xijian/E+ by way of Getty Photographs

Overview

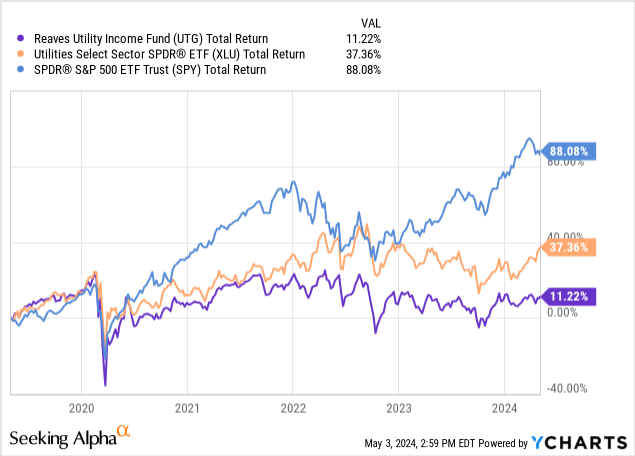

The utilities sector continues to lag behind the remainder of the market for the reason that speedy rising of rates of interest in 2022. For instance, the utilities sector (XLU) has delivered a modest 18% worth achieve during the last 5-year interval. Compared, the S&P 500 (SPY) has grown in worth by over 75% via the identical time-frame. I imagine that receiving a excessive dividend earnings, regardless that worth motion could disappoint, could assist offset this underperformance and make it simpler to carry via unfavorable market situations.

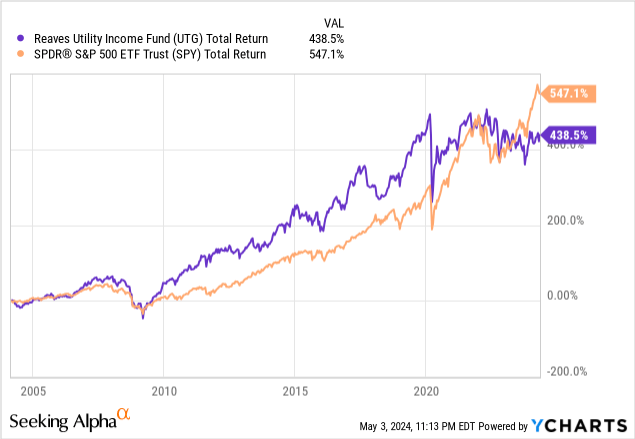

We are able to see that in a measure of complete return, Reaves Utility Earnings Belief (NYSE:UTG) has outperformed the utility sector by returning 3x via its greater distribution charge. On the identical time, although, UTG additionally underperforms the SPY, however this solely serves as a reference level. The principle goal of UTG is to supply a sustainable supply of earnings for buyers, so evaluating the entire return in opposition to the S&P 500 does not actually paint the total image of how UTG is utilized.

For context, Reaves Utility Earnings Belief operates as a Closed Finish Fund that gives publicity to the utilities sector and has the principle goal to supply excessive after tax earnings and complete return. The full return is aimed to be largely comprised of tax advantaged dividend earnings and capital appreciation, which is what makes this a well-liked alternative for retired buyers. Retired buyers usually purpose to put money into funds that may provide a few of the following issues, and UTG manages to ship:

- A dependable supply of dividend earnings

- Tax advantaged distributions

- Diversified publicity

- Low Value

- Capital Preservation

If we zoom out and take a look at the entire return profile, UTG really had lengthy durations of time the place it outperformed the S&P 500. This consistency in complete return instills numerous confidence to maneuver via no matter future headwinds could seem.

Fund Technique & Security

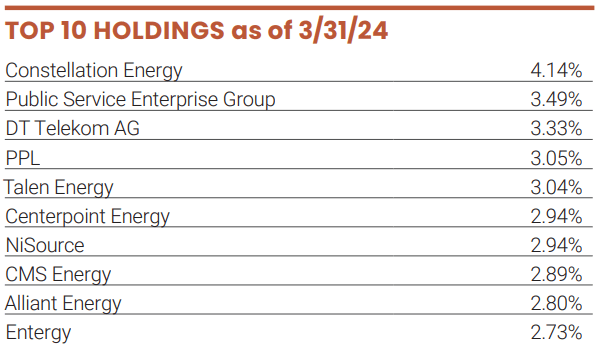

The fund is generally uncovered to shares throughout the utilities sector as anticipated, making up over 58% of the fund. As well as, we do get publicity to Communication Companies at 18%, Actual Property at 7.8%, Industrials at 7%, and the Power at 7.6%. The fund’s technique is to speculate at the very least 80% of their property in dividend paying shares in addition to debt devices throughout the utility trade. The remaining 20% is invested in all the different areas beforehand talked about. For reference, listed here are the highest ten holdings allocation:

