JamesBrey

We have been a bear on pure fuel (NG1:COM) for fairly some time now. In our final week’s NGF, we concluded with the next:

For pure fuel costs to maneuver sustainably greater, Mom Nature must do extra of the heavy lifting. Whereas January heating diploma days are lastly displaying up greater than the 10-year common, the development must proceed if bulls need to see costs common above $3.

By our estimate, we expect pure fuel storage must fall to ~1.65 Tcf or decrease for costs to sustainably common above $3/MMBtu. Because of this February can even have to indicate a lot colder than regular climate.

Fundamentals, as they’re right now, should not ample sufficient to maintain costs right here. Decrease 48 fuel manufacturing stays far too excessive, whereas the true demand drivers for pure fuel will not be right here till the top of 2024.

The bulls want extra, so all eyes on the climate fashions going ahead.

Quick forwarding to right now, pure fuel costs are promoting off over 11% on the again of bearish climate on the horizon.

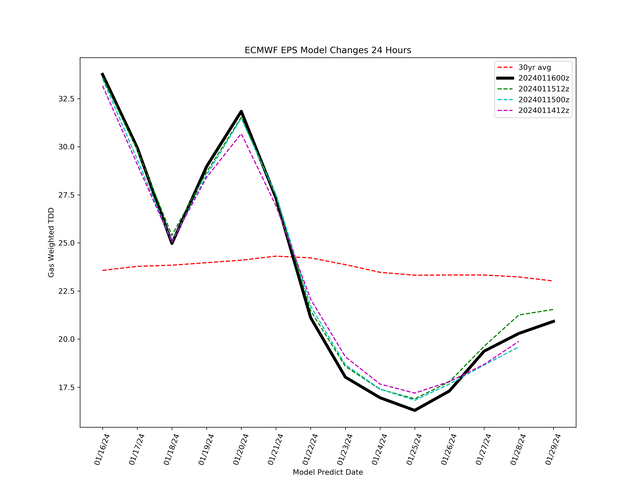

TDDs

HFIRweather.com

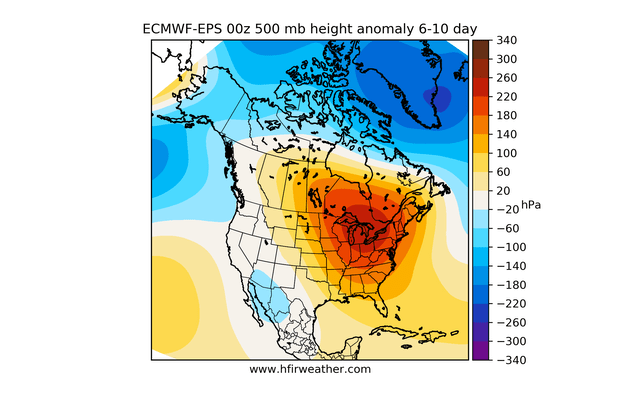

6-10 Day

HFIRweather.com

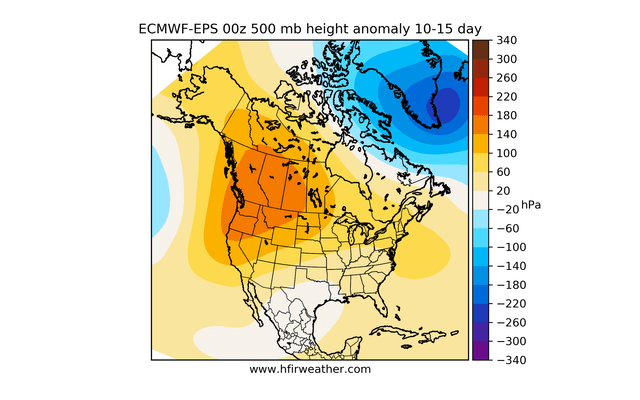

10-15 Day

HFIRweather.com

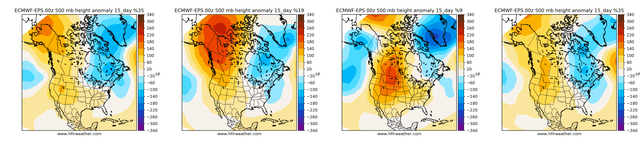

15-Day Development

HFIRweather.com

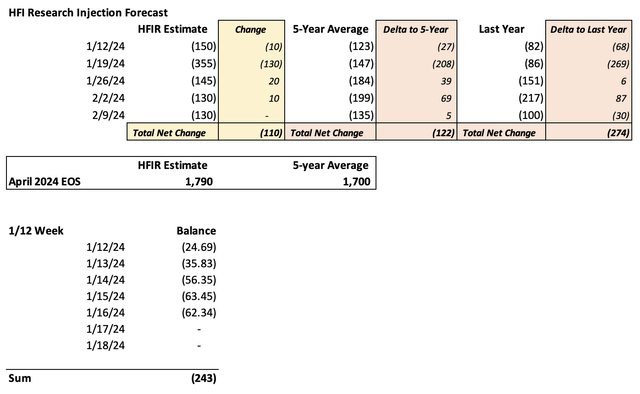

However amidst all this bearishness, one thing fascinating is creating. Notice that we identified final week that the implied balances had been prone to meaningfully shock to the upside. Properly, with real-time manufacturing and demand knowledge in entrance of us, it seems that’s the case.

