YETI Holdings, Inc. (NYSE:YETI) Q1 2024 Earnings Convention Name Might 9, 2024 8:00 AM ET

Firm Individuals

Thomas Shaw – Vice President of Investor Relations

Matthew Reintjes – President & Chief Govt Officer

Michael McMullen – Senior Vice President, Chief Monetary Officer & Treasurer

Convention Name Individuals

Randy Konik – Jefferies

Anna Glaessgen – B. Riley

Peter Benedict – Robert W. Baird

John Kernan – TD Cowen

Peter Keith – Piper Sandler

Brooke Roach – Goldman Sachs

Operator

Good day and welcome to the YETI Holdings First Quarter 2024 Earnings Convention Name. [Operator Instructions] Please be aware this occasion is being recorded.

And now I want to flip the convention over to Tom Shaw, the Vice President of Investor Relations. Please go forward.

Thomas Shaw

Good morning and thanks for becoming a member of us to debate YETI Holdings’ first quarter fiscal 2024 outcomes. Main the decision immediately will likely be Matt Reintjes, President and CEO; and Mike McMullen, CFO. Following our ready remarks, we’ll open the decision to your questions.

Earlier than we start, we might wish to remind you that a few of the statements that we make immediately on this name could also be thought of forward-looking and such forward-looking statements are topic to numerous dangers and uncertainties that might trigger our precise outcomes to vary materially from these statements. For extra data, please seek advice from the danger components detailed in our most just lately filed Kind 10-Okay. We undertake no obligation to revise or replace any forward-looking statements made immediately on account of new data, future occasions or in any other case, besides as required by legislation. Except in any other case acknowledged, our monetary measures mentioned on this name will likely be on a non-GAAP foundation. We use non-GAAP measures as we imagine they extra precisely symbolize the true operational efficiency and underlying outcomes of our enterprise. Reconciliations of those non-GAAP measures to their most immediately comparable GAAP measures are included within the press launch or within the presentation posted this morning to our Investor Relations part of our web site at yeti.com.

And now I would like to show the decision over to Matt.

Matthew Reintjes

Thanks, Tom and good morning. YETI delivered a nice begin to 2024 as evidenced by our sturdy first quarter outcomes. We noticed constructive international demand for our model and our broadening vary of merchandise and we had nice execution throughout a number of fronts, driving double-digit progress in each our wholesale and DTC channels in addition to our Coolers & Tools and Drinkware classes.

Our wholesale efficiency was supported by sell-in and sell-through relative to the yr in the past interval, whereas our DTC enterprise confirmed continued progress throughout e-commerce, company gross sales, Amazon and YETI retail. In Coolers, with our new innovation and expanded consciousness marketing campaign, we imagine we’re nicely positioned for the upcoming seasonal demand. In Drinkware, our vary of bottles and tumblers proceed to ship energy throughout the class. By geography, Worldwide progress exceeded 30% year-over-year to achieve a YETI excessive of 19% of complete gross sales, whilst our home progress was almost 10%. Behind the energy of the model, the rising product portfolio and international enlargement, we’re on monitor to ship on our full yr top-line outlook.

Given the mix of inbound freight restoration, product price enhancements pushed by excellent work by our provide chain and operations staff and powerful value self-discipline, we’re happy to report profitability to construct upon our historic energy, delivering a 450 foundation level enchancment in gross margins. Following our top-line efficiency and gross margin energy, our adjusted working margin additionally expanded by 440 foundation factors for the interval.

Within the quarter, we additionally delivered on our capital allocation priorities, beginning with the completion of our Thriller Ranch and Butter Pat acquisitions. Our integration of those companies is on monitor as we speed up our mid- and long-term alternatives in luggage and cookware. Lastly, we introduced a $100 million accelerated share repurchase plan in late-February which was totally executed final month.

From a top-line perspective, we stay optimistic on our demand drivers for the complete yr. We anticipate gross sales efficiency per our authentic steerage, as we stability efficiency in opposition to anticipated ongoing conservative buying at increased value factors, balanced channel sell-in and demand and are in contrast in opposition to headwinds on account of final yr’s recall-related present card redemptions.

our backside line, we’re elevating our outlook to mirror our margin energy and the execution of our ASR. As beforehand indicated, we are going to proceed to guage considerate and strategic capital allocation alternatives within the quarters forward.

Turning to our progress technique in 2024 and past. Our precedence stays to increase model attain and engagement, drive product diversification throughout our portfolio, leverage our highly effective omnichannel to achieve clients and construct our international enterprise.

Shifting to our model attain. Q1 highlighted the continued evolution of YETI’s breadth and depth model technique. Within the early months of 2024, we have now activated alongside a few of our bigger international partnerships. Within the second yr of our partnership with the World Surf League, we grew to become the presenting companion for the primary occasion of the season, the YETI Professional pipeline in Oahu. On the Mountain, our activation included continued occasions corresponding to pure choice. Lastly, in Formulation One racing, our partnership with RedBull Racing is proving to search out inventive methods for YETI to combine and help the staff.

We additionally established a brand new partnership on the planet {of professional} soccer with a membership trying to disrupt the established order. In March, the Kansas Metropolis Present debuted the world’s first stadium constructed particularly for a ladies’s professional sports activities staff. We’re extremely proud to help the Present, their visionary possession and the staff’s efforts to raise the profile of each the game and these unimaginable skilled athletes. We sit up for the numerous revolutionary methods we are going to join our manufacturers.

Our group advertising and marketing efforts, mixed with the superb work our staff does on the model aspect, confirmed how we develop, develop and join our international audiences. Health was a pure place to begin the yr, highlighting the work our ambassadors put in earlier than heading out to the wild and the YETI gear that will get them by means of all of it. We expanded our well being and health efforts this yr, with model placement in almost 1,300 gyms throughout the nation.

Subsequent, we centered on highlighting our expanded Drinkware choices in espresso, driving consciousness, attain and relevance for brand new and present international clients. As you might have seen this week, we added to the portfolio a brand new YETI French press that may double as a beverage pitcher, as we glance to launch the stand-alone pitcher later this summer time.

YETI additionally acquired 2 unimaginable model accolades in the course of the quarter that talk to the fervour, expertise and creativity of our staff. Advert Age is 2024 In-Home Company of the 12 months and Quick Firm’s most revolutionary corporations in PR and model methods. These affirmations, whereas not the aim, are a testomony to the power, realness and humanity that the staff places into our model. That is what creates the emotional connection and sustainable ardour for what we do.

