Phiromya Intawongpan

The Invesco NASDAQ Subsequent Gen 100 ETF (NASDAQ:QQQJ) invests within the 101st to the 200th largest firms listed on the NASDAQ trade. By this measure, we have a look at QQQJ because the junior fund subsequent to the extra high-profile Invesco QQQ Belief (QQQ) with a definite publicity extra in direction of mid-caps.

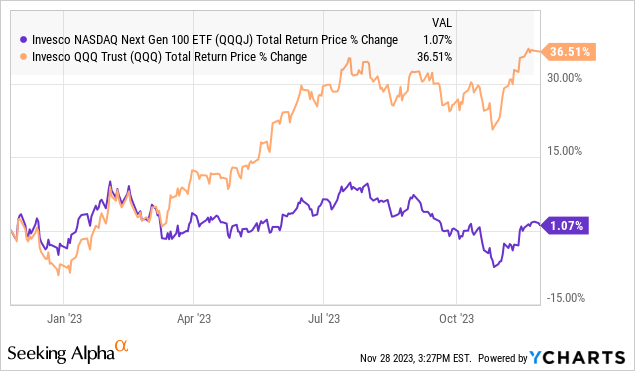

A significant theme out there this yr has been the outperformance of the mega-cap tech leaders, whereas smaller firms have been extra pressured by the shifting macro backdrop together with high-interest charges. Certainly, in comparison with a 37% return over the previous yr in QQQ, the Subsequent Gen 100 ETF is up simply 1%.

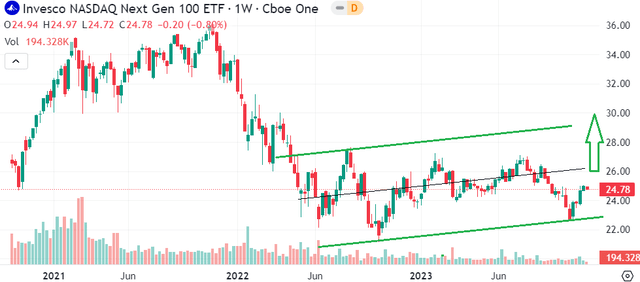

That being stated, we consider QQQJ is well-positioned to climb increased going ahead. In our view, an surroundings of easing inflationary pressures and stabilizing rates of interest into 2024 ought to help increasing market breadth, benefiting this essential market section.

What’s the QQQJ ETF?

QQQJ technically tracks the “The Nasdaq Subsequent Era 100 Index” which includes a modified market capitalization-weighting methodology. On this case, a 4% weighting cap is utilized to the relative market worth of the 100 largest firms exterior of the Nasdaq-100. There’s additionally a quarterly rebalancing.

Notably, QQQJ excludes monetary sector shares in addition to REITs. One clarification for this index-level determination considers that these teams are over-represented inside Nasdaq and would in any other case dominate the fund on the expense of shares in non-financial sectors pushed extra by company-specific elements apart from rates of interest and macro traits.

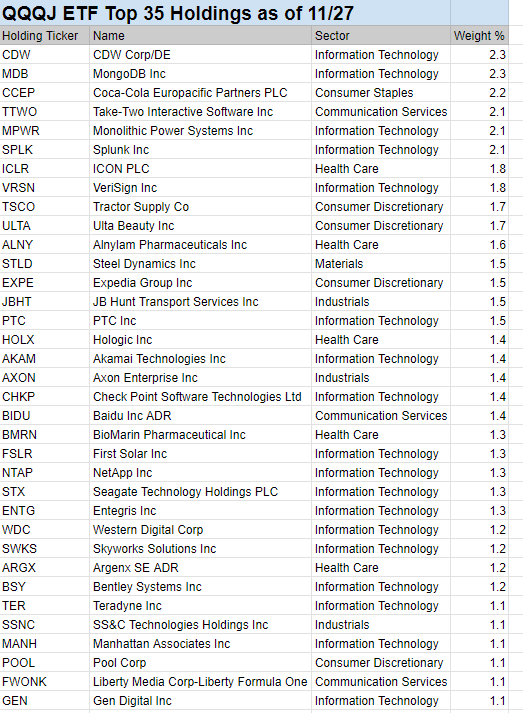

Going via the present portfolio, whereas Nasdaq is usually synonymous with know-how, the sector represents about 41% of the full publicity. That is adopted by the Healthcare sector at 22%, and Client Cyclical names at 11% of the weighting.

