FRMO Company (OTCPK:FRMO) Q3 2024 Earnings Convention Name April 16, 2024 4:15 PM ET

Firm Contributors

Therese Byars – Company Secretary

Murray Stahl – Chairman and Chief Govt Officer

Steven Bregman – President and Chief Monetary Officer

Therese Byars

Good afternoon, everybody. That is Therese Byars talking and I am the Company Secretary of FRMO Corp. Thanks for becoming a member of us on this name.

The statements made on this name apply solely as of as we speak. The data on this name shouldn’t be construed to be a advice to buy or promote any explicit safety or funding fund. The opinions referenced on this name as we speak should not supposed to be a forecast of future occasions or a assure of future outcomes.

It shouldn’t be assumed that any of the safety transactions referenced as we speak have been or will show to be worthwhile or that future funding choices shall be worthwhile or will equal or exceed the previous efficiency of the investments.

For added data, you might go to the FRMO Corp web site at www.frmocorp.com. At the moment’s dialogue shall be led by Murray Stahl, Chairman and Chief Govt Officer, and Steven Bregman, President and Chief Monetary Officer. They may overview key factors associated to the fiscal 2024 third quarter earnings.

And now I am going to flip the dialogue over to Mr. Stahl.

Murray Stahl

Okay. Thanks, Therese, and thanks all people for becoming a member of us. I am going to simply begin off. I am going to simply make a few spotlight factors about our financials, which I believe you may discover attention-grabbing. After which I’ll reply some questions I at all times get, however I by no means get them in actual time on-line.

Now I solely get them as I encounter folks. They usually ask them then it is too dangerous as a result of the reply solely goes to at least one particular person. I actually suppose I ought to share it with everybody, so that is what I’ll do.

So so far as monetary statements go, I consider, if I am not mistaken, that our stockholders’ fairness attributable to the corporate of $219.Four million is the best now we have ever had. And our complete property, which is complete liabilities and stockholders’ fairness of $388 million, I believe that is about as excessive as we ever had.

So it is attending to be huge sums of cash. However what it these monetary statements do not do is they do not present you element behind them. So an essential element and I am going to get to some questions on that element momentarily. An essential element is that we’re truly constructing a crypto enterprise, and we’re on the best way to changing into a crypto working firm.

So the parts of which are, we now personal 1,655,000 shares of Winland, and I believe that is one thing like 35% of the shares. We preserve submitting 10b5 plans, and now we have one on proper now, which is in a quiet interval. And I believe Might 1st, it recommences. So Winland is now largely a crypto minor. We even have a smaller funding in Consensus Mining.

Consensus Mining, if every thing goes proper in just a few months is definitely going to have a list, and that is additionally a crypto mining firm. We additionally — if you happen to take a look at our steadiness sheet, you may see about $1.Three million of digital mining property. So we truly mine for ourselves.

And put all of it collectively, it could not be a small cryptocurrency mining firm, if it weren’t subtle into three totally different pockets. And — however the three parts are typically talking, getting larger progressively. We even have, as you possibly can see from our cryptocurrency holding abstract, now we have a good quantity of cryptocurrency holdings both straight or not directly, some in ETFs and a few straight.

So I am going to simply discuss what we have been doing in these items and what we have not been doing in these items. So the crypto has been, I dare say, fairly profitable. So one query, which I get, and it’ll require somewhat little bit of a prolonged reply is, the steadiness sheet money, which is $38.Eight million.

Why do you want as folks ceaselessly ask, however by no means on this name. Why do you want $38 million of money appears to be at all times round that quantity. Why not take the majority of that and put it into Bitcoin. And that requires somewhat little bit of clarification.

We do not wish to be a Bitcoin holding firm. We wish to be a cryptocurrency mining firm. And that is an essential distinction. Let’s begin with this. If we had been to place the $38 million into one of many varied ETFs which have been improved for the reason that final — these conferences. That is what occurs to, in long term, to a cryptocurrency ETF. Cryptocurrency produces no curiosity, no dividends. The charges are small, however they’re charges. So the charges can solely be paid by promoting somewhat little bit of crypto.

So what occurred is even that the fund will get some huge cash, the fund that we have traded in internet asset worth. The variety of crypto cash per share or per unit, if you happen to choose, is at all times going to go down. Salient distinction, however not the one distinction with the cryptocurrency mining firm is.

For those who do it proper, the crypto per share goes up. So that you’re producing crypto. And there are some very attention-grabbing efficiency facets as properly. So it is theoretically attainable in a yr, cryptocurrency can truly go down by 20%, however you may need mined 10% extra cash. And if these are certainly the numbers, you’re an equilibrium.

So crypto has a unique threat reward sample than your typical ETF. However the extra salient level is, after all, that you’ll be producing extra crypto. You are organically rising your internet asset worth, your internet asset worth.

So if you happen to can proceed to organically develop your internet asset worth and also you do it with regularity, you are more likely to commerce at a premium to guide worth or premium to internet asset worth, which is rather a lot higher than simply buying and selling at a internet asset worth degree. So it is a very totally different consequence for shareholders.

One other facet, which you would possibly discover attention-grabbing. Winland and Consensus do not practically mine Bitcoin. Winland and Consensus are mining Bitcoin, Litecoin and Bitcoin Money. And in addition, anybody who mines Litecoin can be mining Dogecoin. Why is anybody who mines Litecoin mining Dogecoin as a result of Litecoin is a merged mine coin. And as a merged mine coin, for a similar electrical energy, you are mining two cash as an alternative of 1.

So you might, for instance, take the Dogecoin, which is what we have chosen to do, pay all of the bills of mining and preserve Litecoin, and it’s totally worthwhile. However the revenue of mining isn’t the one dimension of that, which suggests each day operational revenue. The concept is, it is theoretically attainable.

And earlier than I say it, let me simply level out that I am in all probability the one one who even believes this. The lesser cash, in my humble opinion, have doubtlessly extra upside than Bitcoin, which I believe has lots of upside. The explanation it may need extra upside is as a result of the scale of the opposite networks are very small.

So for instance, the Bitcoin community is now over 600 exahash. An exahash, by the best way, is one adopted by 18 zeroes, so it is a huge quantity. In strange parlance, you’d say, quintillion. Litecoin, for example, has in spherical numbers one petahash community hash price.

So one petahash is one 600,000th which means that the Bitcoin community is 600,000 occasions measurement of Litecoin community, which explains why Bitcoin has a a lot larger market capitalization. However if you happen to might get the hash price to go from one petahash to 2 petahash, which is a rounding error in Bitcoin, might double the scale of the community and possibly double the worth of the community.

Bitcoin Money has an combination community hash price of about 2.5 exahash. So it is lower than 0.5% the scale of the Bitcoin community. It is theoretically attainable for — in a complete host of situations for processing energy to maneuver from Bitcoin to Bitcoin Money and it has occurred, though within the small scale during the last yr or two. That small scale, which most individuals can ignore, would point out, and it is occurred that Bitcoin Money truly considerably outperformed Bitcoin over final yr for example.

It is attainable that Bitcoin Money, which does not have a use case proper now, would possibly discover a use case. Anyway, the community is small enough, though nonetheless safe, you might make a case for it. and you can also make a superb efficiency case for it. So now we have that.

Now if you are going to construct a mining enterprise, you need to construct it progressively and slowly. The intention is, you’ve lots of money as they are saying to me in any occasion, why not put it to work? Effectively, here is why not put it to work as a result of you need to assume that each three or 4 years, your mining gear goes to be out of date.

Now the estimated use for licensed gear is definitely lower than three years. So lots of it is going to wear down. But when it does not put on out, in our case, we have been very fortunate. It hasn’t worn out. Each 4 years is a halving. So the widespread characteristic behind Bitcoin, Bitcoin Money and Litecoin is a halving each 4 years. Halving signifies that each 4 years, your block reward is lower in half. That is why they name it a halving. However your value of mining stays the identical.

