Gian Lorenzo Ferretti Images

Actual Property Weekly Outlook

U.S. fairness markets declined for a fourth-straight week whereas benchmark curiosity continued an unabating resurgence to contemporary multi-decade highs as a possible looming authorities shutdown, lukewarm financial knowledge, and ongoing labor disputes added problems to current “increased for longer” considerations. Following a promising begin to the third quarter, optimism over a possible “comfortable touchdown” has been dimmed by resurgent oil costs – overwhelming fragile disinflationary tailwinds – and prompting central banks to face agency of their dedication to restrictive financial coverage.

Hoya Capital

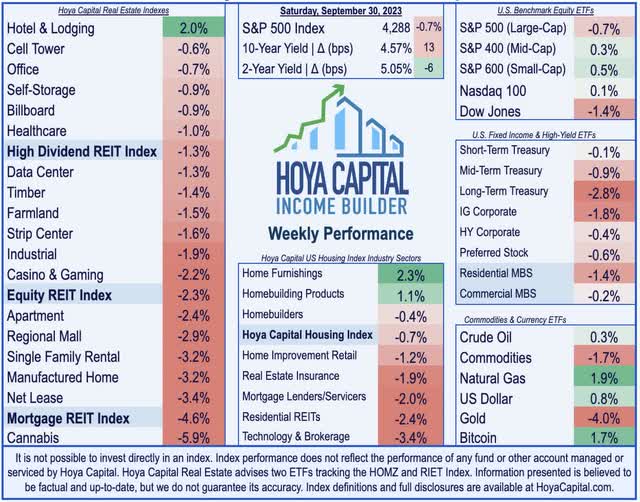

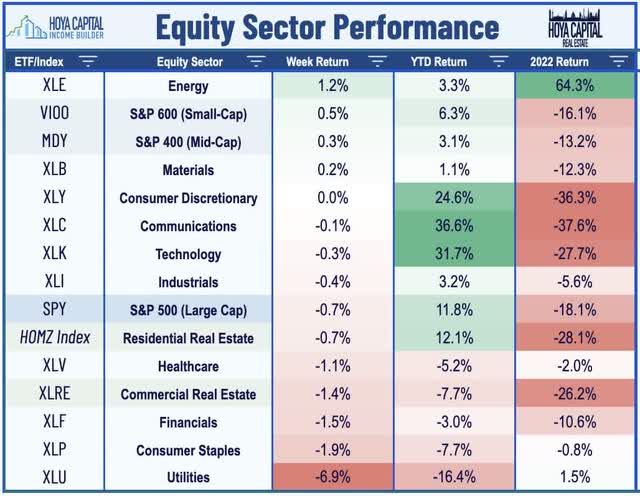

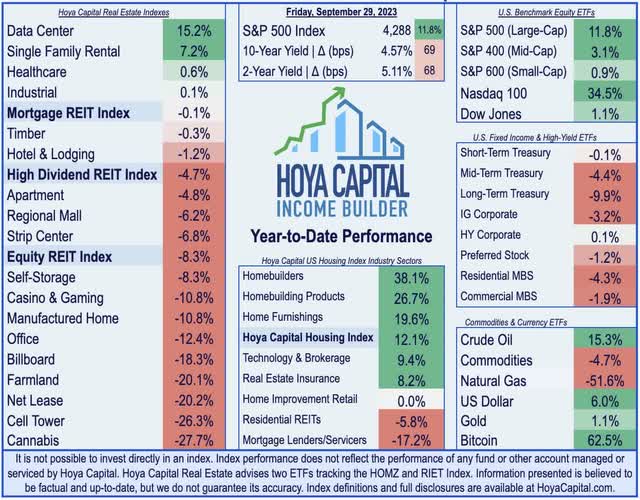

Posting its seventh weekly decline prior to now 9 weeks, the S&P 500 declined one other 0.7% on the week, ending the quarter close to its lowest-levels since early June. Nonetheless, the opposite main fairness benchmarks achieved modest positive aspects on the week, because the Mid-Cap 400 gained 0.3% whereas the Small-Cap 600 superior 0.5%. Following steep declines final week, actual property equities remained below stress amid concern {that a} “increased for longer” rate of interest surroundings will spell extra ache for personal actual property house owners and a few lesser-capitalized public REITs. The Fairness REIT Index declined one other 2.3% on the week, with 17-of-18 property sectors in detrimental territory, whereas the Mortgage REIT Index dipped by 4.6%. Homebuilders declined 0.4% as mortgage charges surged to contemporary 23-year highs, prompting a rate-driven slowdown that was already evident in sluggish New and Pending Residence Gross sales knowledge this week.

