JHVEPhoto/iStock Editorial through Getty Photos

Caleres, Inc (NYSE:CAL) is a footwear firm that manufactures sneakers beneath quite a few manufacturers and sells sneakers via a number of web sites along with the Well-known Footwear retail chain. The corporate’s principally mediocre monetary efficiency has resulted in a poor inventory efficiency up to now ten years, however as Caleres is targeted on streamlining the enterprise, the long run may probably show to be much better for shareholders. The inventory’s valuation doesn’t appear to anticipate very a lot from Caleres’ future efficiency, which I additionally see as an affordable expectation earlier than Caleres proves the technique’s effectiveness with improved long-term earnings.

The Firm & Inventory

Caleres manufactures and sells footwear. The corporate produces sneakers for self-owned and licenced manufacturers. Caleres’ self-owned manufacturers embrace lead manufacturers Sam Edelman, Allen Edmonds, Naturalizer, Vionic. As well as, the corporate has seven smaller portfolio manufacturers with names resembling Veronica Beard, Vince, Dr Scholl’s, and FrancoSarto. The corporate sells self-manufactured and third-party shoe manufacturers via the Well-known Footwear retail chain. As well as, Caleres sells footwear via plenty of web sites named after the corporate’s manufacturers.

The corporate has tried to refocus its operations considerably as informed in Caleres’ 2023 investor day presentation – Caleres has exited 4 manufacturers, closed 150 specialty shops and 100 footwear shops, and restructured groups to enhance the corporate’s operations right into a vertically built-in entity. After a principally mediocre monetary efficiency, I imagine that the technique could be very welcomed – Caleres has managed to cut back inventories and streamline the enterprise for a greater efficiency.

Caleres’ inventory efficiency hasn’t been excellent on an extended timeframe – the inventory has appreciated a complete quantity of lower than 6% up to now ten years. The corporate does additionally pay out a steady quarterly dividend of $0.07, making the yield fairly low at a determine of 1.03% on the time of writing.

Ten-12 months Inventory Chart (Looking for Alpha)

Financials

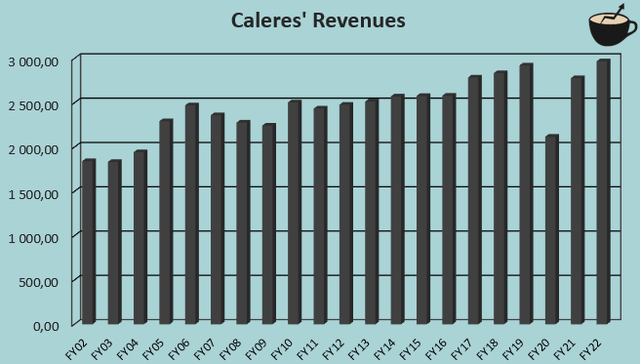

When excluding fiscal 12 months 2020 revenues that had been weakened by the Covid pandemic, Caleres’ income trajectory has been steady. The corporate has principally been on tempo with inflation with a compounded annual development fee of two.4% from FY2002 to FY2022:

Creator’s Calculation Utilizing TIKR Knowledge

The expansion has halted in fiscal 12 months 2023 as far as Caleres’ technique of refocusing operations and shutting down inefficient components of the enterprise is continuing. Additionally, discretionary spending has lowered within the presently difficult macroeconomic state of affairs; in complete, Caleres’ revenues decreased by -7.8% within the first half of FY2023. With an extended timeframe, the income historical past has principally been very mediocre development.