So prices stay the identical. Your income is lower by 50%. What enterprise might endure that each 4 years. So what it’s worthwhile to be in place to do is you want to have the ability to exchange your whole community, no much less each 4 years and generally much more ceaselessly than that. Now the opposite facet of that’s once you exchange your community, the gear you exchange your community with is far, rather more environment friendly in its electrical energy utilization and truly in its sturdiness.

So that you’re shopping for each greenback you spend for gear buys extra processing energy or put one other manner, the price of one terahash of processing energy is continually falling. So for a similar sum of money, that you simply had purchased a Bitcoin miner eight years in the past, as we speak, you might in all probability purchase 12, perhaps even 14, and they are much higher.

So if you happen to make investments some huge cash in a single iteration, you haven’t any manner of understanding when there’s going to be a technological breakthrough. All you realize is that in brief order, there shall be. So you may don’t have any capital reserve to interchange your gear. And also you see that is truly what is going on on in lots of the mining firms proper now. Capital was raised, capital was invested. We’re in Bitcoin three days away from the halving.

On the present worth of Bitcoin, most iterations of apparatus should not going to be worthwhile. Now perhaps subsequent three days, the worth of Bitcoin goes up and income is up. However assuming it isn’t, these machines needed to be turned off. So if you happen to positioned orders to be delivered over many future months.

By the best way, once you try this, it is truly a pure futures curve in gear purchases. So if you happen to order gear for August supply, August 2024, it is truly meaningfully cheaper than if you happen to order gear for Might 2024 supply and also you get a significantly better deal on it. So that you at all times wish to be in that place.

So what is going on to occur is that if the situation proves to be true that the main gear generations during the last three or 4 years are going to be made successfully out of date and inoperable by the halving. The fashionable era gear goes to take over. So let’s simply say there is a having.

Your income is lower in half, Bitcoin worth is unchanged, but when half machines are turned off, the folks you had been competing with for the block reward, a few of them soften away and within the simplistic occasion, you may get twice as a lot block reward measured in cash as you had been getting earlier than, despite the fact that the precise block reward itself is much less, which means you may get proportionately lower than truly much less.

So what’s going to occur is you can be in equilibrium, you might even be in an improved revenue place. So that you dare not make investments some huge cash anybody time as a result of if you happen to try this, you’ve got misplaced all of your strategic flexibility.

Now the unfavorable factor from a shareholder perspective is it takes a very long time to construct a cryptocurrency enterprise in that manner. However I believe if you happen to had been to check, you possibly can’t see Consensus but as a result of it is publicly traded, however you possibly can’t see Winland. So that you at the very least have a window on how issues work in a gradualistic cryptocurrency mining effort. I dare say it is truly been very, very profitable.

So I believe our holdings are roughly 35% of Winland Might 1st, I consider, is the day of the activation and new 10b5 plan, and we’ll proceed with our coverage. So I dare say, in crypto, we’re prepared for almost any conceivable situation.

So we’re staying away from daring strikes. All that however, we nonetheless purchase modest quantities of crypto. And had been we ever to achieve the bulk curiosity of Winland, we must consolidate that. And it could enhance our crypto holdings.

I consider in our cryptocurrency holdings overview which I’ve in entrance of me. I consider, right me if I am incorrect, Therese. We’re not particularly disclosing Winland or our share of Winland and Consensus money. Is that right? Or am I not right so far as that goes?

Therese Byars

I believe that is right, Murray.

Murray Stahl

Okay. Good. All proper. So let’s simply go to a different subject which has been thrilling, at the very least, is Texas Pacific Land Corp, you would possibly observe that we truly purchased extra shares of Texas Pacific.

There was a dispute and it is resolved for higher or actual. However on the finish of the day, there are extremely few firms on this planet, perhaps even none. I solely hesitate to say that as a result of I do not know each firm on this planet, however there are only a few firms on this planet which have the standard of TPL in any enterprise and particularly in commodities.

So let me simply level out a few facets of that. Most companies, they’re going to commerce at a sure worth earnings ratio, and in a sure sense, it is somewhat little bit of phantasm. Why there’s somewhat little bit of phantasm? I am making up a quantity right here, however if you happen to purchased a enterprise at 12 occasions earnings.

Sure, it is 12 occasions earnings and its GAAP earnings, but it surely’s not as if you happen to can take everything of the earnings if you happen to want to and disperse it to shareholders. You may’t try this. So totally different firms have totally different ratios. However ultimately of the day, you need to reinvest a goodly portion and in lots of instances, greater than goodly portion of the earnings to take care of the resiliency of the enterprise.

Now all you need to do is take a look at the monetary statements in TPL. You will say the capital expenditures are de minimis. So the earnings, at the very least in precept, can be found for use for shareholders.

In idea, they will purchase again inventory. In idea, they will make acquisitions. However there are acquisitions which are in there with a view to rising the enterprise or they will simply be paid out in for dividends.

Very, only a few firms have that college. Additionally longevity of the enterprise, as a result of what’s the enterprise? It is oil royalties, it is land, which is easements on land, and it is water, each supply water and produced water and land is perpetually. Water is perpetually. There have been no different companies which have these traits.

So even commodity-based companies, so let’s make two factors. The primary level is simply common enterprise. Most companies both present a service or make a product? And what number of companies, even the very best, I can say they’re unchanged after a few years, the enterprise adjustments, rivals come up, the product turns into out of date, perhaps extra capitalists be invested to take care of the sting. I believe traditionally, only a few firms have maintained the sting over the course of many years. In these form of companies, you actually do not must. Now let’s flip to commodity firms.

Commodity firms, you may not pay attention to this, however most commodities have unfavorable actual charges of return. So for instance, you could not do that in actuality, however you might definitely do it theoretically.

For instance, you measured wheat. I simply wrote one thing saying printed, however one of many details I put within the paper was the worth of wheat in 1866,1867, Division of Agriculture, United States Division of Agriculture, truly maintains data of costs in a planting season as a result of that is the related statistics from their perspective.

Proper after the Civil Struggle, the worth of wheat was $2.06 a bushel. On the eve of the First World Struggle, worth was significantly lower than $1. So folks naively say that investing in commodities for a protracted time frame, they’re inflation beneficiaries, properly, they are not.

Now I might go to the bottom worth recorded and final 100-plus years of wheat, which is 1932, 1933, planting yr, the place the wheat worth truly declined, I believe, $0.38 a bushel. And may you think about wheat costs in 1932 or ’33 and seeing a worth of $0.38 a bushel. And there are individuals who had been alive in 1932, ’33, they really had — had been sufficiently old to have lived by means of the Civil Struggle. There have been even individuals who truly fought within the Civil Struggle.

They usually’re interested by inflation, what may need been they’re interested by inflation. And even as we speak, the worth of wheat is perhaps $5.5 a bushel. So what’s the precise price of return? It is a fraction of the speed of inflation for that point interval.

Now one of many causes it is a fraction inflation. I can provide you statistics on all of the commodities. I will not do it since you’ll discover it boring, however I believe it’s best to look these items up for your self. So what do producers of commodities, keep in mind, these are capital-intensive commodity firms.

What’s their primary mission to a) produce extra of the substances which, after all, will increase the availability and far, rather more importantly b) what’s b) cut back the price of extraction of that commodity the place it is a gold firm, a copper firm, no matter.

And never — in most cases, they do not actually cut back the price — the manufacturing commodity in nominal phrases, however they do achieve lowering it in actual phrases. So the price of extraction is normally happening in actual phrases, and wheat is an instance of that. Then the worth isn’t going to advance at a price commensurate with inflation. Now, you could not, in actuality have purchased wheat in 1866, ’67 planting yr and saved it as a result of lots of commodities simply haven’t got limitless life.

As a matter of reality, most commodities haven’t got limitless life. So even oil, I assume you might say it has limitless life, provided that it is within the floor. You need to use it if it involves the floor as a result of the price of storing it, think about if they might retailer oil from 1866, ’67 to now. What was the purpose? The price of storage mainly overwhelmed what the price of manufacturing was. You are not going to earn cash.

