VioletaStoimenova

One of many largest pitfalls that worth traders must keep away from is making a choice to purchase an organization solely off of that firm’s historic monetary efficiency and its present valuation. I might say that 9 instances out of 10, such a easy evaluation can yield enticing outcomes. However it may additionally end in missed alternatives and worth traps, the previous of which signifies that traders are lacking out on an excellent alternative, and the latter of which ends in some reasonably painful losses. One firm that, from a valuation perspective solely, seems to be reasonably expensive, is The Bancorp (NASDAQ:TBBK). However when you dig deeper and see what the corporate is cooking, the image turns into much more fascinating. In comparison with different banks, shares are fairly costly. However if you issue within the fast progress the corporate is experiencing and its progress prospects, the image seems to be way more fascinating.

An expensive financial institution price contemplating

Identical to any conventional financial institution, The Bancorp engages in all kinds of companies that you’d anticipate. As an example, it accepts deposits, permitting prospects to allocate mentioned deposits into checking accounts, financial savings accounts, cash market accounts, and different comparable choices. It additionally makes use of these deposits to interact in numerous funding actions. Examples embrace, however are usually not restricted to, the origination of SBA loans, in addition to different specialty financing actions just like the issuance of securities backed traces of credit score and insurance coverage coverage money worth backed traces of credit score. The corporate additionally supplies funding advisor financing particularly to funding advisors seeking to both develop or set up their presence.

Lately, administration has additionally targeted on different initiatives. For instance, the corporate has a complete arm of itself that is devoted to offering checking and financial savings accounts, in addition to different banking companies, to monetary expertise corporations and comparable enterprises. A number of the different companies that it supplies to some of these firms embrace fraud detection, anti-money laundering, shopper compliance, and extra. It even supplies ACH processing and bank card sponsoring companies. By means of the cardboard issuing companies division, the corporate points debit and pay as you go playing cards to each shopper and enterprise accounts. It additionally handles payroll, company incentive, pre-tax medical spending profit, and different associated companies.

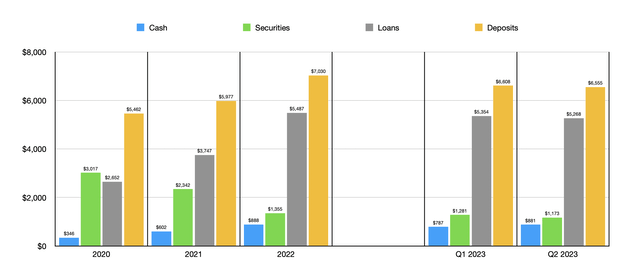

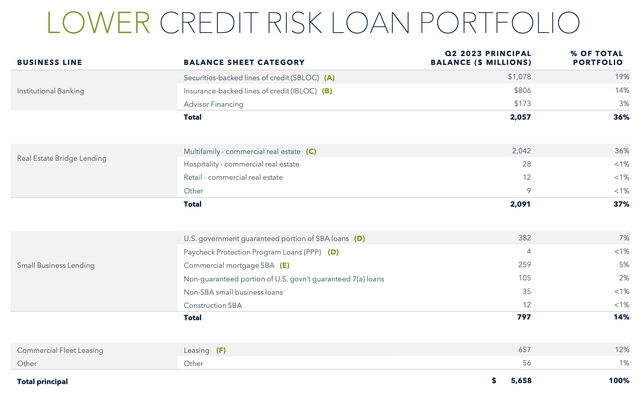

Creator – SEC EDGAR Information

Over the previous few years, administration has achieved some reasonably significant progress for the financial institution. The worth of loans on its books, as an illustration, greater than doubled from $2.65 billion in 2020 to $5.49 billion in 2022. Loans have decreased modestly since then, dropping to $5.27 billion by the top of the second quarter of this yr. Earlier than I level you to the picture beneath for some particulars concerning my very own composition, I wish to level out that the picture has the next quantity for loans than what I simply offered. It’s because I included a portion of its loans into the securities that the corporate has since they’re being labeled as held on the market versus held to maturity. They had been even separated from the remainder of the loans on the corporate’s stability sheet. However I digress. About 36% of the worth of the corporate’s loans fall beneath its institutional banking line. This consists of the aforementioned securities backed traces of credit score and insurance coverage backed traces of credit score, in addition to advisor financing. 37%, in the meantime, fall beneath actual property bridge lending actions, with multifamily industrial actual property comprising the overwhelming majority of that quantity. 14% entails small enterprise lending, with most of that involving SBA loans. The remainder of the loans, totaling about 13% in all, fall beneath industrial fleet leasing actions or different miscellaneous actions.

