AdrianHancu/iStock Editorial through Getty Photos

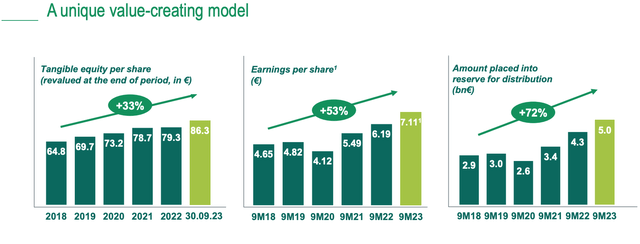

This has been a irritating 12 months for BNP Paribas (OTCQX:BNPQY)(OTCQX:BNPQF) shareholders. The French banking big continues to tick alongside because it usually does, but there’s a sturdy sense that its shares aren’t getting the a number of they deserve from the market. Efficiency since my final replace round a 12 months in the past sums issues up nicely. Roughly flat in share worth, these shares have returned round 8% regardless of a circa 15% rise in nine-month EPS and 9% year-over-year progress in tangible ebook worth per share. A number of growth was part of my ‘Purchase’ case final trip, so the implied de-rating is clearly a disappointment.

Q3 outcomes will not enhance sentiment. Certainly, the shares completed the day 2.6% decrease in Paris buying and selling, with the market’s destructive response contributing a big quantity to the pretty lackluster returns outlined above. Outcomes truly weren’t that unhealthy when it comes to the important thing P&L traces – they had been about according to what analysts had pencilled in – however beneath the floor there have been some disappointing numbers, significantly in its home retail banking and shopper finance segments. A backside line beat pushed by provisioning is likewise not going to do a lot for the shares.

Regardless of some tender notes, the sell-off implies that these shares are actually largely unmoved versus final trip. Given that suggests a good cheaper valuation, I proceed to view the financial institution as undervalued.

A So-So Third Quarter

BNP Paribas launched Q3 outcomes early on Thursday. The shares fell round 6% on the open, recovering to complete 2.6% decrease on the closing bell.

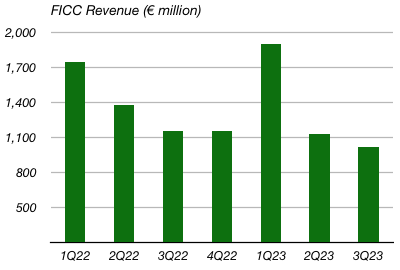

The principle P&L traces had been largely in line or barely above consensus, with income (€11.6 billion, up 4% year-on-year), pre-provision revenue (€4.5 billion, up 5% year-on-year) and return on tangible fairness (12.7%, up 130bps year-on-year) not instantly leaping off the web page in a nasty approach. Nevertheless, beneath the floor there have been undoubtedly some tender notes. International Markets got here in on the weak aspect in opposition to a troublesome comp, with income (€1.Eight billion) down round 9% year-on-year and working revenue (€639 million) down 25%. International macro buying and selling was the primary driver of that, as fastened revenue, commodities and forex income (€1.Zero billion)(“FICC”) fell round 11% year-on-year (Fig 1). That is not unhealthy relative to European friends like Barclays (BCS) (Q3 FICC income down 26% YoY), however it does stack up poorly to numbers put out by the large U.S. banks like Financial institution of America (BAC) (Q3 FICC income up 6% YoY).

Fig 1. (Information Supply: BNP Paribas Quarterly Outcomes Releases)

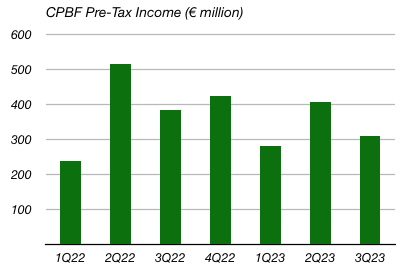

Fig 2. (Information Supply: BNP Paribas Quarterly Outcomes Releases)

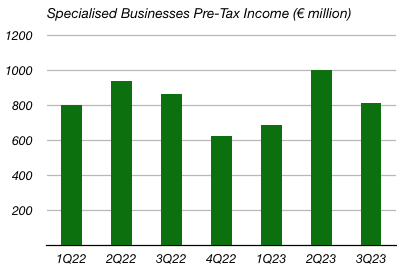

Fig 3. (Information Supply: BNP Paribas Quarterly Outcomes Releases)