So most commodities have unfavorable actual charges of return. Land is an exception. Land has a optimistic actual price of return. The opposite huge exemption is water. Water has a optimistic price of return of time since you would not name it storage, however land is land.

It is probably not being saved within the typical sense of the phrase, but it surely’s not going wherever. Water is similar factor. It is underground until you deliver it to the floor, it does not get used in any respect. However if you happen to do deliver to the floor, it has a pure refresh price.

And that is why on this planet of inflation beneficiaries or inflation safety, if you happen to choose, that is why it is so essential. That is why we’re so keen about. And we stay up for proudly owning it for a protracted time frame to come back.

So to present you an summary of what we’re doing. I requested myself a few questions that I by no means appear to get in the actual world, which is that this discussion board, however I hope you discovered that attention-grabbing. However now let’s go to the actual world.

I am certain you’ve questions, which have been presubmitted. I do not know what they’re, and I would be delighted to reply no matter anybody wish to submit to me. So if you’ll accommodate that, Therese, I will be glad to reply any questions.

Therese Byars

It is my pleasure. The primary query begins. Thanks for all of your work and congratulations on the Scott’s Liquid Gold transaction. I had a fast Miami Worldwide Holdings accounting query. May you assist me perceive the change within the MIH direct account steadiness from the primary quarter of 2024 at $4.7 million to the second quarter of 2024 at $7 million and there’s extra. I perceive the funding is held at value, however I see based mostly on the highest 5 holdings paperwork that FRMO’s shares of MIH elevated from 1.821 million in Q1 2024 to 1.824 million within the second quarter of 2024. Even when we conservatively assume all these — all of that improve in MIH’s straight attributable to FRMO’s steadiness sheet versus South LaSalle, the incremental buy worth appears very excessive versus a $7-ish share valuation given to MIH just a few years in the past. Was the change within the MIH direct steadiness on account of a contribution from FRMO into MIH? And in that case, why? If it was on account of direct purchases, are you able to assist me perceive the place my math above is inaccurate, if in any respect? And Judy truly supplied some extra data, Judy Yellin, would you want me to learn that?

Murray Stahl

Please. At all times welcome it.

Therese Byars

She’s the fund controller. And — there’s — that is what she stated. There is no such thing as a distinction within the variety of MIH shares held straight by FRMO and Fromex from the primary quarter to the second quarter. South LaSalle Companions LP did buy virtually 500,000 extra shares in November 2023. And whereas FRMO’s funding in South Lasalle was down about 2% by the top of the second quarter on account of extra inflows in South LaSalle by outdoors buyers remains to be quantities to an additional 3,000 shares owned not directly. You may see this within the prime 5 recordsdata from August 31st, 2023, and November 30th, 2023. Additional, the MIH shares should not held at value. We have been marking them month-to-month. The worth we used for August 31st, 2023, was $7.18 per share. And for November 30th, 2023, we used $10.66. At year-end, we used $10.30 with the assistance of an out of doors valuation agency, and we’ll proceed to make use of that pricing by means of March 31st, 2024, once we’ll get a brand new valuation from the skin valuation agency. That is it from Judy.

Murray Stahl

Okay. So mainly, I am going to add somewhat shade to that. So the funds, South LaSalle, which we’re invested in, had the chance. Now and again, any person, remember, MIAX is a non-public firm. And other people ready for an IPO. And from time to time, somebody takes place. The IPO has not but occurred. Subsequently, the IPO won’t ever occur. I do not essentially agree with that, however such because the place and the individuals who truly consider that may supply shares up every now and then at preposterously low costs. So we’d be remiss in our obligation if we did not purchase them. And the fund raised some cash, and we take part in that. However mainly, the majority of the change in worth is the rise in worth. Now why is there — how does that worth get decided? It has two parts to it. First part is now we have an impartial valuation evaluation the place simply — it is in comparison with publicly traded exchanges and it’s totally conservative, in my opinion, however such it’s. After which the second quantity of it’s. Now and again, the corporate was a non-public placement. And that isn’t on the $7 worth. In order that will get taken into consideration within the valuation. That is how we arrived at that. So it is truly a reasonably good funding for us. I do not know what to worth what the worth we’re utilizing. Remember, lots of our shares got here from the merger between, Minneapolis Grain Trade, which we had been a giant holder of into MIAX and lots of them got here from the merger of Bermuda Inventory Trade into MIAX, and we had been huge holders of each of these firms. So I do not keep in mind what valuation we had been utilizing manner again in a day, but it surely was significantly beneath the present valuation. And all you actually must do even I do know it is a personal firm, however if you happen to go into MIAX web site, you take a look at the quantity, you might see how sturdy the expansion has been and lots of valuation despite the fact that it isn’t exact, so you may get an actual sense of how a lot advances adjustments in quantity as a result of quantity is a very powerful dynamic of an alternate. So I hope that addresses that. Different questions?

Therese Byars

Sure. Among the commentary on the problem of noncontrolling curiosity confuses me and appears a bit contradictory. Maybe Murray might touch upon his ideas as to how greatest to worth the corporate, notably with respect to the web asset worth of about $Four a share with out noncontrolling and about $Eight together with noncontrolling. I am attempting to worth of the corporate from my perspective, and particularly, what I might get as a public shareholder, if FRMO had been dissolved as of November 30th, 2023 with the proceeds being precisely what’s on the steadiness sheet. If I am decoding yours and Murray’s feedback appropriately, I as a public shareholder, would get $4.69, not the $8. Do you agree? If that’s the case, that reconciles Murray’s remark that the inventory is promoting for greater than guide, i.e., $7 plus versus $4.69 or about 160% of guide worth for the general public shareholders? Thanks for humoring my efforts at readability.

Murray Stahl

Okay. So for readability functions, it’s best to by no means, I repeat, by no means embrace the fairness that is not attributable to shareholders. So what you’ll get if we determine to liquidate the corporate, you are getting the fairness attributable to shareholders, $219 million, divided by variety of shares excellent, that is your quantity. That is what you are getting. The opposite quantity does not belong to the corporate. We want, nonetheless, to consolidate purpose we have to consolidate these accounting guidelines. There are two funds which have lots of outdoors capital, one is HK arduous property one, one is HK arduous property two. The overall property should not small quantity. I believe they gravitate, they modify daily, however they gravitate to round $200 million or thereabouts. And of the $200 million solely about 1/Four of that, and you may see it within the notes, I believe it is Be aware 1. Will not be 1 / 4, perhaps 22% belongs to Horizon Kinetics. However that shall be in our shareholders’ fairness. So $Four and alter is the suitable guide worth. The explanation we commerce at premium guide worth is, we’re constructing an actual cryptocurrency enterprise. And I personally suppose, and it is simply subjective, so take it for what it is value, I am additionally biased. It is not a good valuation in a unfavorable sense, it must be larger as a result of take any of the cryptocurrency mining firms that exist, that are many publicly traded. And I believe arguably, our is rather a lot higher, much more secure and has a lot, a lot much less threat to it. And I might argue it is much more profitable, that is measurable when it comes to our development in crypto, how a lot we produce, how a lot we retain and the truth that we do not want outdoors capital, which the opposite firms seem to do, why we commerce at a a lot lower cost to guide. I do not suppose it is there, however it’s what it’s, and there you’ve it.

Therese Byars

Subsequent query. I not too long ago turned conscious of FRMO, purchased a starter place, and I am attempting to grasp the small print of the enterprise as time permits. If attainable, I might like to get a greater understanding of the historical past of the enterprise and among the present enterprise nuances. Thanks.

