Tom Werner/DigitalVision through Getty Photographs

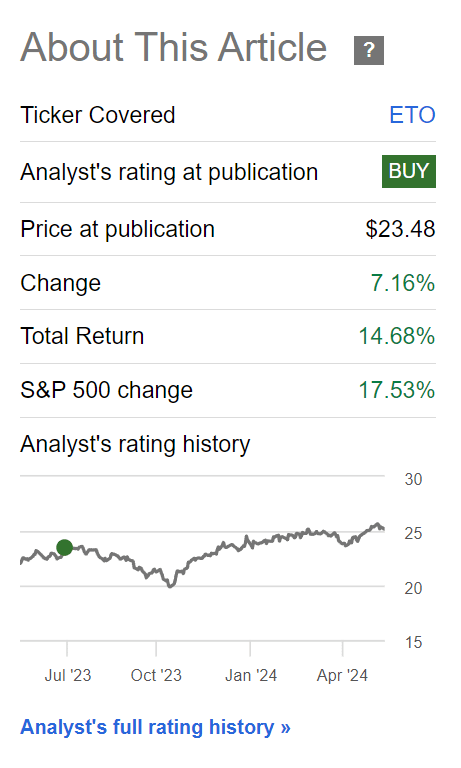

Final summer time, I wrote a bullish article on the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund (NYSE:ETO), noting that it was a stable international equities fund paying a pretty ~7.0% distribution yield that’s properly coated by the fund’s historic returns.

My optimism was not misplaced, because the ETO fund has returned 14.7% in whole returns since July (Determine 1).

Determine 1 – ETO has returned 15% since July 2023 (In search of Alpha)

Finest-In-Class Returns

ETO’s returns are particularly spectacular as a result of the fund has saved tempo with low-cost passive ETFs just like the iShares MSCI World ETF (URTH) since July (Determine 2).

Determine 2 – ETO vs. URTH, since July 2023 (In search of Alpha)

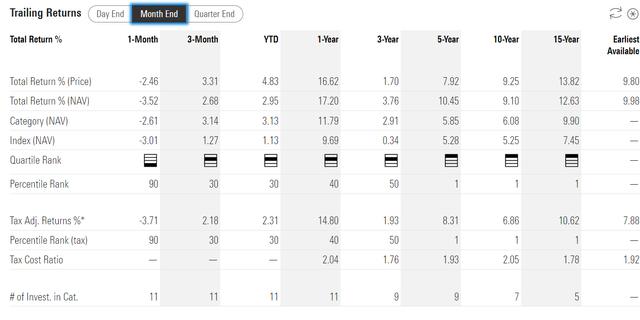

In actual fact, ETO’s robust efficiency previously 12 months has not been a fluke, because the ETO fund is constantly ranked as a first- or second-quartile fund towards its Morningstar International Allocation friends on a 1/3/5/10/15-year foundation to April 30, 2024 (Determine 3).

Determine 3 – ETO historic returns (morningstar.com)

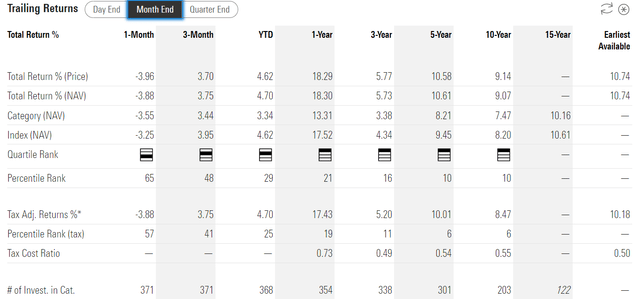

Determine Four exhibits the historic returns of the URTH ETF for comparability. The ETO fund has been in a position to hold tempo with the URTH ETF on a 5- and 10-year foundation regardless of the fund’s considerably larger charges and concentrate on dividend-paying securities, which are likely to lag development shares.