Of barely extra concern was efficiency in CPBF, its French retail banking phase. CPBF income (€1.6 billion) was down round 3% year-on-year and seven% sequentially. Web curiosity revenue (€834 million) was significantly weak, falling 6% year-on-year and 9% sequentially, with that driving a circa 20% year-on-year decline in pre-tax revenue (Fig 2). French present account balances had been down 24% year-on-year to €130.1 billion. Leads to its different retail segments, which embrace different Eurozone markets like Italy, Belgium and Luxembourg, additionally again up the continued theme from European banks that income have now peaked. The Specialised Enterprise phase (primarily private finance and auto/gear leasing) additionally regarded considerably weak this quarter, with income (€2.5 billion) down round €100 million sequentially and better provisioning bills consuming into revenue (Fig 3).

On the group degree, reported internet revenue (€2.66 billion) was truly a shade larger than consensus, although it was pushed completely on the provisioning line and that is not going to earn the inventory a lot kudos. Price of danger was €734 million, which at round 33bps of complete loans stays beneath administration’s 40bps medium-term benchmark. Non-performing loans remained flat versus a 12 months in the past (~1.7% of complete loans), with the financial institution sitting on a stage Three protection ratio of round 70% plus a inventory of €5 billion in stage 1 and a couple of provisions.

Shares Stay Low cost Relative To Tangible E book Worth

Low cost-looking European banks aren’t in brief provide proper now, and I’d not exclude BNP from that class regardless of a really combined quarter. The shares closed out the day at €54.72 in Paris buying and selling ($28.74 per ‘BNPQY’ ADS), roughly the extent they had been at after I coated them in This autumn of final 12 months. Tangible ebook worth per share (“TBVPS”) has elevated by round 9% in that point to €86.30 (~$40.99 per ‘BNPQY’ ADS), which means these shares have truly change into cheaper on a P/TBVPS foundation. They commerce at simply 7.7x 9M’23 EPS.

Fig 4. (Supply: BNP Paribas Q3 2023 Outcomes Presentation)

The financial institution’s return on tangible fairness is not stellar at this level within the cycle, however it’s nonetheless comfortably above 10%. I’d additionally notice that BNP Paribas might be one of many least rate of interest delicate names in its peer group. When you view the present Eurozone rate of interest setting as unsustainable, which present market valuations of European banks appear to suggest, then this can be a reputation to think about.

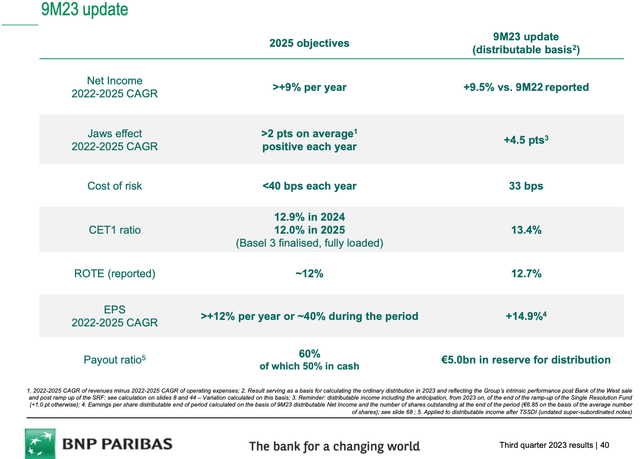

Regardless, BNP Paribas stays on observe to satisfy the targets set out in its 2025 strategic plan. These embrace 9% every year internet revenue progress (relative to a 2022 base), 12%-plus every year EPS progress and a 2025 reported ROTE of roughly 12%. Price of danger continues to be seen beneath 40bps in every year, unchanged from final time.

Fig 5. (Supply: BNP Paribas Q3 2023 Outcomes Presentation)

Given the above, fast math implies 2025 TBVPS of round €91.25. I preserve the view from earlier protection {that a} 0.9x a number of is fairly undemanding given the financial institution’s through-the-cycle ROTE profile, and that will get me to a 2025 worth goal of round €82 per share ($43.28 per ADS). Capital returns are guided at 60% of internet revenue, of which 50ppt is allotted to the annual dividend. Even on a flat a number of of TBVPS (~0.63x at the moment), that will be good for circa 13% annual returns over the following couple of years, with the share worth monitoring TBVPS progress and dividends rising according to EPS. A combined bag of leads to Q3 hasn’t helped the funding case right here, however BNP Paribas shares stay attractively valued, and I affirm my earlier ‘Purchase’ score.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.