Marzia Camerano

Introduction

Nearly excellent execution, one-of-a-kind earnings visibility, a powerful defend from international adjustments within the financial system, and a rising target market of ultra-high-net-worth people are all bundled collectively as the explanations making Ferrari N.V. (NYSE:RACE) a novel asset in my portfolio.

Often, I write about Ferrari as soon as 1 / 4. Nevertheless, this time, after the earnings preview I shared on Looking for Alpha, I really feel compelled to replace my view on the corporate as a result of over the last earnings name following the discharge of the Q3 earnings report a serious change in Ferrari’s enterprise mannequin was lastly unveiled.

My bull-case

My first article ever on SA was on Ferrari (Ferrari: Actually Firing On All Cylinders). Since then the inventory has gone up 70%, not counting dividends. And regardless that Ferrari at the moment finds a spot amongst Wall Avenue’s 20 most overbought shares I’ve no plan on promoting any shares, however I’m really all the time in search of alternatives so as to add to my place. Furthermore, I even consider the rally now we have seen after the final earnings report is effectively deserved, as Ferrari talked about some adjustments that will make it much more worthwhile.

Briefly, my bull-case on Ferrari hinges upon the next pillars:

- Ferraris are distinctive automobiles in a distinct segment and a league of their very own with maybe just one true competitor: Lamborghini. And but, Ferrari’s iconic brand and automobiles are craved by many all over the world.

- Ferrari’s goal market of high-net-worth people is rising all over the world.

- Demand for Ferraris is rising, however Ferrari protects exclusivity by sticking to the rule of restrictive volumes. As Enzo Ferrari as soon as put it: Ferrari will all the time promote one automobile lower than the market demand.

- This enterprise mannequin has many benefits for the corporate. It offers excessive visibility on upcoming orders, making it simpler to plan investments and purchases, it strengthens Ferrari’s pricing energy, and it makes prospects really feel nearly “elected” in the event that they occur to lastly get their automobile delivered to them.

- The launch of the Purosangue has been a game-changer for the corporate, pushing revenues and margins up.

Within the meantime, Ferrari’s market cap has grown as much as the purpose it was just lately added to the Euro Stoxx 50 Index (SX5E), making it one of many 50 largest corporations in Europe.

How Ferrari’s enterprise mannequin is evolving

We have now already seen how an necessary a part of Ferrari’s bull-case is its predictability. The corporate and its shareholders know roughly what’s down the pipeline for the subsequent two years (Ferrari’s order ebook already covers the whole 2025). It’s because there’s a lot demand for Ferraris, however the firm retains its volumes low precisely to protect its exclusivity and push up each demand and costs.

Now, lately, Ferrari has really elevated its quantity by 72% since its IPO. On the identical time, revenues have gone up 79%. For the fiscal yr we’re about to finish, my forecast is a rise of 5% in shipments to round 13,900 items. I really anticipate revenues to be €6 billion.

Ferrari Investor Relations Webpage

Nevertheless, whereas Ferrari’s top-line development is kind of spectacular for a well-established firm, what catches much more my consideration is how briskly the corporate has elevated its profitability. Adj. EBITDA has elevated by 137% and this yr it’s anticipated to be above €2.25 billion (over a 38% margin), which might result in a 2x in EBITDA for the reason that IPO.

Ferrari Investor Relations Webpage

I do not wish to overload the article with graphs, but when we contemplate adj. EBIT development, Ferrari went even sooner: 159% development since 2019 from € 473 million to €1,227 million. This yr, Ferrari’s steering – which I anticipate Ferrari will really beat – sees the adj. EBIT at €1,570 million (not less than 26.5% margin). It will result in a 232% development for the reason that IPO.

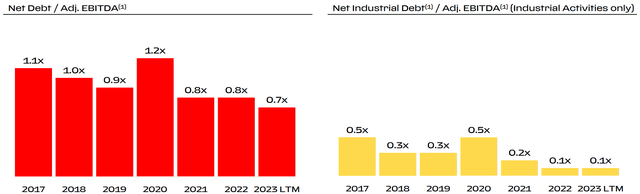

Ferrari has certainly switched mode, turning into a real money cow, whose income have additionally been used to make the corporate’s stability sheet as wholesome as doable. Leaving apart the debt linked to financing actions, the commercial debt has been decreased by nearly 75% from €797 million in 2015 to €207 million in 2022. As of September 30, 2023, industrial internet debt was €233 million. Contemplating the corporate’s EBITDA and the truth that it’s anticipated to generate round €1 billion in free money circulate this yr, this debt is nearly ridiculous.

Ferrari Investor Relations Webpage

Contemplating the corporate’s EBITDA and the truth that it’s anticipated to generate round €1 billion in free money circulate this yr, this debt is nearly ridiculous, making it an organization with nearly no leverage, which is kind of an achievement contemplating it’s, in any case, an automaker (although we will argue if Ferrari actually belongs to this trade).

Ferrari Q3 2023 Outcomes Presentation

The general image now we have seen exhibits us two fundamental drivers of Ferrari’s development: top-line growth primarily linked to elevated volumes and excessive give attention to effectivity which led to margin growth.

