Alex Wong

Palantir (NYSE:PLTR) is checked out as a cult inventory as there’s a large on-line neighborhood from its retail shareholders. These days, Wall Road appears to be warming as much as Palantir, as they’ve now delivered 4 consecutive quarters of GAAP profitability, Dan Ives has topped them the Messi of A.I., and even Jim Cramer, who was extremely bearish on Palantir, is on staff Palantir. I’m shocked people are nonetheless bearish on Palantir after delivering a pivotal quarter, paving a stable path ahead. What was as soon as the gasoline for the bear case has been eradicated, and the one logical bear thesis that I may think about having advantage is the valuation on a backward-looking foundation. For the longest time, corporations like Amazon (AMZN) and Tesla (TSLA) seemed overvalued based mostly on the fundamentals, but the shares stored appreciating as buyers piled in for future progress. I usually search for worth, and lately, I’ve been allocating capital towards PayPal (PYPL), however Palantir is without doubt one of the few progress shares I have never minded paying a premium for.

I’ve been a shareholder for the reason that direct itemizing, I modified my stance on Palantir after the notorious convention name when Alex Karp (Palantir CEO) grew to become unhinged again in 2022. I had stated I’d give Palantir one 12 months to alter my thoughts, and after two quarters, I got here again to the bullish facet. Shares of Palantir can completely decline in worth similar to any inventory can, however in my view, their potential and accomplishments warrant the present valuation. Some buyers are in a fantastic state of affairs the place their buy worth is within the excessive single-digits, and their ROI exceeds 100%, whereas others might have gotten again to even, or some may nonetheless be within the crimson from the 2021 highs. I’ve bought shares at completely different costs, and my opinion is that relying on what your worth per share is, Palantir may very well be an distinctive maintain, however should you’re searching 5-10 years, there’s nonetheless large potential for capital appreciation. I am nonetheless a purchaser at these costs as I’m searching previous 2030 as a result of I firmly consider Palantir will turn out to be the second most necessary software program firm behind Microsoft (MSFT).

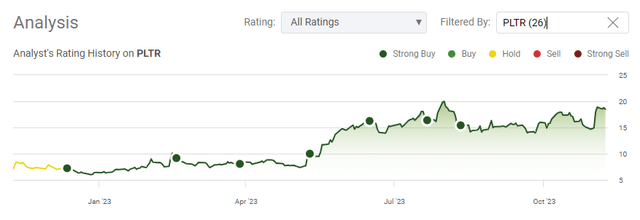

In search of Alpha

The one bear thesis left is that buyers could be paying an excessive amount of for shares of PLTR at at the moment’s costs

There have been many various bear theses over time, from Palantir being a black field to the prevalence of its software program. These specific bear circumstances are extra of an opinion than an precise bear case. Palantir is not a black field because it has at all times been easy about its work with america authorities and that some elements of its enterprise are labeled. Palantir has been very public about its software program, together with Foundry, Gotham, Apollo, and AIP. It is arduous to really argue that Palantir is a black field when their enterprise elements are public, and so they break down authorities vs. industrial income and consumer counts. Anybody who will get hung up on the concept that Palantir works with the CIA or FBI most likely should not put money into Palantir as a result of they’re lacking the larger image.

The subsequent bear thesis that gained traction was the relevancy of Palantir’s merchandise. There’s a good probability that many of the people with unfavourable opinions have by no means used Palantir merchandise, as they solely present enterprise-level software program. Palantir was acknowledged as a Chief in synthetic intelligence and machine studying (AI/ML) software program platforms by famend analysis and advisory agency Forrester. Palantir was additionally ranked the No. 1 Synthetic Intelligence software program platform each in market share and income, in line with the IDC, Worldwide Synthetic Intelligence Platforms Software program of their 2022 report. Most lately, Palantir was ranked the #1 vendor within the 2023 AI, Knowledge Science, and Machine Studying Knowledge of Crowds Market Research printed by Dresner Advisory Companies.

