eyesfoto

Funding Thesis

Frontier Group Holdings (NASDAQ:ULCC) runs its operations via Frontier Airways, providing an ultra-low-cost air transportation service. The sturdy level of this firm is its distinctive enterprise mannequin.

I imagine this firm has potential for development within the future resulting from a number of causes. Firstly, Frontier locations a robust emphasis on buyer expertise. They provide family-friendly plans and bonuses for frequent flyers. Lately, they’ve launched an possibility that ensures an empty center seat, thereby rising the area obtainable to the traveler.

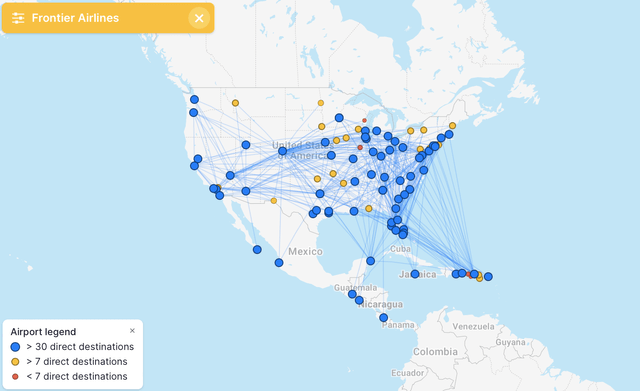

Secondly, the corporate serves over 90 airports in America and is planning to broaden its operations.

Lastly, the corporate’s revenues have seen a major enhance lately, paralleled by a notable rise in passenger numbers.

Enterprise Overview

This firm’s enterprise mannequin is notably bold if we predict that corporations working with low prices typically cope with extraordinarily skinny revenue margins. Generally, these finances airways could make a revenue simply from the sale of additional providers, like baggage insurance coverage, or meals and drinks offered in the course of the flight. Once you take a look at Frontier’s enterprise mannequin, it is clear that their aim is to supply a buyer expertise that merges parts of each exclusivity and finances service, all whereas preserving their costs very low.

In its newest report, the corporate outlined numerous methods aimed toward value discount. These embrace the strategic number of routes, excessive plane utilization, using the most recent era of plane, and seat positioning optimization for gas effectivity. Nevertheless, these cost-reduction methods have been carried out by different low-cost corporations for years, so I do not imagine that these practices present a aggressive benefit. In actual fact, I imagine that the energy of this firm lies exactly within the service and expertise it provides to its prospects, not merely in its low pricing.

In actual fact, Frontier’s technique is targeted on enhancing its model to make sure that prospects affiliate Frontier with an expertise that differs from what different low-cost airways provide. The corporate can not improve its model by providing costly providers, as it might miss its goal buyer base. For that reason, Frontier is intelligently working to enhance each side that may create a pleasing expertise for the client. As an example, they add drawings of animals affected by air pollution to the tails of planes to spotlight the corporate’s dedication to ESG values. One other means the corporate strategically enhances its model is by introducing interesting packages like “Children Fly Free” or “GoWild! All-You-Can-Fly Cross”. The intention of those packages is to penetrate the market by attracting prospects with a singular expertise.

The corporate provides journeys to over 90 airports in the US and between April and Could 2024, the corporate has deliberate to broaden its operations.

Locations (FlightConnections)

The picture supplies a visible illustration of Frontier’s present route protection.

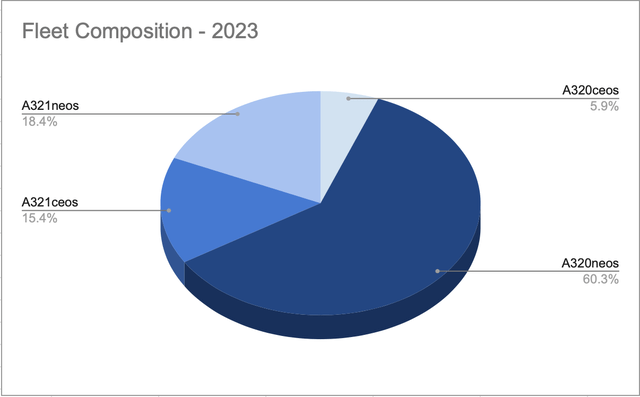

As noticed within the introduction, the corporate’s fleet consists solely of A320 and A321. This presents a bonus for the corporate as these latest-generation plane have low gas consumption and emit fewer emissions. Furthermore, having a fleet comprised solely of Airbus plane allows the corporate to prepare its flight personnel effectively.

