Marje

Abstract

Since my preliminary report in late September, Flagship Communities’ (TSX:MHC.UN:CA, OTCPK:MHCUF) shares have remained basically flat. That is regardless of a powerful Q3 and 5% distribution enhance (n.b., ~3.9% ahead yield). I now consider MHC provides probably the greatest high quality/threat/worth profiles within the residential REIT house. MHC’s portfolio of reasonably priced, recession-proof manufactured housing communities is positioned to ship above-average natural progress, with upside potential by its accretive roll-up technique. With its extremely resilient portfolio, long-duration and largely fixed-rate capital construction, low payout ratio, and important low cost to NAV, MHC is certainly one of my high residential REIT picks (n.b., the opposite could be Northview Residential REIT, although it has the next threat profile).

Earnings Replace

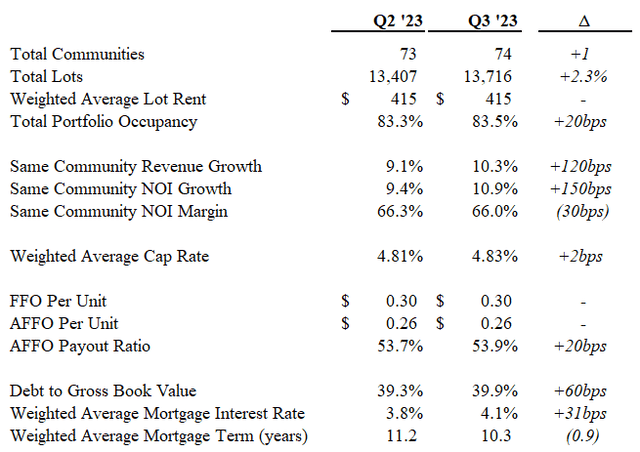

Regardless of current softening within the multi-family rental inside MHC’s core markets, it reported a powerful Q3, demonstrating the uniquely robust fundamentals of US manufactured housing. SP NOI progress accelerated to just about 10.9% (vs 9.4% in Q2). Lot rents have been unchanged whereas occupancy picked up 20bps, although FFO and AFFO per unit have been just about unchanged. Leverage was up barely from 39.3% D/GBV to 39.9%, proper under the REIT’s self-imposed 40% cap.

Q3 Earnings Abstract (Creator; MHC)

MHC additionally introduced a 5% distribution enhance, supported by its continued robust natural progress and ow payout ratio (n.b., ~54% AFFO vs friends ELS, SUI, and UMH at ~70%).

Acquisition Exercise

In August, MHC acquired a 309-lot group in Evansville, IN for $23MM. The acquisition was strategic for MHC, growing pricing energy within the Evansville area. It additionally expects the group to drive incremental occupancy throughout the market (n.b., group ~95% occupied at acquisition), because it owns one other group which is straight adjoining to the property. The acquisition was funded with a short-term bridge financing from a life insurance coverage lender (n.b., 12-month time period, at SOFR + 3.75%, with an all-in value of 9.05% within the current quarter). Administration is seeking to exchange this bridge financing with fixed-rate, long-term debt (n.b., doubtless focusing on 10-12 yr time period), doubtless inside Q1 ’24, and with a price between 6.50%-6.75%.

Moreover, Flagship has acquired a resort-style group (n.b., 62 heaps, ~95% occupied) in Lakeview, OH, for ~$3MM. This acquisition was funded with money and a 6-year, 3% ~$2MM VTB mortgage. I consider the resumption of a sooner tempo of acquisitions is a vital catalyst for MHC, because the REIT must scale considerably to draw a wider investor base.

Valuation

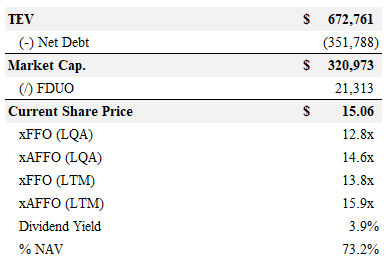

MHC is at the moment buying and selling at 12.8x and 14.6x LQA FFO and AFFO (n.b., vs friends SUI, ELS, and UMH at ~20x), respectively, and ~73% of NAV. Following the current distribution enhance, the yield is ~3.9%.

Present Valuation Abstract (Creator; MHC)

My NAV estimate following the quarter is ~$20.6/share (n.b., ~37% implied upside) and assumes a 6.0% cap price (n.b., ~7.1% implied cap price). My NAV implies 17.5x / 20.0x LQA FFO / AFFO per share. It’s price noting {that a} 10,000-site manufactured housing portfolio traded in early November for a mid-4% going-in cap price. The portfolio consisted of 46 communities throughout six states (n.b., 6 in Florida, eight in Missouri, 2 in Montana, 22 in Ohio, 6 in Illinois, and a pair of in Indiana) and was 87% occupied.

