SOPA Photos/LightRocket through Getty Photos

Thesis

I like to recommend a Sturdy Purchase ranking for AppLovin (NASDAQ:APP) inventory because it presents a compelling alternative attributable to its new, quickly rising, high-margin software program phase powered by AXON 2, mixed with its enticing valuation relative to business friends.

Firm Overview

AppLovin is a know-how firm that gives software program options for app builders to market, monetize, analyze, and publish their apps. The corporate was based in 2012 and is headquartered in Palo Alto, California. AppLovin’s enterprise mannequin relies on producing income from each its software program platform and portfolio of apps. The software program phase consists of charges from builders/firms who use AppLovin’s platforms to handle their app advertising, monetization, and analytics. The app portfolio phase consists of income from in-app purchases and promoting throughout the apps that AppLovin owns or companions with.

AppLovin has grown quickly since its inception, increasing its world presence and buying a number of firms within the cellular business. In 2018, the personal fairness agency KKR acquired a minority stake in AppLovin for $400 million, valuing the corporate at $2 billion. In 2021, AppLovin went public on the Nasdaq, elevating $2 billion in its IPO. Immediately, the corporate has a market cap of ~$19 billion.

Financials

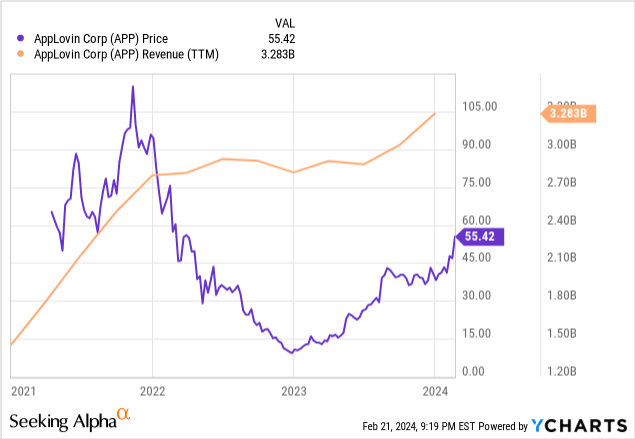

AppLovin’s monetary figures reveal a dramatic pattern. The corporate skilled explosive income progress in 2021, adopted by stagnation in 2022, after which a major rebound within the latter half of 2023.

The graph under illustrates the shut connection between AppLovin’s income and its inventory worth. As income soared in 2021, so did its inventory worth. Conversely, when income flatlined in 2022, the inventory worth plummeted from round $90 to shut to $10 per share. Nonetheless, the latest income surge has pushed the inventory worth again as much as the mid-$50 vary.

So what has led this drastic progress in income during the last couple of quarters? The income progress is attributed, virtually completely, to the efficiency of AXON 2. AXON 2 is an AI-powered advert tech software program that AppLovin launched in the midst of final yr. It makes use of predictive machine studying to focus on app-install advertisements to the customers most definitely to obtain these apps. In response to AppLovin, AXON 2 has improved the efficiency and effectivity of its software program platform, which helps cellular app builders develop their companies. AppLovin claims that AXON 2 can help extra scale and be simpler than its predecessor, AXON 1.

AppLovin’s co-founder and CEO Adam Foroughi highlighted the advantages of AXON 2 over AXON 1 in the latest earnings name:

“It is simply higher. I imply simply the know-how is constructed to scale higher, it is extra environment friendly, simpler. These are predictive applied sciences on the finish of the day. And I am drawing the analogy to Chat GPT. And the one motive I do that’s as a result of we will all sort in a field and get a outcome. And everyone knows that Chat GPT Three to three.5 to 4, Four was higher than 3.5, it was higher than 3, proper? However we might have seen that.

Properly, what we won’t see in a black field algorithm is a kind in and a outcome. However what we will see is that what we’re making an attempt to foretell is present an commercial to a shopper for some advertiser and drive worth to the advertiser. And there is a entire bunch of predictions alongside the best way, and AXON 2 makes them higher than the prior model. And that creates a variety of effectivity acquire, each for our enterprise and that of our companions.”

