tadamichi

Late December final yr, I issued my first article on Trinity Capital Inc. (NASDAQ:TRIN), which focuses on offering debt and gear financing to progress stage and smaller dimension corporations. When it comes to the standard investments, which TRIN provides to these corporations, there’s nothing extraordinary because the lion’s share of the portfolio consists of floating charge time period debt, and to some extent, additionally gear financing with the equity-like investments constituting a comparatively insignificant chunk of TRIN’s publicity.

What was one thing TRIN particular that distinguished the BDC from its friends was (and nonetheless is) the dividend yield, which could be very excessive at 13.7%. The explanation why TRIN is ready to accommodate this excessive dividend yield is its choice to actually go up the chance curve in its funding technique by allocating in the direction of extra dangerous companies than the typical BDC on the market does. As an illustration, as of This fall, 2023, the typical efficient portfolio yield stood at 16.7%, which is a transparent indicative of high-risk investments (or loans).

So, this side of simply too excessive skew in the direction of inherently dangerous companies (e.g., SMEs that haven’t but reached constructive money producing part) made me comparatively bearish in opposition to TRIN.

Particularly, the advice was to keep away from TRIN because it was not value, for my part, to chase additional 200-300 foundation factors in yield, whereas sacrificing the underlying high quality.

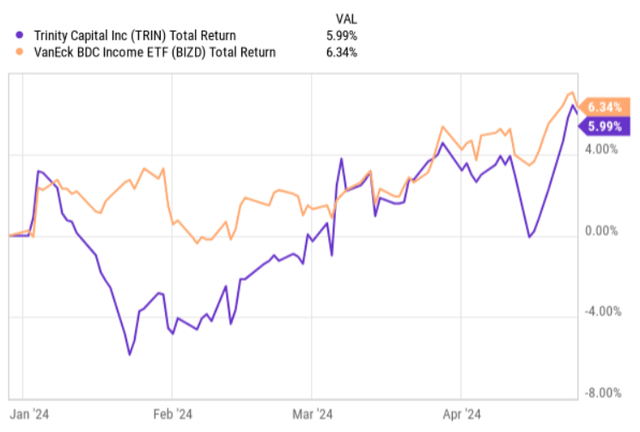

For the reason that publication of my first article on TRIN, the BDC has barely underperformed the market; simply because it has accomplished over the previous 5-year interval.

YCharts

Additionally, a couple of month in the past, TRIN issued it This fall, 2023 earnings report, which revealed some new attention-grabbing information factors which are value contextualizing with my bearish thesis.

Let’s now assessment the thesis.

Thesis assessment

In a nutshell, the This fall, 2023 earnings report got here in robust, the place a number of elementary metrics strengthened, finally permitting TRIN to ship a considerably secure adjusted NII determine. The NII landed at $0.57 per share, which marked a rise of 16% relative to the identical quarter final yr (albeit, if we adjusted for the modifications within the share depend, it was really a decline of ~9%). Equally, the NAV ticked larger by 7%, growing by $0.02 per share from the prior quarter. The rise in NAV per share was largely pushed by the excess internet funding revenue era after the distributed dividends. So, as of This fall, 2023, TRIN’s dividend protection was 114%.

If we take a step again and assess the principle elements which helped TRIN enhance the outcomes, we are going to discover that it was the top-line, which defined the vast majority of the constructive upward motion in outcomes. This, nevertheless, has rather a lot to do with the document quarterly fundings of $267 million in This fall, 2023, which within the context of full-year funding of $642 million might be simply deemed as a wonderful efficiency.

Most of those incremental fundings have been accommodated by, primarily, inside money era and money available. We will additionally conclude this by wanting on the exterior debt dynamics, the place TRIN ended the yr at barely decrease debt to fairness ratio – at 104%, which is beneath the sector common.

With that being mentioned, I nonetheless stay bearish on TRIN, and there are actually two causes for this.

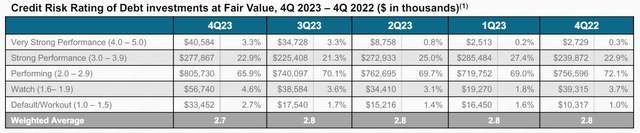

First is the worsening of portfolio high quality, the place we are able to see a continued momentum in credit score high quality migration from “performing” class to “watch” and “default/exercise” classes. Collectively in these two dangerous classes TRIN have positioned 7.3% of its portfolio (expressed on a good worth) foundation, and the quantity retains rising quarter by quarter.

TRIN Investor Presentation

Given the concentrate on dangerous and intensely high-yielding investments, it shouldn’t come as a significant shock that there are some clear struggles with the portfolio high quality / well being. Nevertheless, contemplating the current strengthening of upper for longer, nonetheless shallow sector-wide deal exercise and first indicators of rising non-accruals throughout your complete BDC house, it simply doesn’t appear as the fitting second to hold this type of publicity within the portfolio.

The second side is extra associated to the actual fact of how the market has reacted to the This fall, 2023 earnings information, the place at the very least on the floor, TRIN registered strong outcomes. Even with one other dividend improve, NAV progress and document fundings it was not sufficient for TRIN to exceed the BDC index. Plus, contemplating that TRIN has had a considerably related state of affairs prior to now 5-year interval, the place the Inventory has constantly lagged behind the market, it certainly appears as if the market additionally acknowledges the elevated danger profile that stems from the speculative investments within the underlying portfolio corporations.

The underside line

Whereas TRIN has been in a position to hold the momentum constructive on the core efficiency metric facet (e.g., rising NAV base and secure NII era) and delivered document new funding volumes, it has not been sufficient to beat the market, which I totally perceive.

Within the meantime, throughout This fall, 2023, the portfolio high quality deteriorated, the place there was a continued migration from performing loans to loans that ought to be put beneath watch record or that are already defaulted. As of now, the loans which fall beneath the “enterprise as ordinary” standing account for 7.3% of the whole portfolio on a FV foundation.

In opposition to the backdrop of restricted margin of security by way of the dividend protection and worsening macroeconomic situations (together with rising non-accrual ranges within the general BDC house), TRIN nonetheless appears a subpar and overly speculative funding car.