Eugene Mymrin/Second by way of Getty Pictures

Abstract

Following my protection on Trimble (NASDAQ:TRMB), which I beneficial a purchase score resulting from my expectation that the enterprise was set to trip on the digital transformation secular tailwind in its finish markets, and because the transition to software program and subscription continues, the enterprise would additionally turn into a much less cyclical enterprise, this publish is to offer an replace on my ideas on the enterprise and inventory. I’m reiterating my purchase suggestion, as I imagine TRMB goes to see a restoration in earnings over the following few years if the catalysts that I recognized play out as anticipated. When that occurs, I additionally anticipate valuation to commerce at a premium to the market value within the optimistic basic outlook.

Funding thesis

It has been a full 12 months since I wrote about TRMB, and in hindsight, my purchase score was not the appropriate name because the inventory went on to see steady decline, dropping to as little as $39.57 at one level final November. Nevertheless, I feel the worst appears to be over as the basics and outlook have improved.

Recapping the current 4Q23 outcomes, on the backside line, TRMB reported an adj EPS of $0.63, touching the upper finish of steering ($0.55 to $0.63) and beating the consensus estimate of $0.60. Income was up 9% to $932 million, which got here only a contact above the excessive finish of steering ($890-$930 million) and in addition beat the consensus estimate for $910 million. ARR additionally grew in comparable instructions, up 24% on a reported foundation and 13% on an natural foundation to $1.98 billion. Adj EBIT margin continues to point out growth, bettering by 240bps vs. 4Q22 to 24.3% in 4Q23, which ended FY23 with 24.6% adj EBIT margin vs. FY22 of 22.9%. Guiding for FY24, administration expects FY24 adj EPS of $2.60–2.80, income of $3.57–3.67 billion, and adj EBIT margin within the vary of 24-25%. This set of tips implies ~2% development in EPS, ~4.5% decline in income on the midpoint, and sustaining sustainability on the present stage.

Personal calculation

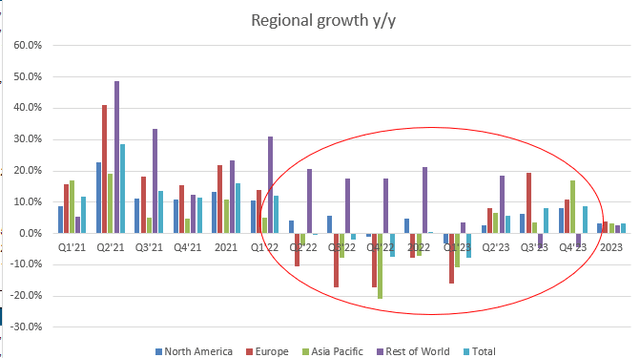

I imagine administration steering is pointing to the beginning of a restoration cycle, which efficiency at underlying areas appears to be pointing to as properly. Development has recovered throughout all areas besides the remainder of the world from the softness seen in FY22. In 4Q23, North America (the most important area for TRMB) grew 8.2%, Europe grew 10.8%, and APAC grew 16.9%, whereas the remainder of the world fell by 4.4%. The remainder of the world’s efficiency is comparatively much less significant, because it represents lower than 10% of whole income. When considered from the top market perspective, it seems to me that demand is robust however held down by a few finish markets which are largely dragged down by macro pressures quite than something structural. TRMB continues to get pleasure from tailwinds within the development finish markets with AECO (architects, engineers, contractors, and homeowners). Natural ARR was up by ~20% in 4Q23. Notably, a big a part of AECO reserving development is achieved by way of cross-selling, which now accounts for greater than 25% of the annual contract worth. This tells us two essential issues. First, the TRMB change in go-to-market technique to undertake a extra direct market strategy has labored out very properly, which is a plus for administration’s means to execute. Secondly, this additionally tells us that the underlying demand stays wholesome (i.e., underlying clients are prepared to undertake extra merchandise). Related power was seen in subsegments akin to infrastructure, renewables, and knowledge facilities, which drove reserving development. Revenues from linked digital platforms additionally carried out properly, now representing ~15% of FY23 income. With the addition of extra companies like e-Builder and Cityworks, in addition to the growth of AECO initiatives to different areas, administration anticipates this to succeed in roughly 35% by the start of 2024. Though that is under administration steering again through the investor day, it’s nonetheless respectable progress. As TRMB shifts in the direction of it digital platform, it ought to open up extra alternatives to cross-sell.

The few finish markets which are dragging down TRMB efficiency because of the weak macroeconomic state of affairs are residential development and agriculture. For residential development, the impression was significantly profound in Europe as mortgage charges and home costs stay excessive, inflicting demand to plummet. On this finish, that is largely a macro drawback quite than a TRMB-only drawback. TRMB isn’t the one enterprise that’s being impacted by this. My view is that charges have to return down finally, and the impression of price will increase has up to now proven optimistic outcomes with inflation coming down. Whereas it would take some extra time, the path is optimistic for TRMB, which I anticipate to point out up someday in FY25. As for agriculture, it additionally suffered the identical destiny, the place excessive commodity costs (as famous by administration) proceed to impression the sector. I’m not an knowledgeable on commodities, however I feel a key motive for the elevated commodity costs is the freight state of affairs (notice that this additionally impacts the TRMB transportation finish market), led by the battle within the Purple Sea. That’s exterior of TRMB’s means to manipulate, however my guess is that will probably be resolved quickly, given the stress from the US and its allies.