Implied movement for this week up to now is pointing to a withdrawal properly over 300 Bcf.

EIA, HFIR

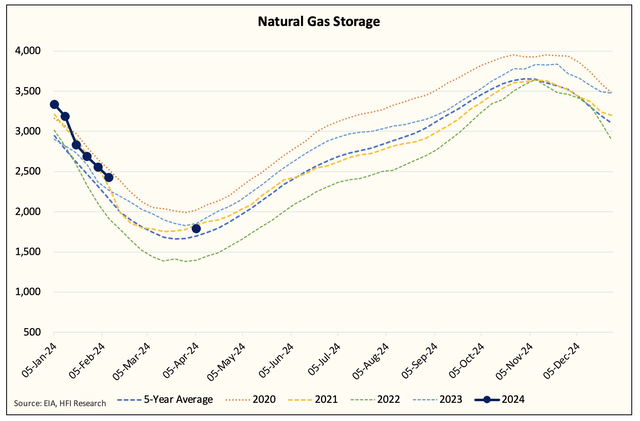

As well as, as a result of the withdrawal is a lot bigger than we had anticipated, EOS has meaningfully moved decrease to 1.79 Tcf. That is getting near the 5-year common of 1.7 Tcf.

Now earlier than you get overly excited, this storage stage continues to be inadequate to revive the pure fuel bulls. We would wish to see this estimate fall under ~1.65 Tcf at minimal earlier than the bulls can considerably rejoice.

The reasoning for such a big revision upward in withdrawal is because of: 1) a big freeze-off in pure fuel manufacturing; and a pair of) a significant surge in demand.

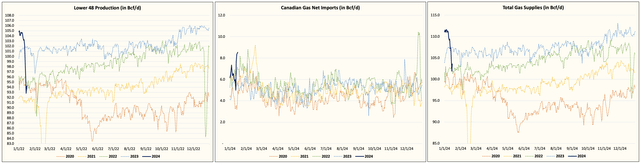

Provides

HFIR

Demand

HFIR

Wanting forward, U.S. fuel manufacturing shall be impacted for the remainder of the week, whereas demand continues to stay robust. We’re, nonetheless, previous the height chilly, so we should always begin to see demand taper off going ahead.

As for provides, Decrease 48 fuel manufacturing will not make a full restoration till the top of subsequent week, so this can probably lead to a tighter-than-expected stability going ahead.

Why the big worth selloff?

Every thing we have written up to now is bullish, so readers have to be questioning why costs are promoting off a lot.

