ablokhin

Introduction

It is time to discuss Previous Dominion Freight Traces (NASDAQ:ODFL), an organization I’ve given numerous consideration to in latest months. The newest in-depth article on the less-than-truckload (“LTL”) large was written on July 2, when I referred to as it “One Of My Favourite Dividend Development Shares” within the title.

On high of that, I’ve talked about the corporate in quite a lot of different articles, most of which have been centered on undervalued dividend (progress) shares that make nice buys in an atmosphere the place market power broadens.

Furthermore, I wasn’t simply bullish on the corporate however put my cash the place my mouth was, as I added the inventory to my portfolio on Might 30. The corporate is one among 4 main investments I made this yr. These 4 investments emptied my somewhat giant battle chest, as Previous Dominion Freight Line is now my third-largest funding, accounting for five.5% of my portfolio.

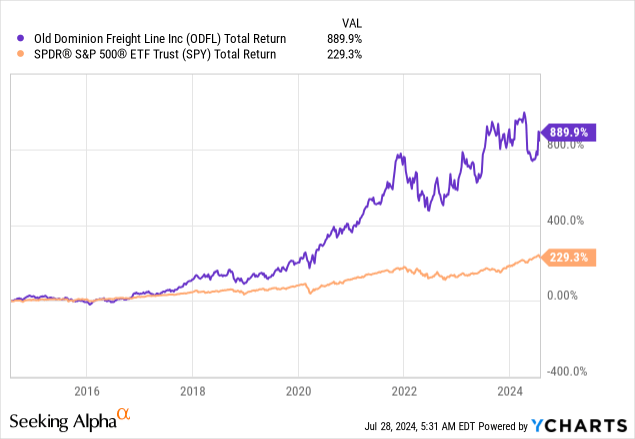

One motive is the stellar begin. Since shopping for, I am up barely greater than 18%, because the ODFL ticker has began a powerful restoration from its lows, which has pushed its ten-year complete return to roughly 890%, a efficiency so excessive that it makes the S&P 500 seem like a boring authorities bond.

The explanation I am writing this text is to replace my thesis. On this case, we are able to use the corporate’s just-released 2Q24 earnings, which have been completely incredible.

Regardless of large strain on cyclical sectors like manufacturing, this industrial-focused LTL large reported an virtually mind-blowing efficiency. It noticed robust pricing energy, enhancing volumes, and continued to decrease its already low working ratio.

I’m satisfied I wager on the correct horse and foresee a lot larger positive aspects, particularly if the corporate will get some assist from recovering cyclical demand within the quarters forward.

Now, let’s dive into the main points!

What Makes ODFL So Particular

With the danger of sounding repetitive, I need to briefly spend a while explaining why I purchased ODFL. Particularly for readers who’re new to ODFL, it helps to higher perceive the numbers we’re about to debate.

As most readers may know, I (often) don’t love to purchase investments that don’t include a moat. Trucking is one among these industries. It is aggressive, cyclical, and vulnerable to what appears like numerous dangers.

Nevertheless, ODFL is a less-than-truckload large. It doesn’t compete with truckload corporations who drive for a single buyer from level A to level B. LTL operations choose up items from a number of prospects, deliver these to service facilities, after which ship them to their vacation spot.

As LTL hundreds often embrace items from a number of prospects, effectivity is vital.

A2Z Market Analysis

That is how the corporate put it in its 2023 10-Okay:

The trucking {industry} is comprised principally of two forms of motor carriers: LTL and truckload. LTL freight carriers sometimes choose up a number of shipments from a number of prospects on a single truck. The LTL freight is then routed by way of a community of service facilities the place the freight could also be transferred to different vehicles with comparable locations. LTL motor carriers usually require a extra expansive community of native pickup and supply (“P&D”) service facilities, in addition to bigger breakbulk, or hub, amenities. In distinction, truckload carriers usually dedicate a complete truck to at least one buyer from origin to vacation spot. – ODFL 2023 10-Okay (emphasis added).