UTG Truth Sheet

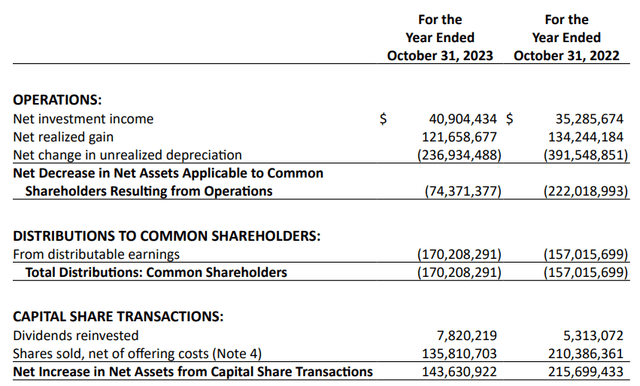

The highest ten holdings make-up roughly 31% of the fund’s complete worth. There are at present about 63 complete holdings throughout the fund. Having no place measurement bigger than 5% of web property is a superb technique for portfolio allocation, because it offsets any type of focus danger. This numerous breakdown will be partly answerable for the expansion of web funding earnings for fiscal 12 months 2023. The final annual report was issued in October of 2023, the place we are able to see that web funding earnings grew from $35.2M in 2022, as much as $40.9M in 2023.

We are able to see that the web realized achieve barely decreased in 2023, all the way down to $121.6M. Whereas NAV (web asset worth) sadly decreased for 2023, it nonetheless managed to lower rather a lot lower than the 12 months earlier than. The full web lower in web property was -$74.3M, which will be attributed to the utilities sector’s poor efficiency through the fiscal 12 months. Regardless of a foul 12 months for the sector, I imagine that UTG administration did the fitting factor by reinvesting extra dividends than the 12 months earlier than to reap the benefits of the decrease valuations. As well as, in addition they retain a bigger portion of their positions as shares bought, web of providing prices, decreased for fiscal 12 months 2023 all the way down to $135M.

UTG 2023 Annual Report

Because of the poor efficiency, the web property decreased 12 months over 12 months. In 2022, the web property of the fund ended at $1.99B, in comparison with 2023’s web asset complete of $1.89B. I additionally observed that the entire distributions out to shareholders weren’t absolutely lined in 2023.

- NII = $40,904,434

- Web Realized Achieve = $121,658,677Whole: $162,566,111

- Minus the distribution complete of ($170,208,291)Distribution Scarcity: ($7,642,180)

Because the fund has not been capable of earn sufficient to cowl the distribution, ROC (return of capital) was seemingly used to fill on this distinction. Evaluate this to the 12 months earlier than, the place the distribution quantity was absolutely lined by the NII and realized beneficial properties. Whereas ROC might not be favorable for some individuals, it does assist remove a few of the tax burden as ROC is normally not taxed the identical as dividends obtained.

Vulnerabilities

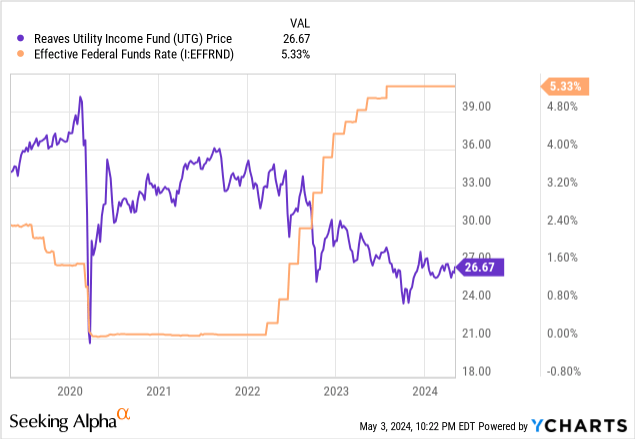

All through 2023, utilities was one of many worst performing sectors. This may be attributed to the quickly rising rates of interest ranging from 2022. We are able to see how the rise of rates of interest had an inverse relationship on UTG’s worth within the graph under. After the preliminary drop of 2020, the value of UTG began to climb because the sector gained development momentum from the close to zero charge setting.