Murray Stahl

Okay. So traditionally, it actually was created by Horizon, not the Horizon Kinetics. So there was a Horizon Asset Administration or Kinetics Asset Administration. The identical shareholders management each teams. However they had been separate firms. One was largely administration of cash for rich people largely, the opposite administration of cash in a mutual fund context. And we began that manner as a result of we thought the one enterprise failed, the opposite enterprise might go on. So we had two separate firms round parallel till and someplace round 2011 I believe it was. These companies merged and have become one, Horizon Kinetics. In roughly the yr 2000, Horizon had collected a specific amount of capital. We did not want it within the enterprise, however we did wish to make investments it. So our function was to search out some automobile the place we might be publicly traded as a result of we thought the everlasting capital mannequin is rather a lot higher mannequin for investing cash than the transitory capital mannequin, which is mutual funds. One of many issues with the transitory capital mannequin isn’t even the flows, cash comes, cash coming, cash goes. It comes on the worst attainable time. So once you get it, you at all times get it after a giant improve in internet asset worth. After which as a result of markets go up, markets go down. If it goes down, you find yourself dropping the cash. If you truly wish to purchase issues. So was mainly a automobile for investing our personal cash and maybe elevating some everlasting capital opportunistically if we had the flexibility and we truly did at one level a non-public placement raised just a few million {dollars} of property rather a lot simply to see if we might do it. And that is the best way it was. However then we accumulate a lot capital, we did not wish to merely be an funding firm. We at all times thought, we’d purchase a enterprise, and we would run our enterprise. And we checked out varied issues. And every thing we checked out, we both did not prefer it as a result of it is too time persevering with to run or it is too costly or it did not have a protracted sufficient life for us or we simply did not have the experience to do it. So it was eight years in the past, that we thought of cryptocurrency, and we made a small funding. And the concept was to study extra in regards to the enterprise and see if it might be a viable enterprise and basically summarizing right here, however that is mainly what occurred. So the following step in our evolution is to make a a lot larger working firm out of crypto. One of many attention-grabbing issues about crypto is you do not want lots of people within the enterprise. And one of many causes we did not actually wish to be concerned within the typical enterprise, it concerned an incredible quantity of individuals administration. Now whether or not or not it’s detracted from our consideration to different managers, may not even have had time to do it correctly. In order that’s, in short, the historical past. What’s subsequent, Therese?

Steven Bregman

Steven right here. I might simply add for Dr. Fink. It is not for me to assign anyone homework, however I believed that was a superb strategic summation, but when any person had been to need somewhat extra taste and sense of growing strategic shifts over time. The varied letters, the annual FRMO letters, that are on the web site can provide you much more attention-grabbing if you happen to’re , that form of factor, element and nuance if that is your line of nation, it is value to try.

Therese Byars

Thanks, Steve. Subsequent, any updates on the Horizon Kinetics merger with Scott’s Liquid Gold that Murray can share and likewise what affect will HK changing into a public firm have an effect on FRMO and the worth of its shares in your opinion. When the mud clears, what number of shares and what % of the shares will HK have and be held by FRMO? What % of the float in shares, yeah, it is lots of questions. Okay. Would you like the final one?

Murray Stahl

You would possibly as properly.

Therese Byars

Okay. What % of the general public float in shares of the brand new HK inventory could be? And what % of the excellent will that be?

Murray Stahl

Okay. So let me simply offer you some background that you do not know. One of many causes we — many causes for doing this transaction. One of many causes on this transaction are that when the founding shareholders of Horizon, small shareholder, however however, a shareholder handed away. So the heirs don’t have any need to personal shares in a non-public firm. So there’s solely two methods to unravel that. The primary manner is to purchase the shares from them. The second manner is come public. Now shopping for the shares from them is problematic as a result of though we are able to definitely give anybody full and full disclosure about what the corporate owns and what its prospects are, et cetera. The valuation assigned to any enterprise is subjective. So we’d assign the valuation of X and another person would possibly assign the valuation of Y. It is a pure battle. We actually did not wish to try this. So we determined the very best factor to do is disclose every thing to the world, simply come public. And if you happen to personal shares, you might both promote it or you should buy the shares. Now the float. Horizon is a non-public firm. So none of these shares within the public area shall be within the public foremost on day one. The one shares in public area is Scott’s Liquid Gold, which is about 2% of the shares. So now — however you realize there are going to be some promoting shareholders. I personally am not amongst them. However look, nobody’s right here perpetually. And among the persons are getting older. And it is solely pure they could need some liquidity. So I can not offer you a quantity apart from the two% quantity as a result of in spherical numbers, that is what Scott’s Liquid Gold goes to — that is the float. And I think there’s going to be another float. However I can not know the quantity. I simply do not know it, so I can not share it. There’s lots of documentation and this can be a reverse merger. So there’s lots of documentation is put collectively. As preparation for doing it, we truly employed a CFO with public firm expertise as a result of there is a mountain of labor that must be performed to finish this transaction. And it took a sure period of time simply to search out after which rent the CFO with firm expertise. So we’re pondering perhaps July transaction we consummated. I do not know that. It is simply what I am informed and in a merger of this kind. Regardless of what number of belongings you do, there at all times appears to be another factor to do. So I do not know if that deadline shall be met. I believe it’ll be met. It seems good proper now, however you by no means actually know the — now will it — how will it have an effect on the FRMO monetary statements, it’ll have an effect on FRMO monetary statements. Why is it going to have an effect on that? As a result of I’ll use quantity 2%, it isn’t the precise quantity. Scott’s Liquid Gold has a market capitalization. So I imply if it finally ends up being 2%, once more, it isn’t actual. I am simply utilizing this for luxurious functions, you bought to get the precise quantity. I am certain if you happen to known as Horizon, yow will discover any person who gives you the precise quantity. However as an instance the quantity is 2%. So that they informed me the precise quantity, however I simply do not keep in mind to what number of decimal factors it’s, however it’s best to get to the X decimal factors. You are taking the Scott’s Liquid Gold market capitalization, as an instance, we’re 2% to be used of computation. So the Scott’s Liquid Gold market capitalization is X. You divide it by 0.02, 2%, that gives you market capitalization for the whole factor. FRMO goes to personal somewhat bit lower than 5%. Once more, I do not know the precise quantity, however within the footnotes, of the FRMO report, yow will discover a quantity. I simply do not memorize numbers like that. However in any occasion, if you happen to now take Scott’s Liquid Gold, the market capitalization, divide by 0.02 and multiply by level, I believe it is 0.0483 or one thing or perhaps it is 0.049, I do not know, some quantity like that. So if you happen to did that, you’ll provide you with the worth the carrying worth that FRMO ought to have in the event that they marked Horizon to market, which we do not do. And it’s best to try this. And if you happen to do it, you may see that the steadiness sheet values will change. It is going to be materials. So I can in all probability do the quantity in my head and provides it to you, however I informed you methodologically, how you can do it. So it’s best to try this. And now you may know the solutions to the questions you are posting.

Therese Byars

Okay. What’s the intrinsic guide worth per share? For those who modify for deferred taxes, the honest worth of the personal companies, the honest worth of the general public companies and the honest worth of the crypto holding?

Murray Stahl

Effectively, the crypto we mark-to-market, the general public companies we mark-to-market. The personal companies, these shall be examples of MIAX and the Canadian Securities Trade didn’t market valuations. They’re simply valuations as conservative as they’re given by a third-party. Horizon is that manner. I simply informed you how you can do valuation I do not know what the IPO worth goes to be. Effectively, I simply have to search out out. So I can not — despite the fact that I’ve my suspicion of what it’s, however I do not suppose it could be correct to touch upon apart from it’ll be a quantity, clearly. However within the Horizon case, you may see it’ll be increased. So it is a increased quantity. Within the case of MIAX, you see the worth is, it is clearly going to be much less essential. Arithmetically, that is apparent, from the monetary assertion, then Horizon goes to be — after which there’s the crypto enterprise. So we do not know what the enterprise of Consensus mining goes to be, however we do not have lots of shares but. In order that’s one thing to thought-about, however I do not suppose the change goes to be materials. I simply suppose that cryptocurrency mining companies which are properly managed, which I consider that is commerce or ought to commerce at huge premiums and asset worth. They usually all do, despite the fact that not all of them are notably properly managed. In order that’s so far as I can go along with providing you with what the valuation could be.