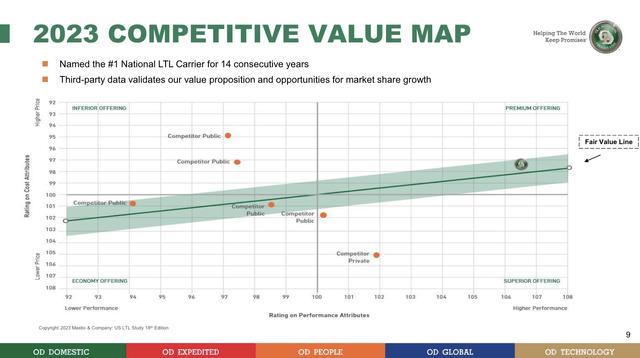

Previous Dominion has perfected the artwork of LTL transport, having received the Mastio & Firm LTL provider award 14 years in a row and constructed a enterprise that comes with pricing energy as a result of its superior service (see beneath).

Previous Dominion Freight Line

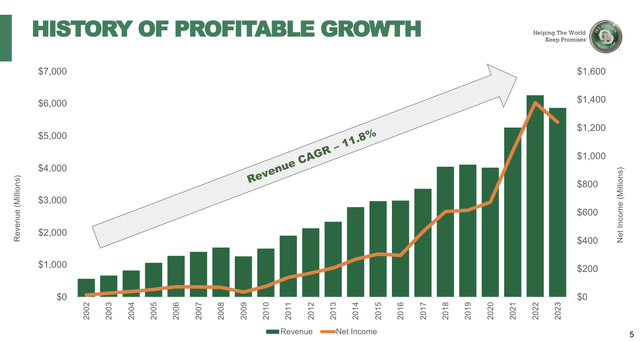

The corporate, which owns virtually all of its service facilities (decreasing lease prices), has grown its income by 11.8% per yr between 2002 and 2023, boosting its market share from 3% to 12% throughout this era – virtually solely organically!

Previous Dominion Freight Line

I’m absolutely conscious that I am beginning to sound like a cheerleader. Nevertheless, this achievement and the aptitude to construct a narrow-moat enterprise in a no-moat {industry} is a incredible achievement.

Having stated that, the just-released earnings have been merely incredible.

ODFL Is Firing On All Cylinders

Within the second quarter, ODFL did what it does greatest: sustaining distinctive service, because it achieved an on-time service degree of 99% and a cargo claims ratio of simply 0.1%.

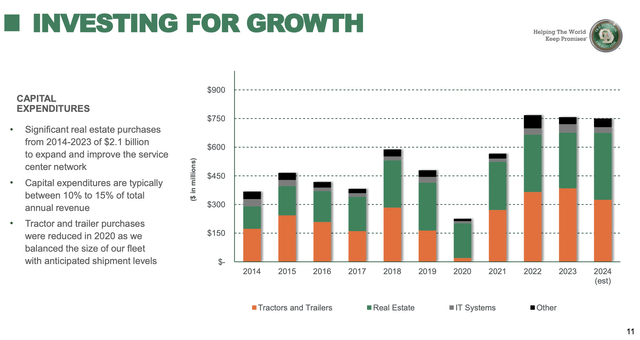

Over the previous decade, the corporate has invested greater than $2 billion in its service heart community, with a further $350 million deliberate for actual property investments this yr.

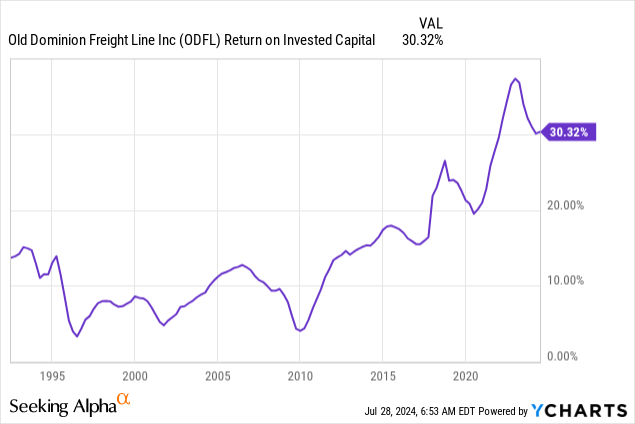

With regard to investments, the corporate has a return on invested capital of 30%, which is extraordinarily excessive and a testomony to its industry-leading capability to successfully make investments cash in its enterprise.

As we simply noticed, these investments have allowed ODFL to virtually double its market share over the previous ten years, offering the infrastructure essential to assist future progress and distinctive service efficiency.