This is not a couple of second. It is about rising a motion in direction of reconnection of individuals and group to the wild. I need to thank your complete YETI staff for his or her perception in pouring themselves into this in opposition to a market backdrop that at instances is extra centered on buzz. This model has been constructed on constantly and sustainably partaking clients and communities displaying up in actual methods and staying true to the spirit of what YETI is, all whereas rising and evolving globally.

To that finish, within the present quarter and all through 2024, we are going to discover moments to interact new and present clients from spring journey to gift-giving events, to the beginning of summer time, with unimaginable story to inform the folks in locations that help our increasing product assortment.

As we shift to product, there are Three key themes this yr: a deal with progress in our cooler household, the evolution of YETI into broader meals and beverage and the product enlargement potential below the YETI model umbrella and brand-building playbook. Throughout our product vary, we’re in a terrific place to capitalize on the hotter climate to start with of summer time journey and outside actions. We’re leveraging a couple of key demand drivers as we head into the season: innovation, consciousness and conversion.

We’re excited in regards to the subsequent wave of laborious cooler innovation in 2024, constructing upon our legacy courting again to our first laborious cooler in 2006. Lately, we debuted our Roadie 32-cooler, our smallest and most moveable wheel cooler thus far. The Roadie was designed to tug as much as a camp website, transfer by means of a tailgate or deal with weekend tournaments.

Later this summer time, we plan to introduce a personal-sized laborious cooler which is able to anchor on the entry value level for YETI laborious coolers at $200. Consider this as day trip kind cooler that can work nicely in a side-by-side on a golf cart or on the job.

On the Drinkware aspect, we’re seeing a terrific response to our deep portfolio of 50-plus choices throughout our premium vary of bottles and tumblers. That is a part of our progress and enlargement technique as we help extra moments of their day. We’re evolving this class and constructing out options to deal with what we see as client wants and alternatives.

For example, the beforehand introduced french press and pitcher complement final yr’s beverage bucket and wine chiller and are an indication of the evolution and the chance. Moreover, after years of requests from our clients, we are going to launch a few extremely giftable barware objects in restricted provide and time for Father’s Day.

To spherical out the 2024 choices, we additionally plan to introduce our first YETI forged iron cookware later this summer time. Exterior of Coolers and Drinkware, we’re excited by the prospects of what we see as potential in luggage, cargo and the increasing group of choices below our Coolers & Tools household. We anticipate to ship innovation throughout this complete vary, beginning with our flagship dry bag enlargement earlier this yr, following final yr’s addition of latest waterproof dustproof cargo packing containers. There’s extra to return round this.

We proceed to be centered on driving consciousness in prime of thoughts for YETI. We’re deploying a variety of brand name efforts throughout TV, digital, print and out-of-home, to maintain the model and product in entrance of the buyer. This consists of an unimaginable partnership with our wholesalers to drive consciousness throughout these essential moments as we launch new merchandise. Moreover, we’re utilizing a broad vary of direct efficiency advertising and marketing applications centered on driving customers in direction of conversion. By way of these expanded efforts in innovation and advertising and marketing, we are going to proceed to ship built-in storytelling that connects folks and merchandise, highlighted at instances with colour inspiration from the wild.

As we see alternatives to achieve extra clients, have interaction them in impactful methods and inform highly effective model and product tales, we’re additionally centered on strengthening our international go-to-market. Our sturdy and numerous channels to market are a key contributor to the balanced progress achieved within the first quarter and communicate to the consistency and energy of YETI.

Turning to our DTC efficiency. We noticed the advantages of buyer worth in UPT in opposition to a some tougher site visitors and buyer depend, as we lap the beginning of final yr’s recall and our chosen end-of-life transitions. Our Amazon market remained constantly sturdy as we see that buyer loyalty to the channel, additional supporting our technique of numerous channels to market.

Company gross sales delivered sturdy order quantity and inbound demand. The addition of extra environment friendly and cost-effective printing know-how for laborious coolers underscores our steady enchancment efforts, delivering worth for the shopper and YETI.

We opened the latest places of our YETI retail shops within the Woodlands exterior of Houston and in New York Metropolis’s Flatiron District. Our shops proceed to supply a singularly distinctive alternative to see the depth and breadth of YETI’s product providing, have interaction with product consultants, study and store. We’re focusing on to open 6 complete places this yr, together with the upcoming openings in Kansas Metropolis and Calgary which might deliver our fleet complete to 24.

In our wholesale channel, we noticed constructive demand throughout classes, additional supported by higher sell-in in comparison with final yr’s interval. Channel stock is in good condition, as our companions proceed to lean into seasonal colours and stay bullish on product releases we have now deliberate all through 2024 and into 2025.

As beforehand outlined, we’re thoughtfully increasing our international wholesale attain, together with the already introduced companion in Tractor Provide within the U.S., mixed with new companions in Canada, Australia and Europe. As well as, we additionally proceed to domesticate new wholesale partnerships that align with our more and more numerous product assortment.

As we shift to our non-U.S. enterprise, I would like to supply some colour on how we’re constructing out our international management to help our focus and progress in these areas. Naoji Takeda joined YETI just lately as our new Managing Director, Asia. Naoji most just lately comes from KEEN, the outside footwear model, the place he held a wide range of international and regional roles, together with main the model’s progress in Japan and all through Asia Pacific. Together with his expertise in passion-based and revolutionary manufacturers, I am excited to see him tackle the immense alternative we have now within the area.

Trying on the general worldwide enterprise. We proceed to see sturdy momentum for the model and unimaginable alternative in undeveloped markets. Along with solidifying our regional construction, our near-term focus is on rising model consciousness and constructing our profitable omnichannel strategy.

In Europe, general model traction is excellent as we see sturdy ends in the U.Okay. and Germany in addition to different markets all through Europe. It has been more and more enjoyable to see YETI present up from the countryside to town streets as we activate the model. Supporting this momentum, we’re making key investments in our staff, the model and processes to scale the enterprise. This consists of the transition of our U.Okay. 3PL this month which is able to help future progress, whereas additionally driving improved pace to market and operational effectivity.

In Australia, we had one other unimaginable quarter. Our staff in Australia continues to point out that the YETI progress playbook travels whilst they contribute to creating a stronger and nuance to the market. We actually just like the stability we have now in Australia with highly effective impartial retailers all the best way as much as our partnership with outside chief, BCF. We may even start testing a brand new partnership with a sporting items retailer as we deal with reaching clients deeper into city markets.

