primeimages

Welcome to a different installment of our Preferreds Market Weekly Evaluate, the place we talk about most popular inventory and child bond market exercise from each the bottom-up, highlighting particular person information and occasions, in addition to top-down, offering an summary of the broader market. We additionally attempt to add some historic context in addition to related themes that look to be driving markets or that traders should be conscious of. This replace covers the interval by way of the third week of March.

Be sure you try our different weekly updates overlaying the enterprise growth firm (“BDC”) in addition to the closed-end fund (“CEF”) markets for views throughout the broader revenue house.

Market Motion

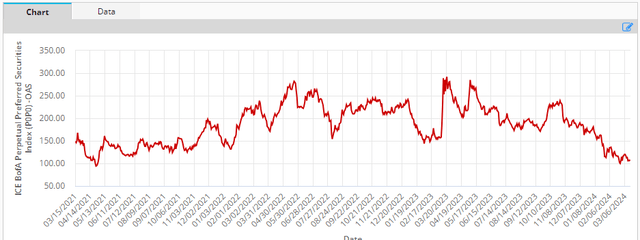

Preferreds had been down on the week, underneath strain from rising Treasury yields as a result of greater than anticipated producer inflation. Month-to-date, nevertheless, most most popular CEF sectors stay within the inexperienced as unfold tightening is offsetting Treasury yields. Spreads are bobbing round their 3-year tights. The sector yield stays sub-7%.

ICE

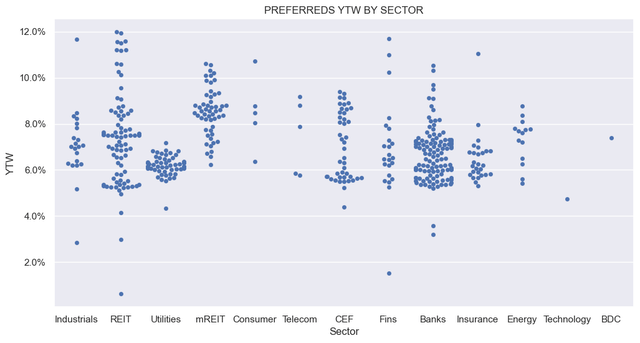

Having a look at how sector yields stack up – Banks and Insurance coverage sectors characteristic comparatively low-yielding preferreds with REITs and, notably, mortgage REITs having extra higher-yielding most popular choices.

Systematic Revenue

Market Commentary

Chemical compounds firm Albemarle just lately issued a brand new most popular (ALB.PR.A). The inventory has a compulsory convertible characteristic in March 2027, that means every most popular will likely be transformed into some variety of widespread shares. Which means that the overall greenback worth of the transformed most popular grows and falls with the value of the widespread inventory apart from a small interval (between roughly $109 and $131) across the worth on the time of issuance (~$120) the place it equals “par” or the liquidation desire.

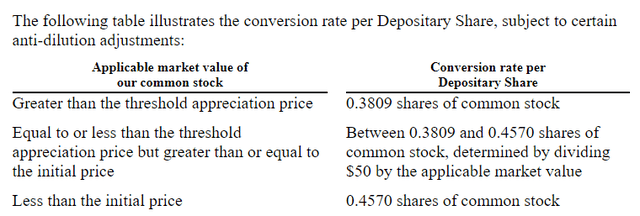

The conversion fee appears like the next.

ALB

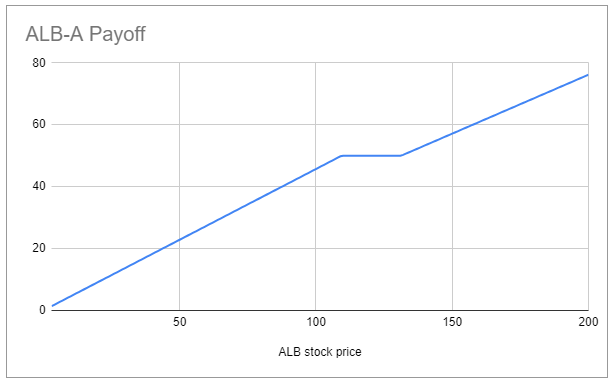

What this principally means is that the value of the popular is tightly linked to the value of the widespread outdoors of an interval across the widespread inventory worth on the time of issuance. Obligatory convertible preferreds should not be confused with convertible bonds which have a convex payoff as a result of holders are lengthy an choice – the MC most popular has a roughly linear payoff and the holders do not maintain any choices (technically, holders have an choice to transform the popular on the conversion flooring fee at any time nevertheless this solely accelerates the conversion and has a linear payoff that means it isn’t an choice within the sense of getting a convex payoff).

Systematic Revenue

Due to this linear payoff, MC preferreds get the next coupon than convertible bonds but in addition have extra volatility and draw back than typical preferreds or convertible bonds. For traders who already just like the widespread inventory the MC most popular can look very interesting as the popular provides vital upside participation however with much less draw back and the next coupon than the widespread.

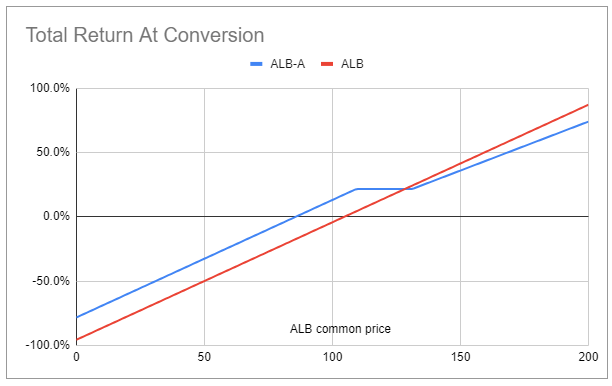

If we add the anticipated dividends over the 3-year interval previous to the conversion we get the next whole return profile. We will see that the popular has much less upside and in addition much less draw back than the widespread as a perform of the value of the widespread ($109 was the place to begin of the widespread worth).

Systematic Revenue

One problem of convertible preferreds is that their yield will not be well-defined. That is for the straightforward motive that the “principal” traders get again adjustments every day based mostly on the value of the underlying widespread inventory although it doesn’t have an effect on the dividend. For that reason traders must take care in how they give thought to the yield of the inventory. Finally, the trail of the widespread share worth is far more related for whole return than the yield.

There are solely a handful of obligatory convertible preferreds within the exchange-traded market, primarily as a result of few are issued and people are transformed to widespread shares after a couple of years. These preferreds are usually within the Know-how and Industrial sub-sectors. These shares can present the next worth participation to traders in higher-growth elements of the market.

Take a look at Systematic Revenue and discover our Revenue Portfolios, engineered with each yield and threat administration concerns.

Use our highly effective Interactive Investor Instruments to navigate the BDC, CEF, OEF, most popular and child bond markets.

Learn our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Verify us out on a no-risk foundation – join a 2-week free trial!