anusorn nakdee

A thoughts all logic is sort of a knife all blade. It makes the hand bleed that makes use of it.”― Rabindranath Tagore.

It has been practically a 12 months since we final took a look at AbCellera Biologics Inc. (NASDAQ:ABCL). The corporate’s income stream fell over a cliff because of the ebbing of the Covid pandemic. Nevertheless, these gross sales helped the corporate construct up an enormous money hoard. AbCellera continues to develop its wide selection of partnerships throughout the drug developmental house. An replace on this pretty distinctive concern follows under.

Searching for Alpha

Firm Overview:

AbCellera Biologics has constructed a platform for antibody drug discovery and growth and is headquartered in Vancouver, BC. The corporate is targeted on discovering antibodies from pure immune responses, that are pre-enriched for antibodies. The inventory trades round $5.50 a share and sports activities an approximate market capitalization of $1.5 billion.

November Firm Presentation

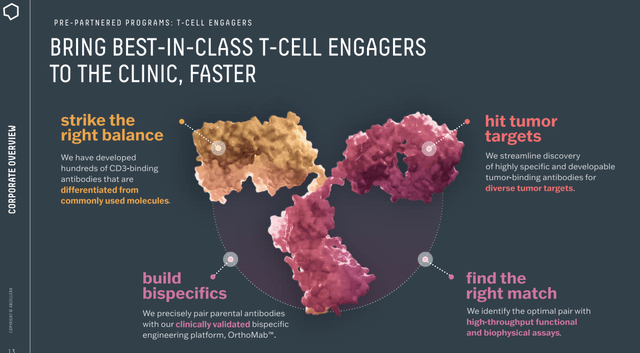

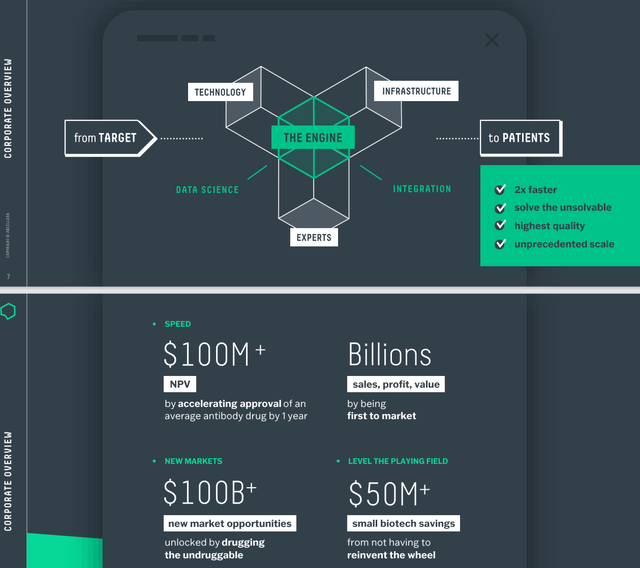

Now that its Covid-related income has dried up, AbCellera is solely targeted on using its AI-driven expertise platform to find antibodies that may be developed by its extensive assortment of companions all through the healthcare house.

November Firm Presentation

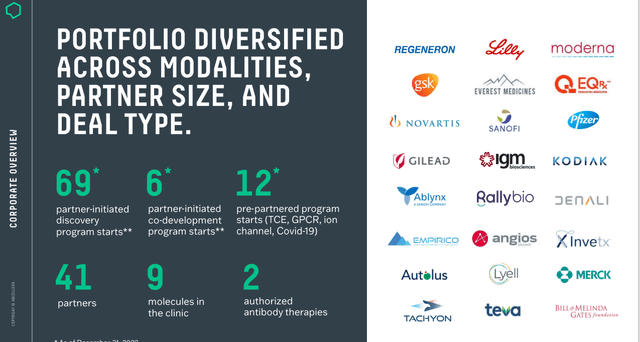

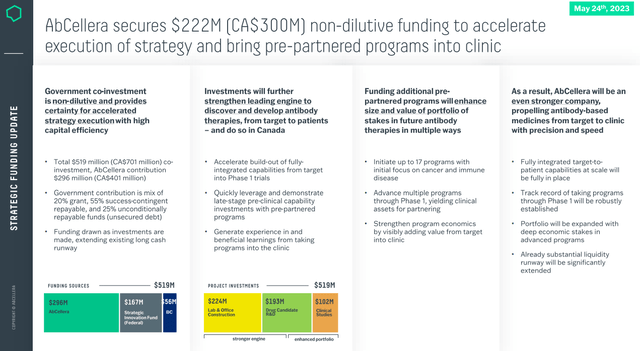

As you may see above, it’s fairly the intensive record. AbCellera can earn varied milestones (developmental, regulatory, gross sales) round these candidates in addition to royalties on any eventual commercialized gross sales. As well as, the corporate has garnered funding from authorities entities as nicely.