From a product providing perspective, we see nice traction throughout the portfolio with customization capabilities and demand, very like we have now seen in North America. In Canada, progress was supported by sturdy wholesale sell-through regardless of a few of the similar channel warning that we have now seen domestically. Inside wholesale, we’re starting to check a number of new focused relationships that can complement our channels to market and permit us to achieve new customers in numerous shopping for moments.

On the DTC aspect, we have seen energy in our rising company gross sales enterprise and are excited in regards to the alternative to scale customization to help each the shopper and company demand.

In closing, I need to take a fast second and spotlight a very essential occasion for the corporate, our current YETI spherical up in April. Every year, we deliver collectively our international staff at our Austin headquarters for every week of immersion, studying and connection. This can be a highly effective technique to stoke the model and hold related to our rising international staff.

I at all times come away from this week energized and with an unimaginable appreciation for our staff and what they’re creating right here at YETI. Importantly, it solidifies my unwavering conviction within the long-term untapped progress alternatives forward for this model.

Earlier than handing the decision over to Mike to overview our financials and outlook, I need to thank our excellent clients, companions and buddies who present up for YETI on daily basis at each launch and in each new market we enter. That is what drives us ahead.

Now, I’ll flip the decision over to Mike.

Michael McMullen

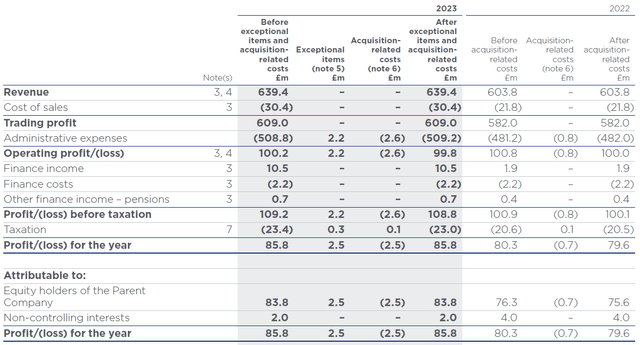

Thanks, Matt and good morning, everybody. I am going to begin with a couple of feedback on the influence of sure strategic actions on our GAAP outcomes that are excluded from our non-GAAP outcomes. I am going to then present an summary of our efficiency in Q1 throughout our non-GAAP measures. Lastly, I’ll give some particulars on our up to date fiscal 2024 outlook earlier than opening it up to your questions.

Our GAAP outcomes for the primary quarter of 2024 embrace the influence of two objects that I might name out for you all this quarter. 1, transition prices related to our current acquisitions, together with the influence of buy accounting on our gross margins; and a couple of, prices related to the closure of our Vancouver design heart. Whereas we had been happy with the work that our staff in Vancouver was delivering, the acquisition of Thriller Ranch offered a possibility to consolidate this work into 1 location in Bozeman, Montana. The influence of those and different objects is excluded from our non-GAAP outcomes. Per our regular observe, our outcomes mentioned on this name will likely be on an adjusted non-GAAP foundation with a purpose to higher deal with the operational efficiency of the corporate in the course of the interval.

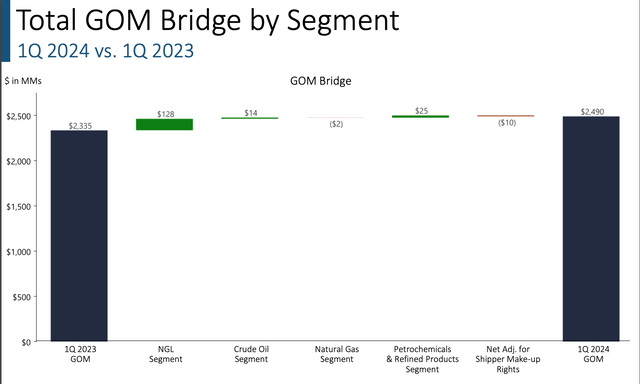

Now transferring on to the main points of the quarter. First quarter gross sales elevated 13% to $341 million. As Matt detailed, our sturdy efficiency was balanced throughout classes, channels and geographies. These outcomes embrace the preliminary contributions from Thriller Ranch and $2 million of present card redemptions associated to cures provided to clients impacted by the product recall. We’re happy with the progress we have now made to combine our current acquisitions and they’re on monitor to generate roughly 200 foundation factors of top-line progress for YETI in 2024.

By class, Drinkware gross sales elevated 13% to $215 million. Our efficiency was pushed by quite a lot of components, together with a portfolio of over 50 merchandise that we proceed to develop, distinctive progress exterior the USA and continued sturdy buyer demand for colour and customization on a worldwide foundation.

Listed here are a couple of particular examples of merchandise that drove our progress in Q1. We launched a brand new lineup of three stackable tumblers that provide our clients the identical nice efficiency, with added functionalities corresponding to improved house saving, hand match and cup holder compatibility. The merchandise that we launched final This autumn continued to achieve traction, together with our smaller espresso specialty sizes, our 42-ounce straw mug and our cocktail shaker. We had a terrific quarter in bottles pushed by the wide selection of sizes, supplies and lid choices that we provide our clients. And we stay excited by the expansion of our tabletop and barware choices such because the beverage bucket and wine chiller.

Coolers & Tools gross sales elevated 15% to $120 million. Each laborious coolers and mushy coolers posted progress for the interval. We’re excited to now have our full assortment of merchandise out there out there, together with in seasonal colours. And we proceed so as to add to this product lineup with the current innovation in laborious coolers that Matt talked about. Whereas we do proceed to anticipate to see some stress on increased value level objects as we undergo this yr, we imagine we’re in a powerful place to win in coolers as we head into the height summer time months.

Past coolers, we noticed sturdy natural efficiency from our legacy YETI luggage lineup, led by our Panga waterproof line and the enlargement of our SideKick Dry Gear Case line. The class additionally benefited from the inclusion of Thriller Ranch which was on plan for the quarter.

From a channel perspective, direct-to-consumer gross sales grew 12% to $188 million, representing 55% of complete gross sales, pushed by progress in each Drinkware and C&E. Moreover, we drove stable progress throughout every of our DSC channels in the course of the interval, together with e-commerce, company gross sales and Amazon.

Whereas nonetheless a comparatively small contributor, we had been additionally happy with the expansion of YETI Retail. As Matt talked about, we’re modestly accelerating our new retailer plans this yr, as we glance to develop our attain and supply extra alternatives for customers to expertise the complete breadth of our product assortment.

