G0d4ather

Broadcom (NASDAQ:AVGO) is pricey proper now, but as one of many main semiconductor firms on the planet, I believe it has a spot in know-how portfolios. My evaluation reveals buyers are paying a big premium if shopping for now, however operations and financials will contribute to continued long-term progress for the agency. As an investor specializing in 10+ 12 months funding horizons, I think about AVGO price holding for the long run.

Firm Overview

For buyers already acquainted with Broadcom, please skip forward to the part ‘Market Drivers.’

Broadcom designs, develops, and provides semiconductor and software program infrastructure. Its prospects come from markets together with knowledge facilities, software program, broadband, networking, wi-fi, and industrials. It was based in 1991 and have become referred to as Broadcom after a sequence of acquisitions that started as a division inside Hewlett Packard (HPE). In 1999, HP spun off its measurements, parts, chemical evaluation, and medical companies into Agilent Applied sciences. A part of this enterprise, known as Avago Applied sciences, was then acquired by Kohlberg Kravis Roberts & Co. (KKR) and Silver Lake Companions in 2005. In 2015, Avago introduced its intention to amass Broadcom for $37 billion. The deal was finalized in 2016.

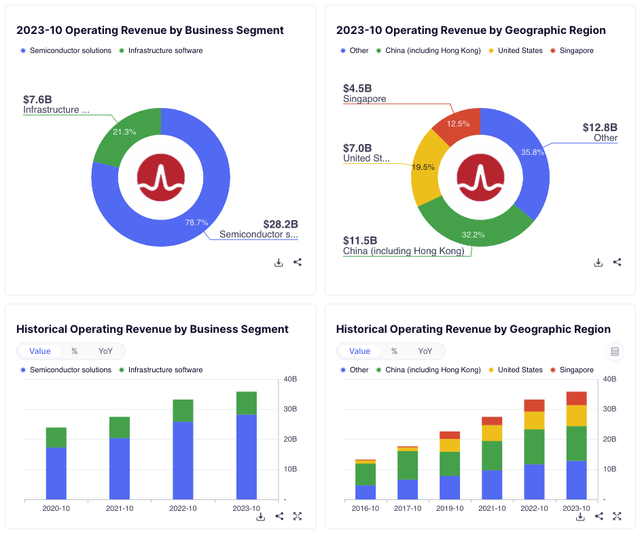

GuruFocus

Market Drivers

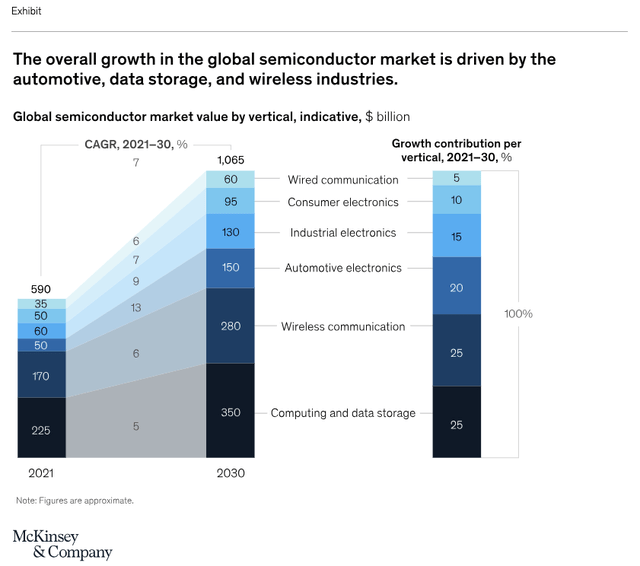

McKinsey has reported that the worldwide semiconductor trade is anticipated to be price $1 trillion by 2030. The mixture annual progress price is forecasted to common between 6 and eight % up till that time. Such progress is pushed by large developments in distant working, the proliferation of AI, and growing demand for electrical automobiles. The analysis outlines that 70% of the market’s progress may very well be attributed to the automotive, computation and knowledge storage, and wi-fi sectors. The automotive trade is especially anticipated to see larger demand, as much as thrice current ranges, attributable to progress in autonomous transport and e-mobility.

