Oleksii Liskonih/iStock through Getty Photographs

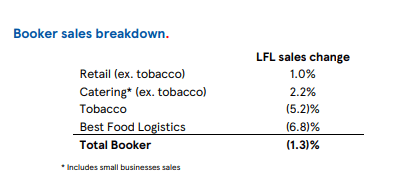

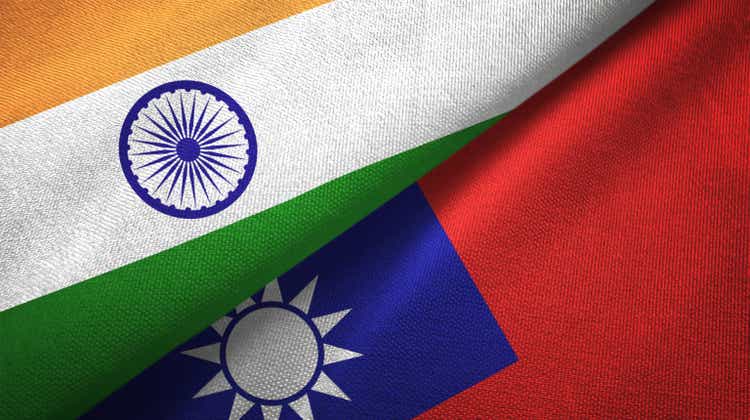

On the finish of Q2 2024, India and Taiwan remained on the forefront of returns, with international traders eyeing potential U.S. charge cuts and the ensuing forex tailwinds from a weakened greenback.

In the course of the second quarter of 2024, rising markets equities held regular, barely surpassing U.S. equities and displaying average outperformance in comparison with their counterparts in developed markets. As soon as once more, most of the similar traits that performed out within the first quarter of the 12 months prolonged into the second quarter.

India and Taiwan continued to guide returns for the MSCI EM IMI benchmark. India’s constructive macro dynamics generated constructive, market-leading returns, whereas Taiwan’s standout firm, Taiwan Semiconductor Manufacturing Firm Restricted (TSM), capitalized on A.I. tailwinds. China looked for footing and notched a constructive quarter. Identical as in Q1, Brazil fared poorly as traders grappled with political instability and fears of excessive authorities spending.

From a macro perspective, the identical points stay. World traders stay under-invested in rising markets equities as they look ahead to a inexperienced gentle to deploy new cash. Whereas many rising markets nations have begun slicing charges, which is often constructive for equities, most traders are ready for the U.S. to start its personal charge slicing in order that the greenback weakens. An accommodative U.S. Federal Reserve (Fed) probably bodes effectively for rising markets equities, which might profit from forex tailwinds on a weakened greenback.

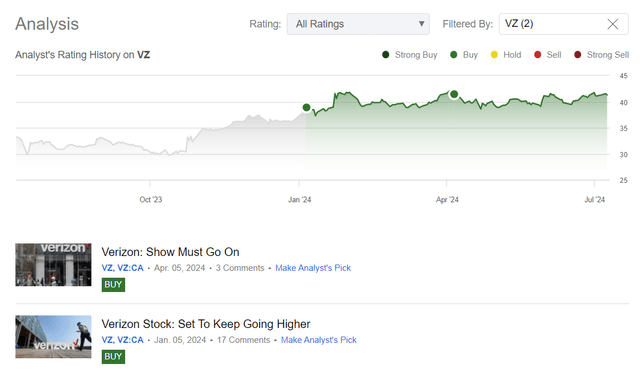

Fund Efficiency

The VanEck Rising Markets Fund (the “Fund”) underperformed the MSCI EM IMI on the quarter-to-date foundation ending June 30, 2024 (+3.51% for the Fund; +5.13% for the Index). The Fund is barely outperforming its benchmark year-to-date (+7.92% for the Fund; +7.41% for the Index). Destructive relative efficiency for the quarter was pushed by allocation (weighting) in Brazil, inventory choice in China and allocation in Georgia. Turkey and South Korea contributed positively for the quarter by means of a mixture of each allocation and inventory choice.

India was the Fund’s high absolute contributor for the quarter, adopted by Taiwan and Turkey. Turkey’s sturdy efficiency is notable, because it was principally pushed by a single title (MLP Saglik Hizmetleri, 3.1% of Fund internet belongings*) during which the Fund holds a big obese place in comparison with the benchmark.