Wholesale gross sales elevated 13% to $154 million, pushed by progress in each C&E and Drinkware. Importantly, sell-through for each product classes was constructive and our channel stock ranges stay in good place.

Exterior the U.S., gross sales grew 32% to $66 million, representing 19% of complete gross sales, pushed by outsized progress in Europe and Australia. The chance exterior the USA stay important as we glance to drive model consciousness, develop our wholesale footprint and leverage our full set of D2C capabilities.

Gross revenue elevated 22% to $196 million or 57.5% of gross sales in comparison with 53% in the identical interval final yr. Constructive drivers of this 450 foundation level enhance embrace 370 foundation factors from decrease inbound freight and 190 foundation factors from decrease product prices. These features had been partially offset by 60 foundation factors from increased customization prices given the continued progress of our customized enterprise, 20 foundation factors from strategic value decreases on sure laborious coolers that we applied in the course of the quarter and 30 foundation factors from all different impacts.

SG&A bills for the quarter elevated 13% to $157 million and remained flat at 45.9% of gross sales. Non-variable bills elevated 10 foundation factors as a % of gross sales, offset by variable bills lowering 10 foundation factors as a % of gross sales. Inside non-variable, increased worker prices and advertising and marketing bills had been offset by decrease warehousing prices.

Working revenue elevated 82% to $40 million or 11.6% of gross sales, a rise of 440 foundation factors over the 7.2% that we reported within the prior yr interval. Web revenue elevated 89% to $29 million or $0.34 per diluted share in comparison with $0.18 within the prior yr interval.

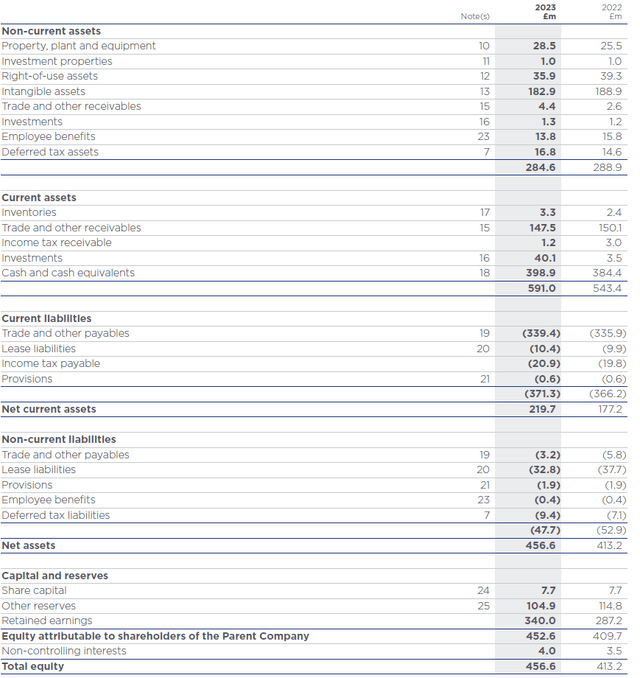

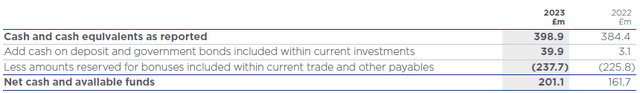

Turning to our stability sheet. We ended the quarter with $174 million in money in comparison with $168 million within the yr in the past interval. The decline in money on a sequential foundation was pushed by our accelerated share repurchase settlement, the acquisitions of Thriller Ranch and Butter Pat and the traditional seasonality of our money and dealing capital.

Stock elevated 5% year-over-year to $364 million. We anticipate year-end stock to typically develop within the vary of gross sales however there could also be quarters this yr, the place it grows at a quicker price than gross sales as we construct stock forward of latest product launches. Complete debt, excluding unamortized deferred financing charges and finance leases, was $81 million in comparison with $84 million on the finish of final yr’s first quarter. Throughout the quarter, we made a principal cost of $1 million on our time period mortgage.

Now turning to our fiscal 2024 outlook. We proceed to anticipate full yr gross sales to extend between 7% and 9% in comparison with fiscal 2023’s adjusted internet gross sales, inclusive of roughly 200 foundation factors of contribution from our 2 acquisitions. As we beforehand indicated, we anticipated a stronger progress price within the first quarter.

Trying forward, we proceed to anticipate comparatively balanced progress throughout the upcoming quarters, with Q2 plan barely beneath our progress price within the second half of this yr. There are a variety of examine dynamics to contemplate this yr, together with present card redemptions which we are going to begin to examine in opposition to in Q2. The biggest influence from prior-year present card redemptions will likely be within the second quarter, once we noticed $12.5 million price of redemptions within the prior-year quarter.

We’re reiterating our expectations for progress throughout channels, classes and geographies. By channel, we anticipate balanced progress between wholesale and D2C. By class, Coolers & Tools is predicted to outpace Drinkware, given each the return of our full mushy cooler lineup and the incremental gross sales of Thriller Ranch merchandise. And we anticipate Worldwide progress of between 20% and 25% in comparison with Home progress within the mid-single-digit vary. As a ultimate touch upon gross sales, per final quarter, we proceed to take a prudently conservative strategy to how we plan the rest of the yr.

Transferring down the P&L. Supported by our sturdy efficiency within the first quarter, we’re growing our 2024 gross margin goal to roughly 58% in comparison with our authentic goal of roughly 57.5% and up from 56.9% final yr. This enhance is because of slight advantages throughout quite a lot of drivers inside our gross margin line versus one single issue. The continued restoration of inbound freight prices stays the biggest driver of our year-over-year gross margin enlargement this yr however we do proceed to see some offsetting price stress because of the Pink Sea battle.

From a phasing perspective, we anticipate margin enlargement to begin to ease in Q2 versus the numerous will increase we have now seen over the previous four quarters. As we transfer into the second half of the yr, we anticipate to have largely comp the advantage of decrease inbound freight prices. Thus, our gross margins within the second half will likely be rather more according to the prior yr. However over the long run, we nonetheless see alternatives to proceed to develop our gross margins by means of drivers corresponding to gross sales combine, product price financial savings and different provide chain efficiencies.

With the rise in our gross margin outlook, we’re additionally elevating the excessive finish of our working revenue outlook. We now anticipate adjusted working margin of between 16% and 16.5%, up from our prior outlook of roughly 16% and in comparison with 15.6% in fiscal 2023. On a quarterly foundation, we anticipate working revenue progress to be roughly according to gross sales progress.

