Jon Feingersh Images Inc/DigitalVision through Getty Photos

Time for a shave

It has come the time to rely one’s blessings. Those that have purchased and held shares of plenty of demolished blue chip shares for the reason that fortuitous bottoms in 2020 and 2022 have quite a bit to be grateful for. Sure, it takes some talent to determine single shares which might be each “low-cost” and have the prospects of snapping again to their all-time highs with even some additional progress baked into boot. Whereas I preach purchase and maintain and have nearly no turnover per yr in my portfolio [I aim for less than 5%], there comes a time when decreasing winners doesn’t equate to “selecting the flowers and watering the weeds” as Peter Lynch would say.

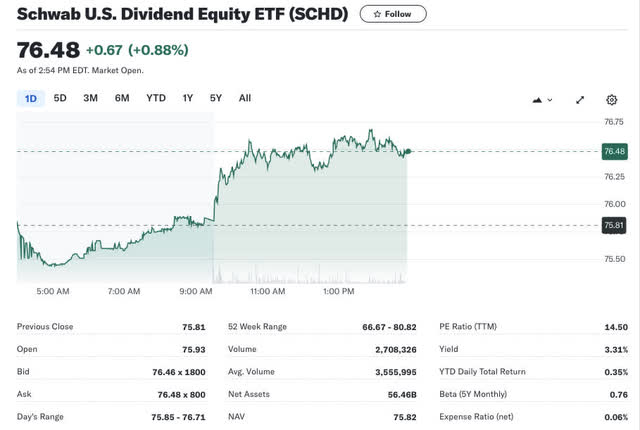

As I sit on a number of of those winners, I’ve been sorting via and making a number of reductions, stuffing the winnings into varied index funds. Particularly State Road and Vanguard’s S&P 500 index funds (SPLG) (VOO), Invesco’s Q’s fund (QQQ), and naturally, Schwab’s U.S. Dividend Fairness ETF (NYSEARCA:SCHD). Of the lot, SCHD is the most cost effective index with a P/E ratio of solely 14.5 X:

Yahoo Finance

Some frequent winners

- NVIDIA (NVDA)

- Exxon Mobil (XOM)

- Apple (AAPL)

- Meta (META)

- Tremendous Micro (SMCI)

Above are only a handful of names the place if timed proper throughout both the flash crash of 2020 or the tech bear market of 2022, you’ve got hit some good low to mid multi-baggers from a complete return perspective.

Whereas I did not purchase all of the shares on this record, these are simply the commonest ones that come to thoughts. Tesla was additionally up there for some time, however everyone knows that story.

Type your leaderboard and have a look at the earnings multiples, see if it is price shaving a bit off or in the event that they nonetheless meet your projections. Most of my winners nonetheless match inside an inexpensive worth spectrum, however I’ve begun to cut back a number of in case the expansion tales subside.

Whereas oil appears an incredible worth proper now, the cyclicality of oil costs might show in any other case. The rising costs in oil enable buyers to guage a discount based mostly on the upper costs of the underlying commodity. Locking in your features on a dividend inventory [oil & gas], whereas diversifying right into a dividend fund like SCHD, which now has a better yield than most oil shares, just isn’t a horrible selection for diversification.

A notice from John Bogle

Index funds haven’t at all times averaged such an expanded a number of, and thus their dividends have represented a bigger portion of the whole return historically than they do now. Often, a better a number of = decrease dividends and vice versa.

A number of excerpts on Dividends from John Bogle’s The Little E book of Frequent Sense Investing pages 65-66:

Dividend yields are a significant a part of the long run return generated by the inventory market. In truth, since 1926 (the primary yr for which now we have complete knowledge on the S&P 500 index), dividends have contributed a mean annual return of 4.2%, accounting for totally 42 p.c of the inventory market’s annual return of 10 p.c for the interval.- John Bogle

and

Compounded over that lengthy span, dividends made a contribution to the market’s appreciation that’s nearly past perception. Excluding dividend revenue, an preliminary funding of $10,000 within the S&P 500 on January 1, 1926, would have grown to greater than $1.7 million as 2017 started. However with dividends reinvested, that funding would have grown to some $59.1 million!- John Bogle

Sure, within the brief time period the earnings progress of an organization, and thus progress funds, can dominate returns over dividend-centric funds. In the long term, after progress peters out, dividends change into a bigger and bigger share of the whole return. I’m on no account saying that SCHD is a superior fund to SPY or VOO, however the present multiples have now compressed the beginning yield all the way down to 1.4% with decrease dividend progress charges for SPY and VOO vs a 3.53% yield on SCHD. If we’re pondering many years into the longer term, SCHD is probably not such a foul deal in any case and an incredible place to park a few of your winnings and decrease your portfolio P/E ratio.