Hoya Capital

Optimistic catalysts have been more and more sparse in current weeks, lifting the Cboe Volatility Index (“VIX”) – also referred to as the Wall Road “worry gauge” – to the very best since late Might. Oil costs – a key supply of a lot of the current dismay – continued their ascent at present with Brent Crude hovering round $95/barrel as contemporary Division of Power (DoE) knowledge confirmed that inventories of the Strategic Petroleum Reserve remained close to 40-year low following a historically-large depletion in late 2022. Benchmark yields continued their ascent as effectively, with the 10-12 months Treasury Yield swelling one other 13 foundation factors to 4.57% – the very best end-of-week shut since 2007 – whereas the U.S. Greenback posted an 11th straight week of positive aspects. Complicating the financial outlook, a last-minute deal to keep away from a authorities shutdown appeared unlikely by Friday’s shut, whereas different carefully watched negotiations between the UAW and automakers additionally yielded restricted progress. Eight of the eleven GICS fairness sectors completed decrease on the week, with yield-sensitive sectors, together with Utilities (XLU) and Shopper Staples (XLP) dragging on the draw back.

Hoya Capital

Actual Property Financial Information

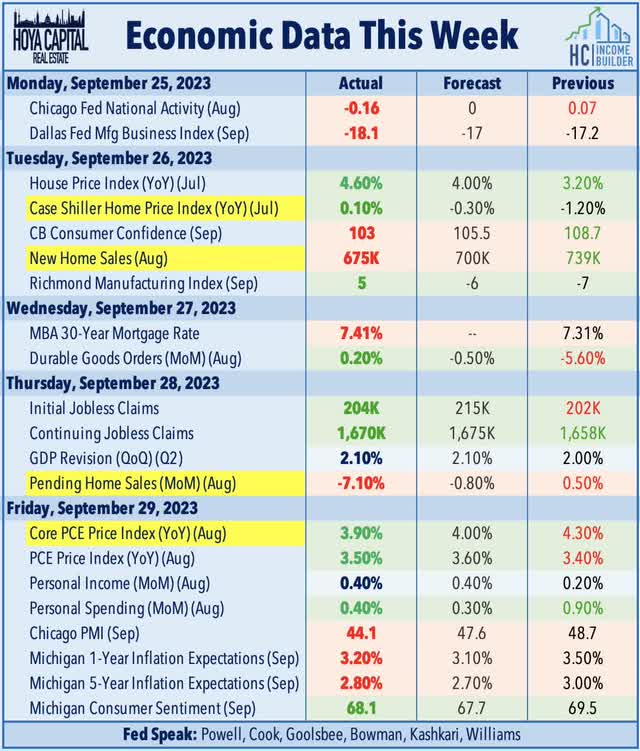

Beneath, we recap an important macroeconomic knowledge factors over this previous week affecting the residential and industrial actual property market.