As we have now mentioned beforehand, we are going to proceed to make use of a portion of our gross margin upside to incrementally put money into our enterprise. These funding areas embrace our international enlargement efforts, our D2C enterprise and help for inorganic alternatives. Due to this fact, whereas full yr SG&A is predicted to develop on the excessive finish of our gross sales vary, the timing of investments might drive some variability in our SG&A progress price on a quarter-to-quarter foundation. Extra importantly, our focus is on delivering our prime and backside line outlook for the yr and on driving prime line progress over the long run.

Under the working line, we proceed to anticipate an efficient tax price of roughly 25.3% for the yr, barely above the 24.8% price in 2023. As we disclosed in an 8-Okay submitting, we entered right into a $100 million accelerated share repurchase settlement throughout Q1. That contract totally executed as of April 22 and thus, we anticipate full yr diluted shares excellent of roughly 86.1 million. As a consequence of this decrease share depend and elevating the excessive finish of our working revenue vary, we now anticipate adjusted earnings per diluted share to extend 11% to 16% to between $2.49 and $2.62 in comparison with $2.25 in fiscal 2023.

As for money, we proceed to anticipate capital expenditures of roughly $60 million and free money move of between $100 million and $150 million this yr. We’ll stay opportunistic going ahead as we glance to deploy money between M&A and additional share buybacks. As a reminder, we have now $200 million remaining on our most up-to-date share buyback authorization.

In abstract, we had been happy with our first quarter execution. We delivered balanced top-line progress throughout the enterprise, proceed to enhance our profitability, made progress on the mixing of our current acquisitions and delivered on key items of our capital allocation technique. On the similar time, we’re aware of the relative measurement of the primary quarter and a few ongoing uncertainties within the general market. Thus, some warning continues to be mirrored in our up to date full yr outlook. However we may even stay opportunistic as we go ahead, making investments and taking actions that help our long-term progress ambitions and drive worth to our shareholders.

Now, I want to flip the decision again over to the operator to take your questions.

Query-and-Reply Session

Operator

[Operator Instructions] At the moment, we are going to take a query from Joe Altobello from Raymond James.

Unidentified Analyst

That is Martin [ph] on for Joe. Simply questioning if we will get an replace on general demand developments, notably on laborious coolers? And simply any rationalization that may be driving them, whether or not it is affordability, competitors, saturation or form of some mixture of all the above?

Michael McMullen

Sure. Martin, thanks for the query. So I believe, initially, we had been happy to return to progress in each mushy and laborious coolers. In mushy coolers, clearly it was associated to having the recall merchandise again in our lineup however in laborious coolers, there was a component of a sell-in examine in wholesale. However on the similar time, throughout Q1, we had been additionally comping in opposition to the EOL transition promo, that was a difficulty in This autumn that we referred to as out. However like we talked about in our ready remarks, we noticed progress in C&E on each a sell-in and a sell-through foundation. However I believe the important thing level is that Q1 is our smallest quarter and there is a seasonality side in coolers to contemplate. However as we glance ahead, as we enter the seasonally increased interval, we predict we’re in a extremely good place to win in coolers. We have got our whole assortment again out there of sentimental coolers and we have got new innovation coming in laborious coolers.

We do imagine there’s some sensitivity to increased value level objects out there that also exist. However for the demand that’s out there, we imagine we’re in a extremely nice place to go win it. From a aggressive standpoint, I believe like we have mentioned all alongside, we have got — we have had opponents in all classes for years. We imagine we have got the perfect merchandise out there and we’re in place to win.

Unidentified Analyst

Nice. And simply type of on our final thought of form of softness in high-end objects, have the focused value cuts on sure Roadie and Tundra merchandise assist this for demand? And will we anticipate any further pricing actions in addition to any future innovation, will that be at lower cost factors, simply to fight affordability?

Michael McMullen

Sure. I believe — so simply to the touch on the second query, the — we launched, as Matt referred to as out, we talked about 2 new merchandise, a lower cost level — our lowest value level wheeled cooler after which a brand new entry level laborious cooler for the class. I would not say that is being accomplished in response to something taking place out there. That is us simply finishing what we imagine is a full portfolio of the merchandise that meets quite a lot of use instances on the market. So I would not characterize this as being accomplished in response to something that is taking place out there. And I believe the identical factor goes for the worth reductions. I imply what we did in Q1 was — and we talked about this final quarter, it was actually in response to the brand new innovation that was coming and ensuring that our pricing stack made sense is that the worth to worth as you go up the portfolio is smart within the client’s thoughts.

So by way of what occurred in Q1, it was a choose variety of SKUs. It wasn’t your complete portfolio however it was largely according to what we anticipated. We noticed the elasticity on a unit foundation that we anticipated and we had been happy with the outcomes.

Operator

Our subsequent query comes from Randy Konik from Jefferies.

Randy Konik

Matt, I wished to ask a query round innovation. Once I take into consideration, as an example, the final couple of years, I’ve thought of incremental progress being derived rather a lot from, as an example, further colour methods to the assortment. However extra just lately, it seems to me and I could possibly be improper, that there is been a large influence from kind issue modifications in innovation because it pertains to, as an example, the french press, or the cocktail shaker, espresso ceramic merchandise, etcetera, on the Drinkware aspect.

Are you able to possibly type of give us that — your perspective there on that innovation round because it pertains to kind issue modifications versus colour? As a result of I believe what could be fascinating there’s, if, actually, a whole lot of the incremental progress is coming from kind issue modifications, it simply supplies much more type of alternative and modifications for present and new clients to purchase into increasingly more YETI merchandise? I simply need to get your perspective there.

Matthew Reintjes

Randy, thanks for the query. I believe it is a mixture of issues. You are appropriate. And as we have now continued to scale, as we proceed to attract on new audiences domestically and globally into the model, we have seen alternative to develop our product portfolio inside our 2 huge teams.

Drinkware has expanded. We expect in a extremely considerate type of highly effective approach as from following our story. We deal with our productiveness and the leverage we get on every SKU we launch. And the identical with C&E, we have pushed innovation inside laborious coolers, inside mushy coolers, enlargement of our cargo enterprise, the enlargement of our luggage, the addition of M&A to drive an accelerant there. And so we do suppose that it provides us the chance to deal with extra client wants and extra deadlines or extra factors of their day. In order that kind issue change, I believe you are going to proceed to see a rhythm of us doing that as we develop and diversify the product portfolio. And we predict that is a extremely impactful technique to develop the enterprise.