For the second straight quarter, Brazil was a high detractor on each a relative and absolute foundation. However, we stay extremely assured within the compelling funding prospects for our chosen corporations in Brazil, which can profit from an eventual resumption of declining inflation and charges. Of observe, whereas our sizeable holding in MercadoLibre is categorized as Brazil, it ought to actually be thought to be a pan-Latin America firm.

China contributed positively on an absolute foundation, however negatively on a relative foundation. We consider that financial development is uneven, and specifically, home consumption is subdued, partially as a consequence of sluggish decision of property market points. Nonetheless, massive cap Chinese language corporations are demonstrating resilience in top-line development, enchancment in working margins and an elevated willingness to reward shareholders with dividends and share buybacks.

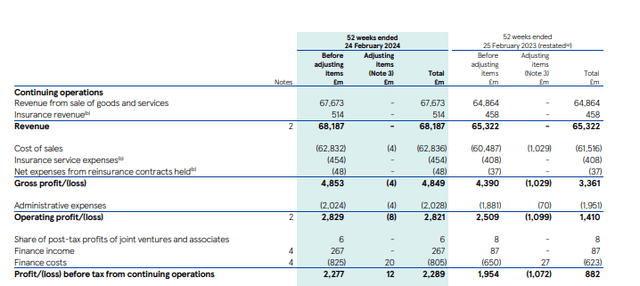

Common Annual Whole Returns (%) as of June 30, 2024

| 2Q2024† | YTD | 1YR | 3YR | 5YR | 10YR | |

| Class A: NAV (Inception 12/20/93) | 3.51 | 7.92 | 14.52 | -9.05 | -0.54 | 1.10 |

| Class A: Most 5.75% Load | -2.44 | 1.71 | 7.94 | -10.83 | -1.71 | 0.50 |

| Class I: NAV (Inception 12/31/07) | 3.61 | 8.18 | 15.08 | -8.56 | -0.04 | 1.61 |

| MSCI Rising Markets Investable Markets Index (IMI) | 5.13 | 7.41 | 13.56 | -4.11 | 3.93 | 3.09 |

| MSCI Rising Markets Index | 5.00 | 7.49 | 12.55 | -5.07 | 3.10 | 2.79 |

|

The desk presents previous efficiency which isn’t any assure of future outcomes and which can be decrease or greater than present efficiency. Returns mirror relevant price waivers and/or expense reimbursements. Had the Fund incurred all bills and costs, funding returns would have been lowered. Funding returns and Fund shares values will fluctuate in order that investor’s shares, when redeemed, could also be value roughly than their unique price. Fund returns assume that dividends and capital positive factors distributions have been reinvested within the Fund at internet asset worth (NAV). Index returns assume that dividends of the Index constituents within the Index have been reinvested. Efficiency data present to the latest month finish is out there by calling 800.826.2333 or by visiting vaneck.com. Bills: Class A: Gross 1.59%; Web 1.59%; Class I: Gross 1.23%; Web 1.01%. Bills are capped contractually till 5/1/25 at 1.60% for Class A and 1.00% for Class I. Caps exclude acquired fund charges and bills, curiosity, buying and selling, dividends, curiosity funds of securities bought brief, taxes and extraordinary bills. |

Fund Evaluation

On a sector stage, Well being Care, Actual Property and Supplies contributed to relative efficiency, whereas Industrials, Financials and Client Discretionary detracted. On a rustic stage, Turkey, South Korea and Saudi Arabia contributed to relative efficiency, whereas Brazil, China and Georgia detracted.

Prime Contributors

Prime contributors to return on an absolute foundation through the quarter:

- MLP Saglik Hizmetleri (3.1% of Fund internet belongings*): MLP Saglik Hizmetleri is the biggest personal hospital operator in Turkey. The corporate has persistently achieved actual gross sales development, outperforming inflation during the last decade. The rising development of holding personal insurance coverage in Turkey has considerably expanded the addressable market. Moreover, we consider that margins will enhance as wage inflation decreases.

