SDI Productions

With a market capitalization of $6.57 billion, Standard (NASDAQ:BPOP) it is actually not the most important financial institution that I’ve analyzed. Nevertheless it’s additionally removed from the smallest. Again in the midst of November of final 12 months, I ended up ranking the corporate a ‘maintain’ to mirror my view on the time that shares can be unlikely to outperform the broader marketplace for the foreseeable future. This conclusion was primarily based on how shares had been priced and up to date weak point/volatility that the establishment had skilled main as much as that time.

Sadly, the market didn’t agree with my evaluation. Since publishing that article, shares have spiked 26.9%. That is comfortably above the 16.1% transfer greater seen by the S&P 500 over the identical window of time. This improve positively took me without warning. To be honest, there are some constructive points of the corporate that deserve consideration. Notably, the worth of deposits, loans, and securities, have all continued to extend. Shares are additionally towards the cheaper finish of the spectrum in comparison with related companies on a value to e-book foundation. However there’s additionally loads to dislike as nicely, akin to a inventory that’s expensive relative to earnings, low high quality belongings, and weakening on its prime and backside strains. In the long term, I feel that my ‘maintain’ ranking will show to be right. In reality, if shares preserve appreciating, it could not take lengthy earlier than I downgrade the inventory additional to a ‘promote’.

Current outcomes have been combined

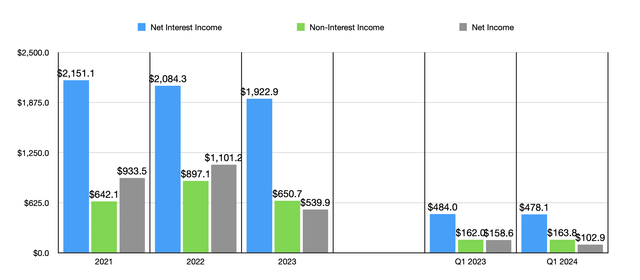

Basically talking, Standard has actually been one thing of a combined bag currently. Take into account monetary efficiency for the 2023 fiscal 12 months for instance. Web curiosity earnings got here in for the 12 months at $1.92 billion. That’s down barely from the $2.08 billion generated one 12 months earlier. A slight worsening of the corporate’s internet curiosity margin on a taxable equal foundation from 3.46% to three.31% is partially answerable for this. However the greater concern was a a lot bigger provision for credit score losses that the financial institution incurred final 12 months in comparison with the 12 months prior. This quantity got here in at $208.6 million. That dwarfs the $83 million reported for 2022.

Writer – SEC EDGAR Knowledge

Non-interest earnings, nevertheless, took fairly a beating, plummeting from $897.1 million to $650.7 million. This was pushed partly by a plunge in different non-interest earnings from $861.eight million to $622.2 million. This decline was pushed nearly totally by a $257.7 million achieve on some transactions that the corporate incurred in 2022. This, mixed with the weak point in internet curiosity earnings, was instrumental in pushing internet income down from $1.10 billion final 12 months to $539.9 million this 12 months. One other contributor to that decline was an increase in bills. Personnel prices, for example, rose from $719.eight million to $778 million. All different working bills mixed grew from $1.03 billion to $1.12 billion.

You possibly can see continued weak point when trying on the first quarter of 2024 in comparison with the identical time of 2023. Web curiosity earnings dipped from $484 million to $478.1 million. It’s true that the establishment noticed an enchancment in non-interest earnings from $162 million to $163.eight million. However while you issue within the internet curiosity earnings decline with greater working bills, internet income fell from $158.6 million to $102.9 million.

Writer – SEC EDGAR Knowledge

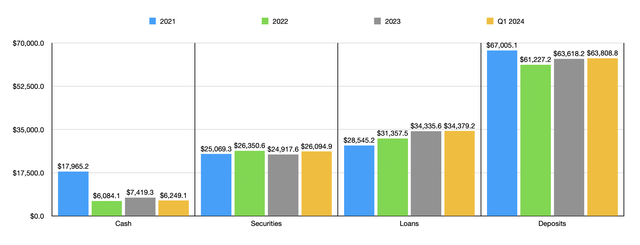

All issues thought-about, this was a internet adverse for the corporate. However there was a shiny spot. Deposits have been challenged within the present surroundings due to excessive rates of interest and considerations over the steadiness of the banking sector. The excellent news for shareholders is that deposits totaled $63.81 billion within the first quarter of 2024. This was up from the $63.62 billion reported on the finish of final 12 months, and it stacked up properly towards the $61.23 billion in deposits that the financial institution ended 2022 with. One other improve got here with the worth of loans. They grew from $31.36 billion in 2022 to $34.34 billion final 12 months. Right this moment, they stand at about $34.38 billion.