Hoya Capital

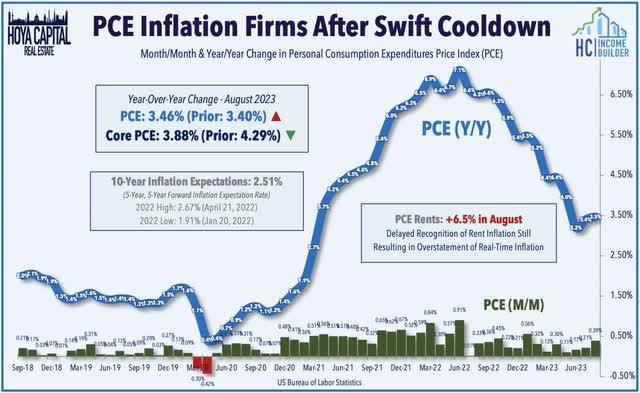

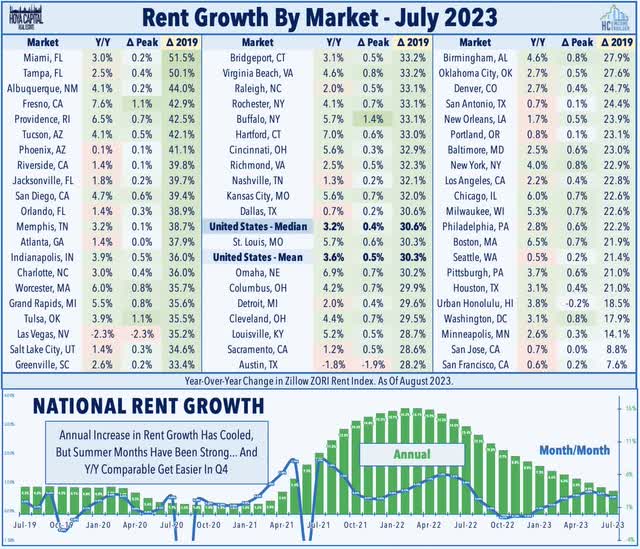

The closely-watched PCE Index this week supplied additional proof that resurgent oil costs have negated the once-promising disinflationary tailwinds. The Private Consumption Expenditures (PCE) Worth Index rose 0.39% in August – the very best month-over-month improve since January – which pulled the year-over-year improve to three.46%, a modest acceleration from July. In keeping with the traits noticed within the Shopper Worth Index, the Core metrics – which exclude vitality and meals costs – have remained on a promising development, which can develop into much more pronounced in months forward because the lagging shelter element begins to exert downward stress on these worth indices. The delayed recognition of shelter inflation has closely distorted the headline and core metrics since 2021, leading to a major understatement of inflation from mid-2021-2022 and an overstatement of inflation since mid-2022.

Hoya Capital

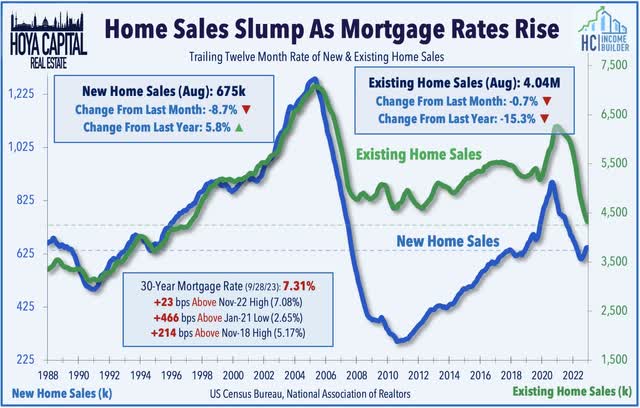

Pressured by a resurgence in mortgage charges to contemporary twenty-year highs, knowledge this previous week confirmed that housing market exercise has cooled as soon as once more over the previous two months following a modest revival in late Spring and early Summer season. New Residence Gross sales fell greater than anticipated in August, dipping 9% from final month to a seasonally adjusted annual charge of 675okay. Pending Residence Gross sales, in the meantime, posted a 7% decline from the prior month, slowing to the lowest-levels since 2020. Present Residence Gross sales knowledge final week confirmed that gross sales of beforehand owned houses dropped to the slowest July tempo since 2010, dipping to an annualized charge of 4.04 million, which was 15.3% decrease than a yr in the past. In line with Freddie Mac, the 30-year fixed-rate mortgage averaged 7.31% final week, which is now effectively above the prior November 2022 highs of seven.08%. Stock ranges have remained close to historic lows, nevertheless, with simply 1.1 million houses on the market on the finish of August, which is the bottom since 1999.