Utility corporations are normally concerned in long-term development and growth tasks that require plenty of time and capital. With a better charge setting, the progress of those will be stalled as they’re now not inside funds as a consequence of a better curiosity fee required on the financed debt. There’s at all times new demand in utilities. For instance, I not too long ago wrote an article on Black Hills Company (BKH) the place I discussed how the corporate has ongoing building tasks to create higher infrastructures to service a rising inhabitants within the Mid-west area of the US, however rates of interest have slowed progress.

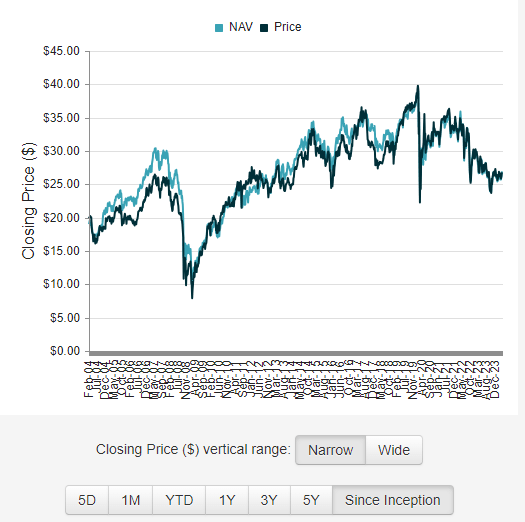

Lastly, whereas incremental makes use of of ROC are handy and useful at instances, long-term use of it’s a bit completely different. Lengthy-term use of ROC can have the aspect impact of eroding NAV and primarily stealing future development away from the fund. Fortunately, the NAV has managed to proceed rising over time, so the ROC use right here has not been extreme. Looking on the chart from CEF Join, we are able to see how the NAV stays greater than it was through the fund’s inception interval. A common indication {that a} Closed Finish Fund is out incomes the distribution is whether or not or not the NAV has grown over time.

CEF Join

Dividend

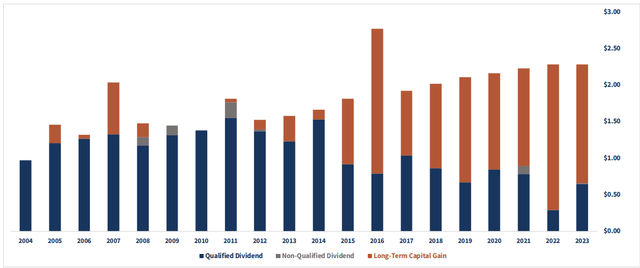

As of the most recent declared month-to-month dividend of $0.19 per share, the present dividend yield sits at 8.6%. As beforehand talked about, an enormous optimistic of UTG is that the fund goals to ship tax advantaged earnings when potential. That is nice as a result of it cuts down on the tax obligation for investor, with a considerable amount of capital deployed. Looking on the latest distribution historical past, we are able to see that it has largely consisted of long run capital beneficial properties and certified dividends, that are taxed at extra favorable charges in comparison with non-qualified dividends. In 2023, there is a small slither of grey space, which was seemingly ROC to fill the distinction.

UTG Truth Sheet

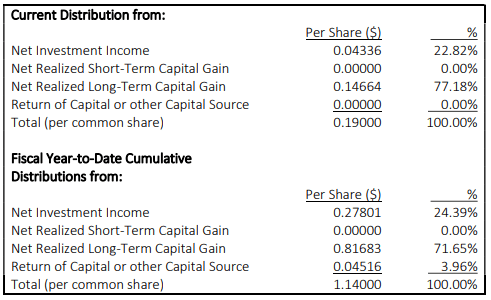

From the most recent April Type 19a, it seems like a lot of the dividend for April was funded from long run capital beneficial properties, roughly 77%. The remaining portion was funded from the NII (web funding earnings), roughly 23%. The 12 months up to now earnings look fairly sturdy because the fiscal YTD earnings sit at $1.14 per share. Which means UTG has primarily earned 6 months of the distribution, in solely Four months time.

