PepeLaguarda/iStock through Getty Photos

At a Look

Constructing on my earlier evaluation of Dynavax Applied sciences (NASDAQ:DVAX), the panorama has shifted subtly. HEPLISAV-B gross sales proceed to be a vibrant spot, however new components like insider promoting actions have entered the equation. Financially, the image stays advanced: revenues have declined year-over-year, but the rise in HEPLISAV-B gross sales, supported by the ACIP’s common advice for Hepatitis B vaccination in adults, is a robust counterpoint. The vaccine’s market share persists at a strong 39%. Nevertheless, investor sentiment has grown extra cautionary, as evidenced by a 12.34% brief curiosity and up to date insider transactions. In abstract, the corporate’s trajectory is caught in a posh interaction between medical triumphs and monetary uncertainties, a story that forthcoming quarterly reviews will both validate or problem.

Q2 Earnings

To start my evaluation, taking a look at Dynavax’s most up-to-date earnings report for Q2 2023, the corporate confirmed a steep decline in whole revenues to $60.2M from $256.5M YoY. Nevertheless, this masks a vibrant spot: report quarterly HEPLISAV-B vaccine web product income reached $56M, marking a 73% YoY enhance. Full-year steering for HEPLISAV-B income was additionally raised to $200M-$215M from $165M-$185M. Whereas operational loss hit $3.4M, in comparison with an earnings of $128.2M final 12 months, share dilution remained modest with weighted-average shares rising barely from 126,347Okay to 128,625Okay.

Monetary Well being

Turning to Dynavax’s steadiness sheet, as of June 30, 2023, the corporate holds $226.8M in ‘money and money equivalents’ and $454.7M in ‘marketable securities,’ aggregating to a complete of $681.5M in liquid property. The corporate’s ‘present ratio’ stands at 17.8, indicating sturdy short-term liquidity. Complete property, primarily liquid, stand in distinction to whole debt of $222.1M, suggesting a strong monetary place. Over the past six months, the “Web money offered by (utilized in) working actions” is constructive at $55.7M, including to the corporate’s assets.

Dynavax’s constructive month-to-month web money from working actions implies the addition of roughly $9.3M per 30 days to its assets, eliminating quick considerations a couple of ‘money runway.’ Nonetheless, traders ought to train warning, as these figures are retrospective and is probably not indicative of future efficiency. Based mostly on the offered information, the chances of Dynavax requiring further financing throughout the subsequent twelve months seem low, given the sturdy liquid asset place and constructive working money circulate.

Market Sentiment

In accordance with Searching for Alpha information, Dynavax’s market capitalization of $1.82B suggests average market confidence, significantly given its strong liquid asset place and low probability of requiring further financing. Analysts challenge income progress to $288.24M for 2024, a 28.29% YoY enhance, additional boosted by HEPLISAV-B’s sturdy efficiency and market share seize. Dynavax’s inventory momentum is notable, outperforming SPY over 3, 6, 9, and 12-month durations, emphasizing bullish investor sentiment. Quick curiosity is at 12.34% with 15.05M shares brief, indicating potential volatility but additionally a chance for a brief squeeze.

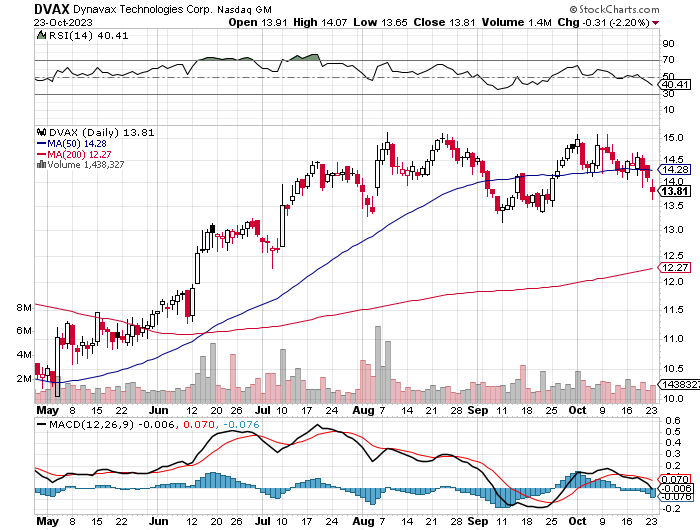

Technically, DVAX shows a bearish momentum, with the newest candlestick revealing a detailed beneath the 50-day MA, suggesting potential short-term draw back. The MACD nears a bearish crossover, whereas RSI stands at 40.41, indicating room for additional descent. The pivotal assist stays on the 200-day MA. Buyers ought to monitor for potential additional retreat or a bounce-back affirmation.