Therese Byars

It has change into more and more irritating watching the world of crypto property explode to the upside, but the share worth of FRMO Corp has not moved an inch. The final time Bitcoin made a run to 60,000 per coin. The share worth of FRMO was buying and selling above $14 per share. Now Bitcoin is at 70,000, and FRMO has not participated in any respect. What will be performed to verify shareholders are rewarded for his or her endurance? The investments you’ve made for this firm have been improbable. However in the end, the corporate shall be judged by share worth, not the guide worth. So do you take into account inventory buybacks, dividends, a reputation change and uplisting to attempt to improve the worth?

Murray Stahl

Effectively. Go forward and end if you happen to I could also be .

Therese Byars

No, no, that is on a unique subject within the subsequent half.

Murray Stahl

Okay. Okay. Effectively, anyway, I consider it’ll get its valuation. None of these issues are an issue in FRMO when it comes to valuation. The issue is all people owns FRMO just about likes FRMO. So no one actually desires to promote their FRMO. So it’s totally arduous for a brand new shareholder of substance to get shares. And due to this fact, you might uplift you are able to do all types of issues. You would change the identify, you should buy again shares. For those who purchase again shares, all you are actually going to do is make it much less liquid. That is not going to assist, it is in all probability going to harm. So if you happen to actually wish to get the valuation, it’ll must be extra liquid. And it’ll be extra liquid as a result of the identical dynamic of Horizon when it comes to shareholders needing liquidity it’ll occur in FRMO. Matter of reality, to a really small extent, it is already occurred. So within the fullness of time, that may — the liquidity drawback will remedy itself and we’ll get the valuation we wish. If it does not occur the following logical factor to do is do an fairness carve-out. So perhaps when now we have the place we’re lastly — if we ever get to a place the place we consolidate crypto folks can see that may do it if now we have the suitable liquidity, then if it does not do it, we are able to do a carve-out, which means we do an providing to a subsidiary. For instance, it is crypto subsidiary, make that public, so folks can see the worth of crypto as a result of proper now, there isn’t any particular person line merchandise the place you might summarize all of the crypto. So how do you worth Horizons, I imply not Horizon, from these crypto efforts. There is not any line merchandise to that. And that is what we’re attempting to unravel. So within the fullness of time, I do not suppose the fullest time goes to be lengthy. We will get to all that stuff.

Therese Byars

Okay. This query is somewhat off subject of FRMO. He stated I do know Murray actually likes the oil royalty belief positions. One among his bigger positions is Permian Basin Belief. It has been hit arduous up to now this yr buying and selling down 50% within the final yr. Would you touch upon why that is and if you happen to nonetheless like this firm?

Murray Stahl

Effectively, I like the corporate, and there’s a dispute. So you might recall when there was a Horizon TPL dispute, though firm carried out splendidly, the inventory went down by 50% when it was dispute. In Permian Basin Belief there’s disputes. It is not the identical dispute as we had with TPL. The operator is accused by a shareholder, not by the trustee, though on behalf of the shareholders, is accused by a trustee of getting too many capital fees that weren’t reliable. So the problem is how a lot money stream, how a lot dividend ought to Permian Basin have. That is going to must be resolved by the courtroom system. And so what occurred in Permian Basin Belief is form of the identical as what occurred TPL with, I’ll say, this the salient distinction. So I dare say this, the — in TPL, you may not consider this, however sure, we had our dispute, clearly, it was in courtroom, however if you happen to had been sitting there within the Board assembly, you may be amazed how remarkably cordial the proceedings actually had been. And the rationale was is as a result of we had dispute. It wasn’t a financial dispute. However extra to the purpose, we agreed on over 99% of the problems. So this isn’t that form of dispute and it’ll be resolved in any manner. So it’ll must be clarified. And it’ll get clarified in the end. So both the — some shareholders are proper and the corporate simply put in too many capital fees or they’re incorrect however we’ll get the suitable quantity. We will discover out. So I personally would not fear about it very a lot. Identical to through the dispute, you could not see it. it is my perspective, after all, however all people is working collectively, I might say, fairly productively. Might need had our odd second once we’d expressed disagreement on sure subject that everyone knows what that was. However apart from that, it is fairly nice being there. That you just would not think about that was the case. But it surely actually was. That is perhaps going to be somewhat extra profound within the case of Permian Basin Belief, however it’s going to resolve itself in the end. So I’m not fearful about it in anyway. And we had been shopping for extra shares of Texas Pacific as any we are able to see from our filings through the controversy, and we’re shopping for extra shares of Permian Basin Belief within the place the place it must be purchased.

Therese Byars

My query is for each Mr. Stahl and Mr. Bregman, is what’s one factor every of you consider FRMO shareholders both do not perceive or recognize about FRMO?

Murray Stahl

All proper. So I am going to do first I do not suppose the evolution of FRMO to an working firm is appreciated as a result of it is taken so lengthy essentially. In order I indicated earlier, however that is the one factor I might say that is essential. I am going to let Steve, you can provide your appraisal.

Steven Bregman

Effectively, there are literally many, and I believe they mirror the variations between the administration and due to the administration, the structural and strategic philosophy and implementation of FRMO Corp versus the standard working firm, which is what buyers are accustomed to as a result of why should not they be accustomed to it. So I am going to identify a pair even. So for example, money. So there’s an terrible lot of money and successfully money and marketable securities on the FRMO steadiness sheet. And I am certain just about everybody on the decision, anyone who follows small worth oriented firms realizes {that a} enterprise does not get any form of valuation a number of on money. Though in a way of money is essentially the most fundamental priceless factor you possibly can personal throughout tough occasions or in occasions when it may be a possibility. The truth is, generally firms promote at a reduction to their money or the money is discounted on the steadiness sheet when it comes to its public market worth. And but, there’s this factor that occurs that you could have an organization that on the final day of a sure month, owns a bunch of money on the steadiness sheet. And within the first day of the following month, that money has been invested in one thing, some asset. It does not matter what you name it. Name it, you realize, a giant workplace constructing or some actual property property or one thing else or a unique firm. And rapidly, folks will apply some a number of, perhaps a giant a number of of that money that is now within the type of the brand new property that is been bought that may occur in a single day. As Murray has already described, there are extra parts of companies inside Horizon Kinetics and FRMO Corp which are on their method to changing into public. And also you get the best a number of for any enterprise within the public markets. And Horizon Kinetics can have its some type of public valuation and that may get us extra eyeballs and legitimacy and so forth and so forth. And I would like to say, it is attention-grabbing that the questions we’re getting as we speak for this explicit convention name. There are lots of extra members in it than we have had earlier than. New names I do not acknowledge and the breadth of questions are larger. And if that is any form of indicator of the earliest daybreak, the early gentle of extra curiosity between Scott’s Liquid Gold and among the different companies which are pending relative to the general public markets, then we’re on target so far as valuation goes.

Therese Byars

Okay. I’ve been informed that nodes have extra management over the Bitcoin blockchain than miners, is that true? Does FRMO or any related firms like Horizon Kinetics or TMST up or run nodes. May they clarify the distinction, please?