Hedge towards a bubble

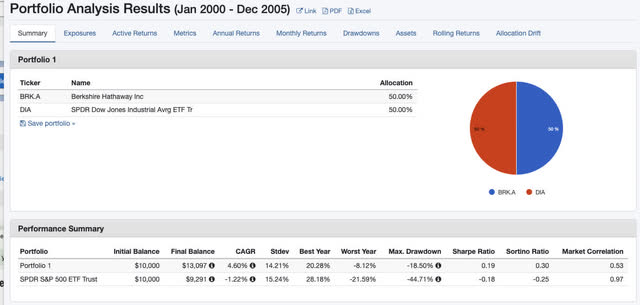

From a earlier article of mine on learn how to make investments $1 million for retirement, worth funds have outperformed in persistent bear eras such because the misplaced decade of 2000-2010, the chart beneath represents the primary tranche of the last decade returns from 2000-2005:

2000-2005 (Portfolio Visualizer)

On this demonstration, the mannequin portfolio was cut up right into a pie in 3rds throughout SPY (SPY) The SPDR Dow Jones Industrial Common ETF Belief (DIA), and Berkshire Hathaway (BRK.B)(BRK.A). The aim was to keep up a chance to realize alpha through together with SPY whereas defending one’s draw back with diversified values just like the Dow 30 and Berkshire Hathaway. If we simply have a look at the whole returns of the Dow 30 and Berkshire Hathaway versus SPY, we’d see even higher outperformance:

2000-2005 BRK and DIA VS SPY (Portfolio Visualizer)

The outcome on this 5-year interval publish dot com bubble bursting was a 4.6% CAGR for Berkshire Hathaway plus the Dow 30 ETF versus adverse -1.22% per yr for SPY. SCHD didn’t exist on this period, but when it did, the technique of worth and revenue would have had an incredible likelihood to carry out as nicely or higher.

Why not simply play cash markets, then?

Honest query, a 5% risk-free return is nice and will final for fairly some time. Even 4+% could be an incredible deal in comparison with a risk-on funding in a potential bear market state of affairs of 4.6%. If solely it was that easy.

Predicting rate of interest trajectories is subsequent to unimaginable. Moreover, conservative or not, SCHD and different worth funds will do an incredible job of capturing the majority of the S&P 500 complete returns ought to the bull market hold working and probably outperform ought to the market flip bearish. For my part, this proposition is way much less dangerous than a long-term money place. Whereas I do hold a superb chunk of money getting 5%, I do not suppose it is an incredible place for reinvested capital features of fairness winners. It is simply an incredible place to retailer new capital that you may not be prepared to take a position.

Constituents publish reconstitution:

SCHD simply went via a portfolio reconstitution, as is the mandate of the ETF. The brand new high 10 holdings seem like this:

From schwabassetmanagement.com:

New high 10 entrants in daring [top 10 = 40.19% of holdings]:

| As-Of-Date | Image | Amount | P.c of Property | Title |

| 4/19/24 | (LMT) | 4947896 | 4.25492543 | LOCKHEED MARTIN CORP |

| 4/19/24 | (CVX) | 14046660 | 4.17318239 | CHEVRON CORP |

| 4/19/24 | (PEP) | 12811281 | 4.16124178 | PEPSICO INC |

| 4/19/24 | (TXN) | 13124803 | 4.05025675 | TEXAS INSTRUMENT INC |

| 4/19/24 | (CSCO) | 44524919 | 4.03886351 | CISCO SYSTEMS INC |

| 4/19/24 | (VZ) | 53363289 | 4.03768488 | VERIZON COMMUNICATIONS INC |

| 4/19/24 | (KO) | 35428282 | 3.93513643 | COCA-COLA |

| 4/19/24 | (UPS) | 14481070 | 3.89732854 | UNITED PARCEL SERVICE INC CLASS B |

| 4/19/24 | (BMY) | 42024111 | 3.82706956 | BRISTOL MYERS SQUIBB |

| 4/19/24 | (AMGN) | 7712355 | 3.82076605 | AMGEN INC |

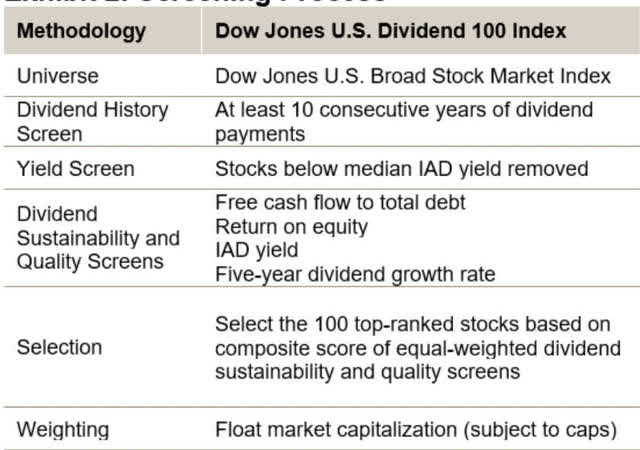

It is a 100 inventory index with a weighting system that has a number of variables.