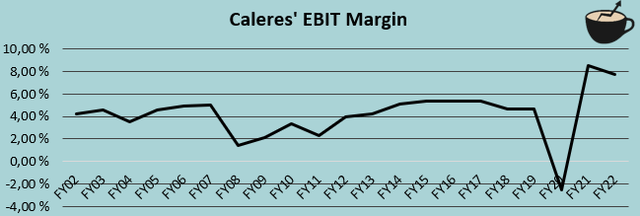

Caleres has traditionally achieved a really skinny EBIT margin – from FY2002 to FY2019, the corporate’s common EBIT margin has been 4.2%:

Creator’s Calculation Utilizing TIKR Knowledge

After the pandemic’s unfavorable impression on Caleres’ operations, the corporate has been capable of recuperate its EBIT margin into the next stage than the corporate has been capable of obtain traditionally. The presently achieved increased stage for my part represents Caleres’ future margin stage higher – the corporate’s technique has yielded some outcomes to date. I wouldn’t anticipate an excessive amount of additional working leverage sooner or later as a baseline state of affairs, although. After an extended interval of mediocre financials, I might relatively replace my notion of the margin stage as Caleres proceeds additional with the technique.

Weak Manufacturers

Caleres’ long-term development fee has been fairly poor – the already modest long-term development of two.4% contains choose acquisitions. I imagine that the income efficiency is partly an element of a too extremely diversified portfolio of manufacturers; Caleres has already exited 4 manufacturers, however nonetheless operates eleven shoe manufacturers beneath lead and portfolio manufacturers. The excessive variety of manufacturers creates challenges in creating a well known model imago with an affordable value stage. Compared to main manufacturers resembling Nike, Caleres’ manufacturers appear very weak. Because of this, Caleres appears to be dropping the battle in opposition to different shoe producers. For instance, Designer Manufacturers (DBI) has achieved a income CAGR of three.8% up to now 9 full years, and Shoe Carnival (SCVL) has a CAGR of 4.0% from FY2013 to FY2022, in comparison with Caleres’ determine of 1.9%.

As informed earlier, Caleres has closed down a major variety of shops ensuing within the just lately weak income efficiency. Though closing down unprofitable shops could be very a lot a welcome signal, it must also fear traders – shrinking operations do not usually lead to a greater long-term efficiency. The shop closings for my part additionally sign a deteriorating model worth. I do not foresee the financials to show round fully at the very least within the medium time period – traders ought to brace themselves for principally weak development sooner or later as effectively, though with seemingly increased margins than within the long-term historical past.

Reported Q3 Outcomes

Caleres reported its Q3 outcomes on the 21st of November. The corporate’s revenues had been $761.9 million in comparison with analysts’ expectations of $770.1 million. The reported determine corresponds to a year-over-year decline of -4.6% – higher than the H1 decline of -7.8%, however nonetheless a poor efficiency.

However, the reported margins stayed stronger than anticipated – Caleres reported an adjusted EPS of $1.37, in comparison with an estimate of $1.30. In complete, the reported consequence was principally pretty much as good as anticipated. The figures diversified fairly little from analysts’ expectations. The reported EPS being increased is for my part a very good signal, though not very significant at this level.

Valuation

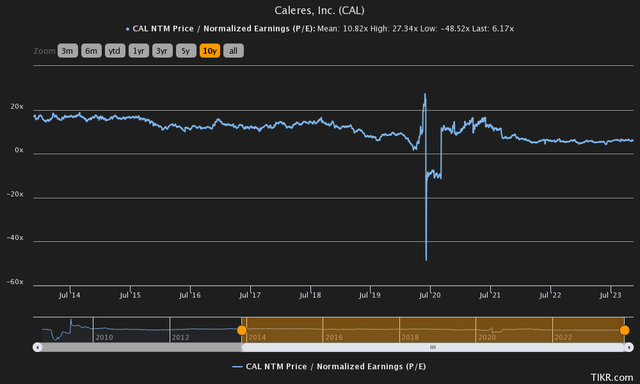

Reflecting traders’ poor religion in Caleres’ streamlined enterprise, the inventory trades at a low ahead P/E a number of of 6.2, considerably beneath the ten-year common of 10.8:

Historic Ahead P/E (TIKR)