StockCharts.com

Institutional possession is excessive at 98.82%; BlackRock, Federated Hermes, and Vanguard have important holdings. New positions have 3,787,391 shares, whereas sold-out positions are at 2,148,983, signifying extra bullish than bearish exercise amongst institutional traders. Web insider exercise reveals 1,652,888 shares offered previously three months and 4,750,922 shares offered over the previous 12 months, probably signaling warning however requiring contextualization given excessive institutional possession. Total, Dynavax reveals promising progress prospects, significantly in HEPLISAV-B, however traders ought to concentrate on elevated brief curiosity and insider promoting.

Accelerating Gross sales and Market Share of Dynavax’s HEPLISAV-B

The market potential of Dynavax’s HEPLISAV-B vaccine has been notably influenced by the ACIP’s common advice for grownup Hepatitis B vaccination, propelling an optimistic outlook towards market growth. Each Dynavax and market analysts challenge the U.S. Hepatitis B vaccine market, catalyzed by HEPLISAV-B, to probably attain or exceed $800 million by 2027.

Inside this increasing market, HEPLISAV-B has been steadily capturing a good portion, holding roughly 39% of the overall market share. The vaccine’s gross sales trajectory surpassed expectations with a 73% rise in gross sales in Q2 2023. The latest earnings name for Q1 2023 accentuated HEPLISAV-B’s strong efficiency, pushed by the ACIP’s suggestions, market progress, and the attainment of a bigger market share. Administration foresees a 30-50% annual income progress for 2023, primarily attributed to HEPLISAV-B.

Administration’s commentary through the latest earnings name resonates with the market evaluation, underscoring HEPLISAV-B’s pivotal function in Dynavax’s progress narrative. Their strategic give attention to rising HEPLISAV-B’s market share is evidently yielding constructive outcomes, significantly within the retail pharmacy and IDN segments, that are anticipated to signify roughly 60% of the Hepatitis B market by 2027. The substantial progress in HEPLISAV-B’s market share inside these segments, from round 32% to 39% general and notably to 53% within the IDN phase, is a testomony to Dynavax’s profitable market penetration methods.

Within the broader scope, Dynavax’s roadmap towards profitability is considerably hinged on HEPLISAV-B’s continued market efficiency. The vaccine’s distinctive two-dose routine, contrasting the standard three doses over six months, alongside an increasing market and an rising market share, locations Dynavax in a good place. Nonetheless, the problem lies in sustaining this progress trajectory amidst the aggressive panorama and potential market dynamics.

Administration’s proactive method in exploring strategic progress accelerators, similar to new collaborations or figuring out industrial alternatives within the infectious illness area, displays a complete progress blueprint geared toward capitalizing on HEPLISAV-B’s market potential whereas diversifying the income streams.

My Evaluation & Advice

Dynavax’s journey reveals a promising but cautious narrative. The ascendancy of HEPLISAV-B’s income in Q2 2023, alongside the uplifted full-year income steering, underscores HEPLISAV-B’s fortifying market place catalyzed by ACIP’s endorsement for grownup Hepatitis B vaccination. However, a steep decline in whole revenues and a transition from operational earnings to loss year-over-year, mirror inherent dangers regardless of a strong liquidity place. The market’s blended sentiment, as evidenced by 12.34% brief curiosity and insider promoting, although juxtaposed by optimistic institutional exercise, sketches a panorama of cautious optimism.

Buyers ought to stay vigilant of market dynamics, significantly rivals’ stratagems and potential shifts in market sentiment that would impression DVAX’s valuation. A meticulous overview of upcoming quarterly reviews for indicators of sustained income progress from HEPLISAV-B and prudent administration of operational bills is warranted. The excessive institutional possession, whereas a vote of confidence, necessitates a more in-depth scrutiny of insider transactions within the ensuing durations to gauge the interior sentiment in the direction of the agency’s prospects.

Funding methods might embody a diversified portfolio method to hedge towards unexpected market volatility. For traders with a longer-term horizon, the maintain technique appears prudent, awaiting extra definitive indicators of sustained profitability and market share growth. These with a shorter-term perspective would possibly contemplate a extra circumspect stance, presumably capitalizing on market volatility by well-timed entry and exit factors.

In abstract, whereas the expansion trajectory of HEPLISAV-B propels a good outlook, the juxtaposition of lukewarm market sentiment and insider promoting invitations a balanced, well-informed funding technique. Due to this fact, sustaining a “Maintain” place on DVAX, whereas conserving a detailed watch on market and inner company dynamics, appears a considered plan of action.