Jirsak

Payoneer World (NASDAQ:PAYO) is a monetary know-how firm that principally works with small companies to run quite a lot of transactions and on-line cash transfers. The corporate provides a strong progress story and certain a path to profitability at a comparatively low value after buyers closely punished it in final 12 months’s bear market.

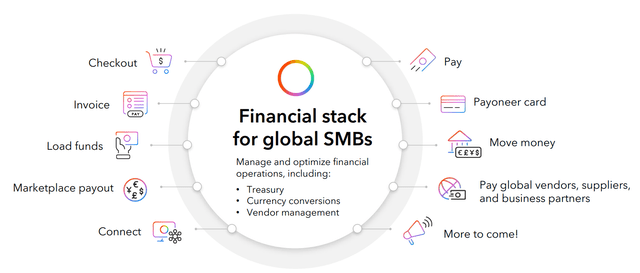

Together with different merchandise, the corporate provides a cross-border fee system which permits enterprise house owners to gather funds internationally in numerous currencies globally. The corporate’s buyer base consists of small companies that do various kinds of companies akin to import, export, freelance work, contract work, consulting, digital artists in addition to workers of corporations who work remotely away from their firm’s predominant location which is changing into extra frequent these days. When an worker works in a single nation however lives out of the country, getting them paid could be a sophisticated method between forex fluctuations, taxations and completely different rules in numerous nations and Payoneer has experience and expertise in coping with conditions like this.

Product Choices (Payoneer)

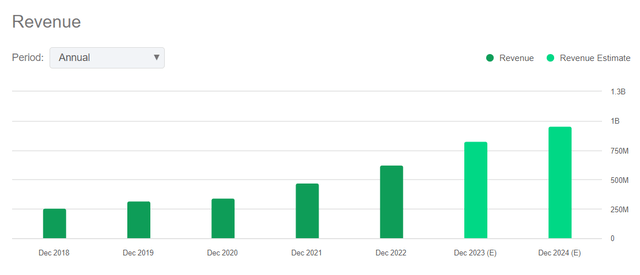

Whereas the corporate has been round since 2005, it had its IPO only a couple years in the past in 2021. Lately the corporate’s progress has accelerated as its merchandise gained extra adoption from individuals who work and receives a commission throughout borders. Between 2018 and 2022, the corporate’s revenues jumped from $250 million to $600 million and it is on monitor to succeed in nearly $1 billion by the top of subsequent 12 months based mostly on analyst estimates which might symbolize a four-fold progress from 2018.

Income progress together with estimates for 2024 (Looking for Alpha)

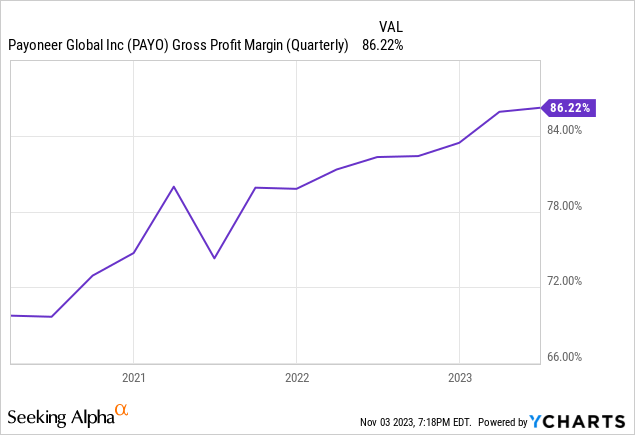

As the corporate’s revenues grew, so did its margins as the corporate was capable of reap the benefits of economies of scale. Since its IPO, the corporate’s gross margins climbed from 70% to 86% which is nothing wanting spectacular. I would not guess on these margins to enhance additional since they’re fairly near 100% as it’s but when the corporate can keep its margins the place they’re proper now, its path to profitability will likely be paved.