The Bancorp

I discussed already the worth of securities. A number of the improve in loans was pushed by a voluntary transition from having some property in securities to as a substitute being in loans that the establishment points. From 2020 by means of 2022, securities values dropped from $3.02 billion to $1.36 billion. By the top of the second quarter of this yr, they’d fallen to $1.17 billion. Money and money equivalents, in the meantime, posted a pleasant improve over the previous three years and, since then, has remained in a reasonably slender vary. As of the top of the second quarter, money totaled $880.5 million.

Creator – SEC EDGAR Information

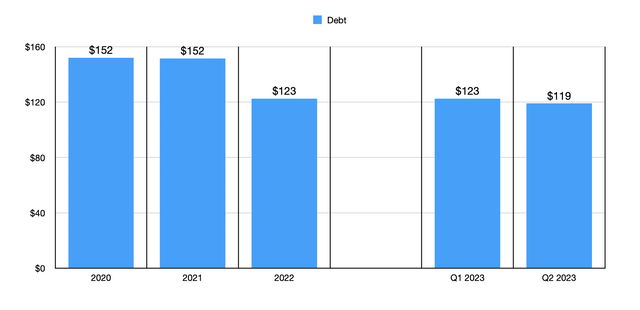

None of this is able to have been potential and not using a surge in deposits. The worth of deposits jumped from $5.46 billion in 2020 to $7.03 billion in 2022. Doubtless due to the banking disaster that occurred earlier this yr, deposits have pulled again barely, dropping to $6.61 billion within the first quarter of this yr earlier than dipping additional to $6.56 billion. Whereas that is worrisome by itself, it is very important word that solely 9% of the corporate’s loans are labeled as uninsured. That is glorious in and of itself as a result of it signifies that the chance of additional declines in deposits is reasonably small. Add on prime of this the truth that debt is just $119 million, which is a lower over what the corporate had in prior years, and there’s a lot to be bullish on from a stability perspective.

Creator – SEC EDGAR Information

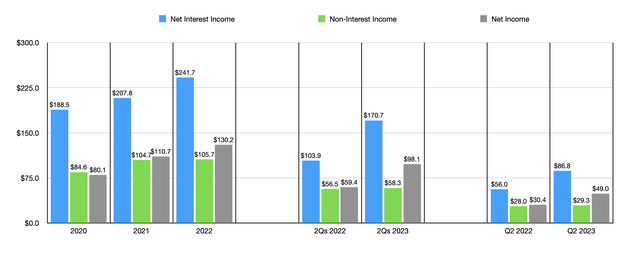

The general progress for the financial institution has allowed it is internet curiosity earnings to develop from $188.5 million in 2020 to $241.7 million in 2022. Non-interest earnings additionally elevated throughout this time, rising from $84.6 million to $105.7 million. And eventually, internet earnings for the financial institution jumped from $80.1 million to $130.2 million. For the present fiscal yr, monetary efficiency has continued to return in robust. Web curiosity earnings skyrocketed from $103.9 million within the first half of final yr to $170.7 million the identical time this yr. We noticed a small improve in non-interest earnings and a close to doubling in internet earnings from $59.Four million to $98.1 million.

