Marlon Trottmann

Thesis

Jones Lang LaSalle (NYSE:JLL) continues to navigate the business actual property headwinds created by rising rates of interest and the work-from-home development. The ECB introduced in June the primary of its rate of interest cuts, and the Federal Reserve is anticipated to decrease charges within the US later in 2024. Indicators of restoration in business places of work are seen with international leasing volumes bettering following a 7% YoY improve, whereas retail and hospitality proceed their robust restoration with sturdy journey demand and rising wages. I imagine the actual property sector’s restoration will spur a rise in funding for brand spanking new tasks, and JLL’s service-based companies are effectively positioned to learn from these new commissions.

Introduction

JLL is likely one of the international leaders within the business actual property enterprise, with 106,000 workers working in over 80 nations and offering a broad vary of providers to landlords, buyers and tenants, briefly summarized under:

-

Leasing

-

Property Administration

-

Facility Administration

-

Venture and Improvement Companies

-

Funding Administration

-

Advisory Companies

The true property trade has been in turmoil for over 4 years within the wake of the occasions in 2020; nevertheless, as a service enterprise that depends on expert actual property specialists, headcount has been lowered by lower than 3% from file ranges set in 2019. Since these reductions, headcount has really risen by 17%, which I imagine highlights their resilience via one among actual property’s most difficult timelines for the reason that 2008/2009 monetary disaster. After all, authorities monetary help minimized the impacts on the time. The expansion in headcount signifies their intention to maneuver ahead as a stronger enterprise as soon as actual property will get again in favor with buyers.

