Monty Rakusen

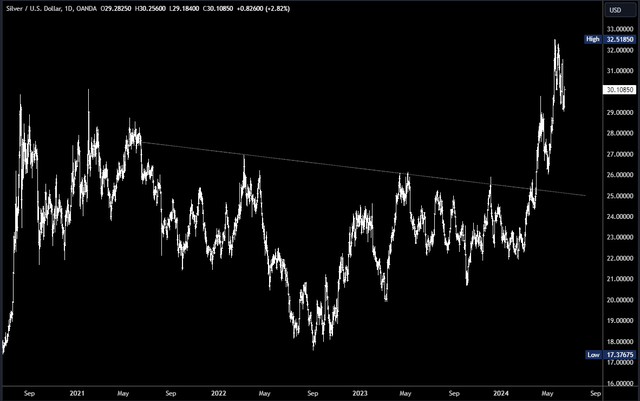

Silver (NYSEARCA:SLV) costs broke out to new 10-year highs final month and technically, there are causes to be bullish. However what about fundamentals? This query can solely be answered if we handle to outline silver’s drivers, and that isn’t at all times straightforward.

What’s Driving Silver

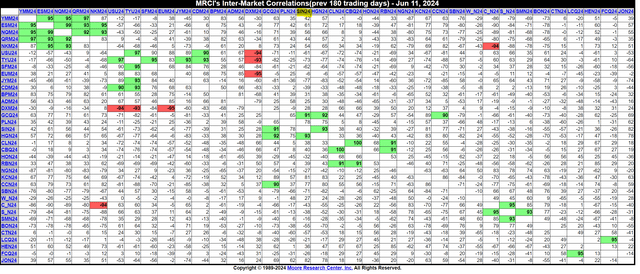

The drivers of silver costs are seemingly onerous to pin down. It’s each a valuable metallic and an industrial metallic, and that is mirrored in its correlation to each gold and copper.

Correlations (MRCI)

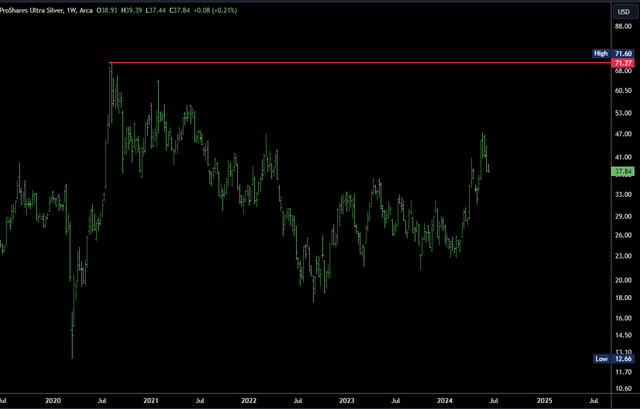

Gold, copper and silver all rallied collectively in Could, however whereas gold and copper broke to new all-time highs, silver is a good distance from its all-time excessive of $50.

Silver Chart (TradingView)

That is largely as a result of silver’s bear market lasted so much longer than gold’s. Gold bottomed in late 2015 and had already rallied 62% by the point Covid arrived. Silver solely bottomed after Covid. The 2 metals had been nonetheless correlated in essentially the most half, however silver tended to fall additional and rally much less from 2015-2020.

Silver’s massive drop in 2011-2020 is another excuse it’s nonetheless so distant from its 2011 excessive. Gold solely needed to rally round 80% from its 2015 low to exceed its 2011 peak, whereas silver wanted a rally of over +280% from its 2020 low.

Oddly sufficient, it is a related scenario traders discover themselves in when coping with leveraged ETFs. It’s referred to as damaging compounding – as a result of losses are amplified, it takes a a lot bigger rally to achieve the earlier peak. That is clearly seen on a latest chart of the ProShares Extremely Silver ETF (AGQ) – AGQ remains to be a good distance beneath its 2020 peak whereas silver exceeded its 2020 peak final month.

