adamkaz/E+ by way of Getty Photos

After the shut of Wednesday’s common session, main photo voltaic string inverter producer SolarEdge Applied sciences Inc. (SEDG) or “SolarEdge” stunned market individuals with an unsightly earnings warning (emphasis added by writer):

Throughout the second a part of the third quarter of 2023, we skilled substantial sudden cancellations and pushouts of present backlog from our European distributors,” mentioned Zvi Lando, Chief Govt Officer of SolarEdge. “We attribute these cancellations and pushouts to larger than anticipated stock within the channels and slower than anticipated set up charges. Particularly, set up charges for the third quarter have been a lot slower on the finish of the summer time and in September the place historically there’s a rise in set up charges.”

Consequently, third quarter income, gross margin and working revenue will likely be under the low finish of the prior steering vary. Moreover, the Firm anticipates considerably decrease revenues in the fourth quarter of 2023 because the stock destocking course of continues. (…)

Third quarter income is now anticipated to be within the vary of $720 million to $730 million, in comparison with the earlier expectation of $880 million to $920 million.

GAAP gross margin is now anticipated to be inside the vary of 19% to 20%.

Non-GAAP gross margin is now anticipated to be inside the vary of 20.1% to 21.1%, in comparison with the earlier expectation of 28% to 31%.

GAAP working loss is now anticipated to be inside the vary of $9 million to $28 million.

Non-GAAP working revenue is now anticipated to be inside the vary of $12 million to $31 million, in comparison with the earlier expectation of $115 million to $135 million.

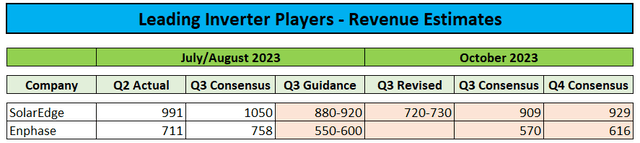

Whereas the business has been pressured by elevated channel inventories in latest months, the sheer magnitude of SolarEdge’s warning is eye-catching, notably when contemplating the truth that administration already lowered Q3 expectations in early August.

Apparently, SolarEdge’s warning would not bode properly for main microinverter producer and competitor Enphase Power Inc. (NASDAQ:ENPH) or “Enphase”.

Nonetheless, I’d assume the corporate’s upcoming third quarter outcomes to be a lot nearer to present consensus estimates for 2 major causes:

- Significantly decrease publicity to Europe

- Administration has performed a greater job derisking Q3 estimates in late July by guiding down far more aggressively than SolarEdge did at the moment

Firm Press Releases

Sadly, Enphase’s core U.S. residential photo voltaic market has additionally weakened in latest months with market individuals more and more involved a few extra protracted downturn primarily because of the continued surge in rates of interest.

With increasingly more analysts now not forecasting a near-term trough in inverter demand, present expectations for an virtually 10% sequential income improve in This fall will seemingly need to be revised following the corporate’s Q3 earnings report and convention name subsequent week.

Contemplating the truth that competitor SolarEdge is projecting “considerably decrease revenues” for the fourth quarter, I would not be stunned to see Enphase administration guiding This fall revenues under $500 million thus leading to an roughly 20% shortfall relative to present consensus expectations.

As well as, expectations for revenues to develop by virtually 10% subsequent yr is perhaps too optimistic.

Furthermore, with SolarEdge projecting a 30% quarter-over-quarter lower in gross margins, Enphase’s margin profile is prone to expertise some stress, too regardless of some anticipated offset from IRA advantages as the corporate ramps shipments of U.S.-manufactured microinverters.

Assuming consolidated gross margin to drop into the mid-30s subsequent quarter, revenue from operations could be down by an estimated 85% from Q2 ranges.

With demand headwinds prone to persist for at the very least the subsequent couple of quarters, I would not be stunned to see Enphase’s 2024 revenues reducing on a year-over-year foundation. Together with anticipated margin stress, profitability could be nowhere close to present consensus estimates thus making the inventory look costly even after the 50%+ decline within the shares year-to-date.

Waiting for the Enphase’s Q3 earnings launch and convention name subsequent week, a lot will depend upon administration’s This fall steering in addition to commentary on buyer demand, channel stock and the corporate’s capability to guard gross margins over the course of the present downturn.

Nonetheless, it is tough to examine Enphase outperforming opponents by a large margin with residential photo voltaic demand beneath persistent stress.

Backside Line

SolarEdge’s dire warning is perhaps a harbinger for Enphase Power’s near-term outlook.

With residential photo voltaic demand prone to stay sluggish in the intervening time, I’d anticipate the corporate’s This fall outlook to overlook present consensus estimates by a large margin.

As well as, expectations for near 10% year-over-year income progress in 2024 may show too optimistic.

Consquently, I’d anticipate analysts to cut back estimates and worth targets throughout the board following subsequent week’s Q3 earnings report and convention name.

Given the elevated chance of a extra protracted downturn, traders ought to keep away from the shares and even contemplate promoting present positions till business situations present tangible indicators of enchancment.

Danger Elements

Given muted expectations, any indication of the corporate maneuvering the difficult business setting higher than competitor SolarEdge or perhaps a potential return to near-term sequential progress would seemingly be enough for shares to stage a serious reduction rally.