Enterprise Replace

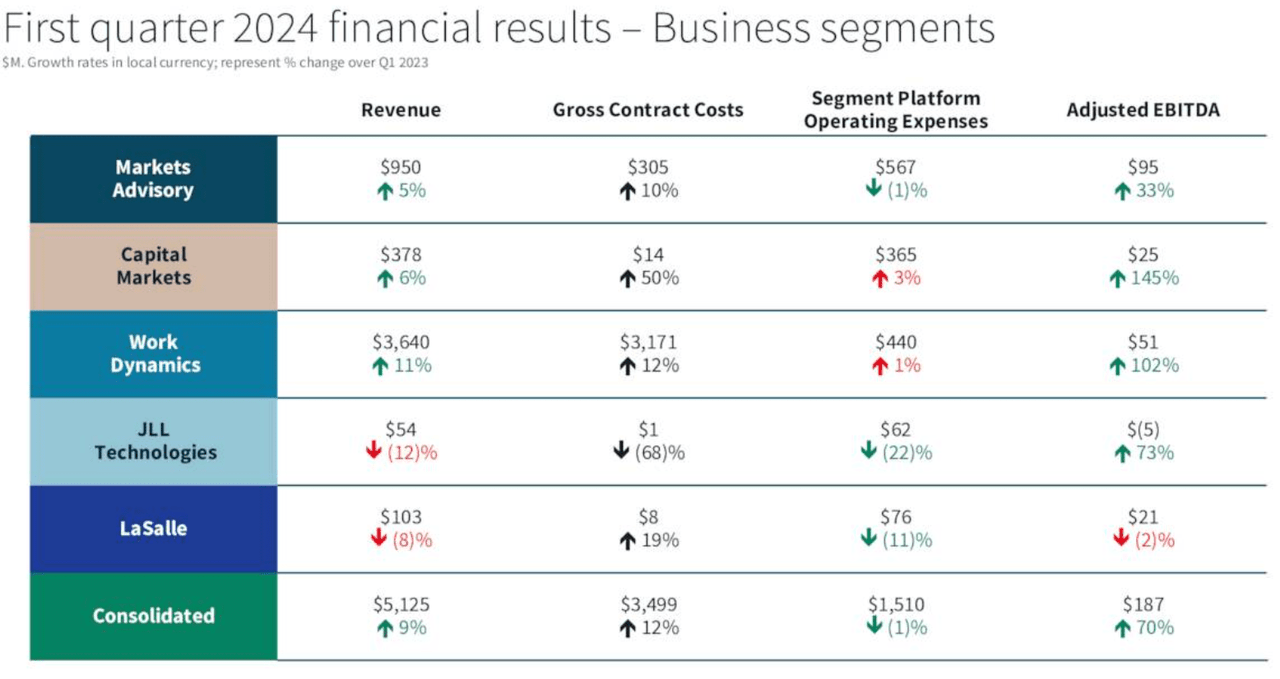

Q1 2024 outcomes confirmed spectacular YoY comparables, with revenues rising 9% to $5.1 billion and adjusted EPS seeing a big 150% improve from $0.71 to $1.78. The expansion in EPS was primarily a results of increased revenues, capital market transactions and value reductions throughout the enterprise. Outcomes had been blended throughout the enterprise segments; Income in Markets Advisory, the group’s second-largest unit, gained 5% YoY, whereas the Capital Markets enterprise unit grew revenues 6% YoY. Work Dynamics, the group’s largest income supply, improved revenues by 11% YoY. Moreover, the 2 smallest enterprise models, JLL Applied sciences and LaSalle, posted decrease revenues of -12% and -11% YoY declines.

JLL Q1 Monetary Abstract (Q1 Earnings)

Business actual property stays a troubled actual property market, with transactions principally frozen and developments postponed or canceled fully. International emptiness elevated to 16.5% in Q1 2024, persevering with the downward trajectory of occupancy since 2020. The US market stays essentially the most troubled geographic space, primarily because of new leases decreasing their usable house by 10–15%. This can be a clear indicator of the persevering with headwinds within the sector, the place tenants merely don’t require as a lot house on account of many causes, however particularly the work-from-home workers who not require a devoted workspace.

In Europe and Asia, new leases in business actual property have been negatively affected by the shortage of recent, energy-efficient, centrally situated workplace house that’s served by public transport. Hybrid and distant work choices are much less obtainable in these markets when in comparison with the US, which has created a extra secure workplace market with decrease emptiness charges; nevertheless, the pause in growth for brand spanking new actual property tasks has created a backlog of demand for contemporary, energy-efficient business house as companies try to supply enticing workspace to encourage worker wellbeing and retention.

JLL’s office and property administration platforms are tailor-made to these companies looking for to be the employer of selection and permit JLL’s workforce to facilitate upselling of present shoppers to enhance revenues when few new transactions are happening. Know-how uptake in actual property continues to lag behind most different industries for quite a lot of causes, which in the end stems from a fragmented, mature trade that has seen restricted technological growth when in comparison with different industries.

On a brighter notice, the Funding Administration enterprise unit has been ramping up debt financing offers for the reason that starting of 2024 with quite a lot of transactions throughout the USA, resembling:

-

$425 million refinancing of the Miracle Mile Outlets in Las Vegas

-

$375 million acquisition financing for a mixed-use campus in San Diego

-

$520 million capitalization for a waterfront mixed-use growth in Brooklyn

-

$750 million building financing for a mixed-use challenge close to Harvard College in Massachusetts

-

$869 million refinancing of a 25-asset nationwide industrial portfolio.

Outlook and Alternatives

As I discussed above, expertise is of nice significance to corporations in the actual property trade, and thru JLL Spark they put money into PropTech as enterprise capital. Being concerned on the VC stage permits JLL to find these PropTech concepts that could be game-changing for the trade and assist differentiate their choices from rivals. I imagine PropTech is likely one of the most attention-grabbing developments in the actual property trade, and though expertise adoption is comparatively sluggish, I count on this enterprise unit shall be a future driver of progress for JLL.

Shifting from expertise to financing, JLL was not too long ago honored because the main business and multifamily portfolio debt originator for the 11th consecutive 12 months. With transaction markets considerably frozen over latest years and conventional lenders hesitant to fund actual property transactions, I imagine JLL is effectively positioned to see progress within the debt origination market as buyers return to actual property.