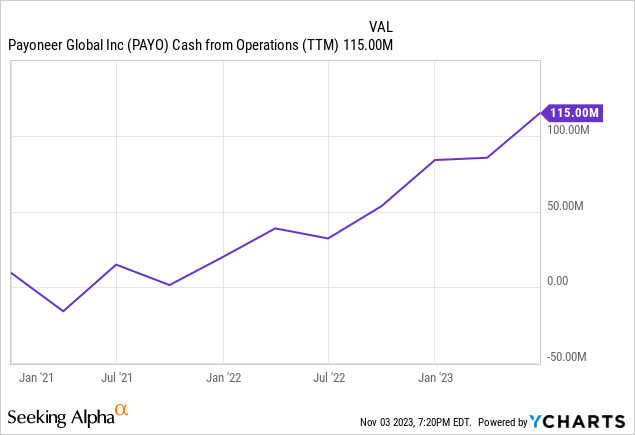

The corporate hasn’t posted full income but however it’s getting there. As you possibly can see under, the corporate’s working money circulation has been enhancing nearly each quarter since its IPO. Within the final 12 months, the corporate was capable of generate $115 million of money circulation from its operations which is spectacular contemplating it is nonetheless in its progress stage. Many corporations report massive losses when they’re in early phases of their progress and it is uncommon to see optimistic margins and progress on the identical time since loads of progress corporations must sacrifice one for the opposite.

Between now and 2030, world commerce is anticipated to develop from $30 trillion to $40 trillion and this might create a fairly good alternative for corporations like Payoneer that course of worldwide multi-currency funds. With its market cap of solely $2 billion, that is nonetheless a small firm and even when it could actually take a really tiny chunk out of this ever-growing world commerce apple, it can lead to a significant progress for the corporate. There are greater than 80 million companies that work internationally however do not use an answer that may enable them to course of transactions internationally in a dependable method which creates loads of room for the corporate to develop for the foreseeable future. At present the corporate’s buyer base consists of about 2 million prospects which suggests it has a fairly small market share which may nonetheless develop for years to return.

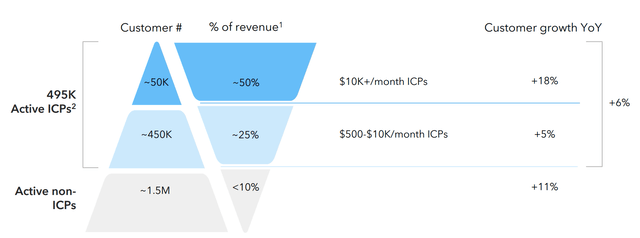

As for the corporate’s present prospects, its most lively 50okay prospects account for 50% of revenues whereas its 1.5 million prospects account for lower than 10% of its revenues. For the reason that firm is coping with small companies, their engagement and quantity ranges will fluctuate tremendously the place some prospects will generate enormous volumes and revenues whereas others won’t. If the corporate may discover a approach to get a few of its least engaged prospects extra engaged, it may unlock extra progress potential. Most of the firm’s prospects are barely getting began of their cross-border enterprise so it can take them a while to develop this section of their enterprise and make extra use of PAYO’s merchandise. In a manner PAYO’s success additionally will depend on success of its worldwide prospects. The extra profitable these small companies turn into in cross-border trades, the extra profitable PAYO will turn into so the corporate has an incentive to make it simpler for these small companies to achieve cross-border trades.

PAYO’s Buyer Base (Payoneer)

Sooner or later there may be additionally a possible for the corporate to supply extra companies via utilization of AI. For instance it could actually create customized experiences for patrons together with AI generated communications companies can ship to their prospects, utilizing predictive fashions to see enterprise traits higher to handle future buyer wants, using predictive energy for companies to foretell creditworthiness of their prospects and fraud detection. Small companies can profit from utilization of those companies and Payoneer may see additional progress alternatives if its swimsuit of AI options can get to a degree of self-service for its enterprise prospects. For the reason that firm has so many shoppers of various sizes all over the world and it handles hundreds of thousands of transactions each month, the corporate possible already has sufficient knowledge to construct some good predictive fashions. That is nonetheless a piece in progress and we must wait and see the adoption charges of the corporate’s AI options.

