tampatra/iStock through Getty Pictures

Written by Nick Ackerman, co-produced by Stanford Chemist.

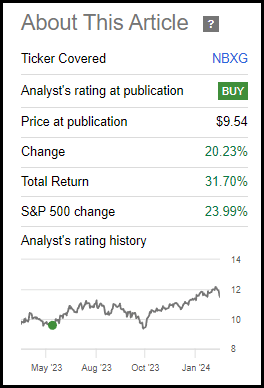

The Neuberger Berman Subsequent Technology Connectivity Fund (NYSE:NBXG) is a fund centered on “next-generation cellular community connectivity and expertise.” Due to its heavy tilt towards expertise corporations, the fund carried out fairly properly in 2023, and 2024 can also be wanting fairly promising. On the similar time, this closed-end fund’s share worth sports activities a deep low cost because it trades properly beneath its web asset worth per share.

Since our final replace, the fund has carried out extremely properly. A few of this efficiency got here from a little bit of low cost narrowing throughout this time as properly. The fund additionally skilled the market correction final October and has seen a little bit of a downturn extra lately as properly. After such a sizzling run, it will possibly make sense to see a pause and pullback.

NBXG Efficiency Since Prior Replace (Looking for Alpha)

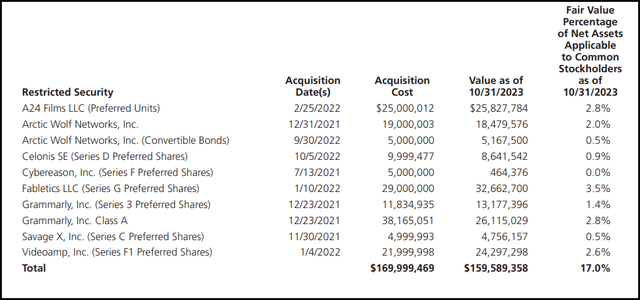

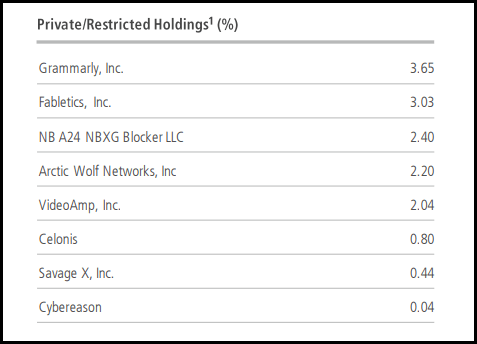

Although the fund holds non-public investments, that may typically trigger some skepticism in regards to the precise NAV. In our prior replace, I famous that many of the values weren’t being up to date often. For some, it had been years with out modifications in what they valued their holdings at. Nevertheless, I am pleased to report that with its newest annual report, the fund has now revalued its restricted holdings.

NBXG Fundamentals

- 1-12 months Z-score: 0.64

- Low cost: -17.06%

- Distribution Yield: 10.46%

- Expense Ratio: 1.32%

- Leverage: N/A

- Managed Belongings: $1.089 billion

- Construction: Time period (anticipated liquidation date of Might 26, 2033)

NBXG is a “non-diversified, limited-term closed-end administration funding firm centered on next-generation cellular community connectivity and expertise.” They haven’t any deal with U.S. or non-U.S. corporations – as an alternative, they’re investing the place they see match. This additionally contains any market cap and personal holdings.

One of many interesting options of this fund is that it does not make the most of any leverage by means of borrowings. On condition that the underlying holdings might be non-public and tech might be unstable sufficient, with closed-end funds having additional volatility because of their low cost/premium, including additional leverage on prime would amplify it additional.

However, the fund makes use of an choices writing technique. That features writing lined calls and places. That, in a means, can dampen a little bit of volatility for the fund. Nevertheless, lined calls may also doubtlessly cap some upside if the place will get known as away or they should shut out the contracts at a loss.

Writing places counteracts that detrimental a bit as a result of it will additionally typically imply that these places are expiring nugatory; that’s if the market is heading in a typically upward course the place they’re seeing their put contracts expire nugatory however are accumulating the choice premiums.

The fund’s expense ratio is on the upper finish, and naturally, decrease is all the time higher. On the similar time, this expense ratio is not exceptional after we begin stepping into funds with non-public investments. The truth is, at 1.25% primarily based on the administration charge and administrator charge, it is consistent with different friends.

Reductions and Illiquid Securities

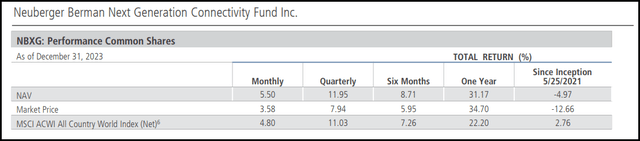

The fund is maturing now, having entered the market with an IPO in mid-2021. Its efficiency since then is definitely discouraging for traders, because it launched simply in time to be basically hit laborious by 2022’s tech bear market. Nevertheless, its efficiency has been way more encouraging since then.