CDW Corp. (CDW) and MongoDB (MDB) every with a 2.3% weighting are the 2 largest present holdings. Remember the fact that the Nasdaq and QQQJ additionally embody worldwide shares, with China’s Baidu (BIDU) with a 1.4% weighting as one instance. On this level, non-US firms comprise roughly 12% of the fund.

supply: Invesco/ desk by creator

QQQJ Efficiency

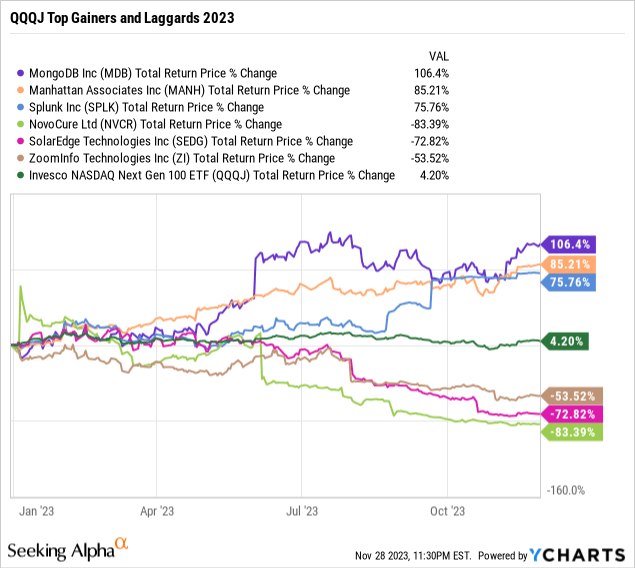

We talked about that 2023 has been a difficult yr for QQQJ, lagging behind broad market benchmarks, returning simply 3.6% year-to-date. Whereas the portfolio contains some massive winners, there are additionally laggards dragging the efficiency.

Our knowledge exhibits that virtually half the shares have a constructive return this yr which is indicative of the underlying volatility and uneven efficiency. MongoDB stands out as the highest gainer with a 106% return to this point in 2023, whereas NovoCure Ltd. (NVCR) is the worst performer, shedding -83% this yr.

So to elucidate the efficiency unfold between QQQJ and its massive brother in QQQ, the latter benefited from a extra concentrated portfolio amongst mega-cap leaders akin to Apple (AAPL), Microsoft (MSFT), and NVIDIA (NVDA) that led the general market increased inside QQQ’s uncapped capitalization primarily based weighting methodology.

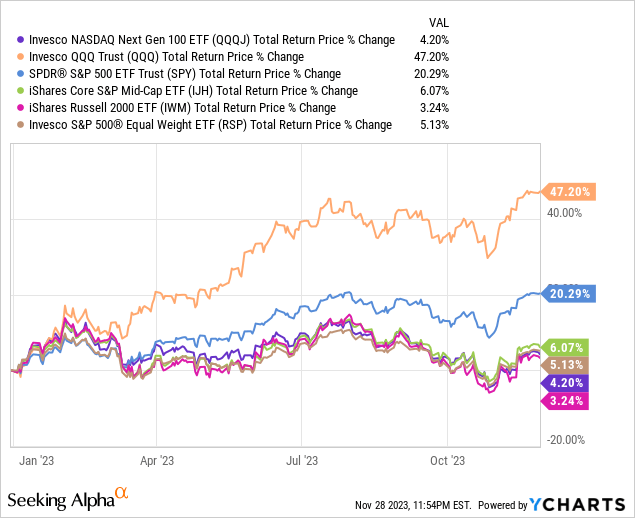

On the identical time, it is price putting the Subsequent Gen 100 fund’s return within the context of extra comparable ETFs inside its class. On this case, QQQJ’s efficiency in 2023 is roughly in step with the three% achieve from the iShares Russell 2000 ETF (IWM) or the 6% return from the iShares Core S&P MidCap ETF (IJH).

The purpose right here is to say that whereas QQQJ wasn’t a world-beater in 2023, we’re extra desirous about the place it goes subsequent.

What’s Subsequent For QQQJ?

Heading into 2024, there’s a constructing consensus that the Fed is finished climbing charges whereas the development of decrease inflation has even opened the door for fee cuts. This setup, even because the financial system stays resilient and averts a recession, describes the allusive “smooth touchdown” that will have appeared inconceivable going again to final yr however is now shifting nearer to a actuality.

The way in which we see it taking part in out is that this favorable macro backdrop must be constructive for danger sentiment and set the stage for the subsequent part of the present bull market. So whereas QQQ and SPY have led increased, we consider the subsequent leg increased shall be outlined by increasing market breadth the place primarily a wider group of shares take part within the rally.

In our view, QQQJ is nicely positioned to seize this development, with its mixture of cyclical names in addition to rising high-growth tech shares that may deserve some enlargement of valuation multiples. In different phrases, a rotation out there away from the winners of 2023 and extra towards beaten-down names together with -mid and small-caps could possibly be a robust tailwind for QQQJ to achieve momentum in 2024.

When it comes to danger, the bearish case for this section will seemingly want a deeper deterioration of financial situations. If inflation by some means re-accelerated, this may pressure the Fed to doubtlessly proceed climbing, seemingly resulting in a brand new spherical of monetary market volatility. In the end, any improvement that impacts company earnings to the draw back would characterize a headwind for shares.

Looking for Alpha

Remaining Ideas

What we like about QQQJ is that the fund gives a novel publicity to shares that aren’t sometimes extensively held or included in broad market indexes. This side provides to its diversification potential that may complement a core holding in a broad market fund like QQQ or SPY, for instance.

In our view, QQQJ is an effective possibility for buyers so as to add fairness publicity in an essential market section that may ship constructive returns over the long term.