Colour does play an essential function in not simply buyer acquisition but in addition repeat buy. As folks construct out their YETI possession, what we see is that individuals need extra colour. They need to add into their portfolio and that is not only a Drinkware factor, that is really throughout the vary. What we actually work to do is discover a stability in these issues. We do not need to chase smaller and smaller alternative and increasingly more bespoke. We need to proceed to place huge consumer-relevant objects on the market in kind issue, huge client related objects on the market because it pertains to colour. And that is a formulation that is labored for us. And as we proceed to develop and scale the enterprise, it is a formulation we’re seeing work not solely within the U.S. however all over the world.

Randy Konik

Sure. Very useful. After which final query and associated to that, simply give us your long-term imaginative and prescient then round how you consider the MYSTERY RANCH acquisition and product set after which additionally your ambition round cookware. Simply give us your ideas there once more on the long run, that will be very useful.

Matthew Reintjes

Thanks, Randy. Two issues and we have mentioned this earlier than, we predict these are two very giant, extremely fragmented classes, very international in nature, each luggage and cookware. We expect there is a chance to leverage YETI’s industrial go-to-market the best way we inform model tales, the best way we do our product advertising and marketing, the best way we domesticate our client base. We expect it is a actually engaging alternative in each of these to drive additional possession of YETI repeat buy additional use instances.

So I believe what you are going to see in each these situations and I talked about this on the decision, we’ll have our actual first entry into cookware, the type of prime finish of cast-iron later this yr. In luggage, as we have a look at taking the a few of the elements and the capabilities and the expertise that got here together with the Thriller Ranch acquisition and we mix that with a few of the supplies and expertise and designs that we had at YETI, is bringing that collectively and actually constructing out our luggage portfolios as we take into consideration the chance in energetic and on daily basis and in journey.

And so with the staff that we put in place round each of these issues, we’re actually enthusiastic about what that may imply beneath the YETI model umbrella. And we speak on a regular basis, our focus is on what the TAM is for the YETI model. And we predict each of these classes match very well beneath that.

Operator

And now we have now a query from Anna Glaessgen from B. Riley.

Anna Glaessgen

I believe final yr, you famous that the introductions of tumbler has introduced a whole lot of new clients into the fold. Are you able to speak about how these new clients are partaking with the model? Are you seeing repeat buy habits? Any colour on that will be nice.

Matthew Reintjes

Anna, that is Matt. A few issues I might say and somewhat bit to the prior query from Randy. As we hold increasing the product portfolio in what I might name helpful methods to the buyer and considerate methods for them to interact, we have additionally continued to diversify our client base. And as we mentioned in our ready remarks, the worth of our clients continues to go up. The returning and newly acquired clients from a price perspective, we like that dynamic the place we may give them extra product that is helpful to them.

I believe whenever you have a look at the enlargement, what we’re seeing is folks diving deeper into our product portfolio, folks coming again and repeat buying their favourite product. And that is a part of our advertising and marketing efforts, it is a part of our product advertising and marketing efforts. It is also a part of how we’re advancing a few of our analytics and the way we put the precise supply, the precise alternative on the proper time in entrance of the buyer. However we actually like the purchasers that we have acquired over the past Three to four years to enhance the purchasers that we have had type of long-standing with YETI.

And we predict that is the chance to maintain bringing innovation in kind issue, hold bringing pleasure in colour after which hold that emotional engagement with YETI.

Anna Glaessgen

Nice. And will you develop a bit? You famous that you simply’re reinvesting within the model and never flowing by means of type of the complete gross margin enlargement. Are you able to speak somewhat bit extra about what’s the important thing priorities are with that funding?

Michael McMullen

Sure. So I would say it is a few areas. No 1, it is actually round what we’re doing to develop YETI exterior the USA. So — and also you’re seeing the outcomes of that, together with this quarter, the place we grew worldwide over 30% and it is now 19% of our enterprise. So I believe inside Worldwide, it is constructing out the groups we’d like, it is rising the model, constructing model consciousness, constructing the know-how instruments that we’d like, the provision chain infrastructure we’d like, etcetera, number one. Quantity 2, as we glance to type of construct out our inorganic alternatives and have the ability to help inorganic alternatives, there’s clearly a must construct out a staff internally to do this and we talked about that final yr by way of the primary steps that we had been making there.

After which I believe third, even domestically, as we glance to develop the portfolio into new areas, which might be centered on new communities, there’s a component of actually driving model consciousness in these new areas and in these new product classes. So these are simply a few of the areas that you’re going to see us proceed to put money into and hopefully see the outcomes as we go ahead.

Operator

And our subsequent query comes from Peter Benedict from Baird.

Peter Benedict

First, type of a follow-up on one of many earlier questions. Simply curious round Thriller Ranch. I imply, Matt, you talked about it as being an accelerant to your luggage innovation. I am simply curious across the timing there. Is 2025 too quickly to suppose that you can see an acceleration in your luggage innovation, leveraging a few of what you’ve got gotten with Thriller Ranch? Or is it going to take longer than that? Or is 2025 time to eye for some preliminary innovation? That is my first query.

Matthew Reintjes

Peter, thanks for that. I might say, virtually frankly earlier than we even closed with Thriller Ranch, we began to work with the groups on how we deliver form of the perfect elements collectively of each companies. And they also’re energetic and nicely down that path. I believe as we go into 2025, we might look to deliver out some further merchandise that can have the outcomes of the work of these 2 groups coming collectively and that is what they’re racing in direction of. This isn’t one thing the place I believe we’re years out from seeing the profit. And it is the results of partnering with a terrific group of individuals, who’ve the expertise, mixed with the expertise we have now at YETI, that we will transfer actually rapidly on this. So we’re excited to get going and type of put our first merchandise out collectively.

Peter Benedict

Nice. After which I need to pivot over to the worldwide enterprise. Good to see type of the administration or the addition for the Asia area. Simply remind us type of the way you’re viewing the org construction now internationally, how you intend to construct that out and help the expansion? After which is there any margin distinction we ought to be fascinated with with the worldwide enterprise relative to the U.S. as that enterprise continues to enhance its penetration? Is there any DTC to wholesale combine to consider or the rest from that angle?

