NicoElNino/iStock through Getty Pictures

I’ve coated the JPMorgan Fairness Premium Earnings ETF (NYSEARCA:JEPI) a number of occasions these previous few years. I’ve both written on the fund and its traits and investments thesis, or written comparisons between it and several other different well-known coated name ETFs. On this article, I will be specializing in a number of the fund’s more moderen developments, to try to assist buyers make sense of those. Three developments stand out.

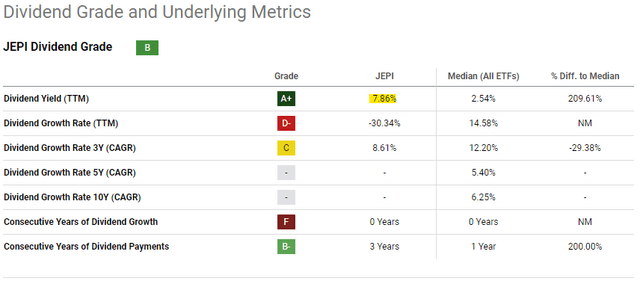

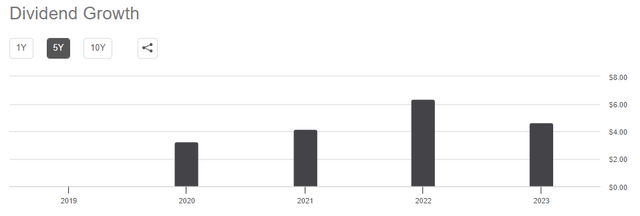

JEPI’s distributions declined by nearly 30% from 2022 to 2023, as a result of decrease possibility costs and premiums from decreased fairness volatility. Distributions stay increased than throughout 2021, nevertheless. Distributions appear unlikely to recuperate, though a lot will rely on future possibility costs.

JEPI has considerably underperformed since early 2023, as a result of considerably decrease capital beneficial properties and decrease tech publicity. The fund suffered a lot fewer losses in 2022, so its medium-term efficiency stays sturdy.

Fairness valuations have risen, which has a decrease unfavorable affect on coated name funds with sturdy distributions, together with JEPI. Valuation gaps between development and worth have widened, considerably positively impacting JEPI.

For my part, JEPI’s fundamentals stay sturdy, and so the fund stays a purchase.

JEPI – Fast Overview

Fast overview on JEPI earlier than tackling some latest developments.

JEPI invests in equities and ELNs.

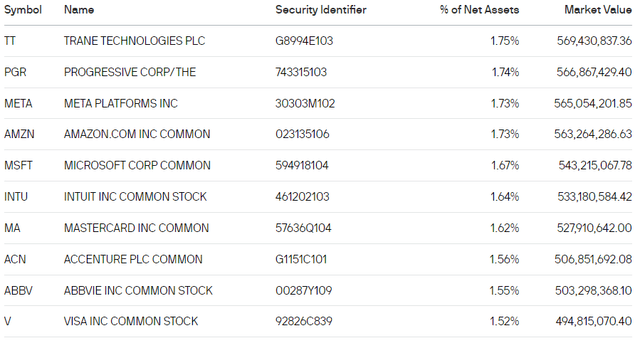

The fund’s fairness portfolio focuses on blue-chip U.S. equities with below-average danger and volatility. Largest holdings are as follows.

JEPI

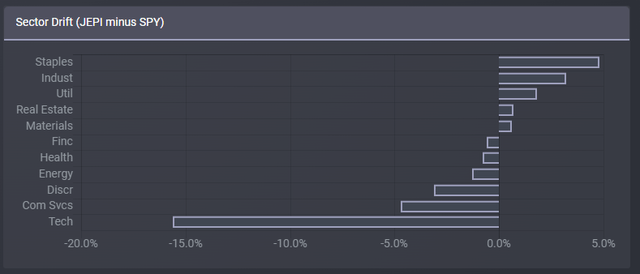

JEPI tilts old-economy industries like shopper staples, industrials, and utilities, whereas being underweight tech and communications.