Dangers

Low Buying and selling Liquidity

I usually don’t like extremely illiquid securities, as I vastly worth the flexibility to be nimble and maintain transaction prices to a minimal. Nevertheless, I’m prepared to simply accept it within the case of MHC given its general low threat profile (i.e., resilient belongings, macro tailwinds, well-structured debt, and enticing valuation). As with every illiquid safety, I’d maintain my place dimension small and be extremely disciplined on pricing for my trades. I additionally anticipate MHC’s liquidity to enhance over time because the investor base grows and extra items are issued (hopefully at higher costs).

Reliance on Fairness Funding

With the purpose of rising through M&A and sustaining D/GBV <40%, two objectives that are considerably at odds, MHC is extremely reliant on fairness issuances to fund acquisitions. That is largely the explanation for this yr’s slower tempo of acquisitions (n.b., ~$50MM YTD). It has already raised ~$23MM of fairness at $17/share through two issuances by its ATM program in March and Could. These issuances have been already dilutive to NAVPU, so I hope administration just isn’t planning additional issuances with the shares round ~$15, which might be extraordinarily dilutive.

Assuming they continue to be disciplined with the ATM program, the substantial low cost to NAV places MHC within the negative-reflexivity situation Soros described for REITs in The Alchemy of Finance. The low cost to NAV results in both 1) dilutive fairness issuances to fund progress or 2) a slower tempo of reinvestment. Both consequence can contribute to a weak share worth, persevering with the cycle. This isn’t the top of the world for MHC, as it’s undervalued primarily based on its in-place portfolio and has an extended runway for natural progress. It might enhance the time wanted to succeed in vital mass and be valued appropriately, but it surely shouldn’t condemn MHC to REIT purgatory.

Associated Social gathering Transactions

Instantly from MHC’s Q3 MD&A:

“The REIT and Empower, an entity majority-owned by the REIT’s Chief Govt Officer and Chief Funding Officer, are celebration to sure agreements that govern the relationships between such events and their associates. Empower will purchase and develop MHCs that don’t meet the REIT’s funding standards and conduct dwelling gross sales, together with gross sales of manufactured properties situated on funding properties, below the ‘‘You Acquired it Houses’’ model.

Transactions between the REIT and Empower are ruled by the Providers Settlement (see “Providers Settlement” within the Annual Info Type) or agreements relating on to the precise transaction.”

Thus far, the fabric transactions with the associated celebration embrace MHC offering Empower ~$2.5MM promissory word (n.b., on the WSJ Prime Charge), and buying a MHC commuinties from Empower for money and Class B Models.

The CEO and CIO additionally personal 50% of Name Now HVAC, which gives HVAC providers to the REIT. The CEO’s brother additionally owns 100% of BG3, a landscaping firm that MHC contracts.

Fortunately, it appears that evidently the associated celebration transactions have been made on truthful phrases and have been appropriately and nicely documented. The connection with Empower is essentially the most dangerous by way of misalignment of incentives, so it’s one thing to regulate. In equity, I will even word that administration collectively owns +5MM items (n.b., together with common, restricted, and sophistication B items, although nearly all of administration’s items are class B) price +$80MM.

I consider that cleansing these relationships up could be useful in gaining the market’s belief as MHC scales. It will not be essential, as different REITs have reached important scale with complicated, and infrequently questionable associated celebration conflicts (e.g., SRU.UN:CA).

Catalysts

On condition that the REIT’s debt is essentially mounted price and long-dated, and its portfolio has seen very restricted cap price enlargement, rates of interest could also be of a lot much less of a catalyst for MHC than in different REITs I observe (e.g., Northview, Tricon). Somewhat, I see a resumption of upper ranges of acquisition exercise to be the important thing driver going ahead.

I consider a pickup in acquisition exercise can be vital in reigniting the market’s curiosity in MHC. If and when this occurs, the reflexivity mentioned above will work in MHC’s favor. And as I discussed, that is essential for attaining vital mass.

A sooner tempo of acquisitions will even drive the size and elevated liquidity (through unit issuances) which can be vital to closing the valuation hole.

Conclusion

MHC seems to be one of the attractively priced, high-growth residential REITs. Working in a extremely resilient residential sub-market and with a really wholesome stability sheet, it carries a a lot decrease threat profile than different equally priced REITs (e.g., CTO, Tricon, and Northview). Given its long-dated and largely fixed-rate debt profile, it will not be as reliant on rates of interest plateauing or falling as a direct catalyst, although maybe charges are an vital driver of M&A, which I consider is the principle catalyst. For these causes, I see it as much less correlated with the opposite REITs I cowl, thereby providing an vital portfolio diversification profit.

I see ~37% upside to my NAV estimate of ~$20.6/share (n.b., 17.5x / 14.6x LQA FFO / AFFO). It provides a ~3.9% yield following the current 5% distribution enhance, with ample room for additional will increase within the coming years (n.b., ~54% AFFO payout ratio, +9% AFFO per share CAGR during the last eight quarters, which I anticipate to proceed rising at an analogous price). I keep my Purchase ranking however would have given it a Robust Purchase if not for the restricted buying and selling liquidity.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.