Matthew Reintjes

Thanks. I am going to take the entrance finish of that from a structural perspective after which Mike can step in on the margin. As we take into consideration the chance internationally, one of many issues we have shifted our construction, our go-to-market construction to have industrial organizations centered on every of the foremost areas. So the Americas, Europe and the Center East after which Asia Pacific. And the reason is all Three are totally different levels of their maturation and their improvement and their progress and their wants. And so to have a staff that’s centered on benefiting from these alternatives, benefiting from the chance we have now within the Americas and benefiting from the chance — the burgeoning alternative we have now in Europe and within the Center East.

After which the chance we have now constructing off the energy of an unimaginable enterprise in Australia, as we referred to as out on the decision however in North Asia and in Larger Asia. And so I believe that is the place we’re excited to get a frontrunner in Naoji over that area to begin actually type of stoking what we predict is alternative beneath the floor.

Michael McMullen

Peter, it is Mike. And so a few issues in your query. First, at a gross sales combine degree, it actually type of — it differs by area however I might say that worldwide, we have not given specifics however what we have now mentioned is that we do not have our full D2C mannequin exterior the U.S. and in a number of instances, we have mentioned that company gross sales is underpenetrated. We’ve not had customization at scale. And so that will indicate that possibly wholesales are a barely greater combine, a chunk of the combination internationally simply due to not having the complete D2C mannequin. However we actually imagine that we’re able to drive that going ahead and you may see the D2C combine internationally proceed to extend.

From a margin perspective, what we mentioned when you normalize by — for channel that the gross margins are comparatively the identical as within the U.S. There’s some variations by area. However for essentially the most half, internationally, they’re fairly — versus the U.S., they’re fairly comparable. The place you see the distinction is on the working margin line. So a few of the extra — the areas the place we have been in marketplace for longer, Canada and Australia, we see actually sturdy working margins which might be accretive to YETI and newer areas which might be nonetheless rising like Europe, we’re nonetheless investing.

And so that you — we nonetheless bought some room to form of drive working margins up in these nations. However as Europe continues to develop, we’ll see that profit. That simply could also be offset by new areas that we enter like Asia, the place we’ll be going by means of an analogous dynamic that we have been going by means of in Europe the place the primary few years are actually about investing and constructing out the area.

Peter Benedict

Bought it. In order we scale internationally, there’s nothing structural however that retains the margins beneath it different than simply investments in rising new markets. So — good.

Operator

We’ve a query from John Kernan from TD Cowen.

John Kernan

Simply a few questions right here. The Drinkware enterprise accelerated the final two quarters over 12% progress near 13% this quarter. Possibly speak to a few of the drivers of that. There’s been some new entrants into {the marketplace}. You have clearly had some class enlargement. Simply curious, how ought to we take into consideration Drinkware versus Coolers & Tools for the tip of the yr?

Matthew Reintjes

Sure. Thanks, John. I am going to take the type of the dynamic piece after which Mike may also help out and take the again finish of that. I might say, as Mike mentioned in an earlier remark, we have at all times lived in a aggressive marketplace for our merchandise. I believe what YETI has accomplished constantly is drive innovation, inform customers why it is related, put related merchandise out in entrance of the buyer and be considerate about not solely our kind issue innovation but in addition colour. I believe the success that we’re seeing is each new and returning YETI clients responding to the product providing.

And I believe when you consider our product portfolio and the explanation we name out the 50-plus SKUs is that in Drinkware, that diversification, giving customers extra causes to interact with YETI merchandise all through the day, I believe is a key a part of our technique and I believe it is a key a part of the success that we have had.

Michael McMullen

Sure. And the one factor that I would add, John is, Matt talked about innovation, simply the expansion alternative exterior the USA that we have now. After which as we glance ahead and what we anticipate for the yr, we mentioned we anticipate C&E to outpace Drinkware progress however we do anticipate to have — to develop Drinkware this yr type of an analogous price that we noticed final yr. And we predict there’s — we’re off to begin to ship that primarily based on Q1.

John Kernan

Bought it. Possibly then only a follow-up on 2 companions, DICK’s and Amazon, clearly, Amazon being on the DTC aspect and DICK’s on the wholesale aspect. I believe the two channels account for nearly 1 / 4 of the corporate gross sales at this level, whenever you gross up the wholesale {dollars} it takes. Discuss, I suppose, the wholesale channel, gross sales house there, notably at DICK’s after which additionally Amazon, progress there continues to outpace the corporate common. I am simply curious what you are studying on Amazon and the way rather more you are able to do with them?

Matthew Reintjes

So let me — I am going to take the DICK’s query possibly type of develop out to wholesale broadly. After which Mike will speak in regards to the DTC dynamics within the general for YETI. As you consider our wholesale and we have mentioned this earlier than, we really feel nice in regards to the wholesale footprint we have now, we really feel nice in regards to the attain we have now with customers and the way we’re intersecting. As , we have been very considerate at what number of doorways and the way quickly we develop as a result of we proceed to put money into our within the productiveness on the shops through which we function and we put money into the productiveness and the efficiency for our companions and that is been a trademark of YETI.

We have commented earlier than that our shelf house is — remained the identical. Our combine on the shelf as we launch new merchandise and as we innovate, our wholesale companions proceed to search out methods to merchandise us, discover the house for our merchandise. So the largest change we have seen in current is how a lot of the entire house inside shops is dedicated to our classes. And I believe that is a dynamic of the buyer curiosity, notably round Drinkware and notably round hydration which we predict the eye to the class, as you’ve got seen within the outcomes from YETI, solely proceed to profit the sturdy product providing that we have now there.

So I would say, as we glance throughout our wholesale panorama within the U.S., we really feel excellent in regards to the footprint we have now. We really feel excellent in regards to the help we have now from our wholesale companions, we really feel nice in regards to the receptivity to our innovation and the issues that we have now coming. They usually proceed to be a extremely essential piece of YETI’s efficiency.

Michael McMullen

On Amazon, John. I imply, clearly, with our disclosures within the 10-Okay, it could indicate we had a extremely sturdy Amazon yr final yr from a progress perspective. We referred to as it out as we went by means of the yr. It was a driver, not solely our progress but in addition from an SG&A standpoint. What we mentioned this quarter is that we noticed good progress throughout all of our D2C subchannels, Amazon included. And that is on prime of getting a extremely sturdy yr final yr. So we did not give particular colour on Amazon or have not given particular colour on Amazon from a steerage or outlook perspective, aside from to say we predict it is a actually essential channel for us. It could actually proceed to be a extremely essential channel for us. However it is going to be, I believe, balanced with our different D2C subchannels this yr.