November Firm Presentation

Third Quarter Outcomes:

AbCellera Biologics posted its Q3 numbers on November 2nd. The corporate delivered a GAAP lack of 10 cents a share, three pennies a share above expectations. Revenues fell over 93% to $6.6 million, lacking the consensus by some $5 million. $6.four million of income got here from partnership analysis charges and the remainder from licensing charges.

Many of the over $380 million in revenues AbCellera racked up in 2022 was on account of a COVID-19 remedy known as bamlanivimab, which AbCellera collaborated on with drug big Eli Lilly (LLY) on. These revenues are within the firm’s rearview mirror now.

Current Developments:

On November 29th, the corporate introduced an approximate 10% discount in its workforce to chop prices. In September, AbCellera prolonged its partnerships. First, by asserting a brand new strategic developmental settlement with Incyte (INCY). Simply over every week later, the corporate disclosed it had expanded an present partnership with Regeneron (REGN).

Analyst Commentary & Stability Sheet:

Since third quarter outcomes posted, six analyst companies together with Piper Sandler and Truist Monetary have reiterated Purchase/Outperform scores on the inventory. Value targets proffered vary for $6 to $28 a share. Benchmark Co. downgraded the shares to a Maintain shortly after Q3 outcomes hit the wires.

Slightly below 13% of the excellent float of the shares is at present held brief. A number of insiders bought roughly $1.6 million in inventory collectively in 2023. There have been no insider gross sales of fairness final 12 months. There was insider exercise within the shares thus far in 2024. AbCellera Biologics exited the third quarter with some $813 million in money and marketable securities on its stability sheet after posting a web lack of $28.2 million for the quarter. The corporate carries no long-term debt.

Verdict:

The corporate made 50 cents a share in FY2022 because of revenues of simply over $385 million. In FY2023, the corporate is on observe to lose 47 cents a share as revenues drop all the way in which all the way down to $38 million. Fourth quarter outcomes are scheduled to submit on February 20th. The present analyst agency consensus is that AbCellera Biologics will lose 61 cents a share in FY2024 as revenues rise to $60 million in the course of the 12 months.

I proceed to take care of a small “watch merchandise” place in ABCL by way of lined name holdings. AbCellera has constructed up an enormous money hoard because of its Covid-related income stream and has a formidable record of partnerships throughout the drug trade.

Searching for Alpha

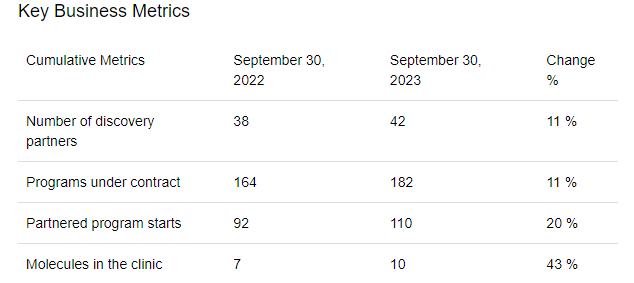

As of the tip of the third quarter, AbCellera had 182 applications underneath contract with 42 completely different companions.

November Firm Presentation

In principle, AbCellera’s developmental strategy ought to ends in decrease developmental prices and quicker time to marketplace for its companions. As well as, AI pushed efforts throughout the drug trade are getting extra discover and growing their share of the developmental greenback. The problem is the corporate’s accomplice pipeline is sort of solely early-stage candidates at this level.

November Firm Presentation

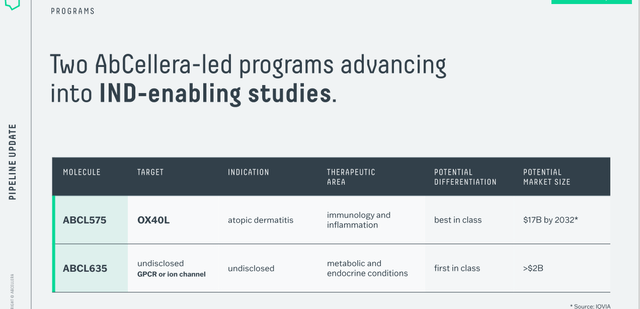

AbCellera did record two of its personal led excessive potential IND enabling research on its final company replace in November. The problem for AbCellera Biologics Inc. is revenues and earnings (really losses) are going to be lumpy for years as a result of timing of charges and milestone payouts. The corporate is well-funded, however it is going to be years earlier than any extra potential partnered merchandise are accepted and hit the market. As such, the inventory solely deserves a small place in a affected person, long-term investor’s nicely diversified portfolio whereas awaiting additional developments.

There are crimes of ardour and crimes of logic. The boundary between them just isn’t clearly outlined.”― Albert Camus.