marekuliasz

Based mostly on the habits of assorted confirmed main financial indicators, we’ve been warning a few main US recession coming, as we did right here.

Three of one of the best main financial indicators — all of that are being ignored by the Fed and most buyers — are the cash provide, the yield curve and The Convention Board’s Main Financial Index.

Main Financial Indicators Have Been Declining

Cash is the lifeblood of the economic system. The Fed’s manipulation of the cash provide is the important thing driver of the increase and bust enterprise cycle, as we mentioned in Four Causes A Lengthy Recession Is Doubtless To Begin Quickly.

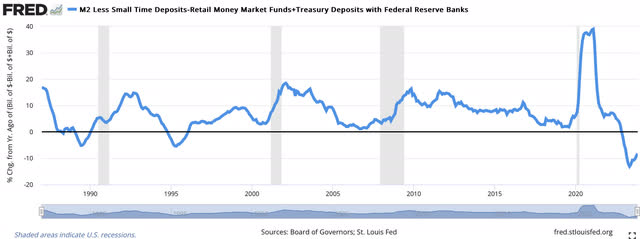

The cash provide has been declining for a yr and reached double-digit declines in mid-2023, as proven within the chart beneath. That’s the deepest cash provide decline because the Nice Despair of the 1930s, which is not a bullish precedent.

FRED

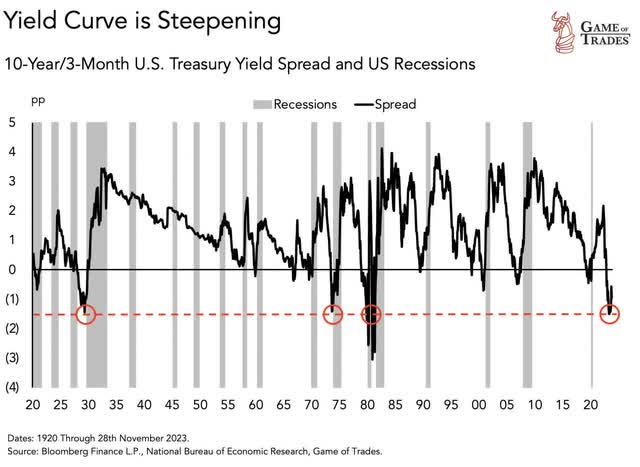

The decline within the cash provide has led to a big enhance in short-term rates of interest. On account of the rise in short-term charges, the yield curve “inverted” in 2022. An “inverted” yield curve — which happens when the 10-Yr Treasury yield falls beneath the 3-Month Treasury yield — has preceded every of the final eight recessions because the late 1960s.

As proven beneath, the depth of the yield curve inversion we’ve seen over the previous yr has solely been rivaled by the yield curve inversions that preceded the Nice Despair of the early 1930s, in addition to the key recessions of the mid-1970s and early 1980s. Given its good monitor file over the previous 50+ years, it will be one thing of a miracle to not have a recession this time.

Recreation of Trades

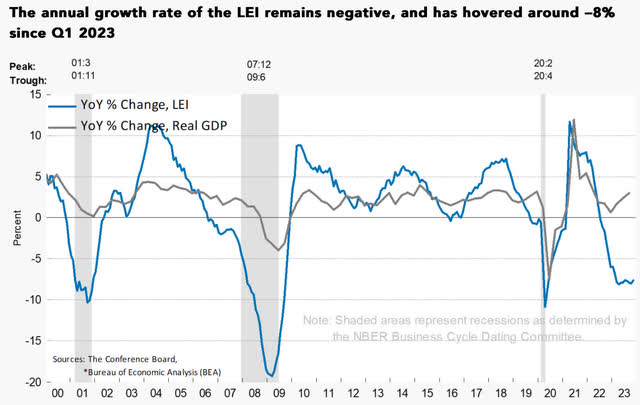

The Convention Board’s Main Financial Index (“LEI”) has fallen to ranges solely seen throughout recessions. This isn’t a bullish signal.