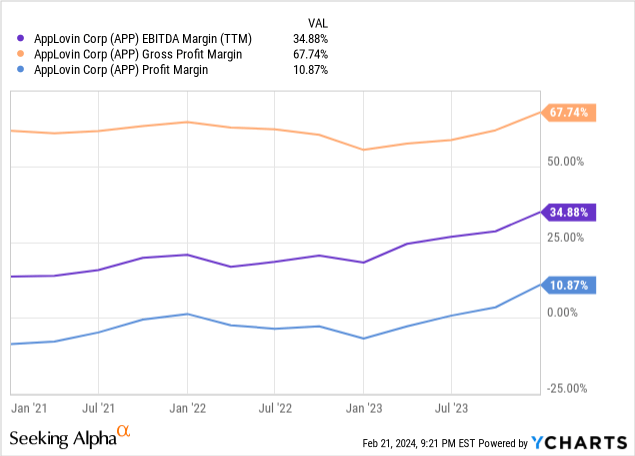

This substantial enchancment to their machine studying mannequin has helped re-ignite their income progress. And even perhaps extra noteworthy, are the margins which are coming because of this progress in software program income. In This autumn, AppLovin’s incremental income had a staggering 80% move via to adjusted EBITDA. Unsurprisingly, these modifications have led to an uptick in margins throughout the board, as illustrated by the graph under.

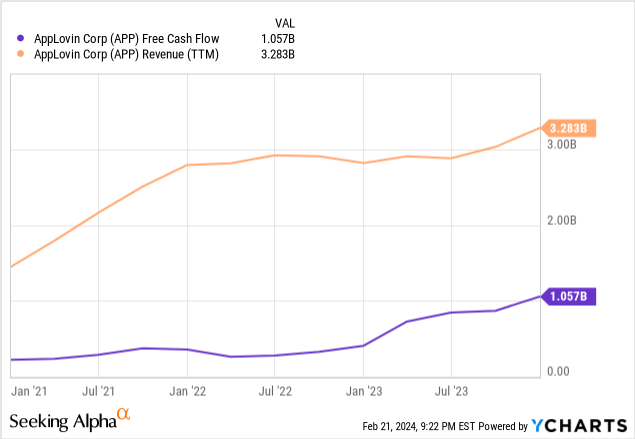

AppLovin’s margin enlargement fueled file money move era in 2023. The corporate produced simply over $1 billion in levered free money move, demonstrating its spectacular profitability with margins approaching 30%. This efficiency clearly positions AppLovin as a “money cow” inside its business.

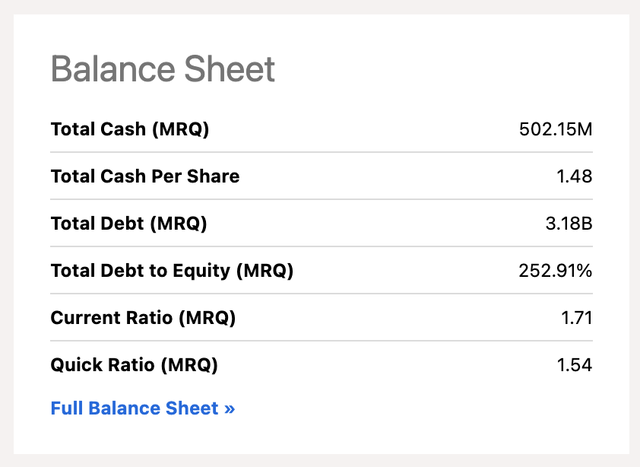

AppLovin additionally has a powerful stability sheet, which is obvious from the next chart. They’ve $1.6 billion of present property, exceeding their $944 million present liabilities by a big margin. As well as, with over $1 billion of free money move coming in, it’s unlikely for them to run right into a money crunch.

In search of Alpha

Collectively, AppLovin put up a stellar monetary efficiency, notably over the latter half of 2023. They doubled down on execution as an organization, and made important strides in enhancing their choices. Because of this, they’re a way more enticing firm than they have been a yr prior.