To get a clearer thought of the composition of the Frontier fleet, we are able to take a look at the next pie chart:

Fleet Composition on the finish of 2023 (Creator’s calculation utilizing firm’s 10okay information)

Frontier does not personal the planes it makes use of, however leases them. The corporate has made it clear that after the lease contracts for the A320ceos will expire, they will get replaced with A320neos or A321neos. Frontier has written a number of lease contracts with completely different finish dates, spanning from 2024 to 2028. Given this, we are able to count on that within the subsequent few years, the corporate ought to be capable to utterly transition its fleet to the A320-21neo household.

The method of utilizing environment friendly plane and optimizing the distribution of weights and seats has already proven its advantages. This side can be factored into the This fall 2023:

Using the A320neo household plane and our seating configuration, weight-saving ways and baggage course of have all contributed to our potential to proceed to be essentially the most fuel-efficient of all main U.S. carriers of serious dimension when measured by ASMs per gas gallon consumed.

Contemplating that the Airbus plane from the neo household permit for gas consumption financial savings of 15 to 20%, if Frontier replaces the Airbus plane from the ceos household with Airbus neos over the subsequent 4 years, it may obtain a major discount in journey prices. This isn’t an element to be underestimated. In actual fact, as we’ll see later, the price of gas has a considerable affect on the corporate’s outcomes.

Key Progress Components for Future Firm Success

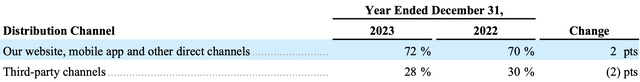

Ranging from the premise that, as we have beforehand seen, Frontier’s success hinges on meticulous consideration to the client expertise. Certainly, the corporate is making vital efforts on this regard. This begins with their web site, which is well-organized and crammed with promotional messages for purchasers, together with choices to make flights as versatile as potential. The location’s visible enchantment is notable, successfully speaking the corporate’s values, reminiscent of sustainability. That is essential, as highlighted by the corporate in its 2023 10-Ok report, the place it was famous that 72% of ticket gross sales had been made through the web site.

Distribution Channels (Firm’s 10okay)

On March 12, 2024, Frontier launched a brand new plan referred to as “UpFront Plus Seating”. This plan, obtainable at an extra value to the essential ticket, ensures prospects an empty seat, thus offering them with extra space. As Frontier has acknowledged, this promotion will not be limitless because of the restricted variety of free seats. In my view, the corporate launched this provide to higher optimize area on the aircraft. There is perhaps sure routes which have fewer passengers throughout particular occasions of the 12 months. Due to this promotion, the corporate may doubtlessly enhance seat yields, as those that go for this promotion are basically paying for 2 seats, albeit not at double the fee.

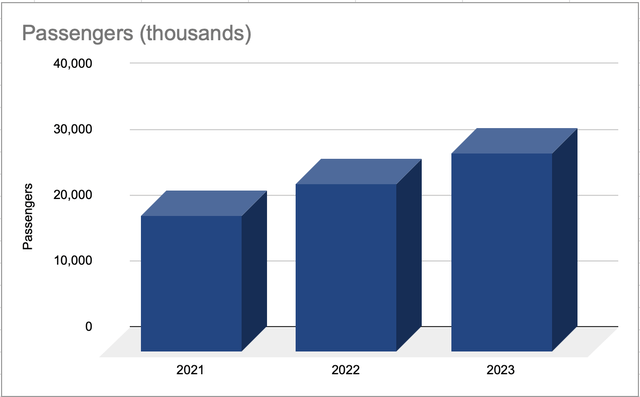

One other optimistic side is the expansion within the variety of passengers lately:

Passengers (Creator’s calculation utilizing firm’s 10okay)

In 2021, Frontier served 20.7 million passengers, and this quantity rose to a complete of 30.2 million folks in 2023, resulting in a CAGR of 13.42%. I imagine it is a vital pattern. If Frontier provides an expertise that stands out from different low-cost airways, prospects will take discover and unfold the phrase. Furthermore, the 2026 Soccer World Cup will likely be held within the USA, an occasion that can undoubtedly necessitate the motion of a lot of folks. Frontier may exploit this chance to draw new prospects and additional speed up this development pattern.

