koto_feja

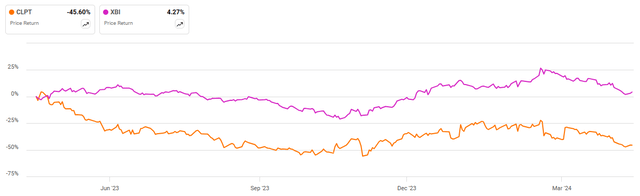

ClearPoint Neuro’s (NASDAQ:CLPT) fourth quarter outcomes have been sturdy, and the primary quarter of 2024 can also be shaping up nicely. Regardless of this, the inventory is down considerably over the previous 2 months on the again of a sizeable fairness increase and rate of interest fears.

The final time I wrote about ClearPoint I advised it was a purchase, as the corporate was moderately valued and approaching an inflection level. This nonetheless seems to be the case, with latest developments decreasing uncertainty concerning the corporate’s prospects. Income development must be stable in 2024 and money burn will start to average, pushed by the commercialization of latest merchandise and working leverage.

Market Situations

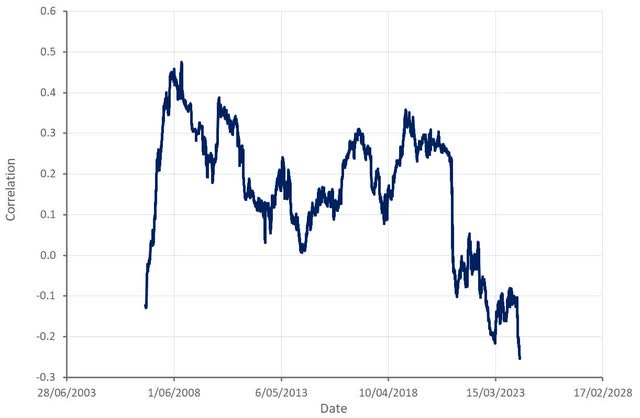

ClearPoint’s inventory is down considerably in latest weeks, however this seems to primarily be the results of macro headwinds, with increased inflation readings in early 2024 contributing to expectations of upper for longer rates of interest.

The price of capital is a big concern for biotech traders for the time being, with rising charges usually resulting in decrease inventory costs. ClearPoint could also be considerably insulated by the truth that a number of of its companions have raised capital in latest months, offering runway to proceed drug growth and scientific trials.

Determine 1: ClearPoint Neuro and XBI Returns (supply: Looking for Alpha)

Determine 2: XBI and Treasury Yield Correlation (supply: Created by creator utilizing information from Yahoo Finance and The Federal Reserve)

ClearPoint Neuro Enterprise Updates

ClearPoint continues to broaden its product portfolio and drive adoption of present merchandise. The corporate lately introduced FDA clearance for its model 2.2 navigation software program with built-in Maestro mind mannequin. Maestro helps customers to determine each targets and security zones within the mind, resulting in superior efficiency versus guide skilled segmentation and FreeSurfer, an open-source segmentation resolution. The primary scientific makes use of of ClearPoint navigation model 2.2 occurred throughout Q1. The software program is now in restricted launch, with a full launch anticipated within the second half of 2024.

ClearPoint additionally lately printed information demonstrating the benefits of is Prism Neuro Laser remedy system. This information demonstrates that the system gives correct, close to real-time temperature measurement of mind tissue with an error of <1°C. ClearPoint’s software program harm estimation has additionally been proven to be correct based mostly on a comparability with histopathology.

ClearPoint has said that it’s making progress with the restricted market launch of its laser system. The corporate additionally anticipates imminent approval of an working room accent package that may allow its laser system to be suitable with different navigation methods. ClearPoint expects submission of information for its 1.5-tesla clearance later this 12 months. The research for that is at present being scheduled and deliberate.

ClearPoint has additionally obtained FDA clearance for its Array model 1.2 software program, which permits surgeons to carry out a biopsy down one channel and a laser ablation down a unique channel. This software program has efficiently been used at a number of facilities.

ClearPoint’s SmartFrame OR additionally lately obtained FDA clearance. This product expands ClearPoint’s presence into the working room, the place over 95% of all stereotactic procedures at present happen. ClearPoint has shipped its first SmartFrame OR merchandise to prospects out of the brand new Carlsbad facility. The product is at present in restricted market launch and minimal income contribution is anticipated in 2024.

ClearPoint’s drug discovery companions additionally proceed to progress therapies by way of the drug growth course of. PTC Therapeutics lately accomplished a biologics license software submission to the FDA for Upstaza as a therapy for AADC deficiency. AADC Deficiency is a pediatric motion dysfunction that causes developmental delays and autonomic signs. Upstaza might be the primary illness modifying therapy for AADC deficiency within the US, and is already commercially accessible in Europe.

AviadoBio lately handled the primary affected person in its ASPIRE-FTD section half of scientific trial, which is evaluating AVB-101 for treating frontotemporal dementia with GRN mutations. The trial is utilizing ClearPoint Navigation with SmartFlow Cannula for drug supply. FTD is a number one reason behind dementia in individuals below the age of 65 with an estimated prevalence at anybody time of as much as 4.6 circumstances per 1,000 individuals.