The primary AIP convention, which was streamed on YouTube (may be watched right here) was one other highly effective second as business titans from Cisco Techniques (CSCO) to Jacobs Options (J) introduced in-depth buyer tales and illustrated simply how impactful implementing PLTRs software program has been to their group. On the 2nd AIP Con HCA Healthcare showcased how AIP was utilized in its healthcare system. HCA had 50 departments and 4 amenities utilizing AIP as of June 1, and on the AIP Con 2 in September, this had grown to 150 departments and 9 amenities. HCA’s purpose for the primary half of 2024 is to have 400 departments and 40 amenities using AIP. There are additionally numerous influence research from their shoppers, together with Airbus, Cleveland Clinic, Ferrari (RACE), and Kinder Mogan (KMI), that may be seemed by. The biggest corporations on the earth throughout many industries are using Palantir’s merchandise as a result of they’ve remodeled their companies, and there’s no higher proof than outcomes relating to the relevancy of Palantir’s software program.

Palantir

Being a black field or an opinion about Palantir’s software program aren’t related bear circumstances in my view, as they proceed to be disproven. Palantir continues to extend its buyer depend, develop its deal guide, develop income, and generate income. The one bear case that I really feel is value contemplating is the present valuation. The valuation for Palantir has at all times come into query. In the present day, Palantir has a market cap of $40.72 billion, their income over the trailing twelve months (TTM) is $2.13 billion, and so they have generated $147.Three million in web earnings. I do not take care of worth to gross sales as a result of I really feel profitability is a a lot better measure of an organization’s success. For the profitability measure, I care extra about FCF than web earnings as a result of it is a tougher quantity to control as it’s a measure of profitability that excludes the non-cash bills and contains spending on gear and property. It is also a tougher quantity to distort or manipulate resulting from how corporations account for taxes, and different curiosity bills. This is also the pool of capital corporations make the most of to pay again debt, reinvest within the enterprise, pay dividends, purchase again shares, and make acquisitions.

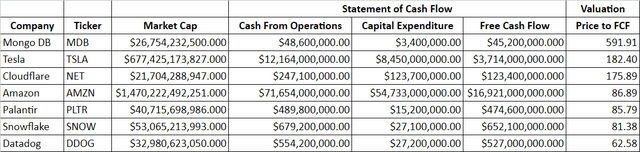

Shares of PLTR have been on a robust run, having elevated by over 95% prior to now six months and by nearly 200% YTD. This has made the valuation increase, and a few have criticized how Palantir is being valued. Under, I created a desk that exhibits the present worth to FCF multiples Mr. Market is assigning to every of the next corporations:

- Palantir

- MongoDB (MDB)

- Cloudflare (NET)

- Snowflake (SNOW)

- Datadog (DDOG)

- Amazon

- Tesla

I’ve added Amazon and Tesla as a result of these have been two corporations which have arguably by no means traded at an inexpensive valuation, but they’ve grown into two of the most important corporations on the earth. Amazon has a market cap of $1.47 trillion and trades at an 86.89x FCF a number of, having produced $16.92 billion of FCF within the TTM. Tesla, which continues to be a battleground, trades at a 182.40x FCF a number of based mostly on their TTM FCF. Palantir is buying and selling at an 85.79x FCF a number of whereas related corporations reminiscent of Snowflake trades at 81.38x FCF, and MongoDB trades at 591.91x FCF. Palantir isn’t a worth firm by any means, however it’s not being unfairly valued, in my view, in comparison with related software program software corporations and even a number of the largest corporations on the earth.