Previous Dominion Freight Line

Furthermore, in keeping with the corporate, with roughly 30% extra capability on the finish of the second quarter, it believes it’s in a fantastic spot to satisfy growing demand because the financial atmosphere improves.

That is extraordinarily necessary to remember, as the corporate is not simply doing effectively on this atmosphere, however it’s also in a position to considerably increase its shipments with out having to speed up capital spending.

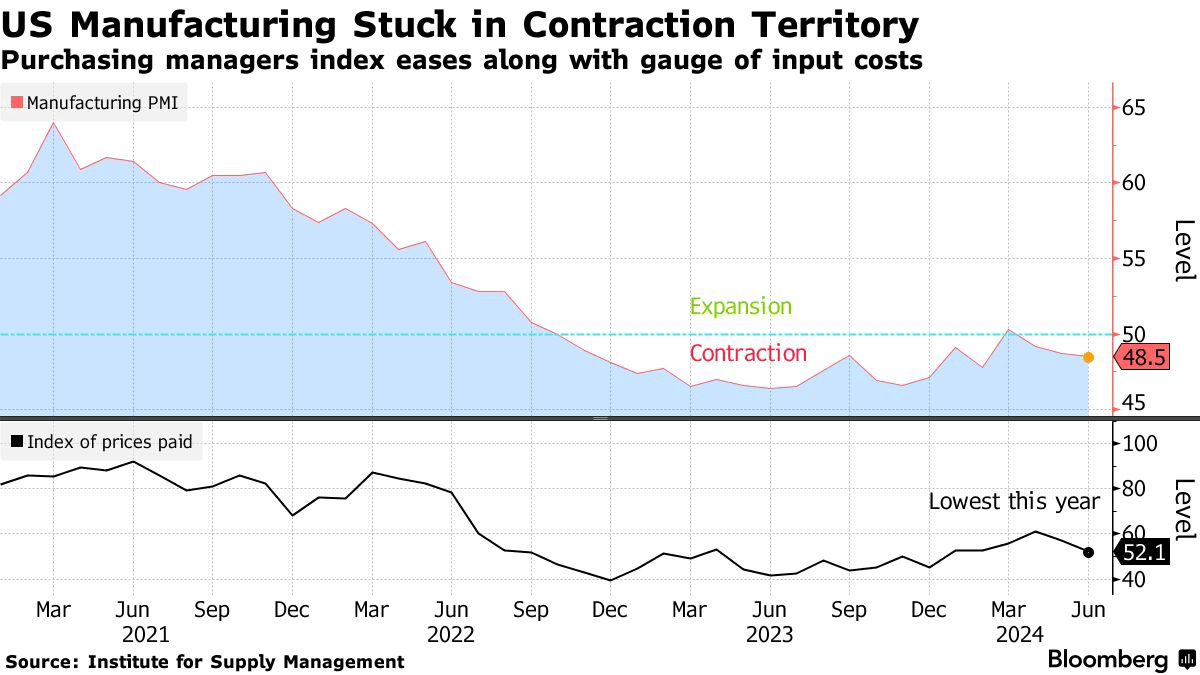

With that in thoughts, after I discuss difficult financial occasions, I imply weak demand in cyclical areas. Through the Q&A session of its 2Q24 earnings name, the corporate famous that as much as 60% of its volumes are associated to industrial operations. The corporate additionally famous the persistent sub-50 ISM numbers.

The ISM Manufacturing Index is a forward-looking financial indicator that has been in a downtrend since 2021 and virtually nonstop in contraction territory for the reason that finish of 2022.

Bloomberg

Usually talking, this doesn’t bode effectively for freight demand and explains why the inventory costs of so many transportation corporations have gone nowhere since 2022.

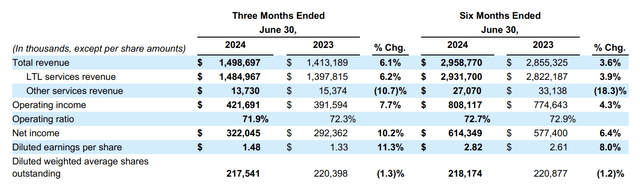

Regardless of these headwinds, ODFL reported income of $1.5 billion, which marks a 6.1% enhance from the prior yr. This progress was pushed by a 4.4% enhance in LTL income per hundredweight and a 1.9% rise in LTL tons per day.