S&P Dow Jones Indices

Vs. high 10 Earlier to the present 2024 reconstitution- high ten 2023 holding exits in daring:

- Amgen- Well being Care

- AbbVie- Well being Care

- Chevron- Power

- Pfizer- Well being Care

- PepsiCo- Shopper Staples

- Merck & Co- Well being Care

- Broadcom- Info Know-how

- Texas Devices- Info Know-how

- Coca-Cola- Shopper Staples

- Cisco-Info Know-how

Previous sector formation high 10:

- Four Well being Care

- 1 Power

- 2 Shopper Staples

- Three Info Know-how

New sector formation high 10:

- 2 Industrials- Aero Area and Protection and Air Freight and Logistics

- 1 Power

- 2 Shopper staples

- 2 Well being Care

- 2 Info Know-how

- 1 Communication Providers

Broadcom is now out of the highest 10, as are Pfizer, Merck & Co, and AbbVie. Bristol Myers Squibb and Amgen stay because the final two huge Well being Care pharma names, UPS joins the highest 10 as does Lockheed Martin on the high representing Industrials.

The highest 10 added two new sectors, with Industrials and Communication Providers. SCHD has reduce healthcare publicity in half inside this high 40% slice, and IT has been barely lowered.

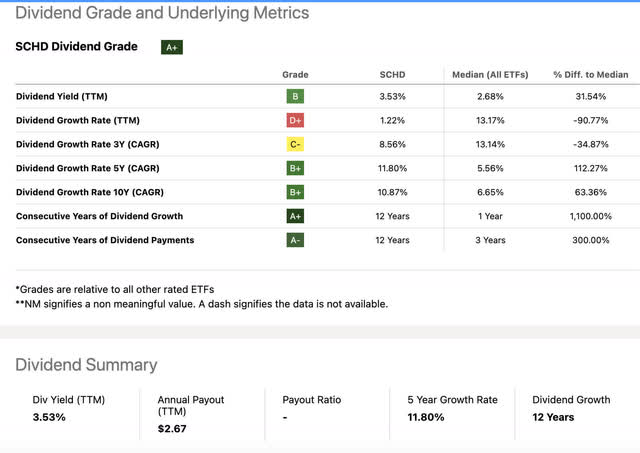

Present dividend and progress price

In search of Alpha

SCHD has been rising its yield since inception circa 2011. Those that purchased and held for the reason that fund was provided now get pleasure from a 10+% yield on price. Though the 3-year dividend progress price now trails its 5 and 10 yr averages, an 8.56% progress price continues to be fairly wholesome.

10 yr Efficiency versus the S&P 500

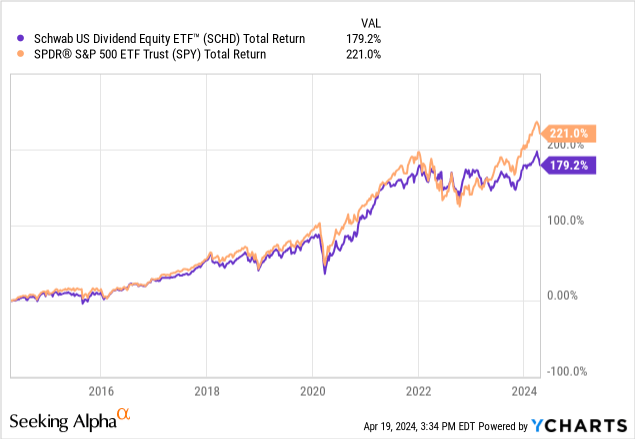

Trying on the 10-year complete return trajectory of SPY versus SCHD, we see a reasonably good-sized outperformance 10 years to this point. 221% for SPY versus 179.2% for SCHD.

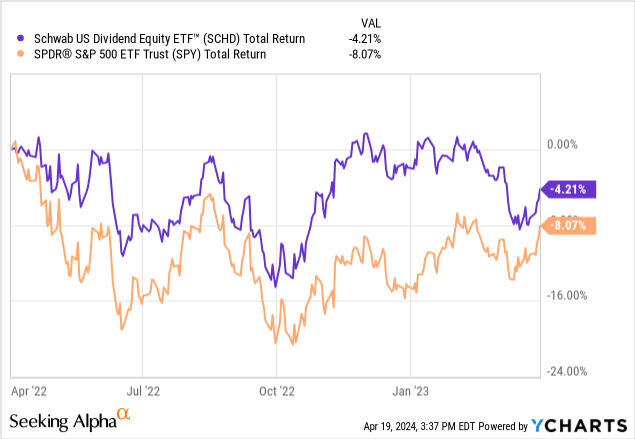

The query is when did SCHD outperform?