- Taiwan Semiconductor Manufacturing Firm Restricted (“TSMC”) (7.8% of Fund internet belongings*): TSMC has skilled upward revisions to earnings forecasts all through the primary half of 2024. Anticipated one-year earnings per share (EPS) development exceeds 20%. This development, mixed with broad sectoral curiosity in semiconductors, has contributed to a robust quarterly efficiency. We anticipate these traits will persist as a consequence of TSMC’s market management and excessive obstacles to entry. Moreover, TSMC’s preliminary strikes to extend capital expenditure (CAPEX) and increase its manufacturing base past Japan are noteworthy. These methods purpose to alleviate geopolitical tensions associated to Taiwan and cut back our danger issues associated to the geographic focus of producing capability.

- Phoenix Mills Ltd (2.7% of Fund internet belongings*): Phoenix Mills Ltd is a diversified actual property developer and operator of enormous retail malls in India. It’s identified for being an distinctive allocator of capital and a disciplined investor. The sturdy efficiency of Phoenix Mills’ shares this 12 months could be attributed to development in earnings from present tasks and elevated expectations for earnings in retail, residential and workplace tasks, each new and present. Notably, the speedy growth of city gentle transport in Indian cities amplifies the attractiveness of Phoenix Mills’ prime places and distinctive product high quality.

Prime Detractors

Prime detractors to return on an absolute foundation through the quarter:

- JSL SA (2.8% of Fund internet belongings*): JSL stays ignored by traders regardless of its stable fundamentals. It’s a development firm with clear aggressive benefits, stable execution, a big addressable market, engaging ROIC ranges and double-digit EPS development (a 3-year CAGR of roughly 30%). The inventory has declined this 12 months regardless of a constructive outlook, with no information or modifications in earnings expectations, and in our view its valuation stays very engaging. JSL share efficiency challenges come up from restricted liquidity, native traders shifting away from illiquid shares, a robust concentrate on short-term positive factors, and encountering redemption pressures. Moreover, the inventory’s outperformance in 2023 has impacted its efficiency this 12 months for technical causes relatively than fundamentals.

- Regional S.A.B. (1.2% of Fund internet belongings*): Regional’s shares have been weak largely as a consequence of political causes, as momentum has shifted because the current election with issues about authorities intervention within the sector and better taxes. Basically, the story has not modified, however the shares might stay risky given the political cycle in Mexico and the upcoming U.S. elections.

- Financial institution of Georgia (OTCPK:BDGSF) (2.3% of Fund internet belongings*): Financial institution of Georgia Group Plc stands as one of many two dominant forces within the Georgian banking sector, holding over 33% of the market share. All through the quarter, the financial institution had surpassed expectations, underpinned by sturdy earnings achieved in 2023, constructing upon an already sturdy efficiency in 2022, with its return on fairness persistently exceeding 25%. Moreover, Financial institution of Georgia lately disclosed the acquisition of a majority stake in Ameriabank, an Armenian financial institution. This strategic transfer is anticipated to be earnings accretive and introduces additional development prospects in a brand new market.

Prime Buys And Sells

In the course of the interval, we established new positions within the following:

- KEI Industries Ltd (“KEI”) (0.7% of Fund internet belongings*): KEI is a number one producer and provider of wires and cables, together with high-voltage and specialty cables. Demand is accelerating in its residence market of India, and the corporate targets optimized capital effectivity by means of a disciplined method to capital allocation that has been profitable and is predicted to be repeatable within the coming years.

- Al Rajhi Financial institution (0.6% of Fund internet belongings*): Al Rajhi, primarily based in Saudi Arabia, is likely one of the largest banks within the area. Regardless of underperforming as a consequence of greater rates of interest affecting its operations, we took the chance to provoke an funding in anticipation of brighter prospects forward, aligning with Al Rajhi Financial institution’s new three-year technique.

- PDD Holdings Inc. (PDD) (“PDD”) (0.6% of Fund internet belongings*): PDD is likely one of the main international e-commerce operators, persistently gaining market share in China and reaching vital success with its Temu model abroad. Though challenges as a consequence of tariff changes could affect the relative worth proposition of its abroad enterprise, we consider that the present valuation greater than accounts for that menace.

- Proya Cosmetics Co (0.5% of Fund internet belongings*): Proya is a cosmetics firm in China benefiting from a persistent enhance in desire for native manufacturers over abroad manufacturers within the business. The corporate has executed effectively and is rising considerably sooner than the business.

- H World Group Restricted (HTHT) (0.4% of Fund internet belongings*): H World owns, operates and franchises inns in China. Home journey has elevated considerably since COVID-19 restrictions have been lifted, and we consider that H World is the best high quality method to capitalize on the home journey development.