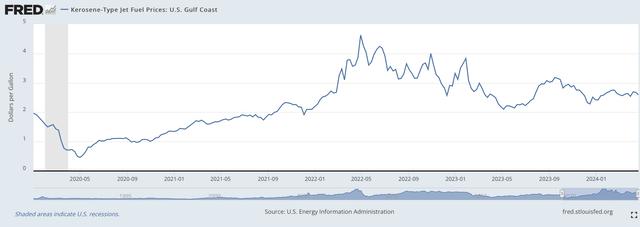

One other vital variable is the price of gas. In actual fact, it represents a big value for Frontier. In 2023, jet gas represented 31% of whole prices, which exhibits that the corporate’s financial efficiency is intently linked to gas worth traits.

Gas worth (FRED)

If we look at the historic pattern of jet gas costs, we are able to observe that there was a major enhance in 2022. This has impacted the corporate and its valuation lately.

A report from BMI means that the worldwide common jet gas costs are anticipated to stabilize at round $105-106 per barrel within the upcoming years, a slight lower from the $110 per barrel seen in 2023.

Moreover, as beforehand talked about, the rising use of Airbus plane from the neo household ought to progressively scale back the corporate’s gas prices within the subsequent years.

Monetary Evaluation

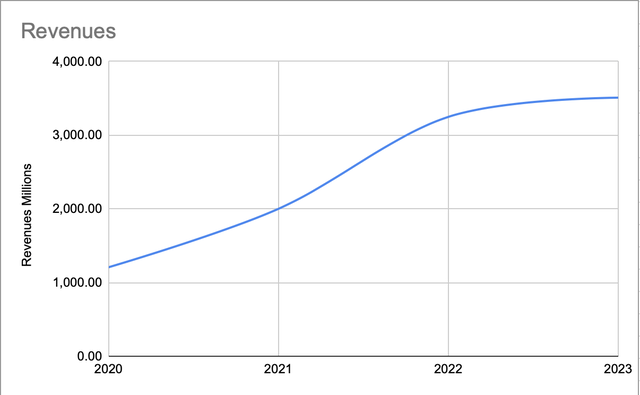

From a monetary perspective, Frontier appears to be enhancing lately, after the detrimental interval of 2020. As we are able to see, revenues are rising at a great tempo.

Revenues (In search of Alpha)

From 2020 onwards, there’s been a constant upward pattern in revenues, escalating from 1.2 billion to a sturdy 3.5 billion, boasting a CAGR of 30.58%.

After we flip our consideration to web earnings, it is clear that there is been a optimistic shift, though the corporate has but to cross into the realm of optimistic web earnings. In 2023, the monetary data confirmed a web earnings of -$11 million.

The monetary consequence was closely influenced by working bills. In 2023, these bills amounted to $3.592 billion. A good portion of those working prices was gas, which alone value the corporate $1.130 billion in 2023.

In search of Alpha

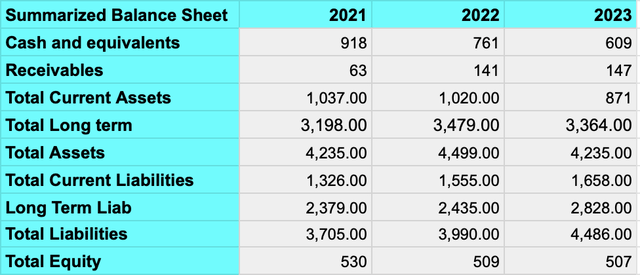

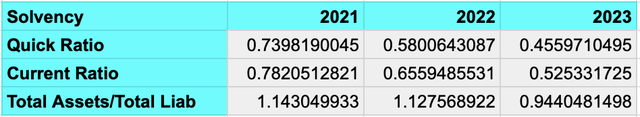

After we take a better take a look at Frontier’s stability sheet, it is noticeable that there is been a lower in liquid belongings, together with money and money equivalents, over the previous few years. This pattern does elevate a small query mark over the corporate’s short-term solvency

Solvency Ratios (Creator’s calculation utilizing In search of Alpha information)

From the evaluation of the solvency ratios, we see that each the fast ratio and the present ratio took successful in 2023. The principle concern stems from the corporate’s constant sample of detrimental money flows lately, which has had a major impact on the corporate’s liquid belongings.

