Richard Drury

Talks of a possible recession ought to be regarding for Wall Road, nevertheless it appears the market is unfazed, judging by the November rally that’s up to now carried into December. It’s time to be cautious when the market is being grasping, and one of many finest locations to park money in a recession is triple web lease REITs.

That’s as a result of triple web lease REITs include excessive margins, for the reason that tenant pays for property upkeep, insurance coverage, and taxes, and one of many names with an extended monitor report of outperformance is Agree Realty (NYSE:ADC).

I final lined ADC right here with a ‘Purchase’ score again in July, highlighting its enticing valuation and excessive publicity to funding grade tenants. Regardless of the current uptick in value, ADC remains to be down by 8.5% since my final piece and down 14% over the previous 12 months. On this article, I talk about why now stays a doubtlessly good time to choose up ADC and its most well-liked situation (NYSE:ADC.PR.A), so let’s get began!

Why ADC?

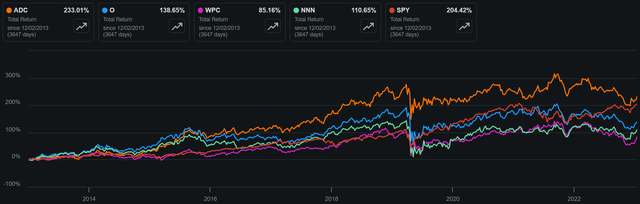

Agree Realty is a self-managed web lease REIT with a diversified portfolio of two,084 properties which are positioned in 49 U.S. States. Whereas its a lot bigger peer, Realty Revenue Corp. (O), captures a lot of the eye within the web lease house, it’s price noting that ADC has outperformed O and its web lease friends from a complete return standpoint over the previous 10 years.

As proven under, ADC has produced a 233% whole return over the previous decade, surpassing that of Realty Revenue Corp., W. P. Carey (WPC), NNN REIT (NNN), and the S&P 500 (SPY).

ADC vs. Friends Whole Return (In search of Alpha)

One of many progress benefits for ADC stems from its comparatively smaller dimension in comparison with its bigger friends, which implies that it doesn’t take as many offers to maneuver the needle. ADC additionally has a demonstrated monitor report of creating properties, making it much less reliant on having to supply offers from present properties.

Importantly, ADC hasn’t needed to sacrifice progress for high quality, because it has one of many highest exposures to funding grade tenants within the web lease house, with 69% of its annual base lease coming from IG tenants. Furthermore, 87% of ADC’s ABR comes from nationally-recognized tenants, reminiscent of Lowe’s (LOW), McDonald’s (MCD), Starbucks (SBUX), Amazon (AMZN), and TJ Maxx (TJX).

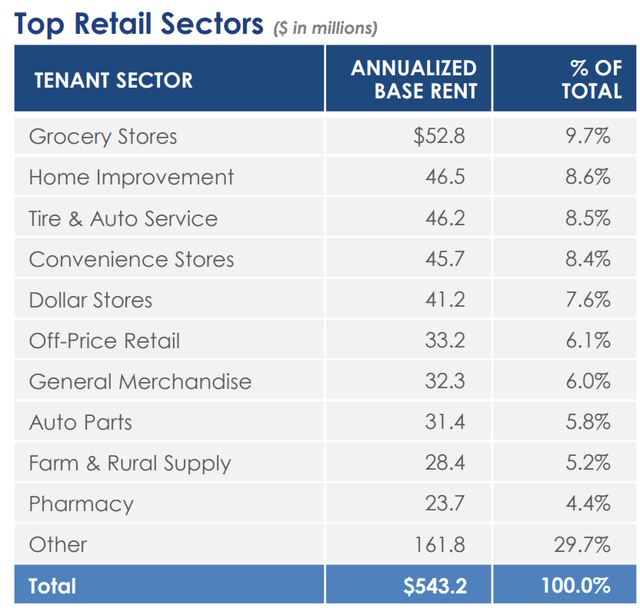

ADC enjoys 99.7% occupancy at current, and as proven under, nearly all of ADC’s tenants present necessity primarily based items and companies that aren’t simply replaceable by e-commerce, with Grocery, Dwelling Enchancment, Auto Service, Comfort and Greenback Shops representing the highest 5 sectors, comprising 43% of ABR.

ADC High Tenant Sectors (Investor Presentation)

In the meantime, ADC has continued to extend its backside line regardless of greater rates of interest. That is mirrored by AFFO per share rising by 2.3% for the primary 9 months of this 12 months and encouragingly, this consists of an acceleration of Core FFO/share progress to 4.2% YoY through the third quarter to $0.96. Importantly for revenue buyers ADC is returning its positive factors to shareholders, as true to its kind, its continued to boost its dividend, by 3.8%. The dividend can also be effectively lined by a 73% AFFO payout ratio.