An upcoming catalyst that I anticipate to enhance TRMB fundamentals and valuation is the three way partnership [JV] between AGCO Corp. (AGCO) and TRMB. The proposed JV is to mix AGCO’s JCA Applied sciences property with TRMB’s precision agriculture enterprise (excluding its core GNSS IP). Within the JV, AGCO will maintain 85% of the curiosity, whereas TRMB will maintain the remaining 15% and obtain a money consideration of $2 billion from AGCO. The transaction is predicted to shut in 1H24. I see this as a significant win for TRMB, as it will be capable of exit the hardware-centric precision agriculture enterprise that’s competing towards the OEMs. With the partnership, TRMB successfully turned this destructive state of affairs right into a less-risky-and-positive one, as will probably be supplying core positioning providers to AGCO. Additionally, the exit of this {hardware} enterprise may even enhance TRMB income combine to extra recurring/software-based, which must also enhance TRMB valuation a number of (the weaker {hardware} precision agriculture enterprise is now a smaller portion of TRMB enterprise).

Valuation

Personal calculation

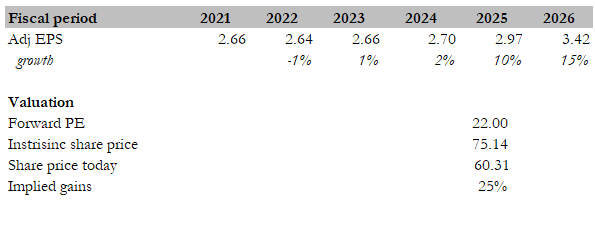

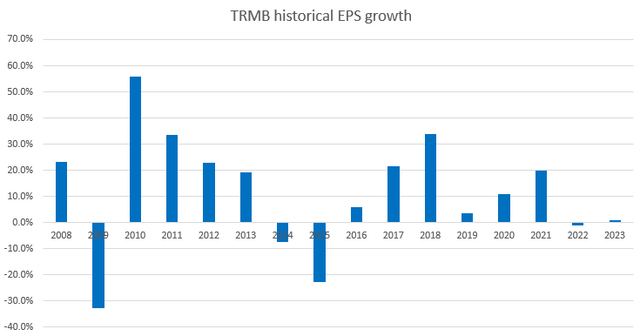

My goal value for TRMB, primarily based on my mannequin, is $75 by the top of FY25. My mannequin assumption is that adj EPS development will comply with the same restoration sample that TRMB has seen over the previous 2 cycles (FY16-FY18 and FY19-FY21), rising 2% in FY24 (administration steering), 10% in FY25, and 15% in FY26. I imagine there are three catalysts that may drive this efficiency. Firstly, the restoration of the worldwide macroenvironment ought to result in decrease rates of interest, thereby reducing mortgage charges, to drive a restoration in residential development. Secondly, the decision of battle within the Purple Sea ought to have a right away impression on reducing commodity costs by way of decrease freight prices, which must also relieve stress on the TRMB transportation finish market. Lastly, the profitable execution of the JV with AGCO ought to higher place TRMB for earnings development because it positions itself away from competing with OEMs (as a substitute, they’re now using on an OEM’s development) and has a greater income combine that ought to enhance margins. As these three catalysts play out, TRMB ought to commerce at a premium valuation to the place it has traditionally traded (21x ahead PE) because the enterprise fundamentals flip optimistic for the close to time period.

Personal calculation

Danger

Of the three catalysts, two are exterior of TRMB management, which may get rather a lot worse than it’s immediately. A key metric that’s being noticed by central banks is the inflation price, and whereas it has come down in main areas, it has confirmed to be rather a lot stickier than anticipated. If it stays sticky and probably re-inflects upwards once more, it may result in additional price hikes which are going to be extraordinarily detrimental to TRMB finish markets. Additionally, the battle on the Purple Sea has been occurring longer than anticipated; if that battle results in a significant battle, it’s going to put TRMB finish markets underneath far more stress.

Conclusion

I preserve my purchase suggestion for TRMB, with the expectation that FY24 marks the start of a restoration for the corporate. Regardless of the inventory’s decline over the previous 12 months, current optimistic developments, together with stable 4Q23 outcomes, point out an improved outlook. Whereas sure finish markets, akin to residential development and agriculture, face challenges, I imagine the restoration in world macroeconomy and the decision of the Purple Sea battle will flip the state of affairs round in these finish markets. A key catalyst is the profitable execution of the JV with AGCO, which ought to enhance TRMB place within the worth chain and its income combine.