10’000 Hours/DigitalVision by way of Getty Photographs

Webtoon Is Rising Income Extra Slowly

Webtoon Leisure Inc. (WBTN) has filed to boost $100 million in an IPO of its widespread inventory, in accordance with an SEC S-1 registration assertion.

WBTN has created a storytelling platform for comics and cartoons on-line.

Whereas Webtoon Leisure Inc. has potential rivals and alternatives with new AI applied sciences, administration appears to be managing the corporate for profitability, which has produced materially slower income development.

I’ll present an replace after we study extra concerning the IPO.

What Does Webtoon Do?

Los Angeles, California-based Webtoon Leisure Inc. was based to offer a platform for people to publish their animation and associated tales worldwide.

Administration is headed by founder and CEO Mr. Junkoo Kim, who has been with the agency since its inception in 2016 and was beforehand a developer at NAVER from 2004 onward.

The corporate’s major choices embrace the next:

-

Net comics – graphic medium

-

Net novels – textual content medium

-

Neighborhood

-

Title variations.

As of March 31, 2024, Webtoon has booked honest market worth funding of $1.7 billion from buyers, together with NAVER and LY Company.

The agency markets its on-line service primarily by way of on-line means, by means of net and cellular apps and phrase of mouth.

Administration says the location “connects 24 million creators with roughly 170 month-to-month energetic customers [MAUs] in over 150 nations world wide.”

Advertising bills as a share of whole income have fallen as revenues have risen, because the figures beneath point out:

|

Advertising |

Bills vs. Income |

|

Interval |

Share |

|

Three Mos. Ended March 31, 2024 |

6.0% |

|

2023 |

9.4% |

|

2022 |

16.7% |

(Supply – SEC.)

The Advertising effectivity a number of, outlined as what number of {dollars} of further new income are generated by every greenback of Advertising expense, fell to 0.8x in the newest reporting interval, as proven right here:

|

Advertising |

Effectivity Price |

|

Interval |

A number of |

|

Three Mos. Ended March 31, 2024 |

0.8 |

|

2023 |

1.7 |

(Supply – SEC.)

The Rule of 40 is a software program trade rule of thumb that claims that so long as the mixed income development price and EBITDA share price equal or exceed 40%, the agency is on an appropriate development/EBITDA trajectory.

WBTN’s most up-to-date calculation was solely 10% as of March 31, 2024, so the agency wants important enchancment on this regard, per the desk beneath:

|

Rule of 40 |

Calculation |

|

Current Rev. Development % |

5% |

|

Working Margin |

4% |

|

Complete |

10% |

(Supply – SEC.)

What Is Webtoon’s Market?

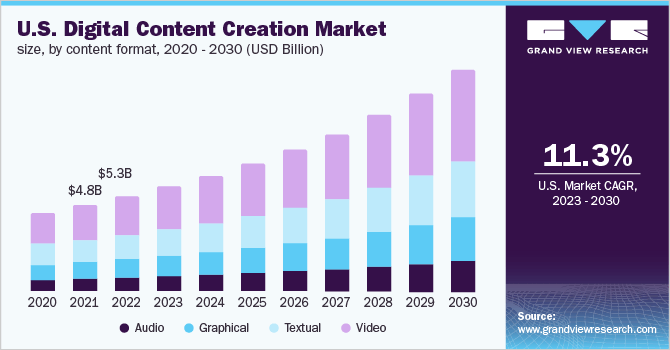

In keeping with a 2023 market analysis report by Grand View Analysis, the worldwide marketplace for digital content material creation was an estimated $25.6 billion in 2022 and is forecasted to succeed in $70.5 billion by 2030.

This represents a forecast sturdy CAGR of 13.5% from 2023 to 2030.

The principle drivers for this anticipated development are development within the sophistication and availability of digital media instruments, the rise of AI, rising adoption of cloud computing amid continued robust shopper demand for attention-grabbing content material.

Additionally, the chart right here reveals the historic and projected future development trajectory of the U.S. digital content material creation market, which is a subset of the worldwide market, from 2020 to 2030 by content material format:

Grand View Analysis

Main aggressive or different trade members embrace the next:

-

Kakao Webtoon

-

Kidari studio

-

Piccoma

-

Leap Toon

-

Tapas

-

Manta

-

KakaoPage

-

Radish

-

GoodNovel

-

Dreame

-

Main social media platforms

-

OTT platforms

-

Gaming firms

-

Video streaming providers.

Webtoon Leisure’s Current Monetary Outcomes

The corporate’s latest monetary outcomes may be summarized as follows:

-

Substantial however slowing topline income development

-

Rising gross revenue however uneven gross margin

-

A swing to working revenue

-

Larger money move from operations.