Determine 4 – URTH historic returns (morningstar.com)

Not Afraid To Deviate From Indices

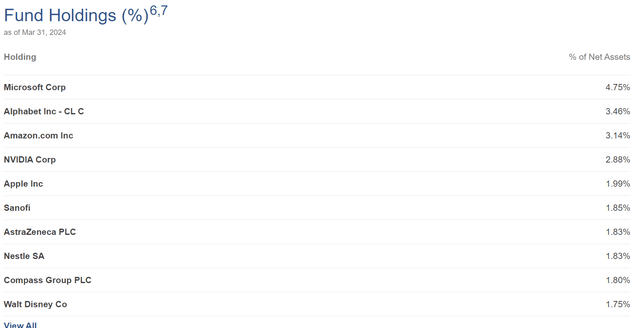

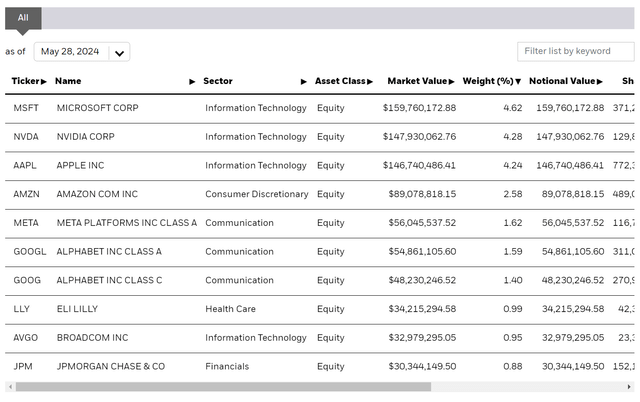

What has been the motive force of ETO’s robust efficiency? Whereas the ETO fund holds top-10 positions within the main expertise mega-caps like Microsoft (MSFT) and Nvidia (NVDA), I don’t imagine these have been the important thing drivers to the fund’s efficiency (Determine 5).

Determine 5 – ETO high 10 holdings (eatonvance.com)

For instance, the ETO fund is underweight the ‘Magnificent 7’ with a mixed weight of 16.2% in its top-10 holdings, in comparison with 20.6% within the URTH (Determine 6).

Determine 6 – URTH high 10 holdings (ishares.com)

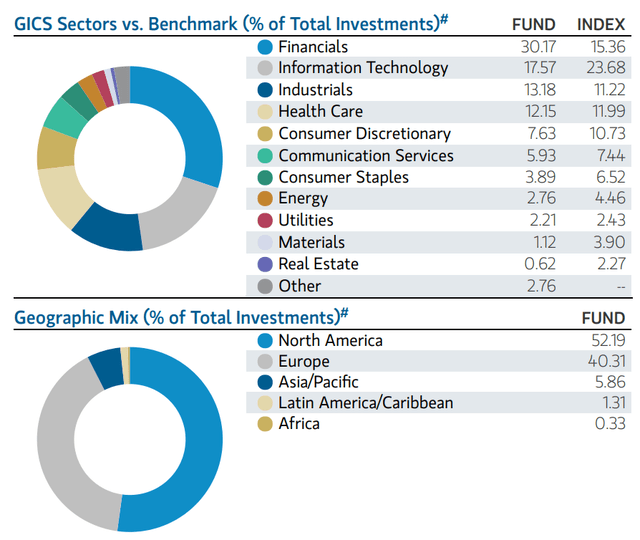

As a substitute, I imagine ETO has delivered long-term efficiency by stable stock-picking and taking differentiated positions in comparison with the indices. For instance, the ETO fund is presently obese Financials (30.2% vs. 15.4% within the MSCI World Index as of Q1/24) and Industrials (13.2% vs. 11.2%) and underweight Expertise (17.6% vs. 23.7%) and Client Discretionary (7.6% vs. 10.7%) (Determine 7).

Determine 7 – ETO sector and geographical allocation, March 2024 (ETO factsheet)

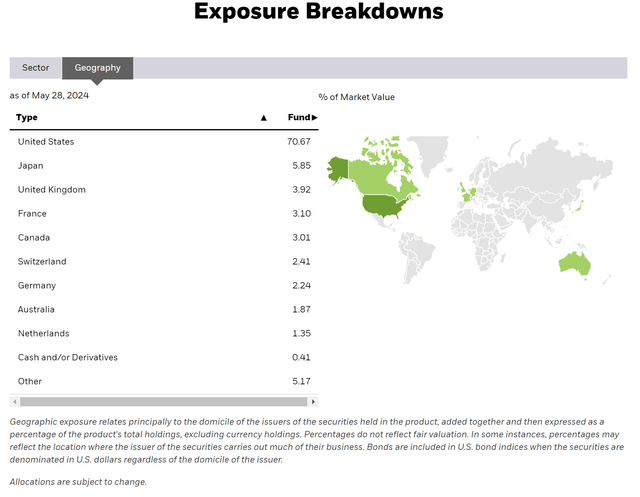

The fund solely has 52% of its portfolio invested in North America and 40% invested in Europe, which is sort of a contrarian wager in comparison with the MSCI World Index (as modeled by URTH’s exposures), which has a 70.7% publicity to the USA (Determine 8).