NBXG Efficiency (Neuberger Berman)

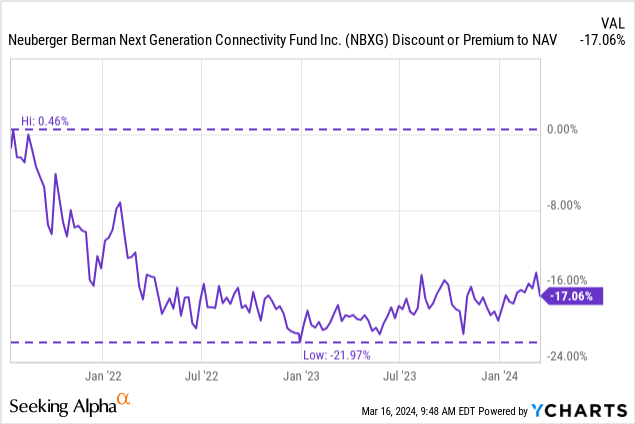

After all, with a brand new closed-end fund, it typically sees its shares fall to a reduction shortly after launch. This one simply so occurred to drop even additional. That might doubtlessly been a results of the general poor market situations for this kind of fund. Both means, the low cost widened to a virtually 22% low cost stage earlier than slowly trending to a narrower stage.

Ycharts

Trying on the fund’s restricted holdings, we are able to see they’ve up to date many of those values as of their newest annual report. In our earlier replace, there have been a number of holdings, together with these going again to 2021, that had not seen their values change one bit. General, the valuation hasn’t shifted too dramatically, with solely a small total decline with this newest replace. Nevertheless, it is nonetheless good to see that they’re getting these repriced. They accounted for 17% of the fund’s complete web property.

NBXG Personal Funding Valuations (Neuberger Berman)

After all, even with a third-party valuation appraisal, on the finish of the day, one thing is just valued if one is keen to pay for it. On condition that these are illiquid securities, that worth might be totally different even with the most effective and most trustworthy of worth assessments.

That is the place some low cost on a fund with such illiquid securities could make sense; nonetheless, given the scale of the fund’s low cost, I consider that it is nonetheless interesting. Even when we assumed a write-down of half the worth right here, the fund’s complete property would nonetheless be simply over $1 billion. Unfold that throughout the fund’s 78,761,496 shares, and the NAV per share would nonetheless be $12.70. In different phrases, that might nonetheless go away the fund with a reduction of -9.7%.

Now, I would not recommend that half of their restricted securities worth is not correct. That is extra of a worst-case state of affairs for illustrative functions to focus on how enticing the present low cost is. Most of those investments are most popular shares, so that ought to present some stability total versus in the event that they had been fairness positions.

~10.5% Distribution Charge

One of many different interesting options of CEFs in addition to the low cost/premium mechanic that may be exploited is the fund’s distribution fee. They typically are typically considerably larger than different investments, and that is primarily as a result of the fairness funds pay out capital positive factors over time. After all, many additionally overpay what they’re really incomes, and that is the place we see fund erosion over time.

For NBXG, they began paying a month-to-month distribution fee of $0.11, and that’s the place they’re at the moment. This works out to a distribution fee of 10.46% and an NAV fee of 8.68%. Given the fund’s NAV is considerably decrease now than at launch, it will imply they have not been incomes their payout to traders.

However, that is primarily because of the plunge in 2022. Since then, the NAV has been heading larger, and one might argue that it’s now being lined. With an NAV fee of 8.68%, it does not seem too elevated both. I might additional have to take a position that in the event that they did not minimize it earlier than, I do not see them reducing it now.

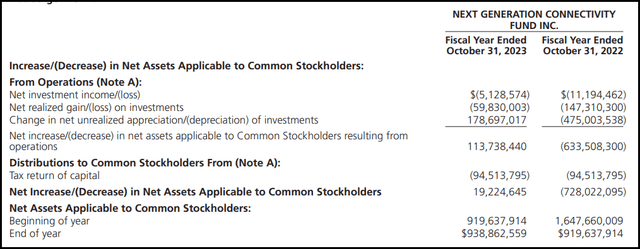

Like most tech-heavy funds, the fund does not earn any constructive web funding earnings.

NBXG Annual Report (Neuberger Berman)

NII is solely what the fund has earned from the underlying portfolio by way of dividends and curiosity minus the fund’s bills.