Etfrc.com

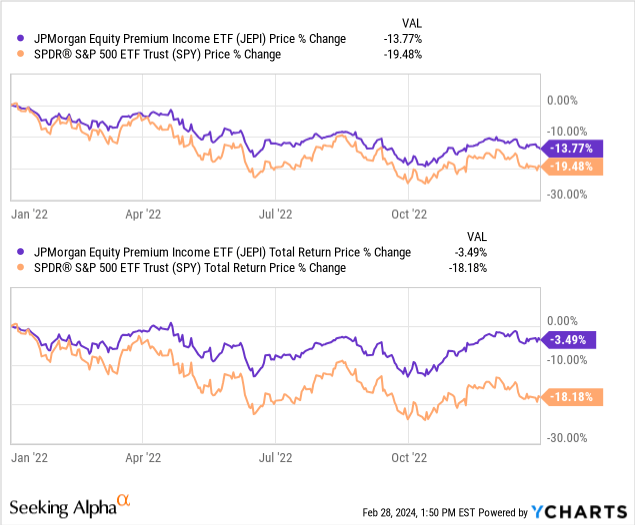

JEPI’s blue-chip inventory portfolio ought to see below-average losses throughout downturns and recessions, as was the case in 2022. Decrease tech publicity additionally helped.

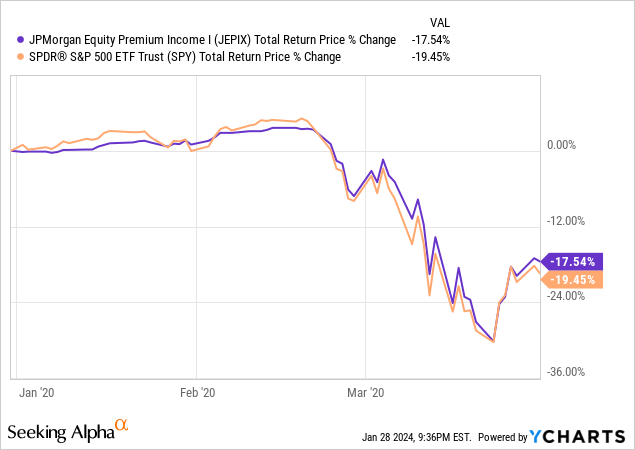

JEPI didn’t exist throughout early 2020, the onset of the coronavirus pandemic. The JPMorgan Fairness Premium Earnings Fund Inst (JEPIX), a mutual fund model of JEPI, did exist and noticed marginally decrease losses throughout stated time interval. Decrease tech publicity didn’t assist this time.

Knowledge by YCharts

General, JEPI’s blue-chip inventory portfolio has resulted in decrease danger, volatility, and drawdowns previously, and appears prone to have the identical impact transferring ahead.

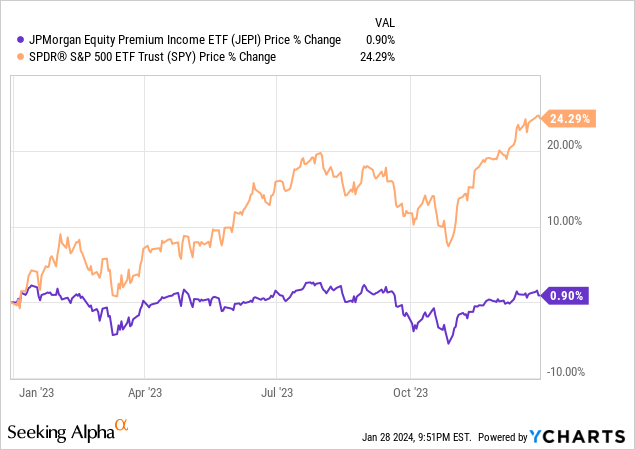

JEPI’s ELNs are derivatives that present publicity to S&P 500 returns plus written name choices on the identical. These derivatives serve to considerably scale back potential capital beneficial properties. For instance, the fund’s share worth elevated by 0.90% in 2023, throughout which the S&P 500 rallied nearly 25%. Decrease tech publicity was partly accountable as properly, nevertheless.