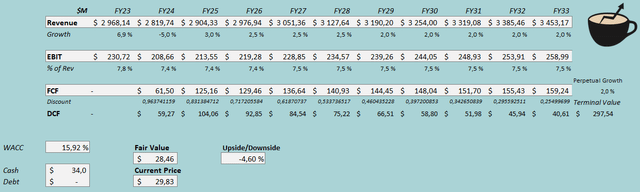

The P/E a number of alone doesn’t contextualize the valuation very effectively. To estimate a tough honest worth for the inventory, I constructed a reduced money move mannequin in my ordinary method. Within the mannequin, I estimate a mediocre monetary future for Caleres, fairly consistent with the corporate’s historic efficiency – for fiscal 12 months 2023, I estimate revenues to lower by -5%, representing a This fall efficiency that is barely higher than the reported Q3. After the 12 months, I estimate a partly restoration in revenues with an estimated development of three%, that slows down right into a steady development fee of two% into perpetuity.

As for the revenues, I don’t see vital drivers for a major change in margins. For fiscal 12 months 2023, I estimate a margin of seven.4%, consistent with Caleres’ steerage. After the 12 months, I estimate the margin to rise into 7.5% in fiscal 12 months 2026, representing a principally insignificant additional margin enlargement. The corporate’s money move conversion is kind of good, however Caleres does have curiosity bills associated to leases worsening earnings.

The talked about estimates together with a weighted common value of capital of 15.92% craft the next DCF mannequin with a good worth estimate of $28.46, round 5% beneath the inventory worth on the time of writing. The inventory appears to be priced for a steady future efficiency that’s principally consistent with FY2023 financials. Caleres may show to enhance the financials above my estimates, probably making the inventory intriguing, however in the intervening time I wouldn’t maintain such a state of affairs as a baseline.

DCF Mannequin (Creator’s Calculation)

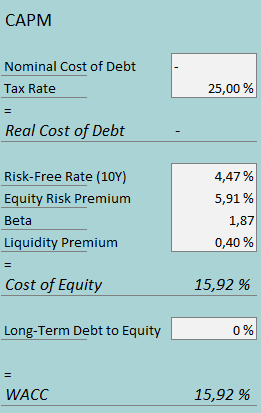

The used weighed common value of capital is derived from a capital asset pricing mannequin:

CAPM (Creator’s Calculation)

Caleres has progressed within the firm’s stability sheet deleveraging – the corporate doesn’t have interest-bearing debt meant for financing functions, as the corporate’s curiosity bills appear to come back from capital leases. It appears to be in Caleres’ technique to preserve the stability sheet deleveraged – I estimate a long-term debt-to-equity ratio of 0% for the corporate.

On the price of fairness aspect, I take advantage of america’ 10-year bond yield of 4.47% because the risk-free fee. The fairness threat premium of 5.91% is Professor Aswath Damodaran’s newest estimate for america, made in July. Yahoo Finance estimates Caleres’ beta at a determine of 1.87 – as latest quarters have demonstrated, the corporate’s operations are fairly cyclical. Lastly, I add a small liquidity premium of 0.4%, crafting a price of fairness and WACC of 15.92%.

Takeaway

Caleres’ concentrate on bettering operations has seemingly resulted in increased margins than the corporate has traditionally achieved. As the corporate has closed down a major variety of shops for higher effectivity, the revenues have nonetheless carried out fairly poorly with decreases in FY2023 to date – though part of the lower is probably going a results of a poor macroeconomic sentiment, Caleres’ financials nonetheless don’t appear implausible to me. The corporate’s manufacturers’ worth appears weak, for my part signaling a mediocre future development efficiency. The inventory is priced fairly low although, anticipating no additional enhancements. In the intervening time, I imagine that the belief of additional weak financials is an effective baseline though the corporate may shock traders in a constructive means. Earlier than Caleres proves higher financials, I’ve a maintain score for the inventory