Murray Stahl

Okay. To start with, we do not run any nodes. However no one runs — no one has management over the blockchain. No miner has management over blockchain. No node has management over blockchain. The miners present a service of validation of transactions. Nodes are simply aggregations and miners that allows miners to speak with each other. That is it. There’s nothing mystical about it. The entire thought behind Bitcoin is, it is decentralized. No one is meant to have management over it. As a result of each time any person will get management over financial system, you see what occurs. It will get abused. So but it surely’s very arduous for folks to consider that as a result of it’s very outdoors of your expertise. So let’s use this for example. We, residing as we speak in our lifetime, we do not know something apart from the central financial institution system of fiat cash. We by no means skilled anything. Now you might say we in FRMO, we skilled one thing else. However only a few folks expertise one thing like that. They take a look at the worth of Bitcoin. And even that’s the incorrect manner of life. You see they’re Bitcoin as if it is some form of inventory. It is quoted. Bitcoin is buying and selling at x, however that is not true. Bitcoin isn’t an asset in that sense. Its worth is relative to the fiat forex, you may say, properly, Bitcoin went up a lot % over the course of its life, not true. So greenback misplaced worth in relation to Bitcoin. If we had been priced that manner so as an alternative of Bitcoin going up x %, if somebody stated the greenback misplaced x % in relation to Bitcoin, folks would say, my God, my {dollars} are dropping worth in relation to Bitcoin. Everyone would then attempt to purchase Bitcoin. They simply suppose it is a inventory. So they do not actually know what it’s but. So nobody has management over the blockchain. There’s not going to be any scarcity of Bitcoin regardless of how excessive it goes. As a result of and I’ll confuse folks by saying it, but it surely’s nothing apart from the reality, and perhaps you possibly can ask a follow-up query, and I am going to make clear it. If there ever was such a factor as a scarcity of Bitcoin, you possibly can at all times fork the Bitcoin Community, anyone can do it. I can do it myself if I needed to. I might change the properties of Bitcoin, I might make them the identical, I might tweak it. I might do no matter I wish to do. It hasn’t been forked.And persons are going to make use of to fork, they are not going use to fork. So no one is controlling of something in Bitcoin. That is the advantage of it as a result of no one can achieve the system. No one has the facility to control the rates of interest, no one has energy to control the cash provide. The issuance goes in accordance with a predetermined protocol and that is the best way the system works. So it is actually quite simple.

Therese Byars

Would you, listed here are some questions. There’s — what are your insights on mining Bitcoin reasonably than straight buying Bitcoin in addition to Bitcoin Money shall be appreciated. It goes on, FRMO has pursued a Bitcoin mining technique for a number of years. On prior convention calls, you’ve listed the numerous challenges that Bitcoin miners face, i.e. periodic discount of block rewards, obsolescence of rigs, rising hash price and electrical energy prices, et cetera, and the wanted abilities to navigate these challenges. It seems to me that the returns from shopping for Bitcoin to US {dollars} have outperformed buying the publicly listed miners for many time durations. FRMO has $38,822,891 in money and money equivalents as on February 29th, 2024. Why does it not greenback value common buying Bitcoin as a part of its money administration technique for the reason that buying energy of the US greenback is being diminished by inflation? And there is a few extra, however I believe I am going to cease there.

Murray Stahl

Okay. Let’s reply this primary. Let’s simply reply this one then we’ll get the opposite ones as a result of it could be a cardinal error. As a result of the aim of the cash is to not defend towards the basement. You would possibly say it’s being debased by inflation, you is perhaps proper about that. However on this planet of cryptocurrency mining gear, the particular person energy of greenback goes up. So it is there as an insurance coverage coverage. If the general public commerce miners get in hassle as it’d occur, perhaps we might purchase a sure asset, that is actually low-cost that we wish. So put it this fashion, you aren’t getting a return on insurance coverage. Insurance coverage protects you towards sure contingencies that you simply hope won’t ever occur. Normally, it do not occur. So is {that a} dangerous use in capital. For those who spend cash on insurance coverage, I might take a look at it this fashion. It is there to offer for sure contingences. There shall be alternatives in some unspecified time in the future, we’d use some rollback that money. We would not, is dependent upon what occurs. However the function is to not maximize the return that manner since you’re by no means going to maximise return that manner. We’re totally invested if you happen to — it isn’t a portfolio. It is a company. It is bought to have a sure natural price of return. So in an organization, plenty of firms traded at huge premiums to guide worth, they usually have money. In a portfolio, you actually do not wish to have any money apart from transactional balances, but it surely’s not a portfolio. It is a residing, respiration, rising company. It is simply not obvious to those that it’s. And that solutions by the way a query that was posed earlier than why it does not have the next valuation properly as a result of the query is, is it a portfolio? Is it an working firm? If it is a portfolio, so we did that and we took the money and we put all of it into Bitcoin, as an instance, or perhaps left just a few {dollars}. I assure you, in my private opinion, we commerce at a decrease and the next valuation. As a result of there is not any — we gave away optionality, cannot try this and count on to commerce your premiums and asset worth. So I believe that addresses that. I hope addresses that so why do not you learn the remainder of it.

Therese Byars

Additionally it seems that MicroStrategy’s apply of issuing convertible debt at low rates of interest has labored properly for the corporate and the purchases of its debt. Have you ever thought-about doing one thing comparable?

Murray Stahl

No, I’ve not thought-about doing one thing comparable, and I haven’t got any intention of doing something comparable. And that coverage isn’t with out its dangers. So that you by no means know what is going on to occur to a crypto forex. The entire challenge might nonetheless fail. It is attainable. So if it fails, the very last thing you wish to do is have debt towards your main asset, which is crypto. So debt and crypto don’t combine very properly. And the inventory exchanges are suffering from the casualties of firms that determined to make use of debt capital to finance cryptocurrency purchases. On this explicit case, it has been profitable, however many individuals tried that technique, and I will not checklist the names, however they’re in public area, did not work out that properly. May have labored out properly, but it surely simply did not. Keep in mind, once you tackle debt, debt needs to be paid on time and also you lose your strategic flexibility. So only a threat, I do not really feel like taking. I do not suppose we have to. So now we have it. So what is the subsequent query?

Therese Byars

Okay. The following a part of that one. On prior convention calls, you’ve talked about that Bitcoin Money might doubtlessly recognize rather more than Bitcoin on account of its comparable financial coverage, however decrease value per level. As of February 29th, 2024, 6.71 Bitcoin Money are held by FRMO and 0.33 Bitcoin Money are held not directly. This quantity is round US$2,200. So I am curious as to why it has not been invested why it has not invested a bigger de minimis quantity into this coin given its potential appreciation.

Murray Stahl

Effectively, since you need not mainly. If it really works, you solely have a small variety of shares. You should purchase it immediately earlier than you go on. In my level, the quantity, as an instance, Bitcoin Money held straight — held not directly to non-public — private and non-private firm use 62,017 held straight 2,382. And people are Bitcoin Money Funding Belief. And now we have some Bitcoin Money shares Bitcoin Money cash itself, the numbers we learn appropriately, 6.74, 0.33, respectively. These numbers are going to alter and go up. As of February 29th, we hadn’t but mined lots of Bitcoin Money in Winland. And given our holdings in Winland, I believe, in the end, you are going to see much more Bitcoin Money. So mainly, if it goes up, it is going up by a staggering quantity. So you do not want rather a lot. All it’s worthwhile to have is sufficient to make an impression. So that you take a look at the price foundation of GBTC, Grayscale Bitcoin Funding Belief, you possibly can’t see it on this. However we made a small funding. Now it is only a large worth. You do not want a giant funding. You need to have simply sufficient funding that if it really works, you are going to make a positive impression upon the web asset worth. And if it does not work, you are going to dwell to battle one other day. That is the philosophy. So what is the subsequent query?

Therese Byars

Okay. Given FRMO and Horizon Kinetics thesis of investing in under-invested arduous property. Why have investments in coal-related equities been prevented? Extra particularly, what are your ideas on the funding deserves of the asset-light coal-related partnership Pure Useful resource Companions, NRP?

Murray Stahl

Okay. We have not invested something in coal. And the one one purpose for that, I do not suppose coal goes away. Nonetheless, utilization of coal in america, it’s declining. However extra importantly than that, the federal government is extraordinarily hostile to coal. So we simply do not wish to put money into a enterprise that the federal government is absolutely hostile in the direction of. And so far as I can inform, they are going to be much more hostile in the direction of. So now we have different issues to do with our cash. I do not suppose they are going to have the ability to make coal in america within the foreseeable future, perhaps not ever. And by the best way, in line with Worldwide Vitality Company, globally, 2023 was the document yr for coal consumption worldwide. So but it surely’s a battle that we simply do not wish to be a part of. That is the one purpose for not investing in it.