Steven Fiorillo, In search of Alpha

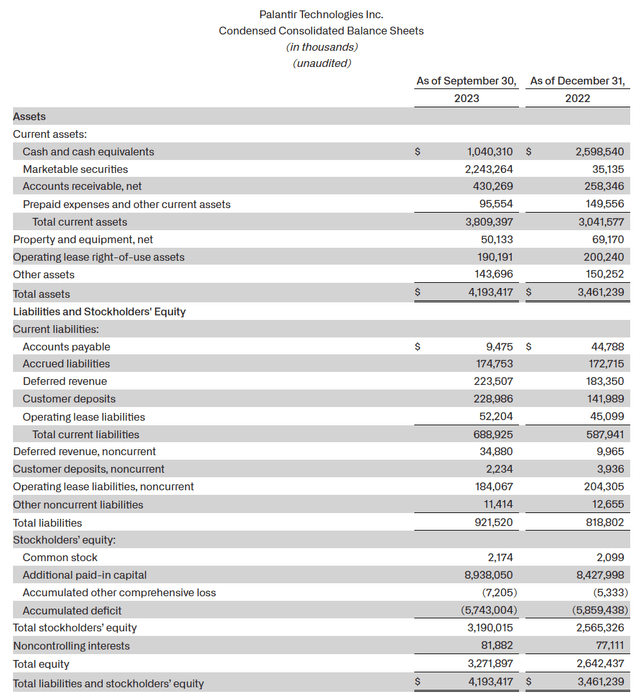

There are a number of other ways to worth a inventory, and that is how I’m taking a look at what I’d be shopping for if I have been so as to add shares at at the moment’s costs. First, I take a look at the steadiness sheet as this tells me concerning the total well being of the corporate. Palantir has the most effective steadiness sheets I’ve seen as a result of there is not a single greenback of debt inside its liabilities. Palantir has $3.24 billion in money, with $2.24 billion allotted to short-term U.S. treasury securities. In Q3, Palantir generated $39.98 million in curiosity earnings from its money pile and has grown its present property by $768 million over the previous 9 months. Palantir may write a examine tomorrow with out touching its treasury payments and remove 100% of its liabilities whereas nonetheless having $118.79 million in straight money readily available.

