A Vital, Increased Margin Development Engine, Which Is Underappreciated By The Market

With the market overly centered on China’s consumption developments and Fila’s restoration, I consider many have neglected the expansion and margin accretive potential that the Amer Sports activities acquisition brings within the medium-long time period. Amer’s manufacturers are in excessive progress markets like winter sports activities, whereas Anta is a confirmed executor in acquisitions, with a powerful observe document of success in turning round Fila and repositioning it as a high athleisure model in China.

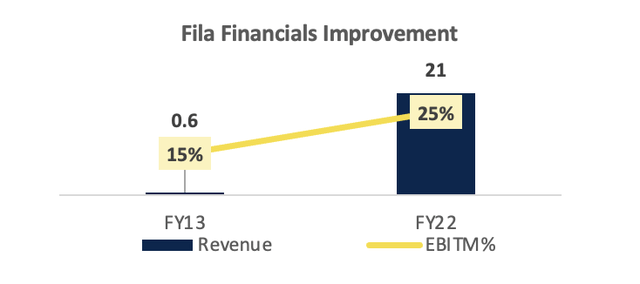

The Fila Turnaround: Anta acquired Fila in 2009 for CNY 332 mn, gaining trademark and operation rights within the Higher China area. Upon acquisition, Fila was loss making. Anta’s technique was to make use of Fila to focus on the high-end sports activities market whereas Anta remained mass market, as they’d all the time been unable to crack the previous market. To turnaround the enterprise, Anta did the next: (1) Collaboration with internationally famend designers (2) Its personal designers flew to Fila’s hometown in Italy the place over 100,000 sketches and product samples have been archived (3) Created designs bringing again Fila’s heritage whereas combining with Chinese language components and its sporting know the way (4) Established new product line Fila Children & Fila Fusion in 2015 and 2017 respectively to reposition and preimmunize the model as a stylish, athleisure product for teens (5) Combining provide chains to streamline prices This turnaround was very profitable, with Fila netting CNY 21 bn of income in FY22 (vs CNY 0.6 bn in FY13) and a 66% GPM, greater than core Anta. By preimmunizing Fila and streamlining operations EBIT margins rose from 15% in FY13 to 25% in FY22.

Turnaround In Fila’s Financials (Style Community)

Utilizing The Identical Tried & Examined Strategies On Amer: Fila & Amer Sports activities manufacturers share related traits. They’re each unprofitable upon acquisition however have a wealthy model positioning and heritage, in addition to abroad recognition, offering a turnaround runway. Fila has over 100 years of Italian cultural designs whereas Arc’teryx is well-known for top of the range waterproof & light-weight jackets. Then again, originating within the French Alps, Solomon has 70 years of historical past in producing prime quality winter and climbing boots.

Due to this fact, Anta might be in a position and has been utilizing related strategies to reposition Amer Sports activities’ manufacturers. For instance, it has (1) relocated shops from the roadside to strategic places in central enterprise districts on floor flooring apart luxurious manufacturers to shine its picture (2) included Chinese language components in attire design (3) expanded its product line to focus on girls & younger – all of those having labored for Fila. As a testomony to the success, Arc’teryx, considered one of Amer’s most important model noticed income soar by 96% to CNY 829 mn the yr after acquisition, in comparison with a 15% CAGR within the 7 years previous. Anta was additionally in a position to reverse the flattish income development of the model since 2015. With premiumization & streamlining of provide chains, Amer Sports activities unprofitability has additionally been reversed in 2022, a testomony to Anta’s profitable execution.

Repositioning of Arc’teryx Storefronts (Baidu)

Financials

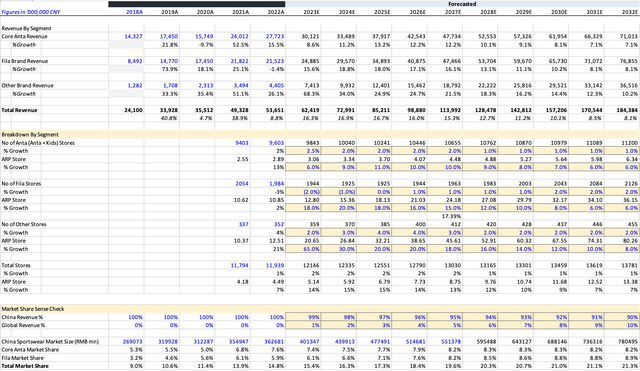

For retail, variety of shops & common income per retailer are the 2 drivers of progress. Retailer rely in 2023 are inside the vary of administration forecasts. Following that, I anticipate core Anta retailer rely progress to stay ~2% as they have already got probably the most shops in China and are solely concentrating on extra growth in some high tier cities. Fila retailer progress will stay flat as administration continues to concentrate on retailer productiveness whereas different manufacturers will see barely greater progress at 4% in FY25E and 26E to satisfy medium time period growth targets. For common income per retailer, I anticipate Anta to develop at a 10% CAGR via FY27E, barely above market charge attributable to rising ASPs. Fila will develop sooner at 17% CAGR attributable to a sooner rising submarket and different manufacturers will develop the quickest at 30% CAGR for the same purpose. I forecast retailer productiveness for different manufacturers to succeed in Canada Goose’s degree by FY2032 (CNY 20mn in FY23 to CNY80mn in FY32), which appears conservative additionally given administration’s CNY100mn objective.

Total, retailer productiveness would be the key driver of progress for Anta attributable to premiumization efforts of all manufacturers whereas retailer rely will stay low at ~2% of complete progress.

Anta Income Mannequin (Analyst Estimates, Annual Studies)

Gross margin clever, core Anta will proceed to extend +550bps to 59.5% in terminal yr attributable to DTC shift and better ASP merchandise. Fila & different manufacturers will rise +700bps and +300bps to terminal yr. Increased Fila enhance is because of a one off fall in FY22. Consequently, profitability might be led by GPM growth attributable to higher product combine and ROCE will rise from 19% FY22 to 24% in FY27E. Anta doesn’t have vital debt so monetary well being is powerful.

Valuation

A 10 yr Gordon Development DCF was carried out for valuation. 10 years was used to permit for the excessive progress in Fila & different manufacturers to normalize. Different assumptions embody (a) SD&M % of income to remain elevated in subsequent 3FY as Anta strikes in direction of a DTC mannequin, however fades to 33% in terminal yr (vs 36% in FY22), (b) G&A % of income to return down 120bps via terminal yr to five.5%. (c) terminal progress charge of three% was used (d) 12.5% hurdle charge was used for WACC.

A goal value of HKD 122.62 was obtained, representing a 34% upside from closing value of HKD 91.55

Catalyst

One key catalyst could be the profitable launch and take up of extra premium Anta merchandise. This may help the thesis that Anta has efficiently rejuvenated their model into one that may command greater ASPs, consequently supporting rising ASPs in the long run and better retailer productiveness. The market must also react positively by re-rating Anta with greater progress charges and be extra assured of allocating a premium a number of.

Dangers

A most important threat could be extended adverse shopper sentiment which can end in sportwear corporations requiring to supply huge reductions to draw patrons. This may severely hurt the highest line & margins. Nonetheless, this must be unlikely as core Anta progress remained sturdy at 6% yoy in 1H regardless of slowing shopper progress. There have additionally been no mentions of potential extra reductions per administration calls amongst friends. Moreover, ought to the mass market undergo, Anta will stay probably the most sturdy amongst its friends because it has greater than half of income supported from the extra “luxurious” market which stays robust.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.