BING-JHEN HONG

Funding Thesis

I consider Costco Wholesale Company (NASDAQ:COST) generally is a improbable funding on the proper value, given its scale, sturdy steadiness sheet, and buyer loyalty. Like many individuals within the U.S., my dad, brother, and I’d hop within the automobile each Friday like clockwork, head to Costco, and store for our weekly wants. My household has been a buyer of Costco for so long as I can keep in mind. Regardless of the good traits of the enterprise, I assign a maintain because of the honest valuation.

Firm Profile

Costco is the third largest U.S. retailer, with over $200 billion in annual gross sales and a warehouse footprint of 861 globally. The corporate has opened a mean of 22 warehouses yearly since 2008. On common, a warehouse’s format is round 147,000 sq. ft. As of 2023, The corporate had 310,000 staff, of which solely 5% are represented by unions.

Investor presentation

COST is ready to leverage its scale to purchase merchandise beneath market value and provide them to prospects. On the finish of the day, prospects need low-priced items in excessive portions. This enterprise mannequin, amongst different issues, has allowed the corporate to draw a loyal buyer base with 71 million paying members globally. The membership program has a 92% renewal fee within the U.S. and Canada and 90% internationally. As of This autumn 23, COST had 127.9 million complete cardholders.

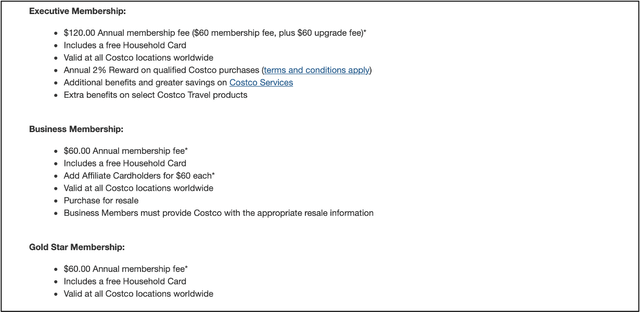

There are three sorts of cardholders. Government membership is the commonest amongst prospects, making up greater than 45% of complete card members (32.1 million). The gross sales penetration of Government members represented roughly 72.8% of worldwide internet gross sales in 2023. The corporate normally will increase membership costs each 5 years.

Firm’s web site

I consider COST’s sturdy steadiness sheet arises from its low leverage, sound liquidity, and internet money place. The corporate ended the fourth quarter with $15.2 billion in money and money equivalents and $10.53 billion in complete debt. COST’s present ratio of 1.07x is above WMT’s and TGT’s of 0.83x. The corporate has an curiosity protection ratio of 51.11x, and with a $10.5 billion TTM EBITDA, it may well meet its debt obligations with no points.

One cannot actually decide an organization except they see how they’ve handled their shareholders. Over the previous 5 years, COST has returned roughly $15 billion to shareholders, of which $3.6 billion was in share repurchases and $11 billion in dividends. COST has a 27.06% payout ratio, a 5-year dividend CAGR of 12.37%, and a historical past of constant dividend will increase (19 years).

COST’s defensive traits make it a high and dependable dividend inventory for traders. I consider that as shoppers tighten their belts, this will function a tailwind for the corporate as a result of the factor that individuals will spend much less cash on is affordable groceries in excessive portions.

Latest Developments

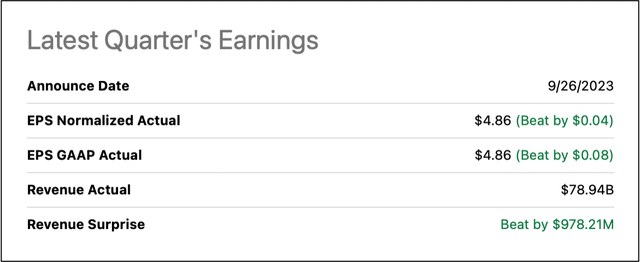

On September 26th of this 12 months, COST reported sturdy fourth-quarter earnings, beating high and backside line expectations. For FY2023, Income elevated by 6.76%, EBIT by 7.51%, and EPS by 7.76%. The corporate opened 23 new warehouses and added four million members to its paid membership program.

Looking for Alpha

On October 18th, 2023, Costco put out a press launch asserting that Craig Jelinek has confirmed his intention to step down from his position as Chief Government Officer, efficient January 1, 2024. The Board of Administrators elected Roland Michael Vachris, President and Chief Working Officer since February 2022, as President and Chief Government Officer, efficient January 1, 2024.