However some traders have began questioning how far can Ferrari increase its manufacturing earlier than it loses the exclusivity attraction it at the moment enjoys. Will the corporate cease round 15,000 autos per yr? Will it go as much as 20ok and even 25ok? To date the corporate has not given a solution when analysts have requested about this problem. Clearly, if Ferrari guided for a remaining roof for its shipments, traders would in a short time make some calculations and find yourself understanding how a lot we will anticipate from the corporate. Nevertheless, Ferrari has caught true to what its founder stated: there isn’t a actual roof to guard shipments. The corporate simply must ship one automobile lower than the market demand. Which means whereas demand grows, so can Ferrari’s volumes.

Nevertheless, within the final earnings name, I consider Ferrari’s CEO Benedetto Vigna did unveil what the way forward for Ferrari can be. The corporate will not must push up volumes as a lot because it did lately.

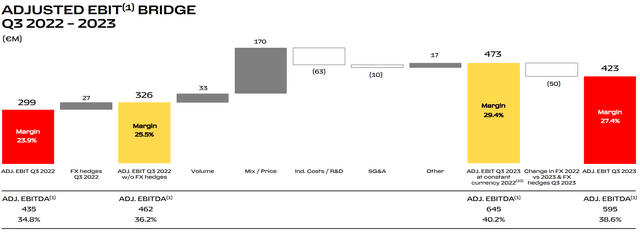

To elucidate what I imply, let’s begin with a graph: the adj. EBIT bridge from Q3 2022 to Q3 2023. We see Ferrari’s EBIT in Q3 2022 was €326 million, whereas this yr it was up by €97 million to €423 million. What led to this improve? Quantity contributed with €33 million, which is round a 3rd of the online improve. However the true soar up got here from combine/worth €170 million. So, the opposite 66% got here from a extra worthwhile gross sales combine and from pricing energy.

Ferrari Q3 2023 Outcomes Presentation

In a footnote of this slide, Ferrari explains what combine/worth meant in Q3: “enriched product combine, sustained by the Daytona SP3, 812 Competizione and SF90 households, in addition to nation combine pushed by Americas, increased personalizations and pricing”.

Amongst all these elements, what’s an important one? If we scrutinize the final earnings name transcript, we discover out that two phrases had been repeated 20 instances: combine and personalization.

Now, relating to combine, Ferrari has all the time tried to introduce each vary fashions, whose lifecycle available in the market is between 3-5 years, and several other particular collection and restricted version fashions which are often out there for not more than Three years. These are extremely high-margin ones, with quite a few personalizations. From this enterprise line, Ferrari has realized how worthwhile personalizations could be even for its vary of fashions. And it has began to increase its personalization choices for every of its fashions.

Excessive personalizations had been mentioned by Ferrari’s CFO Antonio Piccon, who overtly admitted they generated outstanding double-digit development in revenues. We even got here to know the way a lot personalizations contribute to the general revenues:

Personalizations additional elevated in absolute worth within the quarter and reached roughly 19% in proportion to revenues from automobiles and spare elements primarily pushed by paint, leverage and the usage of carbon.

On the identical time, Mr. Vigna did warn analysts that “the velocity of development order ebook won’t be the identical as previously” for the easy cause Ferrari is offered out with shoppers “eagerly taking every thing the corporate supplied them”. Ferrari has additionally the power to work with its prospects on pricing not solely when the order is distributed, as a result of all through the time the shopper waits for the automobile, Ferrari engages with the shopper to present up to date costs and work on personalizations. On this method, Ferrari will not promote automobiles in 2025 with 2023 pricing.

Listening to the corporate was offered out appeared to concern just a few analysts about future development. So Mr. Vigna needed to lastly be fully clear about Ferrari’s new focus:

It is true that we’re offered out. However I might say that the factor that we see is just not occurring as initially we deliberate firstly of the yr. I imply, it is going higher than we plan. It’s the personalization.

Ferrari stored on being shy relating to its future and stored on guiding for 17% of revenues from personalizations. On the identical time, in the course of the name, it was identified that personalization is seeing sturdy momentum into This fall and 2024.

Valuation

After the report, I grew to become much more optimistic Ferrari will put up full-year revenues very shut, if not even over €6 billion, €1 billion of which ought to come from personalizations alone. With Purosangue gross sales set to make up round 20% of shipments subsequent yr, we will anticipate margins to extend once more YoY. I now assume a 40% adj EBITDA margin is in sight. Contemplating a deceleration in deliveries development, we will forecast 2024 with 14,000 shipments with a median promoting worth of not less than €450ok. This result in €6.Three billion in revenues because the minimal aim to realize. This could result in €2.5 billion in EBITDA and a internet revenue of round €1.four billion. This result in EPS of not less than €7.67 which makes the corporate at the moment commerce at a 2024 fwd PE of 47. That is excessive. There is no such thing as a method round it. However what traders are betting on is just not solely 2024 however a steady streak of worthwhile years. Ferrari is a long-term story. Although I’m not shopping for at present costs, I’ve additionally to say it is extremely exhausting to choose up Ferrari’s shares at a reduction. The inventory hardly ever dips. So, whereas the inventory at the moment appears a maintain, the general image for steady development appears to be intact and really strengthened by what we coated within the article. My suggestion is to dollar-cost common within the inventory.