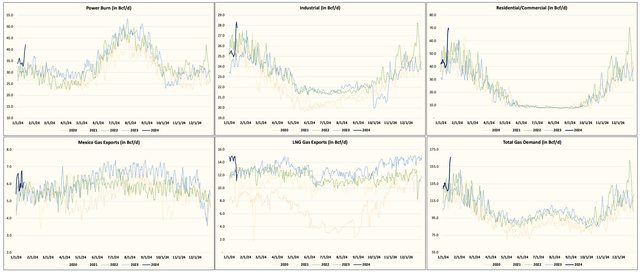

HFIRweather.com

The chilly blast will not be anticipated to final. Within the newest ECMWF-EPS replace, we’ll see a lot hotter than regular temperatures within the 6-10 day interval. Our estimate right now is probably going too conservative as demand is prone to be a lot weaker than we anticipate.

For the pure fuel market, 1.79 Tcf continues to be not sufficient to sustainably transfer costs greater.

EIA, HFIR

There’s additionally no threat of a scarcity come injection season, so from the buying and selling perspective, there is not any incentive to maintain bidding costs greater. As well as, we all know Decrease 48 fuel manufacturing will get well again to ~104 Bcf/d, which might make the market oversupplied.

EIA, HFIR

As we wrote in our NGF final week:

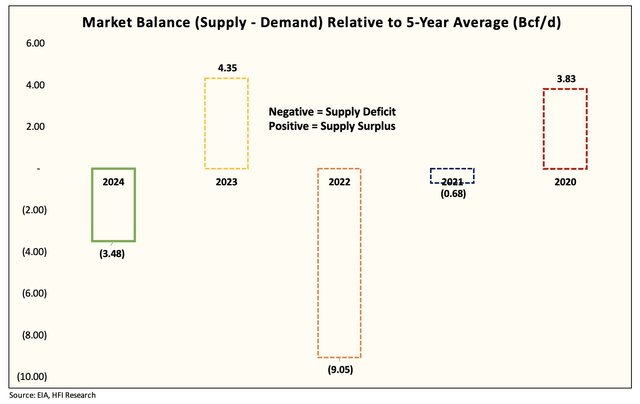

From my standpoint, I take a look at the US fuel market as oversupplied nonetheless. Taking the climate ingredient apart, we nonetheless estimate the US fuel market to be ~2 Bcf/d oversupplied. Consequently, merchants shopping for up pure fuel right now are betting that 1) both the climate fashions get colder or 2) there’s extra extended chilly put up this chilly blast.

Neither of those situations are sound bets, particularly contemplating the run-up in costs right now. And even after making an allowance for the chilly climate situation, we nonetheless see the storage scenario as being bloated.

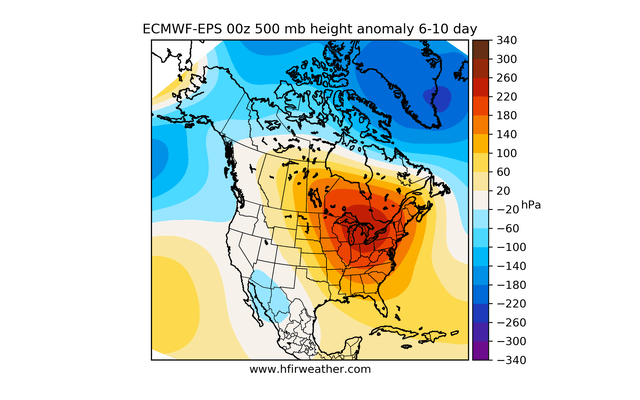

With all that mentioned, the fascinating factor taking place in pure fuel now’s that storage is changing into much less bloated. Though one may argue that the 6-15 day climate outlook is bearish, if the 15-day development factors to colder than regular climate once more, we may simply see a situation the place storage falls under the 5-year common.

In essence, Mom Nature must bail out the bulls, and you may by no means say by no means. With costs promoting off so steeply right now, merchants are actually swinging an excessive amount of to the pessimistic facet.

Alternative?

Is right now a shopping for alternative then? No. It is nonetheless a climate roulette recreation being performed. Fundamentals stay bloated regardless of the chilly blast, simply much less so following the storage revisions. Bulls will want extra sustained chilly to get out of the bloated storage scenario, and if that materializes, then pure fuel producers look extra engaging. Till then, you take on pointless climate threat and may keep on the sidelines till storage estimates transfer low sufficient to warrant lengthy positions.