Whereas the widespread chorus for the true property trade is that prime rates of interest are dangerous, well-capitalized gamers like ADC truly stand to learn attributable to greater leveraged opponents in the private and non-private markets being priced out of the market. That is mirrored by ADC investing $411 million in 98 high-quality retail web lease properties over the last reported quarter in sectors together with farm and rural provide, auto components, comfort shops, off-price retail, residence enchancment, and warehouse golf equipment, at a lovely weighted common cap fee of 6.9%.

Because the begin of the 12 months ADC has invested over $1 billion in 265 retail web lease properties, of which 73% of ABR stems from main funding grade operators. True to its kind, ADC additionally has 14 growth initiatives underway with a value of $56 million which are anticipated to be accretive to the underside line.

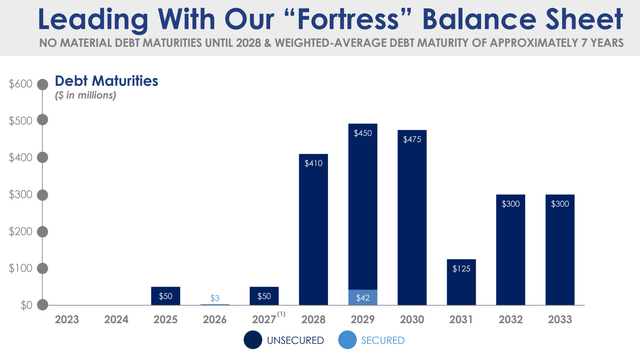

That is supported by ADC’s liquidity of $957 million, and an trade main stability sheet with a web debt to EBITDA ratio of simply 4.5x, sitting under the 5.5x of trade large, Realty Revenue Corp. ADC additionally carries BBB/Baa1 funding grade credit score scores from S&P and Moody’s, and has a powerful mounted cost protection ratio of 5.1x. As proven under, ADC has insignificant debt maturities between now and the top of 2027, thereby shielding it from greater rates of interest at current.

ADC Debt Maturities (Investor Presentation)

Dangers to ADC embody greater rates of interest. Whereas ADC’s sturdy stability sheet helps to blunt the impression from greater charges, its share costs nonetheless might take successful from greater charges, because it has over the previous 12+ months. That’s as a result of the funding neighborhood is keenly conscious of alternative value, and 4.9% yielding ADC with 4% dividend progress (this 12 months) might not be interesting to some buyers as a “risk-free” Treasury Bond yielding over 5%. As such, ADC might see share value declines attributable to greater rates of interest, and that raises its value of fairness capital that can be utilized for exterior progress. Different dangers embody potential for a recession, however I’m not as involved about that, contemplating the sturdy positioning of ADC’s tenant base and its monitor report of getting navigated earlier recessions.

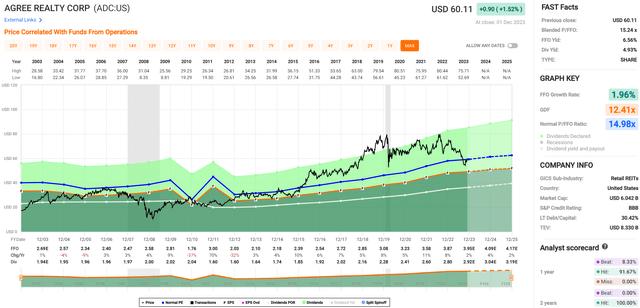

Lastly, I see worth in ADC on the present value of $60.11 with a ahead P/FFO of 15.2. Whereas this sits greater than the 13.Three of O, 12.Three of WPC, and 12.9 of NNN, I consider this premium is warranted contemplating its sturdy stability sheet, principally investment-grade tenant base, and growth prospects. As proven under, ADC at present trades at round its regular P/FFO of 15.Zero after being costly over a lot of its previous a number of years.

FAST Graphs

In the meantime, extra conservative buyers ought to contemplate ADC’s most well-liked inventory, ADC.PR.A. At its present value of $18.21, this most well-liked situation at present sits 27% under its par worth of $25, and might’t be known as till 9/17/2026. Ought to rates of interest stay at elevated ranges, this most well-liked situation doubtlessly gained’t be known as on that date. That is contemplating the truth that BBB rated bonds at present yield 5.9%, which sits above the 4.25% yield of this most well-liked inventory at par worth. As such, shopping for ADC.PR.A at present nets the investor a 5.8% yield with the consolation of figuring out that it trades under the $25 liquidation choice.

Investor Takeaway

ADC is a powerful participant within the web lease house, with a confirmed monitor report of producing constant progress with top quality properties. With its give attention to funding grade tenants and necessity-based items and companies, ADC has been capable of preserve a near-perfect occupancy fee and proceed rising its backside line regardless of greater rates of interest.

Moreover, ADC’s well-capitalized stability sheet permits it to make the most of alternatives out there, reminiscent of investing in high-quality properties at enticing cap charges and creating new initiatives which are anticipated to be accretive to the underside line. With the market seemingly oblivious to dangers round a recession, now could also be time to park money into ADC and/or its most well-liked inventory for dependable revenue and long-term worth. Keep ‘Purchase’ score on ADC inventory and ADC.PR.A.