The Convention Board

Justyna Zabinska-La Monica, Senior Supervisor of Enterprise Cycle Indicators at The Convention Board, summarized their newest LEI report as follows:

The US LEI continued declining in November, with inventory costs making nearly the one constructive contribution to the index within the month. Housing and labor market indicators weakened in November, reflecting warning areas for the economic system. The Main Credit score Index and manufacturing new orders have been primarily unchanged, pointing to a scarcity of financial development momentum within the close to time period. Regardless of the economic system’s ongoing resilience—as revealed by the US CEI—and December’s enchancment in client confidence, the US LEI suggests a downshift of financial exercise forward. Consequently, The Convention Board forecasts a brief and shallow recession within the first half of 2024.”

Whereas I agree with The Convention Board that there shall be a recession in 2024, I feel their “brief and shallow” expectation seems like wishful considering. Their LEI has declined for 20 straight months, which is the longest interval of decline apart from the Nice Recession of 2008-2009 and the key “stagflationary” recession of the mid-1970s.

Given the habits of those three main indicators, I feel the chances favor a protracted and deep recession.

Whatever the severity of the recession, it could not matter for shares. Recall that the early 2000s recession was comparatively brief and shallow, however the NASDAQ nonetheless fell over 80% then as a result of excessive valuations. Sadly, inventory market valuations are even greater now, as I detailed right here.

Coincident Financial Indicators Have Already Began Declining

Sadly, these main financial indicators are infamous for having lengthy and variable lead instances earlier than the beginning of a recession, normally starting from six to 24 months.

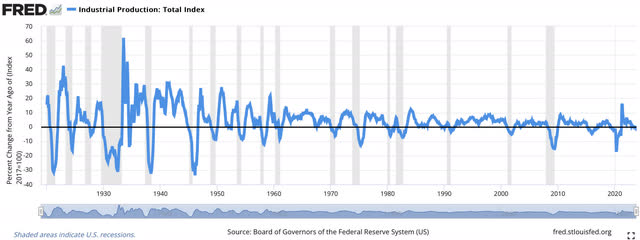

However when coincident indicators like industrial manufacturing and company earnings begin declining, that’s sometimes indication {that a} recession is beginning. That has already been taking place.

Industrial manufacturing has been declining since June and was down 0.4% in December. This key gauge of US output at all times falls in a recession, as proven beneath.

FRED

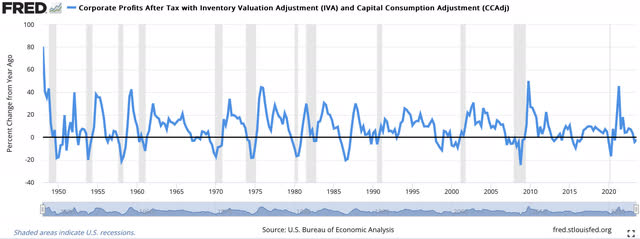

Company earnings are the lifeblood of the inventory market. As this chart reveals, they’ve been declining the previous two quarters and have been down 2.1% in 3Q23. As with industrial manufacturing, earnings at all times fall in a recession.

FRED

Main Employment Indicators Have Been Declining

Employment is a lagging financial indicator and is normally the final one to fall in a recession. Additionally it is the one which will get probably the most investor consideration.