Hoya Capital

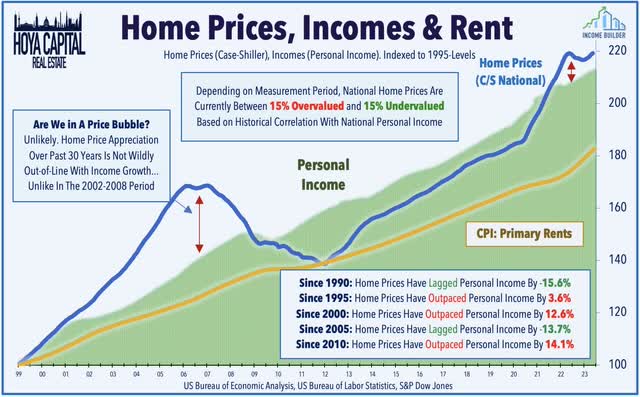

Restricted provide – leading to half from a “lock-in impact” on current householders – has supplied a ground for house values within the face of the stiff rate of interest headwinds, and has helped to usher in a interval of “normalization” in house costs after two years of unsustainable will increase in 2021 and 2022. This week, the Case Shiller Residence Worth Index confirmed that house costs had been roughly flat year-over-year in July, as costs rose modestly for a sixth straight month following a stretch of seven straight months of declines. The cooldown in house worth appreciation is welcome and critically essential to keep away from a speculative bubble that was starting to construct – and the longer-term ache that might consequence from a interval of considerably detrimental nationwide house worth appreciation. Nationwide house costs aren’t wildly out-of-line with private revenue development over long-term measurement intervals. Relying on the measurement interval, house costs are between 15% overvalued and 15% undervalued based mostly on historic correlation with private incomes, probably the most strong long-term predictor of worth traits throughout time intervals and areas.

Hoya Capital

Fairness REIT Week In Evaluation

Finest & Worst Efficiency This Week Throughout the REIT Sector

Hoya Capital

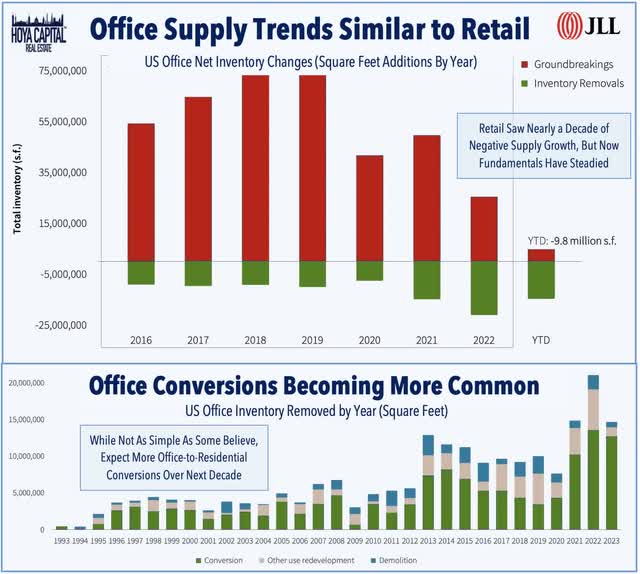

Workplace: West Coast-focused Hudson Pacific Properties (HPP) gained 2% this week following a decision that ended the five-month Hollywood author’s strike. HPP is among the many largest house owners of Hollywood studio house – representing roughly 10% of its NOI – nearly all of that are operated below usage-based income fashions moderately than long-term leases. BTIG upgraded HPP to Purchase from Impartial, citing the ending of the strike, together with comparatively stable pricing on HPP’s current asset gross sales and enchancment in workplace utilization charges in a number of West Coast cities. NYC-focused SL Inexperienced (SLG) was additionally among the many leaders this week 4% after it introduced that One Madison Avenue secured its Short-term Certificates of Occupancy, finishing the event three months forward of schedule. SLG obtained $577.4M in money as the ultimate fairness cost from its three way partnership companions, which SLG used to repay company unsecured debt. The 27-story, 1.Four million-square-foot workplace tower is one in all two new “trophy” property in Midtown NYC developed by SLG prior to now a number of years, following the completion of One Vanderbilt in 2020. As famous in our workplace REIT report, the “flight to high quality” development has been evident in current quarters as renewing tenants search to make the most of the comfortable market to “commerce up” into higher-quality house, in step with our view that the workplace sector shares many parallels with the retail house within the mid-2010s.

