South_agency

Funding Thesis

I like to recommend shopping for Suzano (NYSE:SUZ) shares. The corporate is the world’s largest producer of eucalyptus quick fiber pulp and has nice aggressive benefits for working in Brazil, whose local weather, soil and bushes supply sooner planting and a consequently extra aggressive price.

The corporate has grown strongly in recent times with M&As. Moreover, its EBITDA margin is over 40%, whereas that of its opponents is near 10%. Lastly, its valuation by way of the EV/EBITDA a number of is 20% under the peer common.

Introduction

The pulp and paper trade explores traits equivalent to adjustments in consumption patterns, particularly in packaging. We will additionally point out the rise in high quality of life and urbanization in nations equivalent to China and India.

Brazil was the biggest pulp exporter on the earth in 2023, with 22.5 million tons exported, additionally it is the third-largest producer on the earth, behind the USA and China.

Native traits are very robust, equivalent to environments that present productiveness within the manufacturing of uncooked supplies (eucalyptus and pine) on a big scale. Moreover, there may be nice potential for growth.

The tree rotation time in Brazil is shorter, as eucalyptus (uncooked materials) reaches the perfect age in round 7 years. American or European producers take a median of 15 to 20 years, and logically, this contributes to a wonderful manufacturing price. This can be a nice aggressive benefit for native producers and helps my bullish thesis for the shares.

Historical past and Enterprise Mannequin

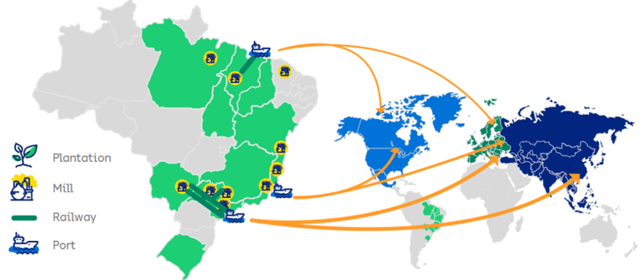

Suzano was based 90 years in the past within the Brazilian metropolis of Salvador. The corporate has 11 industrial models positioned in a number of Brazilian states, along with having 1.Four million hectares of planted forests in Brazil.

Company Overview (Suzano IR)

Within the worldwide market, the sale of paper and cellulose is carried out via direct gross sales by Suzano, primarily via its subsidiaries positioned within the Americas and Europe, along with a consultant workplace in China.

The corporate’s enterprise mannequin depends on excessive verticalization within the manufacturing course of, along with aggressive benefits arising from location and logistics.

Presently, Suzano operates with round 65% of its personal wooden. The typical radius estimated by the corporate within the present interval between its forests and productive crops is 186km, under the common of opponents, along with presenting excessive logistical and self-sufficiency in electrical power with a median surplus of 90 MWh.

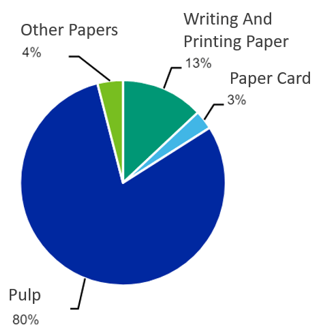

Once we discuss income, regardless of having a focus of revenues from the cellulose section, the corporate has good product and geographic diversification. The cellulose section represents 80% of web income, whereas the paper section accounts for 20% of web income.

Income Breakdown by Phase (IR Firm)

When it comes to location, 20% of the Firm’s web income was generated within the home market, whereas 80% got here from exports, with Asia chargeable for greater than 1/Three of exports.

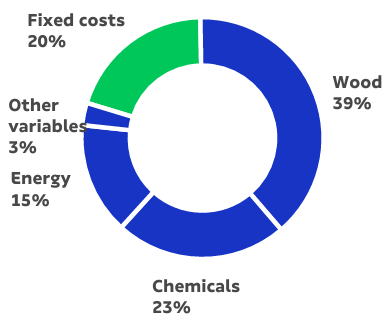

One other necessary level is to know the corporate’s price construction. Presently, 39% of prices are wooden, 23% are chemical compounds, 20% are fastened prices, and 15% are power.