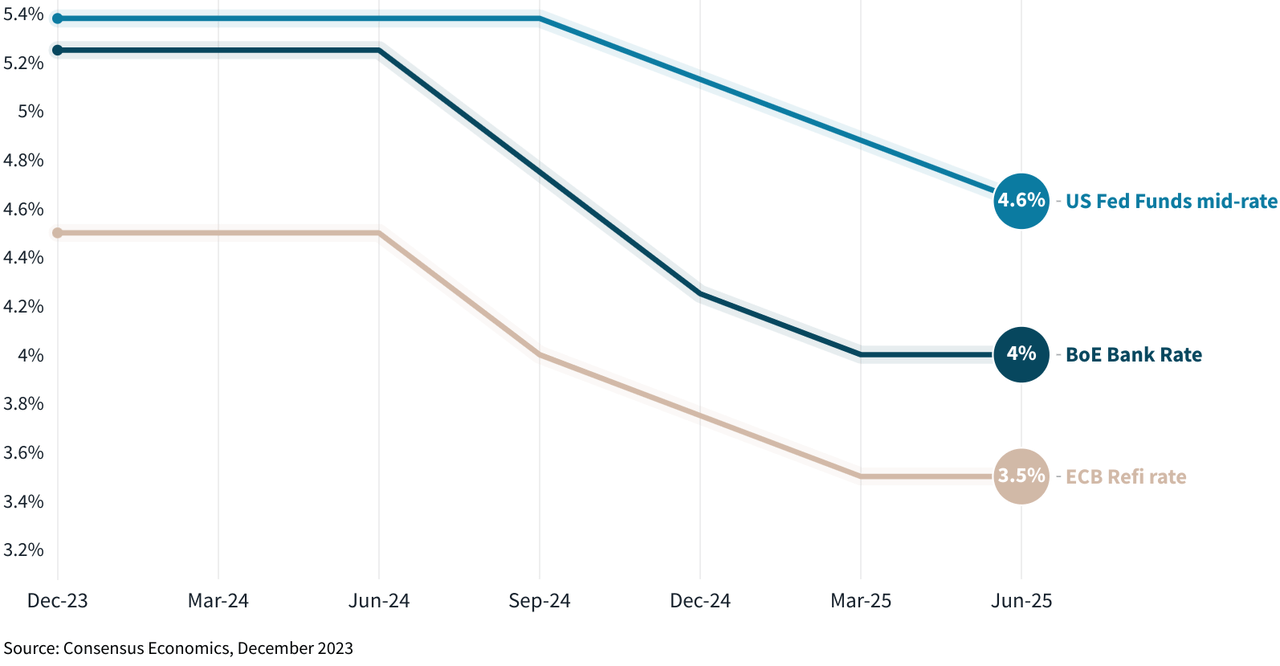

JLL’s devoted market analysis workforce supplies quarterly and annual standing studies for his or her key international markets. Whereas every geographic area has particular challenges and alternatives, the essential issue anticipated to impression every market is rates of interest.

Within the US, the first-rate reduce is anticipated to happen in October, following the ECB 25 foundation level reduce in June. The Financial institution of England was additionally anticipated to chop charges in June; nevertheless, right now, no announcement has been made. Nevertheless, expectation of a reduce in June was lowered after latest CPI studies did not set off motion from the Financial institution of England. The newest data suggests we may even see the BOE decrease charges in August.

Curiosity Price Forecasts (JLL International Market Report)