This era demarcates April 1 2022-April 1 2023. Someplace between the mid-point and the top of the tech bear market. SCHD had its head above water for a interval throughout this downturn, throughout which SPY obtained as little as -20% off its highs. The present relative underperformance of SCHD could also be seen as a optimistic hedge for those who suppose the 21 X ahead a number of of the S&P 500 just isn’t sustainable for for much longer.

I’m not positive in regards to the sustainability of it, however I proceed to purchase SCHD, particularly with funds from portfolio lowered winners, to hedge the likelihood that a number of enlargement is not going to final without end.

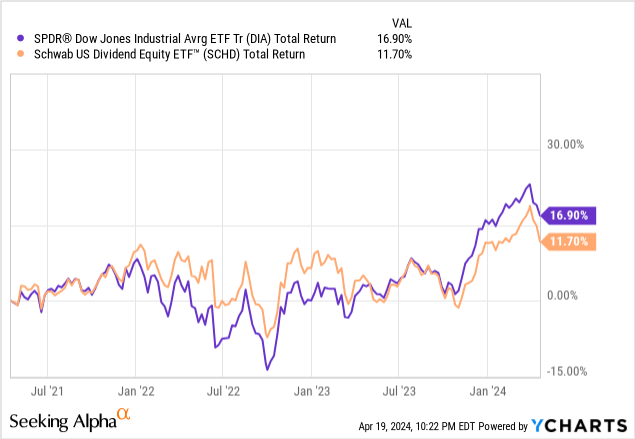

Versus the Dow 30

In truth, on a 3-year foundation through the sequence of shopping for alternatives and upward bull market actions, SCHD has underperformed even the Dow 30. That is largely because of the Dow 30 now mimicking the S&P 500 at a better and nearer clip including extra huge tech and excessive a number of names, that is one thing which is exterior the historic norm for the index. A number of of those non-value names embody:

- Salesforce (CRM) TTM P/E 64 X

- Apple (AAPL) TTM P/E 26 X

- Microsoft (MSFT) TTM P/E 36 X

The above does not even embody the latest addition of Amazon (AMZN) and jettison of Walgreens (WBA). In brief, the Dow just isn’t the historic “worth” index that it as soon as was, it is roughly S&P 500 “lite”.

Yahoo Finance

The Dow 30 now sports activities a 22.48 X TTM P/E ratio versus SCHD’s 14.5 X. The Dow 30 P/E ratio is now solely barely cheaper than SPY, which is sporting a 24.94 X TTM P/E ratio.

Listed here are the P/E ratios of some extra “worth” ETFs:

- Vanguard Excessive Dividend Yield Index Fund ETF Shares (VYM) 15.87 X

- Invesco S&P 500® Equal Weight ETF (RSP) 20.33 X

- ProShares S&P 500 Dividend Aristocrats ETF (NOBL) 21.27 X

As we will see from the above, SCHD gives a less expensive P/E a number of than most “worth” funds.

Admittedly, I am practically as closely invested in DIA as I’m in VOO from a buy-and-hold technique I began over a decade in the past with not one share liquidated. The aim of shopping for DIA was to decrease the general P/E ratio unfold. Nonetheless, DIA is changing into much less and fewer a hedge towards the upper S&P 500 a number of and increasingly more a clone. I do not plan to promote any shares of DIA, however SCHD is starting to switch this thesis as a decrease a number of hedge. Different worth funds do not look like actual values in any respect. VYM could be the closest, with practically an equal P/E to SCHD.

Dangers

New regular? Huge earnings progress forward for the magnificent mega-cap monopolies? Positive, diverting some funds for extra conservative decrease a number of ETFs could be an inherent threat all on its personal if the market continues to run on account of newly justified fundamentals that we won’t at all times predict into the longer term. The ahead P/E may be decrease than we assume for the S&P 500, Nasdaq, and Dow.

Loads of money stays on the sidelines, when that first price reduce hits [if it hits] and if it is unbiased of a recession, multiples may proceed to increase. SCHD has underperformed as of late and will proceed to take action.

Abstract

Look, everyone knows that P/E ratios are elevated. Likelihood is your winners have gained on account of significantly expanded multiples. There’s nothing incorrect with that, and people multiples might match the invoice ought to their earnings proceed to compound. In my e-book, SCHD serves a objective, be it lengthy or brief time period, for an incredible capital features storage once I take a number of chips off the desk. I not often promote out of something, however decreasing my total portfolio P/E ratio is one thing on my thoughts in occasions like these. Purchase.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.