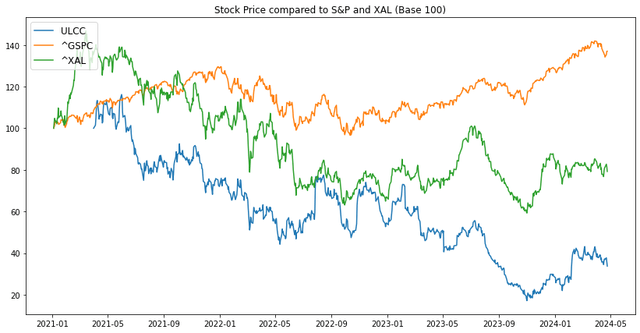

Creator’s calculation utilizing yfinance python library

Within the graph, one can observe the evolution of Frontier’s inventory worth compared with the S&P and the NYSE Arca Airline index. As will be seen, the inventory has underperformed each indices lately. Moreover, it is noteworthy that Frontier’s inventory tends to be considerably influenced by sector dynamics. In actual fact, during the last six months, it has elevated by roughly 55%, following the sector pattern.

Valuation

Ought to the patterns of income development and enhancements in web earnings proceed into 2024, the corporate may doubtlessly obtain a optimistic money movement from its working actions. This hasn’t occurred previously few years, and it is essential to keep in mind that for a corporation of this nature, money flows can exhibit excessive volatility resulting from substantial CapEx, contemplating the excessive worth of the belongings. As an example, in 2023, there was a lack of $224 million brought on by the web change in working belongings, which considerably impacted money flows.

To estimate future money flows, we are able to observe the typical degree of money flows generated by working actions previous to Covid. The typical was $198 million. For the subsequent few years, it is perhaps overly optimistic to imagine that the corporate can return to these ranges of money flows. Nevertheless, by observing the listed development elements, we are able to assume that the corporate may handle to get a degree of money flows of $35 million subsequent 12 months, which is equal to the typical of the final ten years. Then, assuming an anticipated development charge of 5% and a WACC of seven% via the discounted money flows mannequin, we receive a inventory worth of $9.58.

Valuation (Creator’s calculation)

Draw back dangers

A considerable portion of the corporate’s goal market will not be people who have to journey, however moderately households or teams of people that journey for holidays or to go to locations of curiosity. When households scale back their monetary assets resulting from a disaster or recession, they have an inclination to spend much less on vacation journeys. Subsequently, Frontier’s revenues and ticket gross sales are strongly tied to the financial cycle, whereas different corporations that provide extra important providers aren’t affected by this situation to the identical extent. If folks have to journey by aircraft, they may seemingly select the airline that gives the bottom worth, not the one which ensures another onboard expertise. Particularly on this historic interval characterised by vital uncertainty, a contraction in demand may have a considerable affect on the worth of Frontier’s inventory.

One other crucial situation that I highlighted in the course of the monetary evaluation is that the corporate is progressively exhausting its liquid assets. If it fails to generate a optimistic web earnings within the upcoming years, its solvency may additional deteriorate. It is also price noting that the corporate has a Debt to Fairness ratio of round six. This suggests that the corporate funds practically all of its belongings with debt. Consequently, a lower in liquidity heightens the corporate’s threat.

Conclusions

In abstract, Frontier is an intriguing firm that gives a service that defies market logic: it supplies an ultra-low-cost service whereas concurrently providing an expertise that prospects might understand as unique. Lately, it has demonstrated its potential to draw new vacationers and broaden its service.

With the notable efforts in model promotion, a robust emphasis on environmental sustainability and ESG ideas, and the info exhibiting a considerable uptick in vacationers choosing Frontier for his or her journeys, we are able to count on this pattern to persist within the years to return. Given the corporate’s potential to yield optimistic money flows down the road, the inventory, presently priced at $6.25, may current a worthwhile alternative, in my opinion. Consequently, my suggestion could be to contemplate a BUY with a long-term perspective.