Mr. Vachris has been with the corporate for over forty years, beginning as a forklift driver; as of 2022, he owned greater than 27 thousand shares value greater than $15 million. I believe Mr. Vachris has spent greater than sufficient time at Costco to grasp how the enterprise works. His ascension is much like that of the present CEO (Craig Jelinek), and thus far, Mr. Jalinek has carried out properly.

Valuation

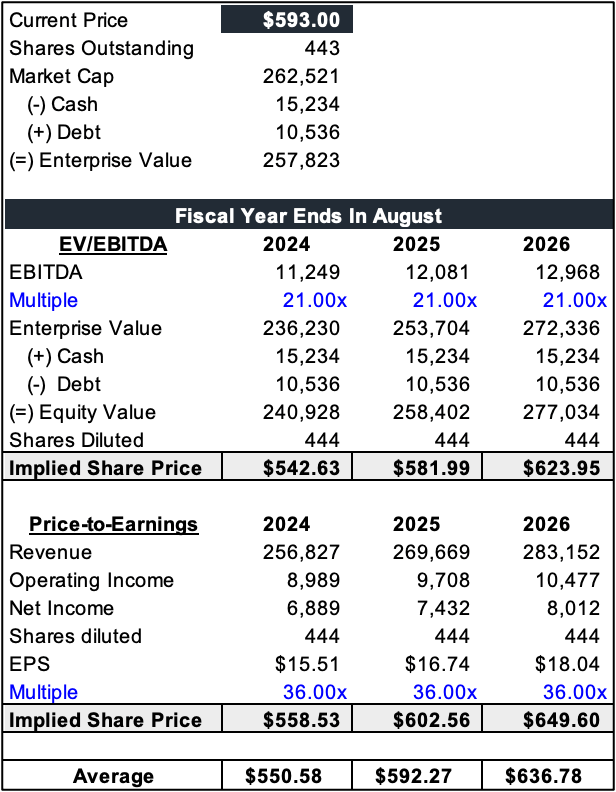

As I am penning this, the inventory is sitting at $593. COST is buying and selling at a ahead P/E of 37.52x the FY24 consensus of $15.67 and 34.30x the FY25 consensus of $17.14. I valued the corporate utilizing the EV/EBITDA and Value-to-Earnings method.

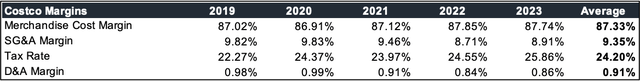

My assumptions for the following three years are that income will develop at a CAGR of 5.33%, pushed by new warehouse openings and value will increase. I estimate the corporate will open 20–25 new warehouses yearly. I assumed a merchandise value margin of 87.60%, an SG&A margin of 8.8%, a tax fee of 24.5%, and a D&A margin of 0.88%.

My assumptions are primarily based on historic figures, since Costco is a comparatively steady enterprise. Over the previous 5 years, COST has averaged a merchandise value margin of 87.33%, an SG&A margin of 9.35%, a tax fee of 24.20%, and a D&A margin of 0.91%. Figures for yearly will be seen beneath.

A few of you would possibly discover that the merchandise value margin has elevated since 2021; that is primarily attributed to inflationary stress, and I count on it to slowly decline within the following years (0.10% yearly) as that stress eases.

Created by the creator utilizing 10-Okay’s

Each multiples used are at a reduction to the FWD a number of however aligned TTM on a five-year common foundation. Taking the common of each strategies, I arrived at a value goal of $592 by the top of FY2025.

Created by the creator

I do know some would possibly disagree with me and state COST deserves a 41 P/E; though that is perhaps true, I am unable to justify it. Costco has traditionally traded at a ten-year P/E of 37.1x (10-year median).

Moreover, I do not assume one ought to provoke a place when the inventory trades at ~1% beneath an all-time excessive. When you have been fortunate sufficient to purchase COST at 30 P/E and even 20, then hats off to you, however for now, I do not assume it’s a nice time to purchase into the corporate.

Key Funding Dangers

My greatest concern relating to COST is maybe competitors. The corporate is in battle with conglomerates reminiscent of WMT, TGT, and extra to win over shoppers. The second is e-commerce. As time passes, persons are shifting increasingly in the direction of on-line platforms. If I have been to match my buying expertise on COST’s e-commerce platform to a bodily warehouse, it would not come shut. I consider the corporate ought to give attention to bettering its on-line buying expertise.

Takeaway

The underside line is that COST is a extremely enticing enterprise, however I am unable to say the identical for its value. At the moment, the inventory is buying and selling near an all-time excessive, given the worth, scale, and security it offers. Even within the monetary disaster of 2008, the corporate nonetheless skilled progress in gross sales.