Knowledge by YCharts

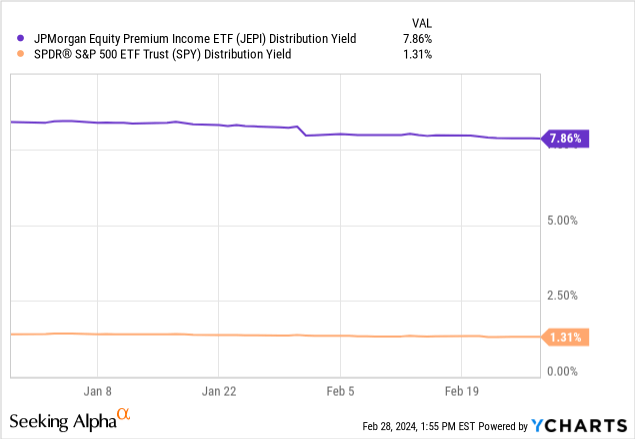

JEPI’s ELNs present the fund with important revenue, equal to possibility premiums in additional conventional coated name funds. These serve to spice up the fund’s distributions to 7.9%, a lot increased than the fairness common.

General, the fund tends to outperform when markets are flat or down, as a result of its blue-chip portfolio and robust distributions. Alternatively, the fund tends to underperform throughout bull markets, as a result of its decrease potential capital beneficial properties. The web impact has been unfavorable since inception, however constructive for the previous a number of years, together with since I first coated the fund in mid-2021.

JEPI’s sturdy distributions and below-average drawdowns are a potent mixture, particularly so for revenue buyers and retirees.

With the above in thoughts, let’s take a look at a number of the fund’s more moderen developments.

JEPI – Latest Developments

Declining Distributions

JEPI’s distributions have declined by over 30% these previous twelve months, a staggering drop.

In search of Alpha

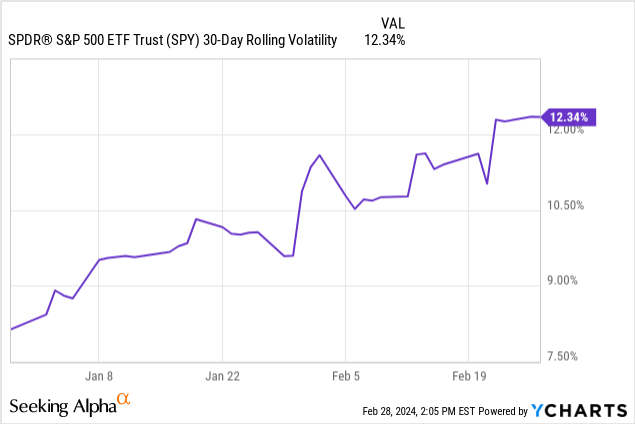

Distributions have declined as a result of decrease fairness volatility, possibility costs and premiums. Let’s clarify this in additional depth. JEPI’s ELNs are equal to investing within the S&P 500 and writing coated name choices on the identical. Doing so generates important premiums, that are distributed to shareholders. Premiums are depending on possibility costs that are, in flip, depending on fairness volatility. As fairness volatility declined, so did possibility premiums, in the end leading to decrease distributions.

The complexity and oddity of this habits are necessary to think about and make me cautious of considerably overweighted coated name funds. Retirees shouldn’t need their total retirement to be depending on fairness volatility or possibility costs.

JEPI’s decrease distributions are, in fact, a major, simple unfavorable to buyers. On a extra constructive be aware, JEPI’s long-term distribution development stays constructive, with these rising over 10% from 2021 to 2023. As a small apart, the fund was created in mid-2020, so distributions for stated yr are usually not akin to these of later years.