Palantir

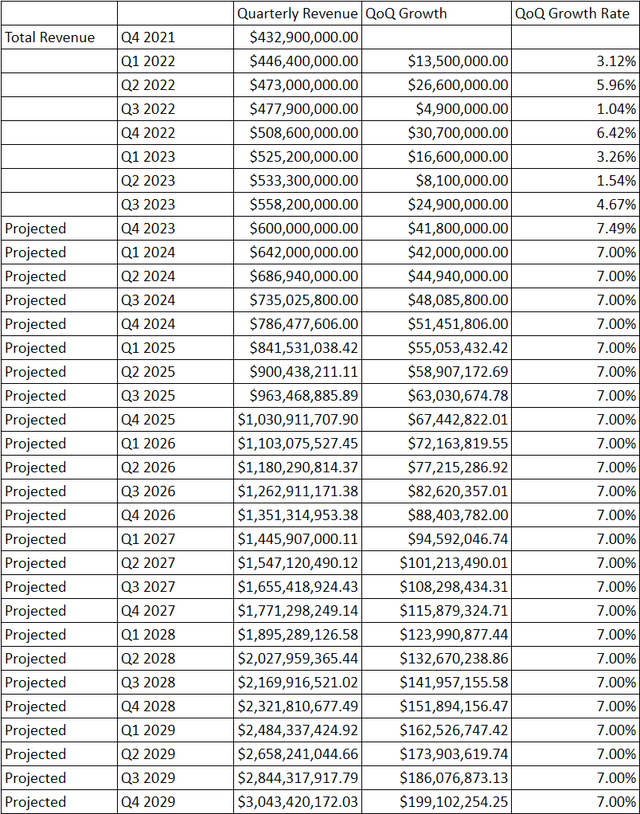

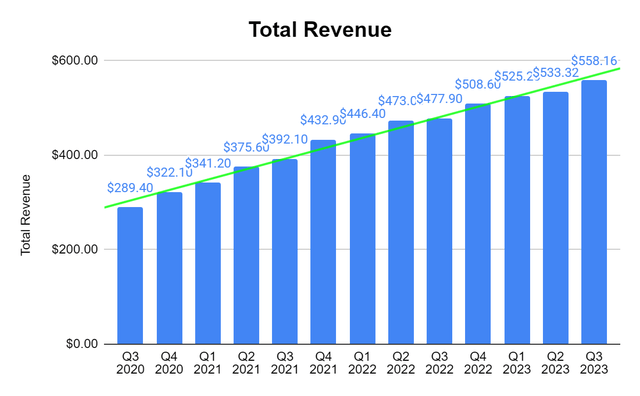

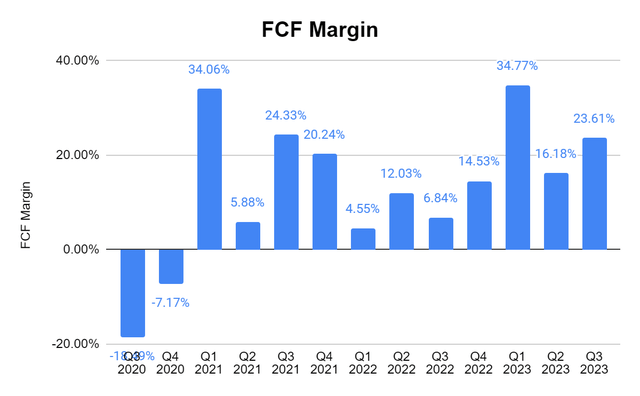

On the enterprise facet, Palantir has generated $2.13 billion in income, $147.Three million in web earnings, and $474.6 million of FCF within the TTM. Palantir had an FCF yield on income of 22.33% for the TTM, and in Q3, their FCF yield was 23.61%. Palantir has guided that it’s going to generate between $599-$603 million of income in This fall, and its 2023 fiscal 12 months income will are available in at $2.21-$2.22 billion. It is arduous to mannequin Palantir as a result of they have not began to monetize AIP but, and there’s a lot of future progress potential for brand spanking new authorities and industrial prospects. In 2021, Palantir had a 41.11% YoY income progress price, which declined to 23.6% in 2022, and if Palantir generated $2.2 billion in income, it might place its 2023 YoY income progress price at 15.43%. For the previous two years, if Palantir is available in on the midpoint of its steerage at $600 million in income in This fall, it is going to have generated a median quarterly income progress price of 4.19% over the previous two years. That is whereas Palantir was thought of a black field, wasn’t a family title, and did not have the identical product providing as they do at the moment.

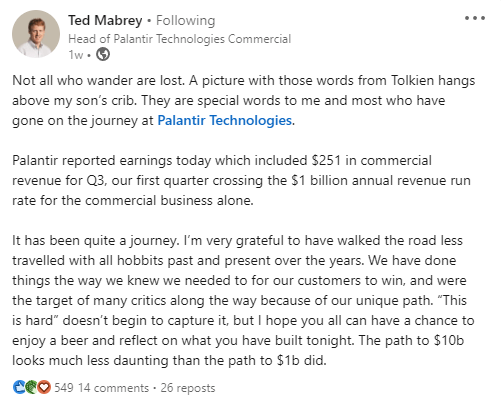

Ted Mabrey, who’s Head of Palantir Applied sciences Industrial, created a LinkedIn submit the place he stated the trail to $10 billion appears to be like much less daunting than the trail to $1 billion. In the end, I feel Palantir does get to the purpose the place they’re producing in extra of $10 billion in income on an annual foundation, the actual questions are when will it happen, and the way lengthy am I keen to attend? At a 23% FCF yield, each $10 billion of income would generate $2.Three billion in FCF, inserting the ahead valuation at 17.7x their ahead FCF.

It doesn’t matter what I put in my ahead projections, there are some who will criticize it, some who will suppose I’m being too conservative, and a few who might agree. Assuming $600 million for This fall, Palantir can have grown its income at a price of 1.54% QoQ in Q2, 4.67% QoQ in Q3, and seven.49% QoQ in This fall 2023. If I speculate that Palantir can maintain a 7% ahead quarterly income progress mannequin based mostly on AIP monetization and an influx of contracts just like what we’ve got seen, there’s a path to generate $11.Three billion in annual income in 2029. At a 23% FCF yield, Palantir’s ahead worth to FCF based mostly on their present market cap could be 16.05x as they’d have generated $2.54 billion in FCF. That is a number of progress over the following six years, and contemplating Amazon trades at 86.89x its present TTM FCF and Tesla trades at 175.89x its present FCF, Palantir may definitely preserve a 50-60x a number of all through its future progress trajectory. At a 50x a number of, producing $2.54 billion in FCF for 2029 would put its market cap at $126.85 billion. Whereas some might think about this too wealthy, remember that even conventional corporations reminiscent of PepsiCo (PEP) are buying and selling at 33x their FCF ($229.34 billion / $6.95 billion), and Microsoft (MSFT) trades at 42.76x its FCF ($2.7 trillion / $63.23 billion)

I may very well be incorrect with my projection, and rather a lot will rely on how Palantir is ready to monetize its AIP resolution, however these numbers may show to be both too enthusiastic or conservative. I feel the trail to producing $10 billion-plus of income earlier than 2030 is on the desk, and based mostly on Palantir’s margins, they might function effectively previous a 20% FCF yield, making my bull case attainable.