Moreover, the already spectacular working ratio improved by 40 foundation factors to 71.9%, which contributed to an 11.3% enhance in earnings per diluted share.

Notice that the working ratio measures what share of income is used for working bills – the decrease, the higher. An OR within the low 70% vary is gorgeous, as most (extremely environment friendly) railroads have ORs within the 60% vary. A whole lot of trucking corporations have working ratios near 100%.

Furthermore, the truth that ODFL lowered the working ratio in an inflationary atmosphere is terrific and one among many examples of why it actually stands out.

Previous Dominion Freight Line

In accordance with the corporate, the 40 foundation factors enchancment in its OR was supported by the standard of income progress and a sustained deal with operational efficiencies. By successfully managing direct variable prices, the corporate has succeeded in enhancing these prices as a share of income.

Though overhead prices have elevated as a share of income, discretionary spending has been saved minimal. This helped the corporate when it mattered most, as cyclical progress is often the largest driver of upper profitability.

As we’ve typically stated earlier than, the 2 essential substances to long-term working ratio enchancment are the mixture of density and yield, each of which usually require a good macroeconomic atmosphere. – ODFL 2Q24 Earnings Name

Going ahead, the corporate goals for a sub-70% working ratio and sees alternatives for a possible restoration.

That is mirrored in its buybacks.

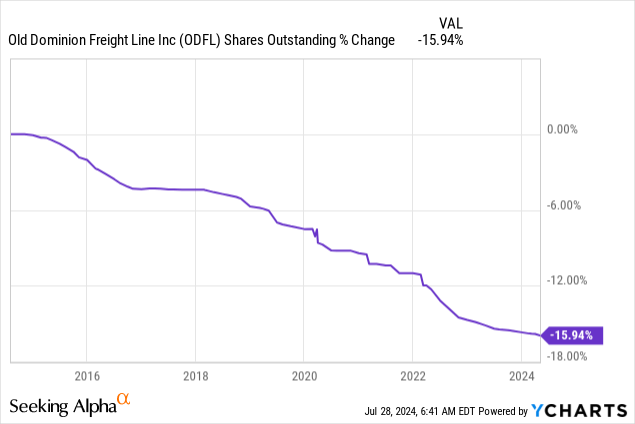

Within the second quarter, ODFL stepped up its buybacks, shopping for again $552 million value of inventory. That is 1.3% of its complete market cap. Over the previous ten years, ODFL has purchased again 16% of its shares, which considerably contributed to its favorable inventory value efficiency.

Aggressive buybacks make sense, as the corporate defined that it wished to make use of its inventory value drop to place cash to good use. As its inventory value rallies, buybacks will doubtless normalize once more.

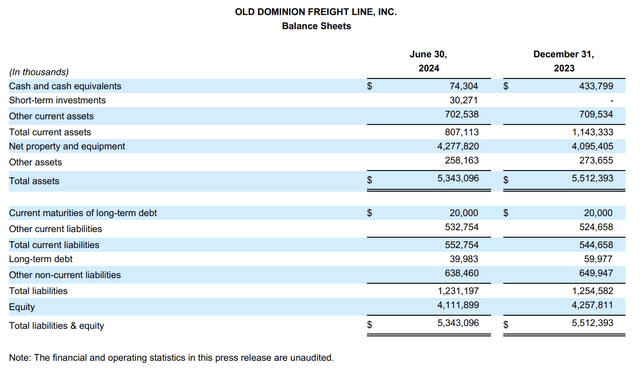

I like this proactive strategy of shopping for again inventory when the inventory is affordable. That is supported by a wholesome steadiness sheet. Subsequent yr, the corporate is anticipated to finish up with roughly $550 million in internet money, which means it has extra cash than gross debt.

On the finish of 2Q24, it had simply $40 million in long-term debt and $74 million in money (excluding short-term investments). This provides it one of many healthiest steadiness sheets in the complete transportation sector.

Previous Dominion Freight Line

ODFL has actually discovered the right way to develop its enterprise and return money to shareholders whereas enhancing its steadiness sheet.