Monetary Evaluation

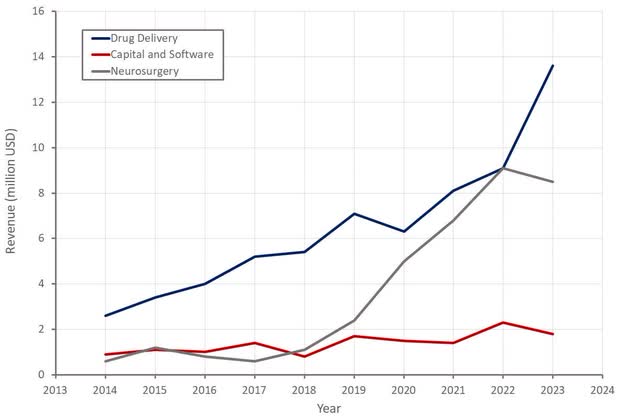

ClearPoint generated 6.eight million USD income within the fourth quarter of 2023, a 32% improve YoY. Biologics and drug supply income was 4.1 million USD, up 76% YoY. This improve was attributed to service income associated to new preclinical research. Practical neurosurgery navigation and remedy income was 2.Zero million USD, down 11% YoY, as a consequence of a co-development program with a mind pc interface associate being paused. Capital gear and software program income was 0.7 million USD, a rise of 23% YoY. Some hospitals have been choosing lease or rental packages, which has weighed on the popularity of income.

ClearPoint is at present guiding to 28-32 million USD income in 2024 and Q1 is on observe to be a file quarter.

Determine 3: ClearPoint Income (supply: Created by creator utilizing information from ClearPoint)

ClearPoint’s gross revenue margin was roughly 57% in 2023, pushed by a shift in income combine in direction of biologics and drug supply preclinical companies. ClearPoint has advised that its margin on capital gross sales is 35-40% and most biologic offers have gross margins in extra of 50%.

ClearPoint additionally confronted elevated prices as a consequence of its transition to a brand new manufacturing facility. The Carlsbad facility is now operational, and the Irvine manufacturing has been shut down, which can be supportive of gross revenue margins going ahead. Gross revenue margin must be near 60% in 2024, depending on income combine.

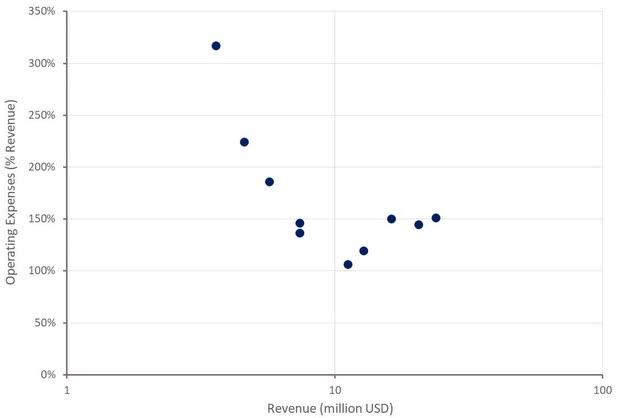

Working bills have been roughly 36 million USD in 2023, up roughly 21% over 2022. This improve was pushed by personnel-related bills and allowances for credit score losses (1.Four million USD). Particularly, gross sales and advertising and marketing bills have been 12.6 million USD, a rise of 35% YoY, pushed by the enlargement of ClearPoint’s scientific and advertising and marketing groups.

Determine 4: ClearPoint Working Bills (supply: Created by creator utilizing information from ClearPoint)

Money burn and potential dilution of present shareholders has been a danger for ClearPoint. The corporate lately issued 2.Three million shares at 6.5 USD per share in an underwritten public providing. The underwriter was additionally granted a 30-day choice to buy as much as a further 346,154 shares. This public providing was efficiently accomplished with ClearPoint elevating roughly 15 million USD. ClearPoint has advised that this may enable it to retire its total excellent debt within the subsequent 12 months.

ClearPoint ought to have one thing like 34.5 million USD money on the stability sheet on the finish of the primary quarter, and the corporate will most likely burn one thing like 20-25 million USD money on the best way to breakeven.

Conclusion

Whereas ClearPoint’s enterprise fundamentals proceed to look stable, the inventory’s near-term prospects are prone to be dictated by the macro atmosphere. If rates of interest transfer materially increased, ClearPoint’s inventory might transfer considerably decrease. Whereas the corporate’s valuation is modest given its prospects, there are no income or money flows to fall again on.

Even when the macro atmosphere stays difficult, ClearPoint’s fundamentals ought to stay stable, pushed by new merchandise and continued market share features. Drug discovery income might be in danger if prospects select to scale back money burn within the face of upper rates of interest, although.

Determine 5: ClearPoint EV/S A number of (supply: Looking for Alpha)