Money Value (IR Firm)

It’s price remembering that cellulose producers established in Brazil profit from shorter harvest durations. In consequence, Suzano has traditionally maintained a excessive EBITDA margin in comparison with its trade friends. We’ll get a greater thought under, the place we’ll do a monetary evaluation of the corporate and its friends.

Suzano Fundamentals

Within the following, I’ll use Looking for Alpha and Koyfin to check Vale with its world friends, like UPM-Kymmene (OTCPK:UPMKF), Worldwide Paper Firm (NYSE:IP), Stora Enso (OTCPK:SEOAY) and WestRock Firm (NYSE:WRK):

| Ticker | (NYSE:SUZ) | (OTCPK:UPMKF) | (NYSE:IP) | (OTCQX:SEOAY) | (NYSE:WRK) |

| Market Cap | $12.6B | $20.1B | $13.8B | $11.7B | $13.6B |

| Income (TTM) | $7.6B | $11.1B | $18.5B | $9.5B | $19.5B |

| Income Progress 5 12 months [CAGR] | 19% | -0.6% | -4.5% | -3.5% | 2.3% |

| EBITDA Margin | 43% | 13% | 11% | 4% | 13% |

| Internet Earnings (TTM) | $1.8B | $0.5B | $0.2B | -$0.5B | $0.3B |

| Internet Earnings Margin | 24% | 4.7% | 1% | -5% | 1.6% |

| ROE | 21.9% | 4% | 2.2% | -4.8% | 3.1% |

| Dividend Yield | 2.3% | 4.3% | 4.5% | 0.7% | 2.2% |

| Internet Debt / EBITDA | 4x | 1.7x | 2.1x | 7.8x | 3.1x |

Properly, trying on the monetary evaluation, it’s clear how necessary the aggressive benefits of working in Brazil are. The corporate has had the best income progress within the final 5 years attributable to its progress technique via acquisitions.

Moreover, its EBITDA margin and web earnings margin are the best available on the market. Lastly, Suzano has a really enticing ROE of 21.9%, however do these nice numbers imply a stretched valuation?

Valuation Is Enticing

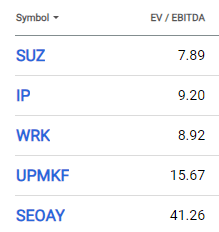

Once we analyze the commodities sector, the EV/EBITDA a number of could be very helpful, because it doesn’t account for the monetary consequence. Moreover, EBITDA is an effective proxy for money era.

EV/EBITDA (Looking for Alpha)

We will see that regardless of Suzano presenting the very best operational indicators, its EV/EBITDA a number of is under all its friends. To calculate an trade common, I’ll exclude the UPM and Stora multiples, as they’d skew the outcomes.

Thus, accounting for the multiples of Suzano, IP and WestRock, we arrive at a peer common of 8.67x, making Suzano discounted by 9.8% in comparison with its friends, which appears enticing to me given the corporate’s operational high quality. Due to this fact, my suggestion is to purchase the shares, since if the corporate returns to buying and selling on the peer common, it could have a good worth of $11.09.

Looking for Alpha Quant and Issue Grades

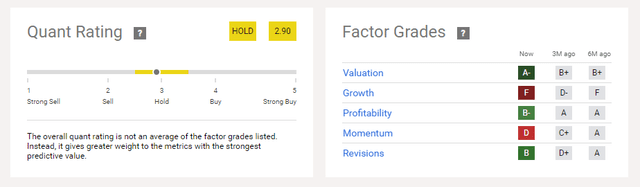

In accordance with Looking for Alpha Quant, the advice for Suzano is to carry the shares:

Quant Ranking and Issue Grades (Looking for Alpha)

Principally, the advice is penalized by the momentum and progress scores. It’s true that the momentum isn’t good, we see that the shares are present process a correction (which will also be seen as a possibility).

Nonetheless, when analyzing the expansion notes, I see that earnings progress is under expectations. I will discuss extra about this within the dangers to the thesis, however for my part, the corporate’s large low cost comes from its larger leverage than the peer common.