($0.19 per share distribution x 6 months = $1.14 per share in complete distributions)

That is reassuring from an earnings perspective because it signifies that ROC (return of capital) does not have to be applied since earnings are largely masking it. Nonetheless, the 12 months up to now distribution complete has consisted of 4% ROC through the months the place the capital beneficial properties and NII could not have been adequate sufficient to cowl the distribution. The ROC make-up is a handy filler to make up the distinction. Lengthy-term use of ROC will be damaging to NAV, however with UTG this has not been the case since web property proceed to develop.

UTG April Type19a

Though the present yield sits excessive at over 8%, the expansion has been stunning. Though we have had a scarcity of base dividend raises since 2021, the years prior have been fairly sturdy. I imagine the latest lack of raises has rather a lot to do with the sector’s underperformance in addition to greater rates of interest. I’ll contact on the consequences of upper charges shortly.

Portfolio Visualizer

The dividend development right here is one thing that’s preferrred for buyers in search of dependable earnings in addition to development with minimal effort. Operating a again take a look at of UTG’s dividend development over time reveals stable earnings will increase. Assuming an preliminary funding of $10,000 in 2010, your earnings would have grown from $702 yearly as much as practically $3,000 in 2023. As well as, your place measurement would now be over $36,000. This assumes no further capital was ever deployed after your authentic funding and dividend have been reinvested each month.

Valuation & Outlook

When it comes to valuation, the value has remained in a fairly constant vary during the last decade. We have hardly ever seen the value go above $35 per share or under the $25 per share mark during the last ten years. Consequently, this has made UTG a fairly predictable inventory so far as understanding when could also be the most effective time to enter. For reference, the value is simply down -6% during the last ten-year interval. There have definitely been instances the place the value has spiked upward and given buyers a possibility to lock in worth beneficial properties and rebuy at a later date.

Looking on the worth to NAV (web asset worth) historical past, we are able to see that the value regularly traded at a reduction to NAV between 2014 – 2019. This has modified within the submit pandemic period of 2020 – 2024 as the value has now regularly traded close to honest worth. I’m referring to honest worth because the cross-point the place the value is sort of equal to NAV; neither a reduction or premium. We are able to see that the value at present trades at a really slight low cost to NAV of -0.11%. Within the final 3-year interval, the value has traded at a mean premium of 0.72%. Based mostly on this, an entry right here is barely extra engaging than common.

CEF Information

Whereas the value sits at a beautiful vary, I imagine that accumulation right here would additionally help you participate within the sector’s rebound. If charges get minimize within the later a part of 2024, I imagine that UTG might even see some upside. Future charge cuts are a possible catalyst as a result of this may decrease the borrowing price for lots of utility corporations. A decrease borrowing price would allow development initiatives, doubtlessly fueling extra upside as valuations develop from elevated operations.

Due to this fact, I believe that UTG’s tax advantaged earnings will be greatest utilized at this present cycle of unfavorable market situations. Accumulation right here would allow you to develop a supply of dividend earnings that’s rooted in a various publicity to utilities. You’d primarily accumulate a excessive dividend yield when you await market situations to enhance over time.

Situations available in the market change fairly regularly and generally unexpectedly. For instance, a latest jobs report got here in softer than anticipated and the market reacted to the upside. A slowing job market signifies that the Fed’s charge hikes are beginning to gradual the financial system. As charges begin to come again down finally, you’ll seemingly see UTG transfer to the upside. At which level, you’d now have constructed your self a big earnings stream from UTG and your capital would have additionally appreciated.

Takeaway

In conclusion, I imagine that Reaves Utility Earnings Belief is a superb earnings play to await the turnaround of the utilities sector. Whereas charges stay excessive, the sector has been crushed by decrease valuations and decrease earnings development. Whereas this additionally interprets into UTG having to implement ROC into their distribution make up at instances, it is not essentially a foul factor so long as NAV continues to develop over time. The portfolio inside is diversified and valuation sits at a extra engaging low cost than what has been the conventional common during the last three-year interval. UTG could be a nice earnings play, however I additionally anticipate some worth upside when charges lastly begin to get minimize. Due to this fact, I charge UTG as a Purchase.