pichet_w

Funding Thesis

This text discusses the Try 500 ETF (NYSEARCA:STRV), an ETF that holds 500 of the biggest U.S. shares and weights them by free-float market capitalization. It is so much just like the SPDR S&P 500 ETF Belief (SPY), however the principle differentiator is that Try Asset Administration promotes “shareholder primacy,” the place selections are made in one of the best pursuits of shareholders reasonably than all stakeholders. For Try to perform its targets, buyers should half method with equally structured funds like SPY, however the Index STRV tracks aren’t completely different sufficient to make the swap sensible. My evaluation reveals a 96.33% overlap by weight with SPY, with weighting variations of 0.20% for all however two shares. Subsequently, regardless of equally robust fundamentals as SPY, I like to recommend buyers keep away from STRV, and I sit up for explaining why in additional element beneath.

Try’s Objective

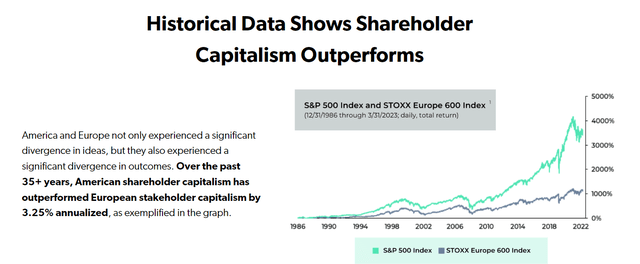

Try Asset Administration was co-founded in 2022 by Vivek Ramaswamy, a 38-year-old entrepreneur and 2024 Republican Presidential Candidate. STRV is the second-most-successful product within the agency’s fairness ETF lineup behind the Try U.S. Vitality ETF (DRLL), although the 2 are neck-and-neck, with $325 and $336 billion in belongings beneath administration, respectively. In response to Try’s web site, the agency’s staff “stay by a strict dedication to shareholder primacy – an unwavering mandate that the aim of a for-profit company is to most long-run worth to buyers.” Try makes use of the success of the S&P 500 since 1986 as an example how shareholder capitalism led to raised outcomes than the STOXX Europe 600 Index, which represents corporations in international locations that largely favor stakeholder capitalism.

Try Asset Administration

The above chart reads near a warning that if america goes the route of stakeholder capitalism, annualized long-term returns might shrink by 3.25%, and pension funds would turn out to be bancrupt. Stakeholder capitalism is a follow already signed onto by almost 200 U.S. CEOs masking each sector of the U.S. financial system. The revised assertion on the Objective of a Company of the Enterprise Roundtable covers the next:

1. Delivering worth to prospects.

2. Investing in staff by compensating them pretty and offering essential advantages like coaching and schooling.

3. Dealing pretty and ethically with suppliers.

4. Offering neighborhood help.

5. Producing long-term worth for shareholders, which incorporates transparency and efficient engagement.

Crucially, the assertion concludes with the next:

Every of our stakeholders is important. We decide to ship worth to all of them, for the longer term success of our corporations, our communities and our nation.

It is this closing half that Try takes concern with, and I am assuming factors #2, #3, and #Four particularly, as they’re probably the most ESG-related. Nonetheless, the enterprise leaders who signed the assertion, together with Jamie Dimon of JPMorgan Chase (JPM) and Tricia Griffith of The Progressive Company (PGR), see it otherwise. Griffith writes:

CEOs work to generate income and return worth to shareholders, however the best-run corporations do extra. They put the client first and put money into their staff and communities. In the long run, it’s probably the most promising strategy to construct long-term worth.

These CEOs view actions like offering neighborhood help as a strategy to construct long-term shareholder wealth reasonably than an pointless price of doing enterprise. Briefly, the targets of shareholders and different stakeholders will not be essentially mutually unique. However, the purpose could possibly be moot. Although Try is poised to achieve the $1 billion mark in mixed AUM throughout its 11 ETFs, it is tiny in comparison with asset managers like BlackRock, State Road World Advisors, and Vanguard. As Columbia Enterprise Faculty finance professor Shivaram Rajgopal put to Ramaswamy, “Why would the CEO of Apple take heed to you if you happen to personal 0.02% of inventory?”

It is a good query and sums up my view that even when an investor believes in Try’s mission, investing in STRV will not matter. Nonetheless, Try’s different merchandise, significantly DRLL and STXE, an Rising Markets ex-China ETF, appear to raised mirror the agency’s imaginative and prescient.