That is unhealthy as a result of the corporate operates in a cyclical sector, wherein a extra conservative technique could possibly be extra assertive. Moreover, the corporate carries out money circulation hedges over an extended interval, from 6 months to 2 years, and this finally ends up producing nice volatility in income. In my view, that is the principle motive the market has discounted the corporate’s shares.

I’ll discuss extra about it within the danger subject on the finish of the report, however first, let’s have a look at if the most recent outcomes had been good.

Newest Earnings Outcomes

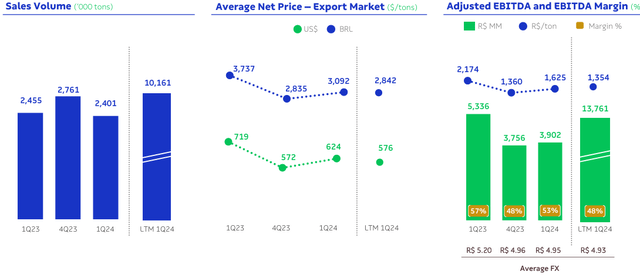

Suzano reported first rate leads to 1Q24, with EBITDA of $904.6 million, steady quarter-on-quarter. What weighed most was the efficiency of cellulose volumes (-13% q/q and -2% y/y), pushed primarily by stock formation.

Outcomes (IR Firm)

Pulp money prices (excluding stoppages) confirmed steady enchancment in 1Q24, with wooden prices reflecting the corporate’s efficiency-related efforts and positively pushed by the drop in enter costs, setting a constructive tone for the approaching quarters.

Nonetheless, what actually caught our consideration was the information leak that the corporate would make a proposal to accumulate rival Worldwide Paper, which I’ll discuss under.

Lastly, my projections for the corporate’s outcomes are:

Internet Income 24E: $8.45 billion. Internet Income 25E: $10 billion. Ebitda 24E : $Four billion. Ebitda 25E : $5.2 billion. Internet Earnings 24E: $1.98 billion. Internet Earnings 25E: $1.65 billion.

Potential Threats To The Thesis

Earlier than mentioning the 2 main dangers to the thesis, it’s vital to speak in regards to the information that induced the shares to fall greater than 11.5% on Might sixth, which indicated an obvious poor communication between the corporate and the market.

Information states that Suzano is contemplating buying rival Worldwide Paper for a valuation of $15 billion, higher than Suzano’s personal market worth. Initially, the market was taken unexpectedly for the reason that firm had knowledgeable that the funding cycle would finish after the Cerrado mission.

It’s also necessary to spotlight that the information isn’t official, nonetheless, if it happens, it could be a foul signal, because it provides restricted synergies and interrupts a deleveraging perspective. I’ll regulate the information in regards to the negotiation.

However what if the corporate carries out the acquisition? I imagine we may give the good thing about the doubt to the corporate’s administration as a result of Suzano has already carried out a serious acquisition of Fibria previously, which additionally had a better market worth than Suzano itself. And regardless of this, the consolidation was constructive and this introduced an excellent enhance in scale to the corporate’s enterprise.

However going again to the 2 primary dangers, I see excessive leverage as the principle one. This could be a main danger provided that the corporate operates in a cyclical market, and one of many economies that the majority demand its product (China) is present process structural adjustments.

Lastly, leverage brings excessive volatility to the consequence. For the reason that firm carries out money circulation hedges with an extended horizon, from 6 months to 2 years. Due to this fact, there’s a giant variation between revenue and loss every quarter. This volatility doesn’t captivate me as a long-term investor.

The Backside Line

On this report, we noticed that Suzano trades at an EV/Ebitda a number of with a reduction of 9.8% to the peer common. Moreover, the corporate has the best margins, the very best return, and probably the most aggressive price available on the market.

That is because of the aggressive benefits of working in Brazil. The nation provides a wonderful local weather and soil, which permits the time it takes to chop down bushes to be decreased by Eight to 10 years.

Primarily based on this evaluation, I like to recommend shopping for Suzano shares. Buyers ought to take note of the corporate’s strengths. The chance-return ratio appears fairly enticing on this case.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.