McKinsey

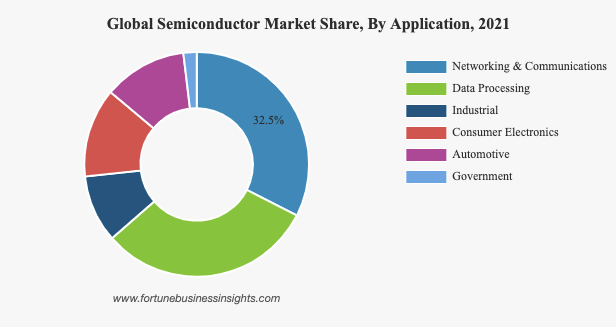

Fortune Enterprise Insights additionally reviews that the semiconductor market was valued at $527.88 billion in 2021 and is forecasted to develop from $573.44 billion in 2022 to $1,380.79 billion in 2029, indicating a CAGR of 12.2% from 2022-2029. The expansion is attributed to the upper use of electronics throughout the globe and the emergence of AI, Web of Issues, and machine studying.

Fortune Enterprise Insights

At Broadcom’s 2021 investor day, it outlined its plan to emphasise its enterprise mannequin to deal with strategic prospects. Its plan focuses on partnerships with elite, multinational prospects, primarily from the Fortune 500, to drive income sustainability and foster progress. 70% of its annual income comes from these core prospects, and 80% are licensed to make use of 5 or extra Broadcom software program options.

On November 22, 2023, Broadcom accomplished its acquisition of VMware, considerably bettering its standing as a prime know-how infrastructure agency. This merger ought to enhance its non-public and hybrid cloud networks, providing larger safety. VMware Cloud Basis ought to modernize cloud and edge environments, and the deal evidences Broadcom’s acquisition technique to stay on the reducing fringe of know-how developments in its area.

Monetary Evaluation

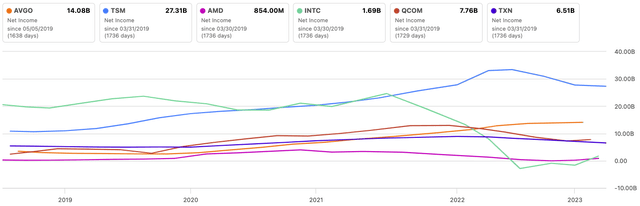

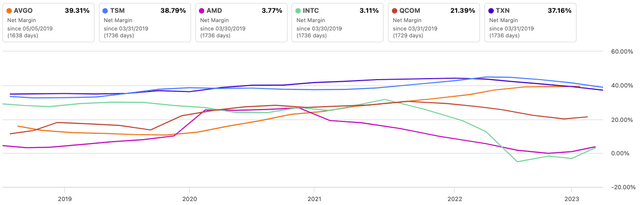

In comparison with main friends, Broadcom has the second-largest internet revenue of the group, together with Taiwan Semiconductor Manufacturing Firm (TSM), Superior Micro Gadgets (AMD) and Texas Devices (TXN):

In search of Alpha

Moreover, it has a internet margin that’s primarily joint prime with TSMC and TXN:

In search of Alpha

In comparison with the sector median internet margin of two.49%, AVGO has a 1,479.66% distinction.