STRV Evaluation

High Ten Holdings

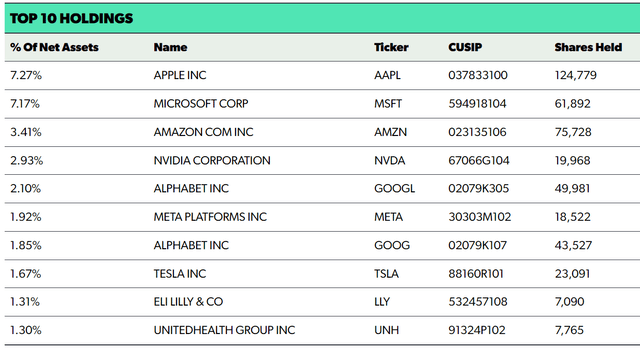

STRV’s similarities with SPY imply it’s a stable “core” funding. Its high ten checklist is sort of similar and consists of Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN) at 7.27%, 7.17%, and three.41% weightings. These shares’ weightings in SPY are 7.34%, 7.33%, and three.48%, so there is not an excessive amount of distinction on the high. The primary distinction is that Berkshire Hathaway (BRK.B), SPY’s #eight holding, is #11 in STRV, with Eli Lilly (LLY) transferring up the checklist.

Try Asset Administration

Fundamentals By Trade

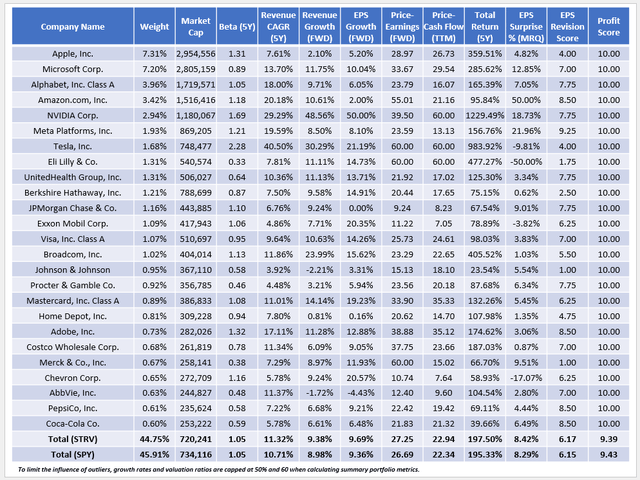

The next desk highlights chosen elementary metrics for STRV’s high 25 holdings, totaling 44.75% of the portfolio. As proven, there’s hardly any distinction with SPY.

The Sunday Investor

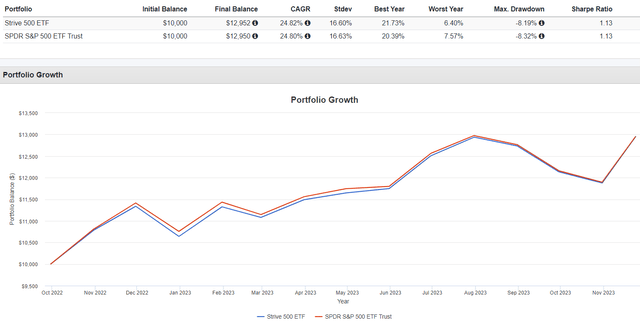

Particularly, STRV and SPY have equal 1.05 five-year betas and almost similar weighted-average five-year complete returns and revenue scores. STRV has a barely larger development profile, evidenced by a better ahead P/E (27.25x vs. 26.69x) and 0.30%-0.40% extra estimated gross sales and earnings development, however the distinction is negligible. Since its launch, the 2 have adopted an identical path, per the beneath complete returns chart:

Portfolio Visualizer

Essentially the most important variations with SPY embody an underweighting of Berkshire Hathaway by 0.51% and an overweighting of Uber Applied sciences (UBER) by 0.28%. In any other case, all weight variations are lower than 0.20%, so there is not any cause to count on any deviation in efficiency transferring ahead.

Funding Advice

There aren’t any sensible causes to purchase STRV, as Try Asset Administration remains to be too small to affect the 500 largest U.S. corporations. Nonetheless, its efficiency and fundamentals are almost similar to SPY, and it ought to act as a stable core holding for these trying to help Try’s mission of advocating for shareholder primacy. Personally, I doubt the dramatic claims of stakeholder capitalism doubtlessly decreasing long-term fairness returns by an annualized 3.25%. Subsequently, whereas attention-grabbing to analysis, I do not advocate readers purchase STRV. Thanks for studying, and I sit up for the dialogue within the feedback part beneath.