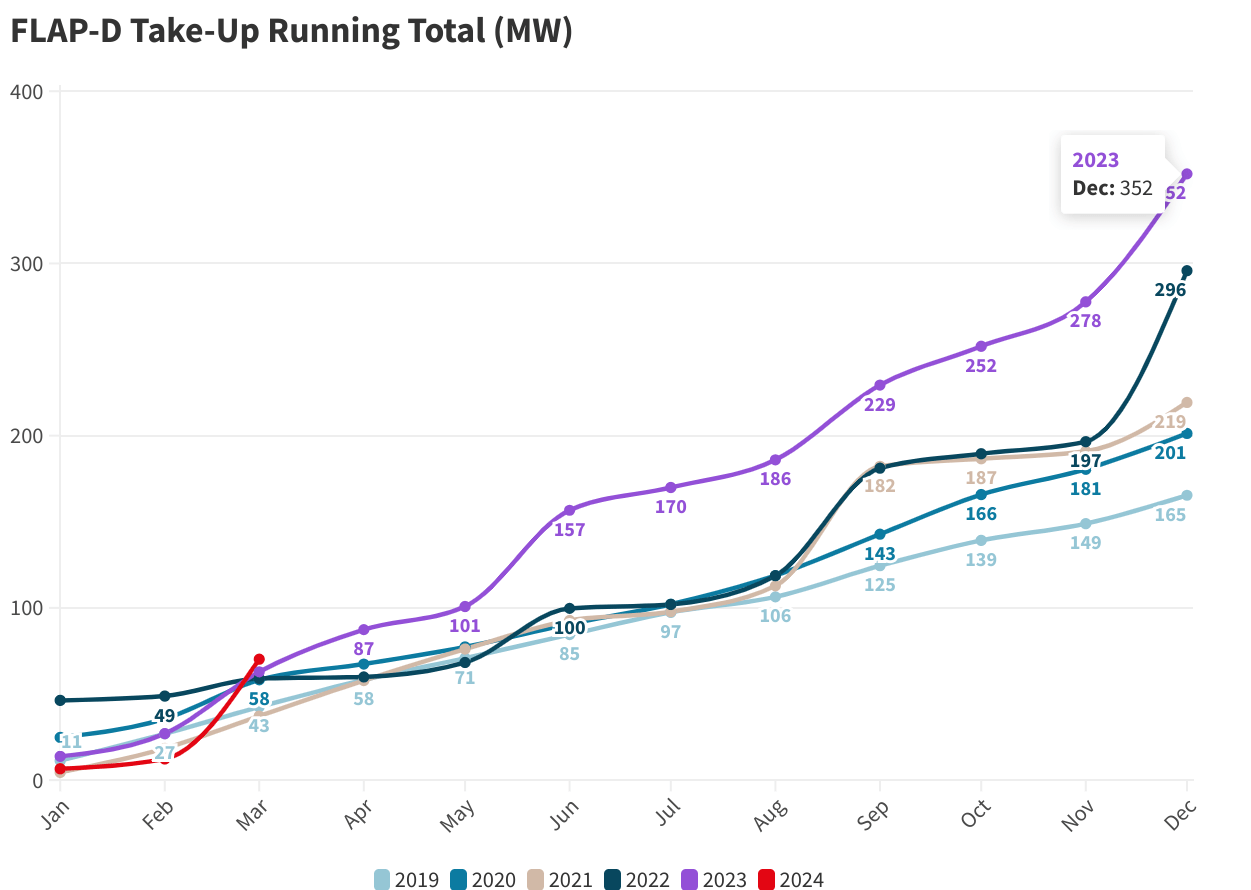

Information facilities have turn into an necessary sector for JLL, with the event of this sector coming at an necessary time within the wake of the decline in workplace growth globally. Information heart growth has been gaining momentum in recent times, significantly within the USA, the place Q1 2024 stock elevated 24% YoY. Moreover, Europe has turn into an more and more necessary market, with progress of 20% YoY.

Within the knowledge heart house, JLL helps their shoppers in website choice and property administration providers, that means they’re concerned within the challenge workforce from challenge inception and preserve the connection via the operations interval, making a secure fee-earnings function via property administration.

The under chart highlights the spectacular surge within the knowledge heart growth throughout the most important European markets of Frankfurt, London, Amsterdam, Paris, and Dublin. 2024 has began off very robust, with JLL estimating 1,587 MW at present underneath building and an extra 969 MW within the planning phases within the core European markets, scheduled for supply over the subsequent three years.

European Information Middle Market (JLL EMEA Q1 DC Report)

Opponents

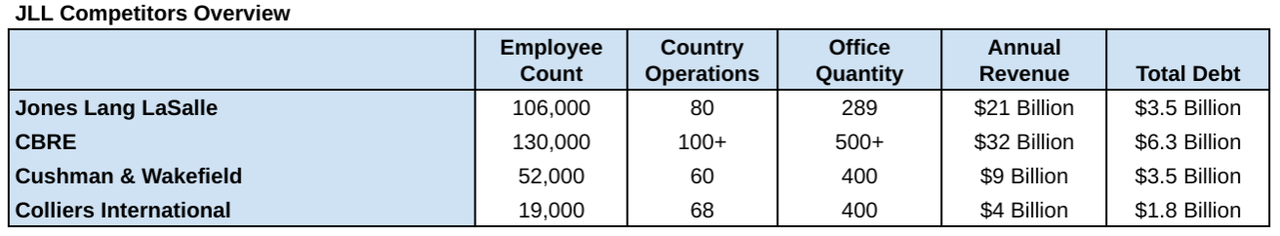

Earlier than I cowl the dangers to JLL’s enterprise, I feel it is price commenting on the competitors in the actual property house. Actual property has at all times been a aggressive trade, and the skilled providers supplied by JLL are thought-about to be resilient and worthwhile areas within the trade, which creates a excessive degree of competitors for brand spanking new work and expert staff.

The next rivals, together with JLL, type the ‘Massive 4’ of Business Actual Property. Every enterprise has sure specialty areas, resembling challenge administration, financing or pre-construction; nevertheless, nearly all of providers overlap amongst the competitors. The biggest competitor is CBRE (CBRE), adopted by Jones Lang LaSalle, whereas Cushman & Wakefield (CWK) and Colliers Worldwide (CIGI) are considerably smaller, however direct competitors however.