Writer – SEC EDGAR Knowledge

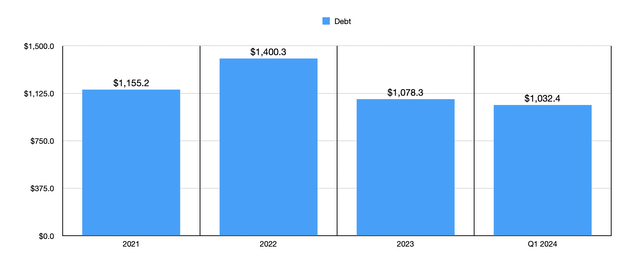

Additionally on the rise has been the worth of securities. Despite the fact that we noticed a decline from $26.35 billion in 2022 to $24.92 billion final 12 months, that drop was brief time period in nature. By the top of the primary quarter of this 12 months, securities had risen to $26.09 billion. However this isn’t to say that each metric improved. Money and money equivalents fell from $7.42 billion on the finish of 2023 to $6.25 billion on the finish of the primary quarter this 12 months. Luckily, there was some upside to those declines. On the finish of 2022, the financial institution had $1.40 billion in debt. That quantity dropped to $1.08 billion final 12 months earlier than dipping down additional to $1.03 billion within the first quarter of this 12 months.

Writer – SEC EDGAR Knowledge

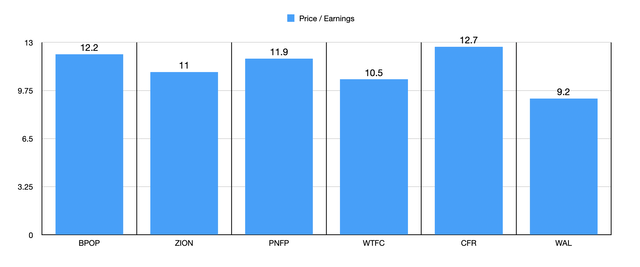

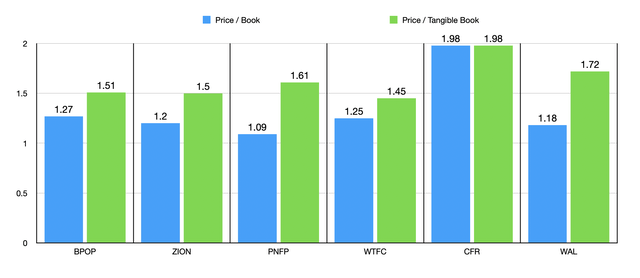

Whereas the earnings assertion is actually a internet adverse for buyers, I might say that the constructive points of the steadiness sheet roughly counter this. However there are different issues we have to take note of. As an illustration, we have to see how low-cost shares are. Because the chart above illustrates, Standard is buying and selling at a value to earnings a number of of 12.2. That very same chart compares it to 5 related banks. 4 of these are cheaper than it’s. I then in contrast our prospect to the identical 5 companies within the chart under, utilizing each the value to e-book strategy and the value to tangible e-book strategy. Within the value to e-book situation, 4 of the 5 corporations ended up being cheaper than it. However this quantity drops to 2 of the 5 when utilizing the value to tangible e-book strategy.

Writer – SEC EDGAR Knowledge

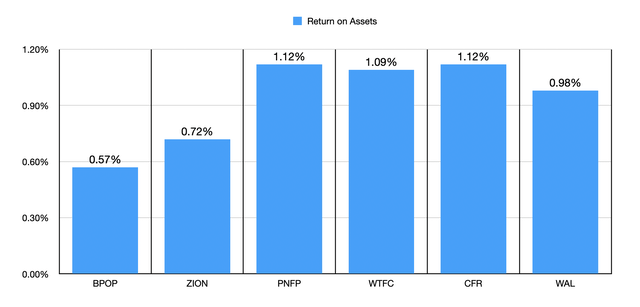

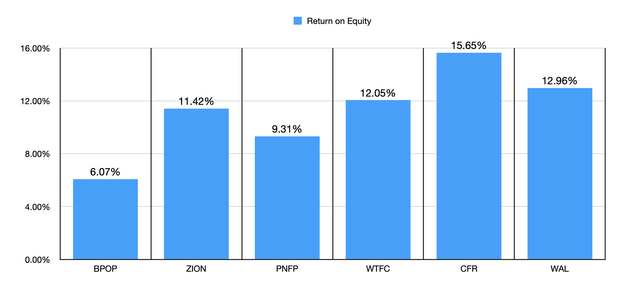

The truth that two of the three valuation approaches make Standard look costly in comparison with related companies just isn’t awe inspiring. It is actually not confidence inducing. However this may be justified if we have now an establishment that has top quality belongings. Sadly, this does not look like the case proper now. Within the first chart under, you’ll be able to see the return on belongings, not just for Standard, but in addition for a similar 5 companies that I in contrast it to already. Our candidate ended up being on the backside of the checklist. Within the subsequent chart, I did the identical factor utilizing the return on fairness of every establishment. However as soon as once more, Standard ended up being the worst of the group.

Writer – SEC EDGAR Knowledge

Writer – SEC EDGAR Knowledge

Takeaway

As a lot as I might like to see Standard stand out as an exceptional alternative, the numbers simply do not appear to assist this. We do see some constructive issues, akin to deposits, securities, and loans, all rising. The agency appears to be like low-cost on a value to tangible e-book foundation. However while you take a look at latest monetary efficiency from a income and revenue perspective, the decline in money, how shares are priced relative to earnings and e-book worth, and the general asset high quality of the establishment, it appears to be like to be nothing greater than a mediocre alternative proper now. Given these elements, I imagine {that a} ‘maintain’ ranking makes essentially the most sense.