Therese Byars

Wanting on the newest stories from Winland Holdings they mined 56 Bitcoin in 2021, 71 Bitcoin in 2022 and solely an extra internet of 75 Bitcoin in 2023 on account of promoting of items in that yr. Given administration’s previous feedback on the advantages of an working Bitcoin miner that banks of Bitcoin earnings and accrues that to its steadiness sheet versus spot ETFs that almost all in the end promote parts of their holdings. Why did Winland, which has been successfully run by Horizon Kinetics promote the vast majority of the Bitcoin in thoughts in 2023, which in the end resulted in realized losses on gross sales of Bitcoin per Winland’s most up-to-date annual report, Be aware 17. How ought to buyers take into consideration the speed of accumulation of Bitcoin at Winland?

Murray Stahl

Effectively, there was — the speed of accumulation decreased as a result of the gear was beginning to get previous. And the one manner you possibly can treatment that’s machines went out offline and you bought to pay the electrical invoice. The electrical invoice is huge. So and we’d like cash to purchase new machines, we bought to interchange gear cycle. So the main asset now we have is that. So cash has come from someplace. So we’re going by means of an gear cycle. We managed to develop the variety of cash, it simply is not develop at historic charges as a result of we’re nonetheless going by means of gear cycle. And I believe you may see within the subsequent couple of months, you may see we have navigate efficiently. We did not challenge shares, properly, truly, we did challenge shares to FRMO, but it surely definitely wasn’t a giant quantity. So simply going progressively and rising our Bitcoin holdings. And in addition, remember, one other issue is we moved machines from Bitcoin to Bitcoin Money. So now we have much less machines engaged on Bitcoin. And one other issue is in our alternative gear, we had mined Litecoin earlier than. We spent some cash on shopping for Litecoin gear which we might have purchased Bitcoin gear to maintain the speed as excessive because it was earlier than. However Litecoin is extra worthwhile, they wish to diversify.

Therese Byars

Prior to now, administration has talked about that one of many foremost advantages of an asset-light arduous asset firm is the flexibility to take a position countercyclical versus the broader trade that the asset-light arduous asset firm could also be part of. Maybe I am mistaken on this, however FRMO didn’t seem to make important investments through the 2020 COVID market shocks or within the 2022 crypto winter regardless of the corporate’s robust steadiness sheet. In 2020, administration commented in a quarterly assembly that they didn’t see any alternatives to purchase a complete working enterprise, but Winland seems to be the goal for that function and has been in FRMO’s portfolio since round 2015. Why did not FRMO use its massive money steadiness within the depth of the 2022 crypto winter to complete shopping for out a majority of stake in Winland? It doesn’t seem because it’s doing. So would it not have been a mutually unique or contradictory resolution to FRMO’s step-wise technique in shopping for new mining gear? What sort of occasion would spur administration into utilizing the money steadiness of the corporate, if not a world financial shutdown on our 2008 second within the cryptal trade? It ought to have appeared that purchasing up the remainder of the focused 51% stake in Winland would have been solely a small portion of FRMO’s money steadiness through the latest crypto winter? That is the top of that query.

Murray Stahl

Effectively the latest crypto winter was about the truth that different folks had been shopping for — had been issuing shares excellent earlier than the crypto winter. What value crypto winter is lots of firms issued shares and acquired lots of cryptocurrency mining gear. That gear recognize in worth. Sixfold, which means the worth at which you might have purchased a machine proper earlier than the crypto winter. After which on the eve of the crypto winter, the worth machine went up, I believe, from $2,000 to main mannequin was in to $12,000. At one level, you even bought to $14,000. So, sure, it was happening as a result of the machines had been being marked down. So to purchase the machines through the crypto winter could be to take machines which are destined obsolescence, who we would must worth the shares with the machines at their then market values. Shares that we knew in a few years, machines we knew it in a few years are going to be nugatory. And we’ll pay $12,000 a machine. I do not suppose so. So we did not do it.

Therese Byars

Given the small relative scale of Winland versus FRMO, what’s administration’s aim enrolling FRMO into Winland as an working enterprise versus doing crypto mining at FRMO itself at a scale commensurate with FRMO measurement? Winland presently makes up round 2% of FRMO’s property, complete property. How would this ever be of fabric worth to FRMO?

Murray Stahl

Effectively I am going to offer you two solutions to that. First reply is, there are different shareholders Winland that do not wish to promote their shares in alternate for FRMO shares. So we do not management every thing. That is primary. And I assume you might say as well as, you say it is 2%. For those who return to the start, the primary report that FRMO issued to the general public, I do not keep in mind the quantity, there is a small quantity of capital on the steadiness sheet. It is actually small. And somebody requested me virtually the one other query was simply this. Have a look at the capital. It is so small. How can they ever develop? Something materials? Effectively, take a look at the capital is as we speak and take a look at the capital is then, and you’ve got the reply to the query. Cannot choose it by the % weight it’s proper now as a result of if that was true, then the we did not — we weren’t promoting shares to the general public. May have argued you do not have sufficient capital at first. It was actually a really small sum of money. You need to increase extra capital. So you’ve cash to work with. Folks raised that time, and we did not regard it as the suitable method. And we did not do it. I believe we’re very pleased we did it proper now.

Steven Bregman

That was $10,000, if I recall correctly and $0.00.

Murray Stahl

One thing like that. There was one thing like that. Now $10,000 is a rounding error. After I say a rounding error, I actually imply a rounding error, which means that if it did not occur, in the event that they ever dispute about $10,000 it isn’t thought-about to be in a normal firm with our property. $10,000 dispute isn’t even thought-about legally to be materials. And there was a day when $10,000 was our capital. So once they let you know once you meet with accountant, they let you know $10,000 discrepancy, if you happen to had been to search out one, we take into account to be immaterial. It is truly loopy when you consider it. I do know that is the reality, however we do not have $10,000 discrepancies. However we did, and we take into consideration, sure, it was $10,000 at first. How might it not be materials? But it surely is not. So these are the legal guidelines all people has to abide by. Jeez, what’s subsequent, Therese? Is she nonetheless there? Are you there? Hi there?

Steven Bregman

If not, Murray, I can learn the query.

Murray Stahl

Okay. Why do not you learn it.

Steven Bregman

Within the absence of Therese till she returns.

Murray Stahl

Okay.

Steven Bregman

How does administration take into consideration the dearth of clawbacks of Bitcoin Money within the case of fraud and the way that hinders adoption. By this, I do not imply the Bitcoin blockchain being hacked, however reasonably the rather more frequent occurrences of individuals having a Bitcoin seed phrases, addresses personal keys and subsequently, their Bitcoin Money itself stolen from them by tricking them into pondering they’re a reliable entity. Hacking makes use of private computer systems, another type of trickery or simply taking place to see them getting into their seed phrase on a pockets over their shoulder at a espresso store. In relation to adoption regardless of over 10 years of growth, Bitcoin seems to go away little room for error and no client protections, which makes it arduous to think about how mainstream Bitcoin adoption would work? Requested one other manner, suppose one of many US Federal Reserve banks all needed to publicly maintain Bitcoin and requested Horizon Kinetics to advise on how that Bitcoin must be acquired, saved securely, probably transferred at later occasions, how would you advise the banks? How would you advise a family with the dearth of clawbacks, each storage mechanism and good contract is only a bug of bounty reward ready for somebody to find the code, exploit or social engineering that breaks it?

Murray Stahl

Okay. In order that’s a great query. So let’s simply reverse it although to reply it. To be able to defend the shoppers as prompt, you would need to have Bitcoin some enforcement company, to have the ability to name it again, you would need to centralize it. So if as a result of some folks would argue, was it a reliable fee? Or what’s it a fraud? And any person have to find out that. So that you mainly create a government that has the flexibility to make the principles and implement them. You’ve got now destroyed Bitcoin. So the best way it really works in the actual world of decentralization is you are — you need to watch out together with your cash. So if you are going to sit in Starbucks, because it suggests within the query, and somebody is wanting over your shoulder, in the event that they’re actually wanting over your shoulder they usually steal your cash. I hate to be cool about it, so that you’re a troublesome luck. Sure, Therese.