Hoya Capital

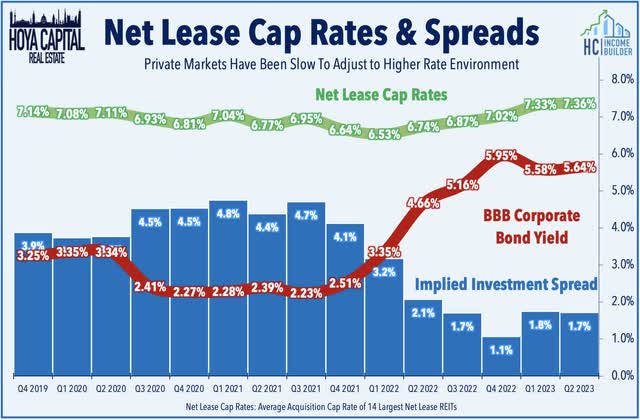

Internet Lease: W. P. Carey (WPC) remained below stress this week after extra analysts piled on the criticism of its announcement final week that it’s going to spin-off its workplace property right into a separate externally-managed REIT as a part of a “strategic exit from workplace” geared toward driving a “re-rating” of WPC’s inventory worth, which has traded at discounted valuations to similar-sized friends. This week, we revealed Internet Lease REITs: Preventing The Fed, which mentioned why these REITs have lagged in current months as traders come to grips with a possible “higher-for-longer” rate of interest surroundings. Thriving within the “decrease endlessly” surroundings, the business has been reluctant to acknowledge the higher-rate regime, preserving private-market values and cap charges stubbornly “sticky” and leading to compressed funding spreads. Regardless of the tighter funding spreads, acquisition exercise has slowed solely modestly for some REITs – who’ve paid top-dollar for current purchases – a technique that would show pricey if charges stay elevated. Sturdy stability sheets and restricted variable charge debt publicity had afforded these REITs the power to be affected person till the worth is correct, and whereas some REITs have exhibited prudence, others have plowed forward with a “enterprise as ordinary” method or made seemingly pointless pivots, placing in danger a long time of hard-fought progress.

Hoya Capital

Single-Household Rental: Invitation Houses (INVH) – which we personal within the Dividend Progress Portfolio – obtained a contemporary Wall Road ‘Purchase’ ranking by UBS, with analyst Michael Goldsmith citing the rising demand for SFR leases and a “lengthy runway” for development given the macroeconomic backdrop of a lingering housing scarcity, growing older millennials, and excessive price of house possession. UBS particularly likes INVH’s “infill product” – upper-end suburban neighborhoods – which it expects will see significantly restricted provide development, whereas its tenant base is positioned to soak up lease will increase. Among the best-performing property sectors this yr, Single-Household Rental REITs have rebounded because the dire predictions of a “arduous touchdown” in rental markets have been rebuffed in current months by steadying rental charges and robust occupancy traits seen throughout the foremost lease indexes. Whereas multifamily markets face provide headwinds over the subsequent yr, single-family builders have pulled again from an already traditionally supply-constrained single-family market, fundamentals that assist sustained inflation-beating lease development. These REITs have performed it protected – a privilege earned by way of disciplined stability sheet administration – however tighter financing circumstances will likely be a catalyst to drive additional market share positive aspects to bigger establishments which have entry to cheaper and deeper capital.

Hoya Capital

Healthcare: A pair of externally-managed REITs suggested by RMR Group – Diversified Healthcare (DHC) and Workplace Properties Revenue (OPI) – traded sharply decrease this week as each REITs introduced Board and C-suite shakeups after their merger proposal did not garner shareholder assist. OPI introduced the resignation and alternative of its Chief Monetary Officer and appointed Christopher Bilotto – presently its Chief Working Officer – as its new CEO. DHC, in the meantime, introduced the resignation of two of DHC’s Board members who served on the DHC Board’s particular committee in reference to DHC’s terminated merger plan and introduced that B. Riley Securities has been engaged as its monetary advisor to assist it consider choices to handle close to time period capital wants together with upcoming debt maturities. DHC additionally supplied a enterprise replace, highlighting a continued restoration in its Senior Housing Working Portfolio (“SHOP”). Comparable occupancy charges elevated to 79.3% in August – up 30 foundation factors from July – which was nonetheless 720 foundation factors beneath the pre-pandemic 2019 baseline of 86.5%. Larger rents have helped to offset a few of the relative occupancy declines, nevertheless, with DHC noting that comparable income was solely 7.6% beneath 2019-levels. Final week in Healthcare REITs: Restoration and Relapse, we famous that Senior Housing has emerged as a pacesetter in current quarters because the long-awaited post-pandemic occupancy restoration is lastly taking maintain, however different sub-sectors have regressed of late amid a mixture of macro and sector-specific headwinds.