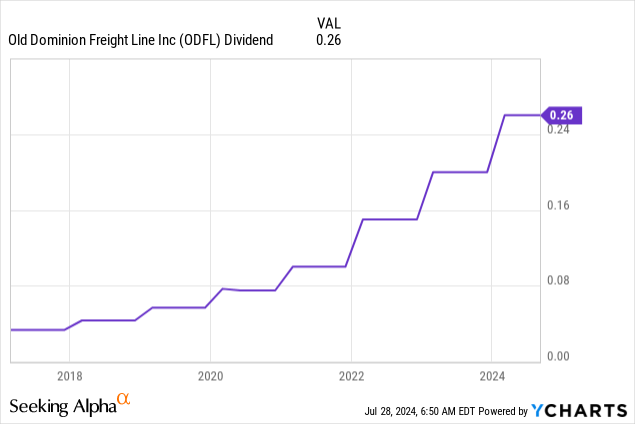

Shareholder distributions additionally embrace a dividend. Though its 0.5% yield is nothing to jot down dwelling about, it comes with a subdued payout ratio of simply 16% and a five-year CAGR of 36%!

Whereas I can’t make the case that ODFL is an effective inventory for income-focused traders, I consider its dividend progress profile and distinctive enterprise mannequin make it a incredible dividend grower for a variety of portfolios.

Valuation

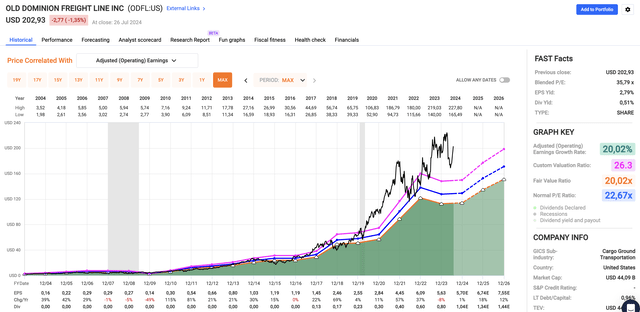

The unhealthy information is that ODFL is not low-cost anymore. After its most up-to-date surge, the inventory is buying and selling at a blended P/E ratio of 35.8x.

Utilizing the FactSet information within the chart beneath, even when we take into account 18% and 12% anticipated EPS progress in 2025 and 2026, we get a good inventory value of $202, which is the place ODFL is presently buying and selling.

FAST Graphs

Nonetheless, these expectations are based mostly on poor financial progress numbers. Any upswing in expectations might set off a big enhance in EPS expectations.

Consequently, the inventory has obtained larger value targets of roughly $215 after its earnings (TD Cowen and BMO Capital), roughly 8% above the present value.

If 2Q24 earnings have been much less spectacular, I’d have gone with a Maintain ranking. Nevertheless, as a result of latest developments, elevated extra capability, and market share positive aspects, I stay bullish on ODFL, which warrants a long-term Purchase ranking.

Takeaway

Previous Dominion Freight Traces has confirmed to be a stellar funding, shortly changing into a high holding in my portfolio.

Now, the corporate’s excellent 2Q24 earnings reinforce my confidence, exhibiting robust pricing energy, effectivity, and a incredible working ratio.

Basically, ODFL’s distinctive LTL enterprise mannequin and strategic investments have allowed it to develop organically, virtually quadrupling its market share.

With a wholesome steadiness sheet and sensible buyback technique, I consider ODFL is poised for elevated long-term progress. For this reason I proceed to view ODFL as a standout dividend progress inventory, particularly as we get a rebound in cyclical demand.

Execs & Cons

Execs:

- Sturdy Development: ODFL has delivered spectacular income progress of 11.8% yearly since 2002, rising its market share from 3% to 12%.

- Environment friendly Operations: Its low 70%-range working ratio and talent to leverage pricing energy set it aside within the aggressive LTL {industry}.

- Monetary Well being: With a pristine steadiness sheet and internet money place, ODFL is well-positioned for future progress.

- Dividend Potential: Regardless of a modest yield, the 36% five-year CAGR and a low payout ratio promise important dividend progress.

Cons:

- Excessive Valuation: ODFL’s present P/E ratio of 35.8x is above its long-term common, suggesting a much less favorable valuation. Nevertheless, in mild of progress potential, I feel it is a “whole lot.”

- Financial Sensitivity: Relying on industrial output, any extended manufacturing slowdown might negatively influence demand.

- Aggressive Business: Regardless of its strengths, ODFL operates in a extremely aggressive {industry} (but much less aggressive than truckload transportation).