Therese Byars

I am sorry. This name was dropped on my finish. I do not know the place I used to be on this very long time.

Murray Stahl

That is okay. Steve simply raised the query, and we’ll get that. I used to be in the course of answering the query. Okay. So the very last thing you wish to do is create a centralized authority in Bitcoin. Sure, the seed phrases get stolen. Sure, the personal keys get stolen. Individuals are careless and only a myriad of how. And I hate to be cool about it. It is robust luck. As a result of the choice, you are again to centralized authority and now you are giving monumental energy to the actual rascals. You don’t need that. So if you happen to do not wish to take the possibility, you’ve two choices. That you must be very, very cautious together with your cash otherwise you will be sloppy together with your cash, and you are going to have to just accept the implications. However for one I believe communicate for nearly all people within the Bitcoin neighborhood, nobody’s going to go for making a safety. So as an instance, america authorities imposed a rule saying, okay, we’re now going to take cost of the system.W ell, what occurred, we’d fork Bitcoin and in the event that they could not fork Bitcoin, they fork Bitcoin Money or they could not do something. They simply — as a result of all people is aware of what protocol is. It might be an issue. And by the best way, the quantity of lack of cash by means of this may be mitigated by simply utilizing a good custodian like Coinbase. You do not have to do any of that stuff by yourself. So the market will determine options. For those who actually need safety, there are market options. The federal government isn’t a type of options. It is the worst attainable resolution. So anyway, if the federal government tried to impose it, Bitcoin be forked or the protocol would simply be rewritten or copied see no one is aware of what the hacking mechanism, the antihacking mechanisms are on the huge banks. Nobody is aware of what number of occasions they get hacked. All we all know is that they carry lots of insurance coverage. It occurs a hell of much more ceaselessly than it ever does in Bitcoin. So if you happen to’re fearful about it, take your cash transfer into a spot like Coinbase or Constancy, and now it is their drawback they usually’ll take care of it. So that is the market resolution, not the federal government, for my part.

Therese Byars

May administration present insights into the rationale that might be used for valuation of Texas Pacific Land Belief, the Land Corps, Land Holdings notably in gentle of questions across the viability of ongoing and future developments. The floor land appears largely uncooked and barren and has restricted growth potential. Particularly, I’ve issues concerning the nominal lease charges similar to a budget per acre per thirty days lease value per cattle operations and the environmental challenges related to the area, together with restricted water assets and sparse inhabitants density. How does TPL justify the perceived worth creation potential of its intensive land portfolio beneath these issues.

Murray Stahl

Okay. So it isn’t my job to talk for TPL. So I’ll reply the query the next manner. I am simply going to speak about land typically. So a TPL acre, a neighboring rangers’ acre, they’re just about the identical. So let’s discuss in regards to the land within the area. So one of many issues that nobody ever talks about is that they suppose land goes to be developed as a result of they are going to herald huge populations to folks and construct faculties and hospitals and all types of different issues. Not too many acres is that going to occur. So proper now, within the Permian Basin produces Eight plus million barrels of oil a day, okay? Good by fracking. So that you pump water and a few propants, that are chemical substances into the land and outcomes oil and fuel. The addition to grease and fuel, what comes out of floor for each barrel of water you pump down there, it is roughly 5 barrels of oil, which known as, I imply, 5 barrels of water, which known as produced water comes up. What are you going to do with it? You bought to place it someplace. You may’t transport it very far. It is too costly as a result of water is heavy. You may make some efforts to recycle it, and it is performed in some instances, but it surely’s lots of water and it’s totally costly. So what they do with that is they get rid of it by pumping it again into the bottom. Now to present you an thought of the magnitude of the issue, I say a barrel of oil, only a few folks know what a barrel oil is, a barrel of oil or a barrel itself a barrel of water. It is 42 gallons. Nobody is aware of what a barrel seems like, if we do gallons, everybody is aware of what gallon seems like. So you are taking Eight million barrels occasions 42 million — 42 barrels per every barrel of oil, multiplied by doing this proper, sure. So it is Eight million barrels of oil, 42 gallons in a barrel. So now that is 336 million per day occasions 5. That is 1.68 billion to be gallons of water needed to be disposed of every day. So the worth to land is what’s beneath the land. And the — there’s solely a finite quantity of land that can be utilized for that function, and we’ll run out of land in the future. So the worth for injection in produced water retains going up. It was, a few years in the past, $0.01 a barrel. Now it is perhaps $0.06 a barrel and $0.50 and even $1 a barrel on day is quickly conceivable. So if you happen to begin figuring in how a lot, as an instance, as an instance, an acre of land. And as an instance, for a yr, I am making up numbers, simply to present you — present you the way enormous these aren’t actual numbers. So as an instance you might pump 60,000 barrels of water into the bottom daily for a finite time frame. Effectively, 60,000 barrels of water is when it comes to gallons, 2.5 million gallons a day. So if you happen to’re getting, as an instance, $0.01, properly, as an instance you are getting $0.10. In order that’d be $6,000 a day. So you might do it for 365 days. Possibly they’re going to do longer. In order that’s $2,190,000 with no expense related to simply giving any person proper to place water in your property, underground. So let’s do it once more. It is 60,000 barrels a day, if that is what the quantity was. It is $0.10 a barrel. $6,000 a day, occasions 365 days at $2,190,000. They will solely do it for a yr. The acre of land this has no significant property on it, that acre of land, perhaps you might purchase it for $500. That is what they valued at. But when just for a yr, you get $2,190,000 and you continue to have the acre floor land remains to be there. Subsequent factor, easements. Ultimately you are going to run out land and go additional out? Effectively, you possibly can’t put any extra water in that acre, however you bought to deliver the water some place else and any person has to have a pipeline that traverses your land and also you get a lease on that. So the acres you save value $500 an acre. Effectively, what do you suppose they are going to cost any person for straight away. I believe it is $500 a yr. Even it was that is 100% return on capital. What if it was $10,000 a yr? What if have you ever had 400,000 acres and all you bought was an easement, $10,000 a yr. Effectively, it is 400,000 acres of Class B land, $10,000 a yr. That is in all probability even $1,000 a month. See what that’s, that is $Four billion would it not be money stream with no bills towards it. That is the after the produced water. So I believe these figures I can do different form of issues. I believe these figures communicate for themselves. Those who find out about them as a result of the produced water drawback solely turned a giant deal a few years in the past. And numbers haven’t gotten to the scale and the worth to dispose the barrels haven’t gotten to a degree the place it is an issue. But it surely’s quickly moving into that route. In order that’s the worth proposition amongst different issues, I might say.

Therese Byars

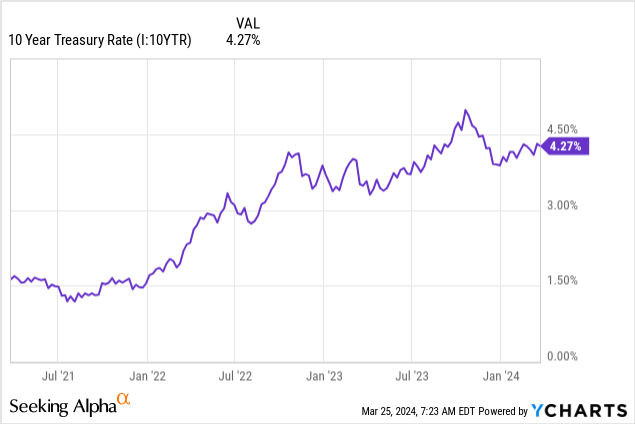

Okay. In previous commentary, administration has talked about how low rates of interest are basically anomalous. Why would rent for longer rates of interest and tougher entry to cash be good for securities exchanges, equities and futures buying and selling bonds, that are, by and huge, traded on March?

Murray Stahl