The Bancorp

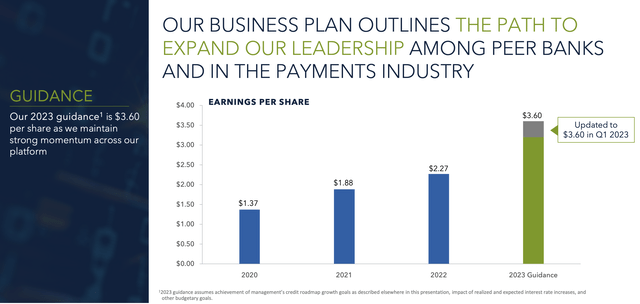

Purely from a valuation perspective, shares do not look nice. Utilizing information from final yr, the financial institution is buying and selling at a worth to earnings a number of of 14.4. The typical within the area is roughly 10.Four and I’ve analyzed many banks with multiples ranging between 6 and 10. Some have even are available beneath that vary. Equally, the corporate is buying and selling at 2.6 instances its e-book worth per share. Banks today are likely to commerce someplace between a good low cost to their e-book worth and a good premium, however virtually by no means at a degree that is excessive. However that is the place the image begins to get extra fascinating. You see, administration is forecasting earnings per share this yr of $3.60. That might suggest internet earnings of $196.Four million. That might carry the value to earnings a number of for the financial institution down significantly to 9.6. This does not change the value to e-book worth, nevertheless it also needs to lower some as long as continued revenue technology interprets to an increase within the e-book worth of fairness for the financial institution.

The Bancorp

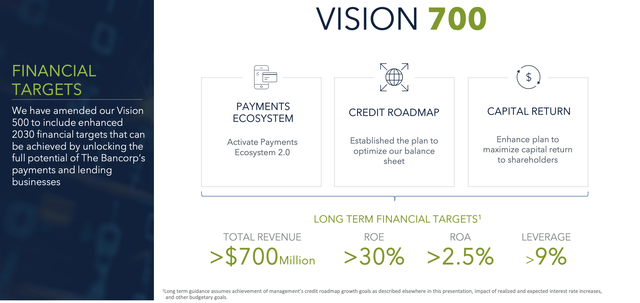

This progress appears to be solely the beginning of the plans that administration has. You see, in its newest investor presentation, the corporate mentioned what it calls Imaginative and prescient 700. It is a plan for the corporate to unlock the ‘full potential’ of its funds and lending enterprise. This consists of activating its funds ecosystem 2.0, using the expansion it receives from this to optimize its stability sheet, and dealing to return capital to shareholders alongside the way in which. By 2030, administration hopes for this a part of the corporate to develop income to greater than $700 million per yr. By working straight with monetary expertise firms by means of the sponsorship of credit score and debit playing cards, in addition to by facilitating different fee actions, the corporate hopes to not solely generate income from its fee ecosystem, but additionally to usher in extra deposits that it may use to lend out much more.

The Bancorp

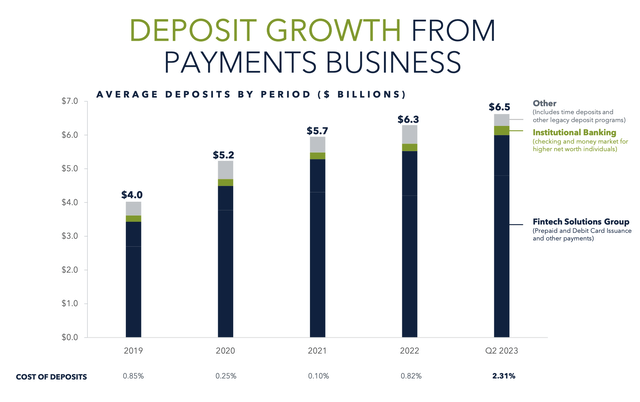

Already, 22% of the income generated by the financial institution comes from its monetary expertise options. And deposit progress from its funds enterprise has been spectacular. Again in 2019, as an illustration, $Four billion price of deposits had been attributable to this a part of the enterprise. By the top of the newest quarter, this quantity had grown to $6.5 billion. Whenever you then mix this with a method of specializing in the aforementioned specialised lending actions to the financial institution already engages in, actions that, it ought to be talked about, have a low loss historical past, the upside potential for traders will be significant.

Takeaway

Primarily based on the info offered, The Bancorp seems to be, at first, to be a reasonably costly prospect. However if you look beneath the hood and see what administration is engaged on, that image modifications reasonably quickly. The corporate is rising properly and the long-term trajectory for it ought to be optimistic. Absent something surprising popping out of the woodwork, I might make the case that additional upside in all probability exists from right here. And due to that, I’ve determined to price the enterprise a ‘purchase’ at the moment.