In search of Alpha

Transferring ahead, JEPI’s distributions will rely on fairness volatility, possibility costs, asset values (share costs), and underlying fairness dividend development. General, I believe that low single-digit distribution development is probably going, because of the latter two components. Progress has been a lot stronger since inception, nevertheless.

Important Underperformance

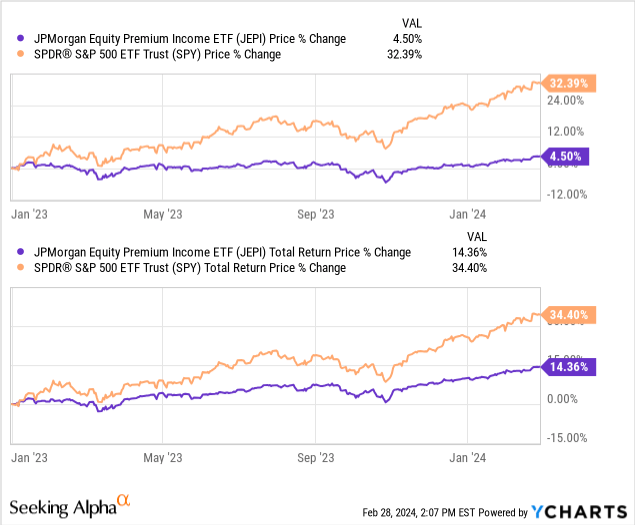

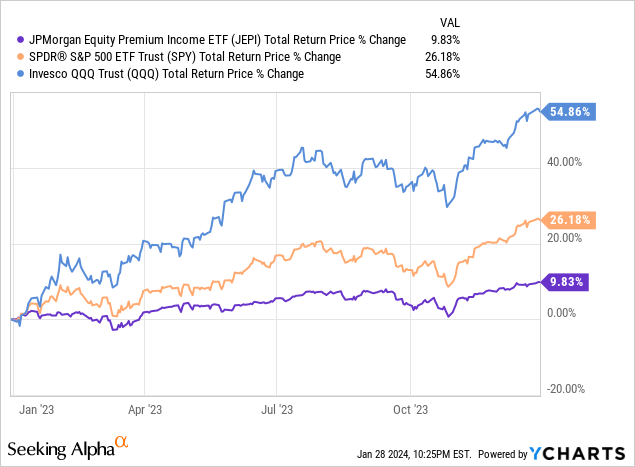

JEPI has considerably underperformed since early 2023, seeing whole returns of solely 9.8% in comparison with 26.2% for the S&P 500. JEPI’s whole returns have been lower than half these of the broader market.

JEPI’s underperformance was as a result of a number of components.

First, the fund’s ELNs serve to considerably restrict potential capital beneficial properties, and these have been extremely excessive throughout 2023. As may be seen above, JEPI’s share worth has elevated by 4.5% since early 2023, in comparison with 32.4% for the S&P 500. Distributions narrowed the full return hole, however solely partially.

Second motive for the fund’s underperformance is its decrease tech publicity mixed with important tech outperformance. For reference, the Nasdaq-100 skyrocketed greater than 50% throughout 2023, greatest efficiency in many years. JEPI is underweight these securities, therefore the fund’s underperformance.

Knowledge by YCharts

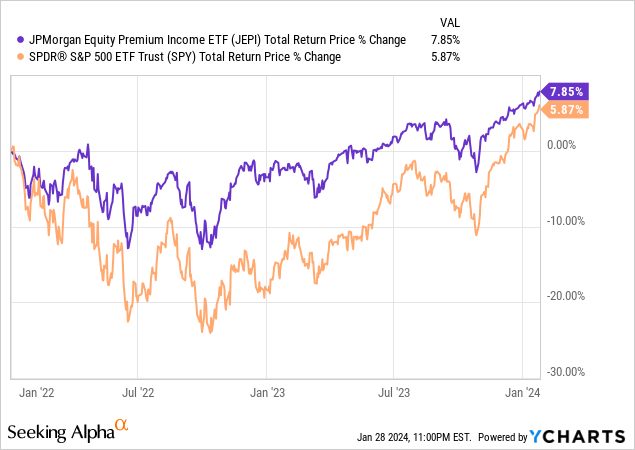

Lastly, JEPI’s latest underperformance was as a result of a way more secure fairness portfolio and technique, resulting in fewer losses in 2022, and so a shallower restoration in 2023. JEPI has truly outperformed the S&P 500 since early 2022, when the newest downturn began. In different phrases, JEPI noticed a shallower restoration as a result of it merely did not have that a lot to recuperate from.