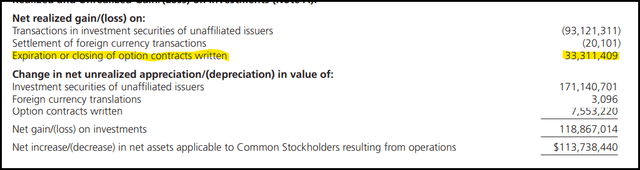

As a substitute, this fund will rely solely on capital positive factors to fund its payout to traders. Going again to the choices writing technique, that was a major supply of realized capital positive factors for this fund of their final fiscal yr, 2023. Their fiscal year-end is in October, so it does not match the calendar yr. Nonetheless, the overwhelming majority of the portfolio’s rise of their FY was because of the unrealized positive factors of their underlying portfolio.

NBXG Realized/Unrealized Good points/Losses (Neuberger Berman (highlights from writer))

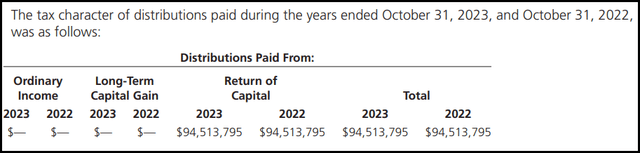

For tax functions, the fund’s distribution has been fully return of capital for the prior two years.

NBXG Distribution Tax Classification (Neuberger Berman)

This may be the case regardless that the fund is seeing vital unrealized positive factors as a result of they have not been realizing these positive factors. What they have been doing as an alternative has been to see realized losses of over $93 million.

Thanks additionally to the 2022 losses gathered, they’re sitting on round $243.Three million in carryforward losses. Positive, that was unhealthy for the fund going by means of that yr, however for an investor investing in late 2022 or early 2023, that is a profit. It’s because these carryforwards can be utilized to offset future potential realized positive factors and produce ROC distributions even when the fund’s NAV and share worth are rising.

For traders, which means they do not pay taxes within the yr these distributions are obtained, however it does decrease their value foundation. In that means, the tax obligation might be deferred till the place is bought – at the moment, there might doubtlessly be taxes due ought to an investor understand a achieve.

NBXG’s Portfolio

This fund’s turnover was a lot decrease in 2023, at 31%. In FY 2022, it was a really lively 103%. That being stated, the portfolio is not very giant as they checklist 67 complete public positions and eight non-public or restricted investments.

Curiously, we are able to see that the fund listed above has 10 non-public or restricted funding holdings. That was as of the top of October 31, 2023. The Eight proven are of their reality sheet for the top of 4Q 2023, which additionally traces up with the Eight names listed as of January 31, 2024, of their fund “snapshot.”

NBXG Personal Investments (Neuberger Berman)

This might be as a result of they don’t seem to be breaking out the precise holdings and as an alternative itemizing the variety of corporations to which they’ve publicity, or they bought two of their non-public investments. My suspicion is that it’s the former, as wanting on the two Grammarly positions they maintain had a complete proportion weight of 4.2% of their annual report. Additional, in our prior replace, additionally they talked about having Eight non-public investments when, at the moment, that they had the identical 10.

If they’re solely updating the valuations on these non-public investments quarterly or bi-annually in some circumstances, it will make sense that we see the share weight go down by the top of January 31, 2024. This could be as a result of their public holdings have primarily gone up throughout this time. In complete, that may be why the fund’s restricted/non-public investments within the newest snapshot are all the way down to 14.4% from the 17% listed of their final annual report. It is usually down from the 17.5% it was throughout our final replace.

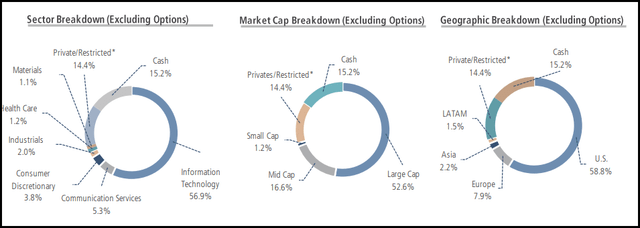

NBXG Portfolio Breakdown (Neuberger Berman)

The overwhelming majority of the fund’s allocation is to the tech sector at almost 57%. That is mainly consistent with what we noticed in our prior replace as properly.

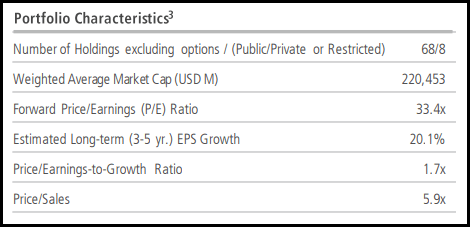

The ahead P/E on this basket of holdings involves a fairly lofty 33.4x, however that may be a reflection of the fund’s tech holdings being richly valued. That is up from the 28.8x final yr after we appeared on the fund.