Under are related monetary outcomes derived from the agency’s registration assertion:

|

Complete Income |

||

|

Interval |

Complete Income |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2024 |

$ 326,744,000 |

5.3% |

|

2023 |

$ 1,282,748,000 |

18.8% |

|

2022 |

$ 1,079,388,000 |

|

|

Gross Revenue (Loss) |

||

|

Interval |

Gross Revenue (Loss) |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2024 |

$ 82,359,000 |

25.1% |

|

2023 |

$ 295,490,000 |

8.2% |

|

2022 |

$ 273,011,000 |

|

|

Gross Margin |

||

|

Interval |

Gross Margin |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2024 |

25.21% |

4.0% |

|

2023 |

23.04% |

-8.9% |

|

2022 |

25.29% |

|

|

Working Revenue (Loss) |

||

|

Interval |

Working Revenue (Loss) |

Working Margin |

|

Three Mos. Ended March 31, 2024 |

$ 14,188,000 |

4.3% |

|

2023 |

$ (36,358,000) |

-2.8% |

|

2022 |

$ (114,719,000) |

-10.6% |

|

Complete Revenue (Loss) |

||

|

Interval |

Complete Revenue (Loss) |

Web Margin |

|

Three Mos. Ended March 31, 2024 |

$ (22,465,000) |

-6.9% |

|

2023 |

$ (162,916,000) |

-12.7% |

|

2022 |

$ (161,723,000) |

-15.0% |

|

Money Stream From Operations |

||

|

Interval |

Money Stream From Operations |

|

|

Three Mos. Ended March 31, 2024 |

$ 23,856,000 |

|

|

2023 |

$ 14,804,000 |

|

|

2022 |

$ (140,608,000) |

|

|

(Glossary Of Phrases.) |

(Supply – SEC.)

As of March 31, 2024, Webtoon had $218.7 million in money and $418.6 million in whole liabilities.

Free money move through the twelve months ended March 31, 2024, was $60.9 million.

Webtoon Leisure’s IPO Info

Webtoon intends to boost $100 million in gross proceeds from an IPO of its widespread inventory, though the ultimate determine could also be materially increased.

No doubtlessly new shareholders have indicated an curiosity in buying shares from the providing.

The corporate might be an “rising development firm” in accordance with the 2012 JOBS Act, which suggests the agency will be capable to disclose considerably much less info to shareholders.

Administration says it’s going to use the online proceeds from the IPO as follows:

The principal objective of this providing is to extend our capitalization and monetary flexibility and create a public marketplace for our widespread inventory. We intend to make use of the online proceeds from this providing for common company functions, together with working capital, working bills and capital expenditures. We can’t specify with certainty all the specific makes use of for the remaining internet proceeds to us from this providing.

(Supply – SEC.)

Administration’s presentation of the corporate roadshow is just not but out there.

Relating to excellent authorized proceedings, management stated the corporate is just not uncovered to any authorized motion that will have a cloth adversarial impact on its enterprise or monetary situation, though it’s doubtlessly uncovered to NAVER and LY Company legal responsibility given its relationship to these two entities.

The listed bookrunners of the IPO are Goldman Sachs & Co., Morgan Stanley, J.P. Morgan, Evercore ISI, Deutsche Financial institution Securities, UBS Funding Financial institution, HSBC, Raymond James and LionTree.

Webtoon’s Topline Development Price Is Slowing

WBTN is looking for U.S. public market funding for its common enlargement plans and dealing capital necessities.

The corporate’s financials have generated a declining topline income development price, rising gross revenue however variable gross margin, a flip to working revenue and elevated money move from operations.

Free money move for the twelve months ended March 31, 2024, was $60.9 million.

Advertising bills as a share of whole income have dropped as income has elevated; its Advertising effectivity a number of fell to 0.8x in the newest reporting interval.

The agency at the moment plans to pay no dividends and to retain any earnings for reinvestment for its enterprise necessities.

WBTN’s latest capital spending historical past signifies it has spent sparingly on capital expenditures as a operate of its working money move.

The corporate’s Rule of 40 outcomes have been comparatively low, with sluggish income development and low working margin contributing to an underwhelming determine for this metric.

The market alternative for digital content material creation and platforming is giant and anticipated to develop at a powerful price of development within the coming years.

Dangers to the corporate’s outlook as a public firm embrace the rise in the usage of AI instrument platforms from new rivals.

Conversely, including new AI instruments may develop the corporate’s choices and its skill to draw new customers.

It seems from the financials that the agency is being managed for working profitability over development, maybe to point out potential buyers the corporate may be worthwhile whereas nonetheless rising income.

Nonetheless, income development has dropped into mid-single-digits, which is way from spectacular.

After we study extra IPO particulars from administration, I’ll present a ultimate opinion.

Anticipated IPO Pricing Date: To be introduced.