Steven Fiorillo, In search of Alpha

Palantir is doing all the pieces proper and there’s a cause why skeptics are coming round

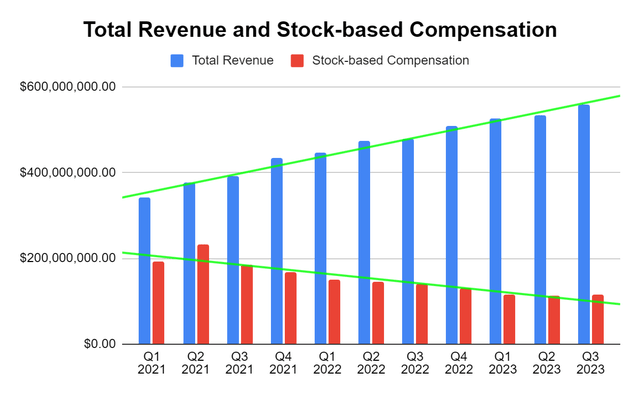

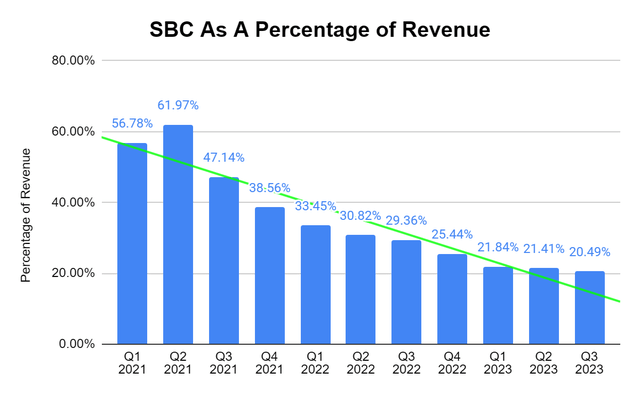

Along with the numbers, I’m additionally taking a look at how Palantir’s enterprise is working. Inventory-based compensation (SBC) has been a sticking level for a lot of buyers. In Q3 2023, Palantir generated $558.16 billion in income and paid its staff $114.38 billion in SBC. When Palantir first went public, its SBC exceeded 50% of income, and in Q2 of 2021, Palantir paid 61.97% of its income in SBC. This has continued to say no over the previous 9 quarters whereas income has continued to develop. In Q3 2023, Palantir’s SBC as a proportion of income was 20.49%, which is a big step in the best route. Palantir is not an unprofitable firm and is not leveraged with debt. Palantir can afford to pay its staff in SBC based mostly on efficiency, and SBC is not the difficulty it as soon as was. If SBC continues on its present trajectory and continues to say no, then its profitability margins ought to enhance so long as its different prices keep in line.