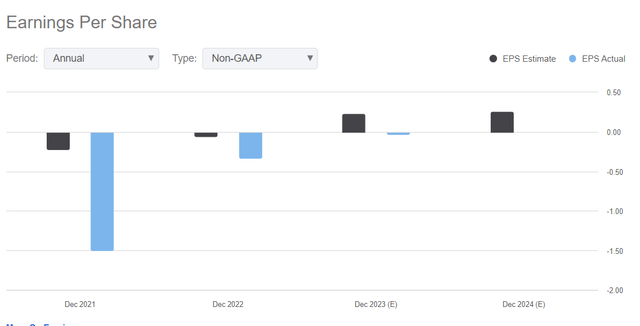

The corporate now has a path to profitability. After posting a big loss and lacking analyst estimates badly in 2021 (it misplaced $1.50 when analysts have been anticipating it to lose solely $0.22), the corporate improved its funds in 2022 and posted a a lot smaller lack of 33 cents, though it nonetheless missed analyst estimates. In 2023, the corporate was anticipated to submit a small revenue and it posted a small revenue of 12 cents within the final quarter whereas analysts have been anticipating it to generate three cents. Analysts anticipate the corporate to submit a small revenue for the rest of the 12 months and a revenue of 26 cents per share in 2024. For the reason that firm has a historical past of lacking revenue estimates sometimes, it’d nonetheless miss in 2024 however not less than its funds are lots higher than they have been a pair years in the past and the corporate has a path to profitability. As I stated above, the corporate already improved its gross margins and achieved optimistic working money circulation so it’s getting there slowly however absolutely even when it misses estimates sometimes alongside the way in which.

EPS estimates and actuals (Looking for Alpha)

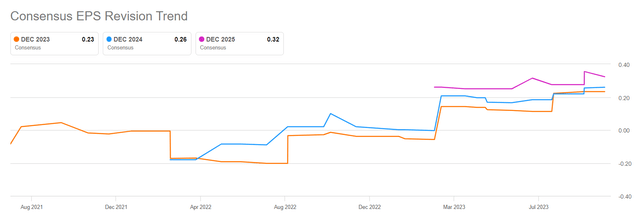

If something, analysts have been revising their estimates upwards for the corporate in latest months which suggests they’re extra optimistic concerning the firm. Since it is a small cap firm, there are solely a handful analysts masking the inventory however that is nonetheless higher than nothing. There are additionally a pair analysts who initiated their estimates for 2025 and they’re calling for 32 cents per share in web revenue. If the corporate have been to attain that, this might give it a ahead P/E of 17 which is fairly low cost for an organization that is rising in double digits.

Analyst revisions (Looking for Alpha)

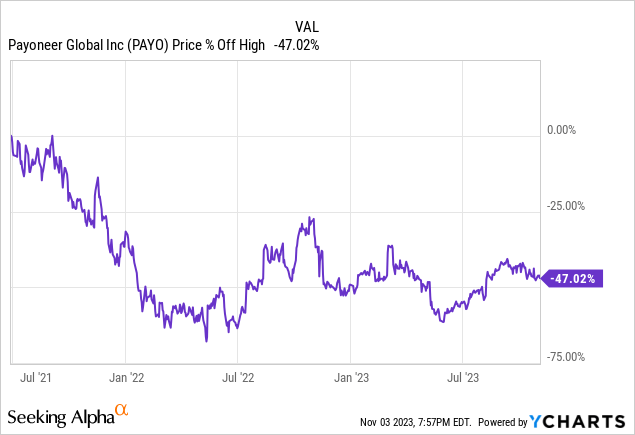

Traders have not been very favorable for this firm throughout its whole existence as a publicly traded company. Since its IPO a pair years in the past, the inventory is down by nearly half. A part of it could possibly be as a result of buyers did not have a lot religion within the firm and a part of it could possibly be as a result of the corporate’s IPO got here at a foul timing proper earlier than final 12 months’s bear market began. This 12 months it seems to be like we’re not in a bear market anymore however it’s principally pushed by the efficiency of mega caps. Many small caps are nonetheless in bear territory and this inventory appears to be a type of as properly.

The inventory’s unhealthy efficiency may proceed within the quick time period till the sentiment shifts however this inventory possible provides a very good alternative for long run buyers no matter quick time period complications. It’s a good progress story that additionally comes with a path to profitability and the corporate has loads of progress potential it could actually unlock if it executes appropriately which it has been doing these days. There are numerous causes to be hopeful and optimistic about this firm’s future and it is valuation is not too unhealthy both with a ahead P/E of 17.