Hoya Capital

Mortgage REIT Week In Evaluation

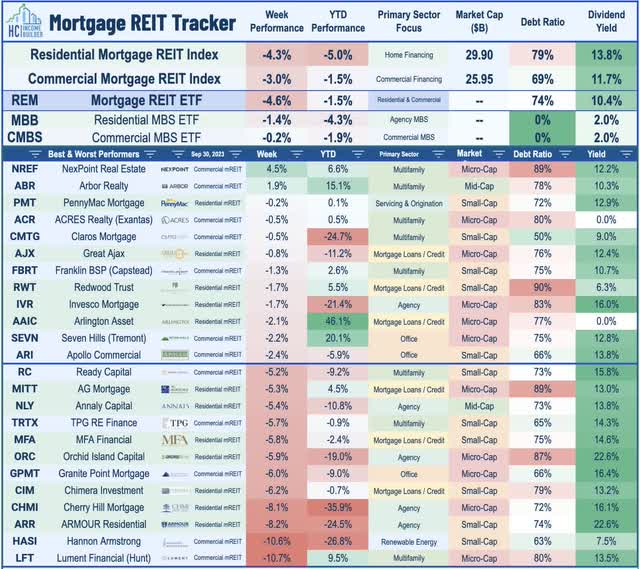

Mortgage REITs had been below stress for a second week amid a rebound in rate of interest volatility, because the closely-watched MOVE Index jumped to one-month highs after calming to its lowest ranges of the yr in mid-September. The iShares Mortgage REIT ETF (REM) dipped 4.6% on the week, dragged on the draw back by sharp declines from a handful of agency-focused residential mREITs amid stress on residential mortgage-backed safety (“RMBS”) valuations, with Annaly Capital (NLY) and Armour Residential (ARR) among the many notable laggards. Newsflow was mild this week forward of the beginning of mREIT earnings season in mid-October. Invesco Mortgage (IVR) was among the many better-performers after it held its quarterly dividend regular at $0.40/share (16.0% dividend yield). In our Earnings Recap, we famous that mREITs stand on steadier floor with dividend protection after a comparatively stable slate of earnings outcomes exhibiting a modest improve in earnings per share.

Hoya Capital

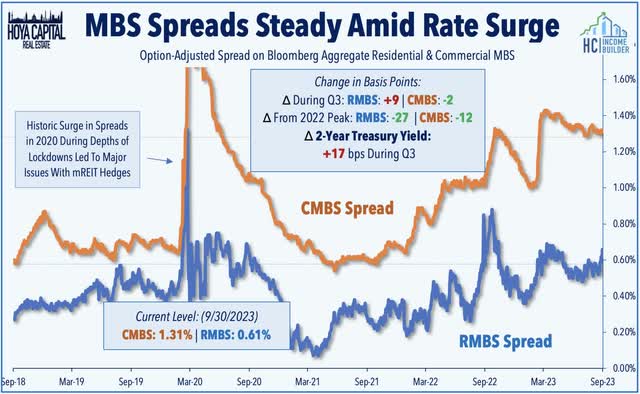

Guide Values had been in focus because the third-quarter wrapped up. Ellington Monetary (EFC) slipped 3% after it introduced that its e-book worth per share was $14.30 on the finish of August, down about 3% from the tip of Q2. Spreads on mortgage-backed bonds (“MBS spreads”) – an vital enter into Guide Worth fashions – trended increased within the ultimate two weeks of the quarter on the residential-side, however had been little modified for industrial MBS. Through the third-quarter, RMBS spreads widened by 9 foundation factors to 0.61%, whereas CMBS spreads narrowed by 2 foundation factors to 1.31%. Whereas MBS spreads had been typically regular in the course of the quarter, benchmark rates of interest – the opposite crucial enter affecting Guide Values – have elevated considerably throughout this era, with the 2-12 months Yield leaping by 17 foundation factors. The iShares MBS ETF (MBB) – an un-levered benchmark monitoring RMBS valuations – declined 3.7% in the course of the quarter, whereas the iShares CMBS ETF (CMBS) posted declines of 1.2%, indicating downward stress on mREIT Guide Values in Q3.