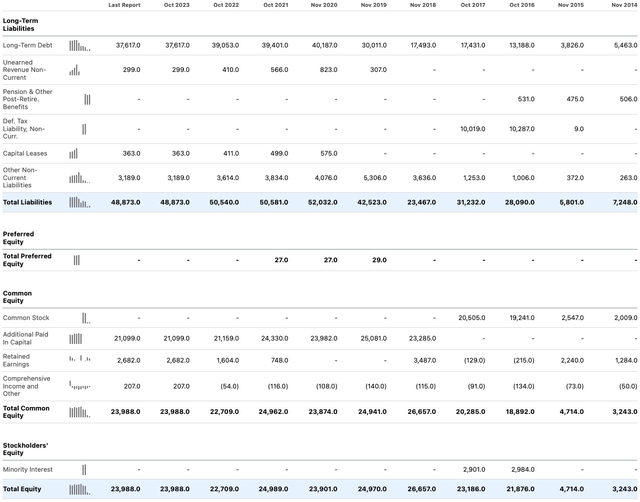

Traders could be smart to take warning on the corporate’s stability sheet, the place its equity-to-asset ratio is simply 0.33. Evaluate this to TSMC’s ratio of 0.63 and TXN’s 0.52.

In search of Alpha

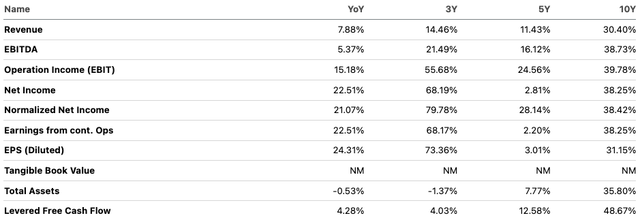

Contemplating historic progress charges for Broadcom and the huge proliferation in superior know-how at present underway, the long run seems to be optimistic for the corporate by way of earnings progress. It doesn’t appear unreasonable for the agency to hit 15% annual EPS progress as a mean over the subsequent 10 years when contemplating normal market CAGRs, but additionally inner efficiencies which are probably on account of the implementation of automation pushed by AI.

In search of Alpha

Worth Evaluation

For my discounted money circulate evaluation, I used the ahead EPS of $46.83 as my start line, a 15% annual EPS progress price, as commented on above, for the subsequent 10 years, a 4% annual EPS progress price for my 10-year terminal stage following this, and an 11% low cost price. My truthful worth got here to round $1,046, indicating a possible unfavourable 19% margin of security right now.

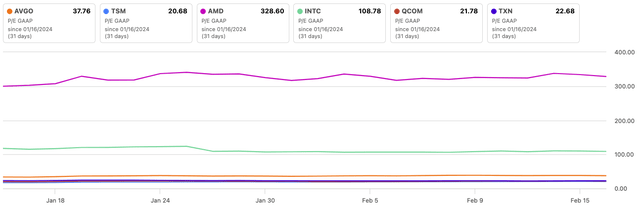

Nonetheless, additionally think about its a lot decrease P/E GAAP ratio when in comparison with AMD and Intel (INTC):

In search of Alpha

Dangers

Broadcom is considerably associated to geopolitical threat between the US and China surrounding Taiwan’s TSMC. Whereas any escalation of those tensions would trigger vital shocks to most international markets, know-how firms could be the primary and most negatively affected, certainly. As such, allocating too closely to Broadcom or any of the know-how firms aggressively may imply excessive ranges of volatility to return, as this threat doesn’t look precisely priced into current valuations.

Moreover, my above-mentioned 15% EPS progress price as an annual common over the subsequent 10 years is under no circumstances assured and is larger than another analyst estimates. My optimistic future earnings outlook considers inner efficiencies pushed by developments in know-how, however the efficient execution will depend on administration’s future selections regarding worker depend, automation, and organizational construction.

Conclusion

General, I think about Broadcom a superb funding to have. I don’t suppose it’s the greatest firm to personal for publicity to know-how and, particularly, semiconductor operations, however it’s a best choice. Traders ought to concentrate on the current geopolitical dangers surrounding the know-how sector and if they’re prepared to tackle the danger related to Broadcom, could need to think about investing extra closely in TSMC, which I think about the higher funding of the 2.