Determine 8 – URTH geographical publicity (ishares.com)

Valuations Might Be A Driver Of Allocation Distinction

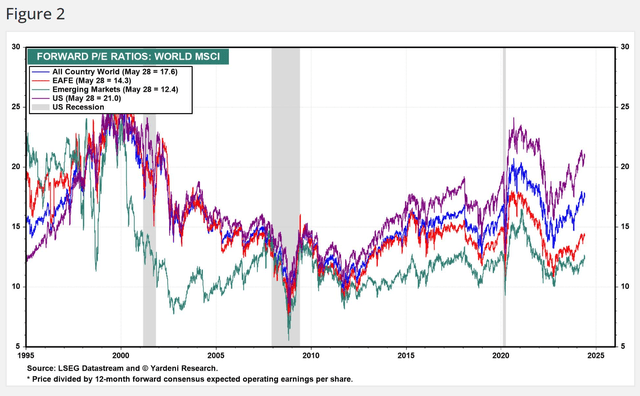

The rationale ETO could have a decrease allocation to American equities might be as a result of American equities are basically ‘costly’. In accordance with consensus estimates, U.S. equities are presently buying and selling at 21.0x Fwd P/E, traditionally one of many highest valuation ranges aside from the dot-com bubble and early 2021 (Determine 9).

Determine 9 – U.S. equities are costly (yardeni.com)

In distinction, Europe and Asia (“EAFE”) have far more modest valuation ranges, with a Fwd P/E of 14.3x. Rising Markets has a Fwd P/E of 12.4x.

Go Worldwide For Constructive Returns

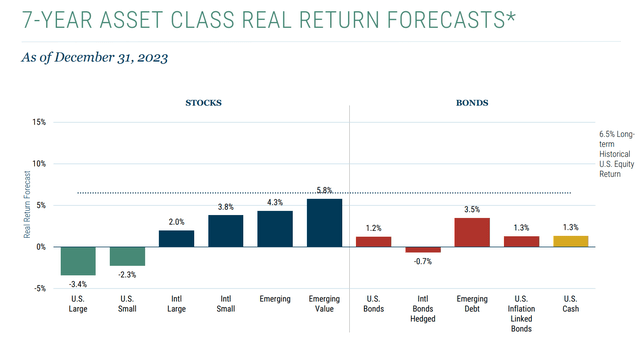

As I’ve been warning for the previous couple of months, ahead returns for U.S. equities could also be poor when the beginning valuation stage is bigger than 20x Fwd P/E. In actual fact, the value-investing agency GMO estimates 7-year ahead returns for U.S. equities to be unfavorable (Determine 10).

Determine 10 – 7-yr ahead returns (GMO)

From a portfolio perspective, now could also be an excellent time to take earnings on U.S. fairness funds which have delivered good-looking returns however have stretched valuations and reallocate to worldwide funds just like the ETO.

Dangers To ETO

The largest threat I can foresee with the ETO fund is its excessive Financials publicity. If my worst fears a couple of international recession are realized, monetary corporations like banks could also be a few of the hardest hit since they may see a spike in credit score losses tied to actual property and enterprise loans.

Moreover, a part of the rationale for American exceptionalism in fairness markets is the dimensions of America’s expertise giants. Every of the ‘Magnificent 7’, except Tesla (TSLA), are behemoths main varied sectors of the trendy economic system, from cellular handsets enterprise software program, and on-line search, to e-commerce, social media, and synthetic intelligence. Underweighting this group is a harmful recreation if the traits have been to proceed.

Conclusion

The Eaton Vance Tax-Advantaged International Dividend Alternatives Fund continues to be a global-focused funding fund I like. The fund has matched the MSCI World Index’s robust efficiency with a better allocation to non-U.S. equities and an underweight within the ‘Magnificent 7’ mega-caps. That is fairly a feat.

With U.S. fairness valuations close to historic highs, I imagine traders ought to take into account diversifying internationally and the ETO fund is an effective candidate to take action. I charge ETO a purchase.