Steven Fiorillo, In search of Alpha, Palantir

Steven Fiorillo, In search of Alpha, Palantir

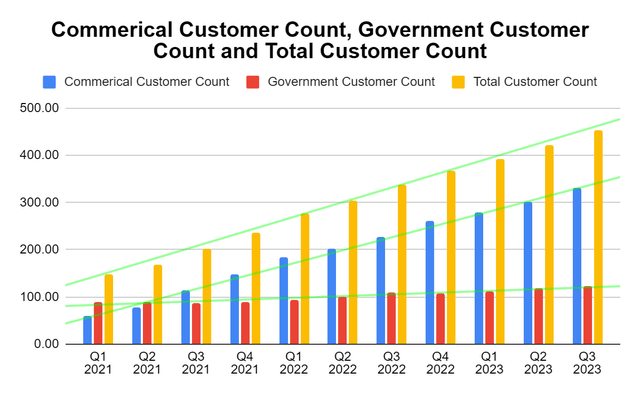

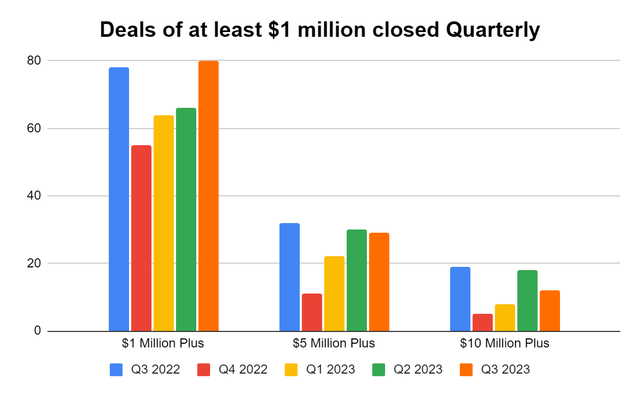

The satan is within the particulars, and Palantir continues to develop its industrial and authorities buyer counts. Palantir continues to disprove each criticism that it was solely a authorities contractor, and in Q3, they elevated their U.S. industrial buyer depend by 37% YoY and by 12% QoQ. Income generated from U.S. industrial elevated 33% YoY and by 13% QoQ. Palantir closed 102 US industrial offers in Q3 and watched its U.S. industrial buyer depend develop 10x over the previous three years. Palantir closed Q3 with 330 industrial prospects, 123 authorities prospects, and 453 complete prospects. What may very well be much more spectacular is their deal movement exercise, as they closed 80 offers value at the least $1 million every in Q3. From this cohort of offers, 29 have been valued at $5 million plus, and 12 have been valued at $10 million plus.

Steven Fiorillo, Palantir

Steven Fiorillo, Palantir

This has allowed Palantir to proceed rising its income and profitability. We have now seen two quarters since 2021 the place Palantir had an FCF margin that exceeded 34% and a number of other quarters the place its FCF margin has exceeded 20%. Palantir can be getting its act collectively on the gross sales facet as they’re now introducing AIP Bootcamps, which is its go-to-market technique for AIP. Palantir is now on observe to conduct AIP Bootcamps for greater than 140 organizations by the top of November, which can enable organizations to know the way to apply A.I. to their enterprise, develop their preliminary use circumstances, and practice their staff for implementation. Palantir has proved its software program is not hype as a result of the most important corporations on the earth are its shoppers, not as a result of somebody who would not use their software program has an opinion. Palantir’s software program is utilized by 16% of the hospital beds throughout the U.S. There’s a giant pipeline of corporations implementing AIP that have not been monetized but. To some, Palantir might look overvalued, however to me, it appears to be like like they’re simply getting began, and there’s a clear path to giant profitability and capital features going ahead.

Steven Fiorillo, In search of Alpha, Palantir

Steven Fiorillo, In search of Alpha, Palantir

Conclusion

Palantir continues to innovate and ship software program options that resolve actual issues throughout many sectors and industries. Whereas I’ve had my criticisms prior to now, Palantir continues to indicate the world why they’re the perfect in breed, from authorities to industrial options. Palantir is not only a firm that I see a path to generate giant quantities of capital appreciation; it is an organization I’m proud to be a shareholder of. One in all Palantir’s missions is to guarantee that the U.S. and its allies are the strongest they are often and that Palantir won’t ever do enterprise with adversaries of the U.S. From the battle entrance to industrial companies, Palantir is making a distinction. A.I. continues to be in its infancy, and Palantir has established itself as a transparent chief within the subject. I’m simply as bullish at the moment as I used to be final quarter and initially of the 12 months earlier than shares rallied. I can not time the markets, and Palantir may see a pullback, however I’m taking a look at the place Palantir shall be years into the long run, not tomorrow or subsequent month. I’m holding and plan on including to my place due to the place I see Palantir headed, and I’m not making my resolution based mostly on at the moment’s valuation, which can proceed to alter.