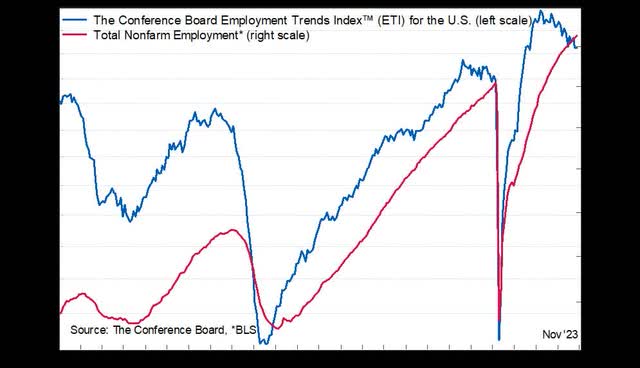

The Convention Board publishes a number one Employment Developments Index (“ETI”). As proven right here, their ETI has been declining since Spring 2022. Based mostly on the profitable monitor file of this index, payrolls will possible begin declining within the coming months.

The Convention Board

As Seljuk Eren, Senior Economist at The Convention Board, defined right here:

The ETI continued to pattern downward after peaking in March 2022. Whereas the index remains to be elevated in comparison with its pre-pandemic degree—and job features are anticipated to proceed in December and early 2024—the labor market reveals clear indicators of cooling with fewer alternatives out there for jobseekers. With the labor market provide and demand coming into stability and client value inflation slowing, we consider the Federal Reserve will now not enhance rates of interest.

Over the past six months, payroll employment development was virtually solely pushed by healthcare and social help, leisure and hospitality, and authorities. Employment development in these industries is much less prone to be impacted by a recession, given acute labor shortages. Job development in different industries has been flat or unfavourable. Elsewhere, we see clear indicators of cooling with a number of part indicators of the ETI pointing to loosening labor demand. The variety of staff working in non permanent assist providers—an essential early indicator for hiring in different industries—resumed its decline in November from its peak in March 2022. Preliminary claims for unemployment insurance coverage elevated for a second consecutive month in November, although they continue to be low traditionally. From The Convention Board Client Confidence Survey, the share of respondents that reported jobs have been exhausting to get reached its highest degree since March 2021, whereas a smaller share of small companies reported difficulties hiring. Wanting forward, we mission that job development will proceed slowing and forecast job losses will begin within the second quarter of 2024, with the unemployment price rising to 4.Three % by the second half of 2024.”

If the unemployment price will increase to 4.3%, as The Convention Board predicts, that may be a 0.9% enhance from the three.4% low in 2023. Each time the unemployment price has elevated by 0.5% or extra, there was a recession. Each time there was a recession, the inventory market has fallen to new lows.

Will It Be Totally different This Time?

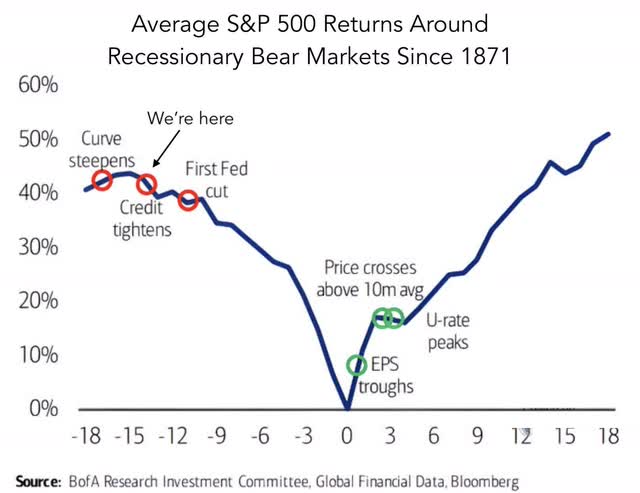

This chart from Financial institution of America reveals the common S&P 500 returns round recessions over the previous 150+ years. With the inverted yield curve starting to steepen now, we’re possible on the level on the left of the chart. Usually, credit score situations begin to tighten subsequent. Then the Fed sees {that a} recession is coming, so they begin slicing the Federal Funds price. I feel that’s why they’ve already indicated to the market that they plan to chop charges in 2024. Then shares fall considerably over the subsequent 12 months or so.

Financial institution of America

Except it’s someway “completely different this time”, I consider buyers ought to put together for a way more difficult yr in 2024.