AppLovin Valuation

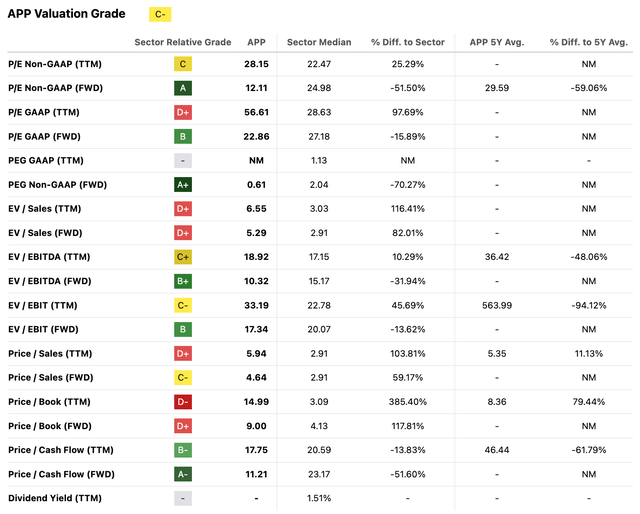

AppLovin’s valuation is the one downside of the corporate, as could be seen from In search of Alpha Quant metrics. AppLovin scores poorly on many of the metrics that measure primarily based on its previous efficiency. Nonetheless, it scores decently on many of the forward-looking metrics.

AppLovin’s two totally different enterprise segments and lackluster 2022 have put a damper on their valuation. However trying ahead, issues are shaping as much as be a lot better.

In search of Alpha

One of many challenges that AppLovin faces is the problem of valuing its two distinct enterprise segments: apps and software program. The apps phase is a mature and secure enterprise that generates regular money move and earnings, however has restricted progress prospects and faces excessive competitors. The software program phase is a fast-growing and revolutionary enterprise that has excessive margins and big market potential, however requires important investments and faces regulatory uncertainties.

The market could not absolutely admire the worth of the software program phase, as it may be dragged down by the apps phase, which now accounts for lower than half of the corporate’s whole income. It is price noting that the apps phase is what acquired AppLovin to its IPO in 2021, because it represented 52% of its income that yr. Nonetheless, the corporate’s id is altering, because it shifts its focus to its software program phase, which is anticipated to drive its future progress and profitability. This will likely create a possibility for traders who can acknowledge the considerably hidden gem in AppLovin’s software program enterprise, and profit from its future progress and profitability as the corporate shifts its focus away from its apps enterprise.

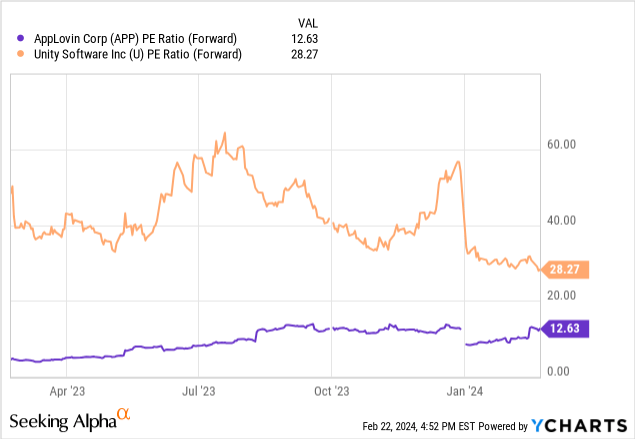

Unity Software program (NYSE:U), a developer of platforms for creating 2D and 3D video games and interactive experiences, presents a priceless comparability to AppLovin. Whereas their core choices differ, each firms serve a largely overlapping buyer base of cellular app builders. This commonality makes Unity a related benchmark for AppLovin’s potential.