AGQ Chart (TradingView)

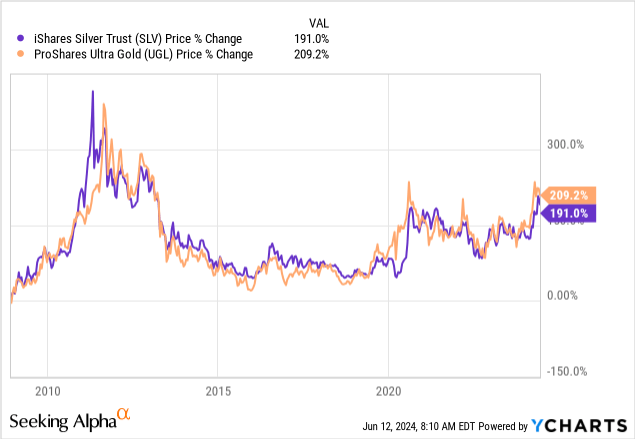

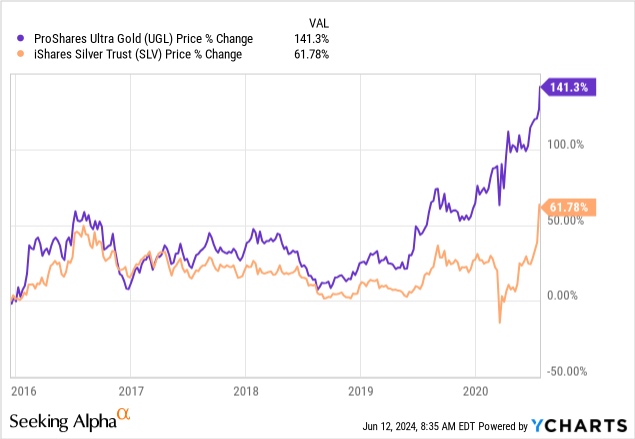

It might subsequently be stated silver is performing like a leveraged model of gold. This concept is definitely examined as gold has a 2x leveraged ETF referred to as the ProShares Extremely Gold ETF (UGL). Amazingly, it has traded nearly precisely like silver has over the past 15 years.

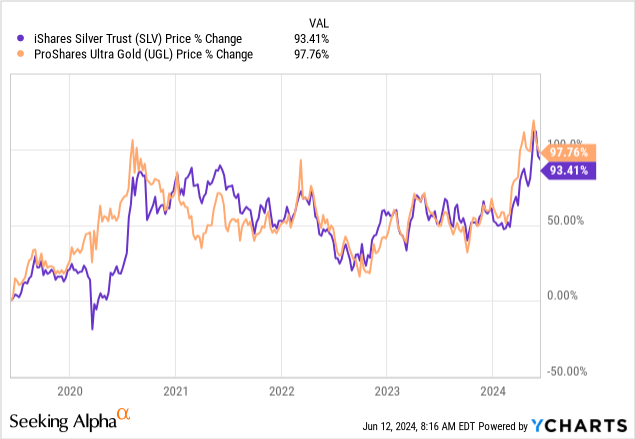

The comparability holds up over the past 5 years.

Certainly, the one time the 2 charts have correctly diverged is from round 2019 till Covid.

In fact, silver does have its personal fundamentals, however they don’t appear to have a sustained impact. If you wish to perceive how and why silver strikes, I feel it makes extra sense to investigate gold and consider it by the lens of leverage.

A Constructive Setting

Importantly for silver, the outlook for gold is bullish. It’s consolidating close to all-time highs and sentiment is constructive. Falling yields ought to be a tailwind as gold will get extra enticing when actual yields are low.

Silver has a bullish chart – it broke to new 10-year highs final month and has fashioned an inverse head and shoulders.

Silver Chart (TradingView)

So long as the present dip holds above $26, the sturdy uptrend ought to stay intact and goal new highs above $32.5. Nonetheless, as I imagine we will deal with silver like a leveraged gold ETF, we should be cautious of lengthy corrections and the influence of damaging compounding. Breaking $26 would recommend a interval of weak spot.

Conclusions

It’s nothing new to say silver is carefully correlated to gold and has greater volatility. Nonetheless, many shall be shocked, it trades precisely like a 2x leveraged gold ETF. Because of this it’s nonetheless so distant from its 2011 peak.

With this in thoughts, silver is suited to sturdy uptrends and the present setting might be very best as costs are breaking above the 2020 peak.