Operator

Now let’s take a query from Peter Keith from Piper Sandler.

Peter Keith

Good outcomes right here. Sticking on internationally. I’ve gotten a few questions. However with the acceleration you’ve got seen within the final 2 quarters, I hoped you can simply possibly spotlight the place a few of that acceleration is coming from? After which Mike additionally with the acceleration, why would the complete yr information nonetheless be 20% to 25% for Worldwide? And at last, on Worldwide. I believe you’ve got talked a couple of 30% gross sales penetration goal long run. Is there any thought that, that may be increased as we go ahead?

Matthew Reintjes

Thanks, Peter. I am going to take a little bit of that after which Michael weigh in a bit, too. After we have a look at type of the place that acceleration is coming from, we referred to as out on the decision, Australia continues to carry out extraordinarily nicely. We’ve an unimaginable staff down there. They’ve a terrific wholesale footprint that’s getting the model out in entrance of customers all through Australia. We’ve a powerful e-commerce enterprise. We recognized and referred to as out the chance within the rising customization or personalization capabilities. They’re constructing a very nice company gross sales enterprise. After which we’re somewhat earlier in New Zealand however New Zealand is a superb marketplace for us. It is a market that is an ideal match for YETI. So I believe that is a market the place we have got a whole lot of issues in place to have the ability to construct on prime of the momentum and the success that, that enterprise is at going again to 2017. So I believe that enterprise is within the type of construct strength-on-strength mode.

In Europe, we referred to as out the U.Okay. and Germany, been broadly in Europe, we’re seeing the model consciousness develop. We’re seeing product placement. Our partnerships, our advertising and marketing, our ambassadors, our occasion activations, so working the basic YETI playbook is admittedly beginning to pay dividends. And we launched that enterprise proper earlier than — in late-2019, proper earlier than the pandemic. So it had somewhat little bit of a slower begin with the wholesale disruption throughout that interval. I believe now we’re in a mode the place wholesale companions are beginning to develop. We’re getting the proper of and considerate further doorways. We’re driving a powerful e-commerce enterprise. We have got a company gross sales enterprise that is actually beginning to turf up some actually fascinating alternatives which might be actually model — on model, model proper and thrilling methods to get that type of first-hand shake of product into the buyer’s palms. So we really feel actually good about these progress platforms.

In Canada, as our longest-standing worldwide market, continues to diversify their channels to market, continues to develop the company gross sales, continues to drive the customization, has nice wholesale partnerships. So general, I believe we’re on the mode the place that accelerant is one thing we’re placing some power into to the earlier query and placing type of sensible {dollars} behind it.

I believe so far as the goal of the place it will probably go, once we first — once we had been type of speaking about Zero worldwide gross sales, we put illustrative examples of manufacturers that had been U.S.-based which have grown internationally and that is the place the 30% got here. It was by no means essentially a goal. However as you have a look at the chance that we’re proving is on the market after which the chance we have not but tapped, we have not put a cap on what we predict worldwide may be so far as a contribution to YETI.

Michael McMullen

Peter, that is Mike. The one factor I would add is by way of why we did not alter the steerage and I believe it comes down to only — it is 1 quarter, it is our smallest quarter. Nonetheless have a whole lot of the yr left to go. In the event you take the complete yr information and type of again out the Q1 outcomes, you are still in that vary that we have talked about of 20% to 25% progress for the yr. However clearly, as we predict there’s a whole lot of momentum right here, we predict there’s alternative right here for us, not solely this yr however long run. However for now, we’ll form of maintain our steerage for the yr. We’re simply centered on delivering the 7% to 9% for the corporate general and we really feel like Worldwide goes to be a giant piece of that.

Operator

And now we have now a query from Brooke Roach from Goldman Sachs.

Brooke Roach

The place do you suppose a sustainable long-term margin path may appear to be for the model as you more and more diversify your small business into new classes and geographies relative to the prior charges that you simply achieved in 2021?

Michael McMullen

Brooke, I believe the entrance finish of your query, at the least on our line, reduce out, so I apologize however might you repeat the query?

Brooke Roach

Sure. Positive. Are you able to hear me now?

Michael McMullen

Sure.

Brooke Roach

Nice. I used to be simply hoping you can assist us perceive the place you suppose the sustainable long-term working revenue margin path may appear to be for the model as you diversify your small business into new classes and geographies relative to the 2021 prior peak?

Michael McMullen

Brooke, it is Mike. Thanks for the query. In order we have talked about, we imagine that as we — that we have recaptured a whole lot of the inbound freight price peak that we noticed within the 2021 and 2022 timeframe. We’re at some extent that now we have captured that, we imagine we will begin to type of construct again working margin over time. I believe you are going to see that in form of 2 methods. Clearly, 1 could be proceed to drive up gross margins by means of gross sales combine, provide chain efficiencies, product price efficiencies. And a couple of, we imagine that over time, we are going to start to — we are going to begin to get leverage on our SG&A. There’s going to be quarters right here there the place that won’t — you might not see that simply quarter-to-quarter variability. However over the long run, that’s completely our aim and is totally what we imagine we will ship.

We talked in regards to the worldwide piece a bit earlier. 2 of our areas are, from an working margin standpoint are completely accretive to the corporate. They’re at some extent to the place — they have piece of the infrastructure they want. Europe is the place we’re doing a whole lot of our investing now simply due to the chance that we see. So — however over time, as we scale that enterprise, we’ll begin to get profit as they drive up their working margin. That simply could also be offset as we launch new areas. And clearly, we took a giant step just lately with a brand new member of our staff goes to assist lead our entrance into that area.

From a brand new product standpoint, I believe we’ll need to see type of the place we go. However as we have accomplished over the past 6, Eight years, as we broadened our product portfolio past simply Coolers and Drinkware, these new merchandise, as we have launched them, are even expanded inside these core classes. They’ve all been at margins which might be comparatively according to what we have accomplished previously. So we have now — we do not have a historical past of as we develop the product portfolio, the margins go down. So we imagine we will proceed to develop our working margins from right here, each by means of gross margin upside in addition to leverage on our SG&A.

Operator

And it will conclude our question-and-answer session. And now I want to flip the convention again over to Matt Reintjes for any closing remarks.

Matthew Reintjes

Thanks, operator and thanks all for becoming a member of the decision this morning. We sit up for talking with you throughout our Q2 name.

Operator

And this concludes our convention. Thanks very a lot for attending immediately’s presentation. You might now disconnect and have a terrific day.