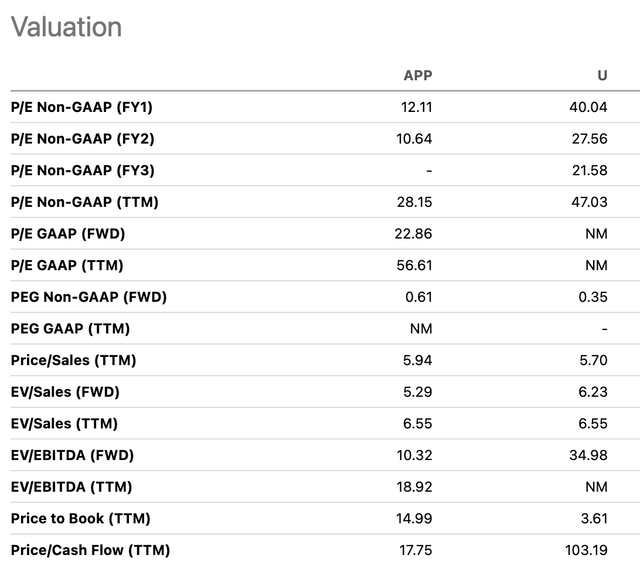

The chart above highlights a stark distinction: AppLovin trades at a major low cost to Unity on a ahead P/E foundation. This valuation hole persists throughout almost each related a number of. AppLovin constantly trades nicely under Unity’s multiples, suggesting potential undervaluation.

In search of Alpha

Apparently, regardless of buying and selling on the similar trailing EV/Income a number of as Unity, AppLovin seems considerably cheaper on EV/EBITDA and Worth/Money Circulate metrics. This implies that the market could not absolutely admire the profitability potential of AppLovin’s software program phase. Moreover, AppLovin’s ahead Worth/Money Circulate a number of of 11x is lower than half the IT sector median of 23x.

As AppLovin’s high-margin software program phase continues to develop, an affordable enlargement of its ahead Worth/Money Circulate a number of in direction of 15x (nonetheless under the sector median) might sign a 30-50% upside within the inventory worth. This interprets to a possible share worth of round $75, considerably larger than its present degree.

Catalysts

One of many potential catalysts for AppLovin’s inventory worth is the corporate’s strategic choice to lower the quantity of assets that they commit to their apps enterprise and shift their focus virtually completely on their software program enterprise. AppLovin’s apps enterprise consists of creating and publishing cellular video games, which generate income from in-app purchases and promoting. Nonetheless, this phase faces intense competitors, excessive consumer acquisition prices, and low retention charges, which restrict its profitability, progress potential, and in the end valuation multiples.

Then again, AppLovin’s software program enterprise advantages from a big and diversified buyer base, a recurring and scalable income mannequin, and a powerful aggressive moat primarily based on its proprietary know-how and information. Moreover, as AppLovin earns extra from software program, its valuation multiples will develop as a result of software program income is larger high quality.

The precise timing of this catalyst is unknown, however it’s doubtless solely a matter of time earlier than the shift in focus turns into extra obvious. The corporate’s displays and administration’s mannerisms have indicated that they’re much more assured and enthusiastic about their software program enterprise than their apps enterprise. Because of this, the software program enterprise is getting far more consideration and funding from the corporate, and it’ll proceed to flourish sooner or later. And with AppLovin working as a lot of a money cow as it’s now, it’s a inventory that I wouldn’t hesitate to carry for the long-run.

Dangers

One of many predominant dangers is that AppLovin’s future efficiency is basically primarily based on its latest progress within the final 6-Eight months, which might not be sustainable or repeatable. AppLovin’s progress in 2022 was just about non-existent, and the primary half of 2023 was considerably lackluster. It wasn’t till the second half of 2023 that AppLovin unlocked its progress potential, with software program income surging. It is doable that these outcomes could have created unrealistic expectations for AppLovin’s future progress, as the corporate could not be capable of replicate or keep its momentum within the aggressive and dynamic cellular app ecosystem.

Whereas that is definitely a sound danger, traders have many causes to stay assured in AppLovin’s future prospects. For one, insiders nonetheless personal 37% of the corporate—over $6 billion price of market worth. This massive portion of fairness will definitely hold administration’s incentives aligned with traders.

Conclusion

AppLovin’s turnaround story in 2023 is spectacular. Because of the success of its AXON 2 software program, the corporate not solely reignited income progress however achieved spectacular margin enlargement and sturdy money move era. The power of its software program enterprise, mixed with a powerful stability sheet, positions AppLovin nicely for continued progress and innovation.

Whereas AppLovin’s valuation could seem combined attributable to its legacy apps phase, a deeper look suggests the corporate is undervalued in comparison with its friends. As the corporate continues to efficiently execute its strategic shift in direction of its high-margin software program phase, there’s robust potential for valuation a number of enlargement, providing traders a compelling alternative. Given these components, mixed with administration’s massive insider possession, I consider it’s affordable to assign a Sturdy Purchase ranking to AppLovin.