NBXG Portfolio Stats (Neuberger Berman)

Primarily based on the ahead P/E, it definitely appears to be like richly priced, as does the general market nowadays. However, with a PEG ratio of 1.7x, that is up as properly from the 1.4x we noticed in our prior replace. That’s nonetheless on the costly aspect, however it additionally displays a extra modest overvaluation somewhat than an excessive overvaluation, in my view.

Most wish to see a PEG ratio of 1 or decrease, however this additionally displays the portfolio’s progress potential. As we are able to see, the 3-5 yr EPS progress is anticipated to be over 21%. For some context, the estimate is for the S&P 500 Index to see 9.5% EPS progress after EPS progress was 4% in 2023.

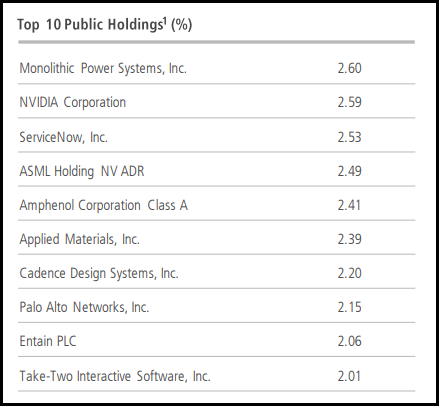

After all, these are all solely estimates, however a number of the prime ten names have definitely been capable of already ship some great earnings progress. Being amongst the highest ten is NVIDIA (NVDA), which most likely wants little introduction.

NBXG Prime Ten Holdings (Neuberger Berman)

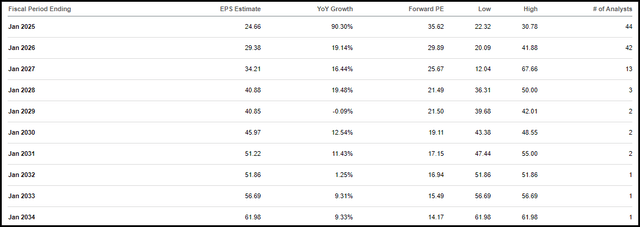

NVDA is estimates of potential earnings progress at about 90% in fiscal 2025. That’s fairly spectacular, however the next two years are nonetheless properly within the double-digit space of EPS progress estimates.

NVDA Earnings Estimates (Looking for Alpha)

Monolithic Energy Methods (MPWR) won’t be as spectacular with a 90% EPS progress estimate, however it additionally has estimates which might be nonetheless fairly robust.

MPWR Earnings Estimates (Looking for Alpha)

On the finish of the day, these are all estimates, and there’s no assure that they are going to be achieved. It might be considerably decrease or larger, and we’ll solely know that when it happens in hindsight. Nonetheless, it is why we are able to see the valuations on most of NBXG’s portfolio as being seemingly absurd – as a result of a few of these progress estimates are simply so spectacular that traders are keen to pay up for it.

Conclusion

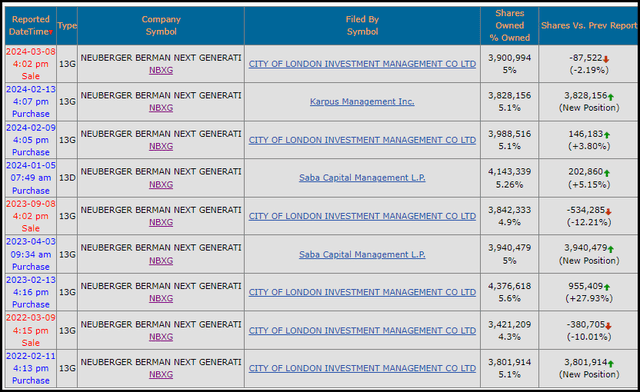

One final observe on this fund could be that notable activists maintain positions in it. That features Saba Capital Administration, Karpus Administration and Metropolis of London Funding Administration. Although CLIM has lately lowered its place a bit by means of a sale. These are all 13G filings, indicating that they’re solely being passive traders. It is nonetheless one thing value watching; these managers handle billions in investments. If they’re holding a place, it will possibly typically imply that they discover it enticing for one cause or one other.

NBXG Activist Possession (SecForm4)

NBXG is buying and selling at a deep low cost even when we contemplate a worst-case state of affairs for its non-public investments getting minimize in half. The fund began off fairly weak because of the timing of its launch however has since been performing a lot better.

The valuations of their underlying investments have turn into stretched for the reason that final time we touched on the fund. An total pullback or correction might even be wholesome. So, I would not in the end be shocked if we noticed the most recent begin to a pullback we have been seeing proceed. With that in thoughts, I will nonetheless go along with a ‘Purchase’ ranking on this fund as a result of it’s nonetheless buying and selling at a sexy low cost.