Knowledge by YCharts

General, JEPI’s extra secure share worth and returns are positives, although these do lead to decrease beneficial properties throughout bull markets. Brief-term underperformance attributable to these points is not a unfavorable, for my part at the very least.

For my part, JEPI’s latest underperformance is one thing of a unfavorable for shareholders, as a few of it was triggered as a result of actual points or downsides with the fund (decrease potential capital beneficial properties from its ELNs). It’s not a important unfavorable, as some underperformance is because of constructive traits of the fund (blue-chip low-volatility portfolio). A little bit of an odd assertion, however I do assume it precisely describes the scenario.

Greater Fairness Valuations

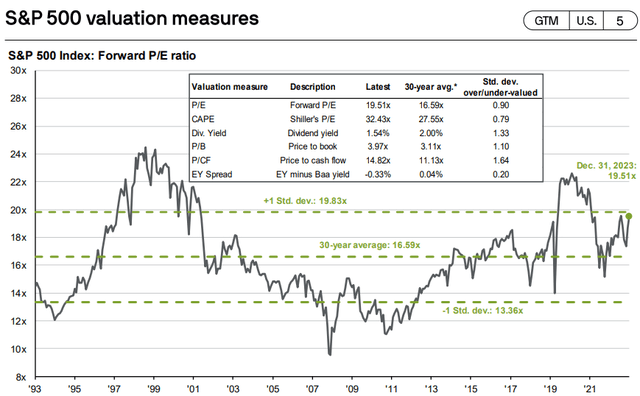

Fairness market valuations have risen, with the S&P 500 being one normal deviation overvalued throughout most related valuation metrics.

JPMorgan Information to the Markets

The above is one thing of a profit for JEPI, insofar because it reduces S&P 500 potential capital beneficial properties, blunting the unfavorable affect of its ELNs. In different phrases, JEPI underperforms throughout bull markets, so it could be greatest to keep away from the fund prior to those. Valuations are a bit stretched, considerably lowering the likelihood of a major bull market, and its magnitude. Plenty of uncertainty and volatility in these points, nevertheless.

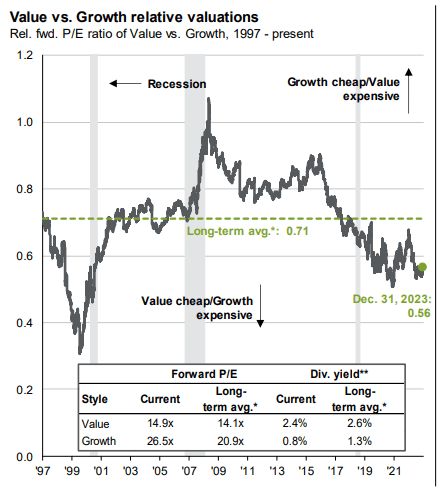

Valuation gaps between worth and development shares have widened these previous few years and are at traditionally above-average ranges. Progress was a bit dearer throughout 2021, simply previous to 2022 losses, and considerably dearer in the course of the dot-com bubble.

JPMorgan Information to the Markets

JEPI tilts cheaper industries whereas being underweight tech, benefiting from the traits above. As a result of fund’s lowered potential capital beneficial properties, these are small advantages however advantages nonetheless.

Conclusion

Within the latest previous, JEPI has seen declining distributions, some underperformance, and an enchancment in its relative valuation. General, fund fundamentals stay sturdy, and the fund stays a purchase.