Competitor Overview (Writer, Information by Companies)

Shareholder Returns

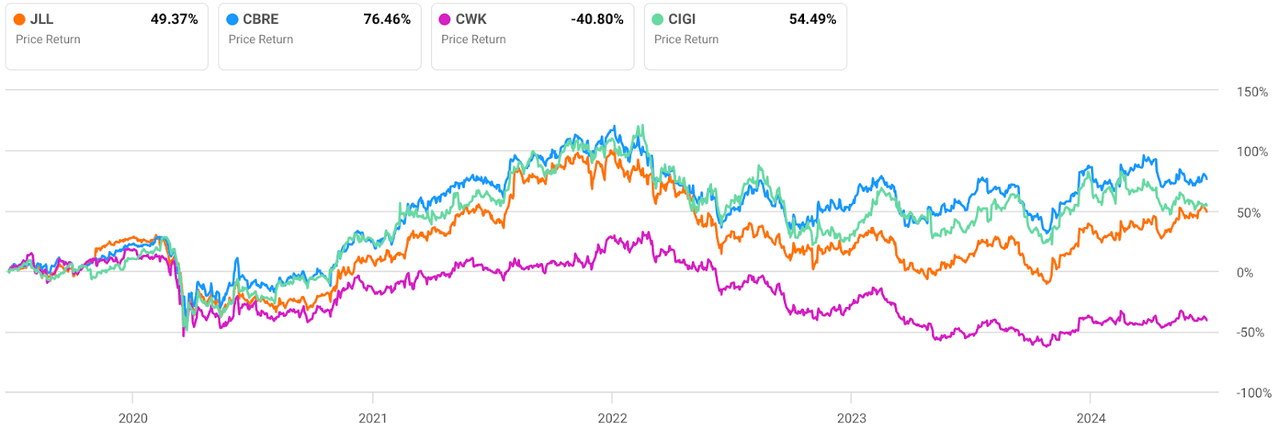

Over the previous 5 years, JLL has marginally underperformed its closest rivals, CBRE and Colliers, returning 49% share value progress, whereas Cushman & Wakefield has underperformed the peer group following a sequence of unfavourable earnings in latest instances.

JLL eradicated the dividend in 2020 in response to the worldwide lockdowns, and to this point, it has not been reinstated regardless of improved free money move. Right now, I imagine the corporate is making the proper choice by not distributing a dividend as a result of headwinds in business actual property and the 1.9x web leverage ratio. Nevertheless, as charges are anticipated to say no and earnings are sturdy, I might count on to see the reinstatement of a small dividend to appease shareholders within the not-too-distant future.

In Q1 2024, share repurchases amounted to a modest $20 million. For the rest of 2024, repurchases are anticipated to offset stock-based compensation; subsequently, shareholders are usually not actually benefiting from these share repurchases however merely standing in place on account of inventory awards.

JLL’s Competitor Worth Return (SA Charting)

Dangers

Geopolitical tensions impression enterprise confidence for buyers, slowing investments selections in addition to creating provide chain challenges. JLL is really a worldwide enterprise working in 80 nations, which might result in elevated ranges of danger in sure geographic areas because of geopolitical points.

Rates of interest stay elevated, inflicting a slowdown in growth and transactions as buyers keep on the sidelines. JLL’s personal market analysis suggests the second half of 2024 would be the start line for a restoration, with declining charges revitalizing funding in the actual property sector again to historic ranges.

Know-how development is sluggish in the actual property trade. JLL operates its personal enterprise unit, providing expertise options for shoppers looking for expertise options, albeit a comparatively small contributor to the highest line. Competitors in PropTech choices that will higher go well with the top consumer might disrupt JLL’s in-house expertise unit, that means steady innovation shall be required and doubtlessly additional acquisitions with a purpose to sustain with these developments. After all, acquisitions create their very own dangers for the buying firm as they search to combine exterior expertise into their present choices, though JLL has confirmed they’re adept at M&A transactions.

Last Ideas

In conclusion, I imagine there shall be a noticeable uptick in exercise throughout the actual property sector later in 2024 and into 2025, following a protracted quiet interval for the trade (excluding industrial and knowledge facilities). JLL has navigated these headwinds over the previous Four years and now seems to be in a terrific place to succeed. Competitors is powerful, and shoppers can in some instances change service suppliers fairly simply; nevertheless, JLL’s robust Q1 report suggests their resilient revenues are bettering, which reinforces their status for delivering a high-quality service.

In gentle of the recovering actual property market and robust progress in sub sectors resembling knowledge facilities, I imagine Jones Lang LaSalle is a Purchase for these looking for publicity to the actual property sector and people in search of diversification from capital-intensive bodily actual property possession.