Hoya Capital

2023 Efficiency Recap & 2022 Evaluation

On the finish of the third quarter, the Fairness REIT Index is decrease by 8.3% on a worth return foundation for the yr (-5.9% on a complete return foundation), whereas the Mortgage REIT Index is decrease by 0.1% (+4.9% on a complete return foundation). This compares with the 11.8% achieve on the S&P 500 and the three.1% advance for the S&P Mid-Cap 400. Inside the actual property sector, 4-of-18 property sectors are in constructive territory on the yr, led by Information Middle, Single-Household Rental, Healthcare and Industrial REITs, whereas Internet Lease and Cell Tower REITs have lagged on the draw back. At 4.57%, the 10-12 months Treasury Yield has elevated by 69 foundation factors for the reason that begin of the yr – up sharply from its 2023 intra-day lows of three.26% in April – and now hovering at 15-year highs . Following the worst yr for bonds in a long time, the Bloomberg US Bond Index is decrease once more this yr, producing complete returns of -1.2% up to now. WTI Crude Oil – maybe an important inflation enter – is increased by 15% this yr however stays roughly 15% beneath 2022 peaks.

Hoya Capital

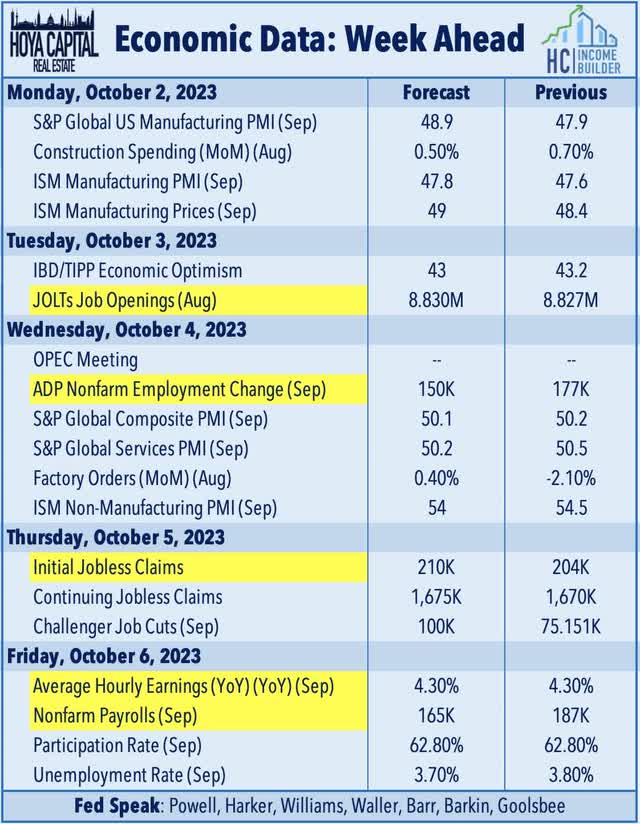

Financial Calendar In The Week Forward

Employment knowledge highlights one other crucial week of financial knowledge within the week forward – however a number of of the experiences could be delayed within the occasion of a authorities shutdown. The main report of the week – which might certainly be affected by a shutdown – comes on Friday with the BLS Nonfarm Payrolls, which is anticipated to indicate job development of 165okay in September, a moderation from the 187okay in August. The closely-watched Common Hourly Earnings collection throughout the payrolls report – which is the primary main inflation print for September – is anticipated to indicate a continued moderation in wage development to 4.3%. Wage development slowed to 4.28% final month, the slowest since June 2021. Earlier within the week, we’ll see JOLTS knowledge on Tuesday, ADP Payrolls knowledge on Wednesday, and Jobless Claims knowledge on Thursday – of which the ADP report could be the one launch unaffected by a shutdown. ‘Excellent news is unhealthy information’ will probably be the theme of those experiences as a number of Fed officers have pinned their selections to pivot away from aggressive financial tightening on a long-awaited cooldown in labor markets. We’ll even be watching Development Spending knowledge on Monday, the OPEC assembly on Wednesday, and Buying Managers’ Index (“PMI”) knowledge from each ISM and S&P.

Hoya Capital

For an in-depth evaluation of all actual property sectors, try all of our quarterly experiences: Residences, Homebuilders, Manufactured Housing, Pupil Housing, Single-Household Leases, Cell Towers, Casinos, Industrial, Information Middle, Malls, Healthcare, Internet Lease, Purchasing Facilities, Accommodations, Billboards, Workplace, Farmland, Storage, Timber, Mortgage, and Hashish.

Disclosure: Hoya Capital Actual Property advises two Trade-Traded Funds listed on the NYSE. Along with any lengthy positions listed beneath, Hoya Capital is lengthy all parts within the Hoya Capital Housing 100 Index and within the Hoya Capital Excessive Dividend Yield Index. Index definitions and a whole listing of holdings can be found on our web site.

Hoya Capital

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.