In the course of the interval, we exited the next positions:

- ReNew Power World (RNW) (“ReNew”)(0.0% of Fund internet belongings*): ReNew is a developer of renewable power tasks in India. Its pipeline is powerful, however execution has been slower than anticipated and leverage stays excessive. We swapped our holding in ReNew for KEI (see above).

- JD.com (JD, OTCPK:JDCMF) (0.0% of Fund internet belongings*): JD is an e-commerce operator in China. We basically swapped our funding in JD for PDD (see above) as a consequence of higher prospects.

- Fu Shou Yuan Worldwide (OTCPK:FSHUF) (“FSY”) (0.0% of Fund internet belongings*): FSY is a funeral providers and cemetery operator in China. Whereas long-term development for the corporate is stable, partly pushed by mergers and acquisitions, present development stays tepid. Consequently, we felt there have been higher alternatives elsewhere.

- Yum China Holdings (YUMC) (“Yum”)(0.0% of Fund internet belongings*): Yum operates quick meals franchises in China, significantly KFC. Current working outcomes have been disappointing, partly as a consequence of fierce competitors available in the market. The corporate had benefitted from a “international premium” for its choices, however with subdued consumption in China, worth for cash has turn into extra essential, favoring its cheaper rivals.

- SUPCON Expertise Co (“SUPCON”)(0.0% of Fund internet belongings*): SUPCON manufactures and distributes industrial automation gear in China and abroad. We exited our small remaining place as a consequence of a pessimistic outlook for one in all its most essential segments (chemical), weaker-than-anticipated margins and fewer sturdy money circulate projections.

Fund Positioning and Outlook

We stay grounded by our funding course of, and our positioning displays our convictions from a bottom-up foundation. Our course of has created some positioning differentials versus the benchmark, for instance, Brazil stays obese to start out the quarter (11.1% Fund weight versus 4.1% Index weight) as does the Philippines (5.4% versus 0.5% Index weight). South Korea, Taiwan, and China stay underweight versus the benchmark.

The Fund’s goal is to seek out long-term structural development corporations at truthful costs (S-GARP). Investments are chosen primarily based on particular person firm evaluation, specializing in high quality, governance, progressive enterprise fashions and low disruption danger, with energetic administration and detailed analysis guiding our choice course of.

Disclosures

† Quarterly returns aren’t annualized.

* All nation and firm weightings are as of June 30, 2024. Any point out of a person safety is just not a advice to purchase or to promote the safety. Fund securities and holdings could range.

All indices listed are unmanaged indices and embrace the reinvestment of all dividends, however don’t mirror the fee of transaction prices, advisory charges or bills which are related to an funding within the Fund. Sure indices could keep in mind withholding taxes. An index’s efficiency is just not illustrative of the Fund’s efficiency. Indices aren’t securities during which investments could be made.

The MSCI Rising Markets Index is a free float-adjusted market capitalization index that’s designed to measure the fairness market efficiency of rising markets nations. The MSCI Rising Markets Investable Market Index (IMI) is a free float-adjusted market capitalization index that’s designed to seize large-, mid-and small-cap illustration throughout rising markets nations.

MSCI Rising Markets Investable Market Index (IMI) captures massive, mid, small-cap cap illustration throughout rising markets (EM) nations. The index covers roughly 99% of the free float-adjusted market capitalization in every nation.

This isn’t a suggestion to purchase or promote, or a advice to purchase or promote any of the securities, monetary devices or digital belongings talked about herein. The knowledge introduced doesn’t contain the rendering of personalised funding, monetary, authorized, tax recommendation, or any name to motion. Sure statements contained herein could represent projections, forecasts and different forward-looking statements, which don’t mirror precise outcomes, are for illustrative functions solely, are legitimate as of the date of this communication, and are topic to vary with out discover. Precise future efficiency of any belongings or industries talked about are unknown. Data supplied by third occasion sources are believed to be dependable and haven’t been independently verified for accuracy or completeness and can’t be assured. VanEck doesn’t assure the accuracy of third occasion knowledge. The knowledge herein represents the opinion of the creator(s), however not essentially these of VanEck or its different staff.

You’ll be able to lose cash by investing within the Fund. Any funding within the Fund ought to be a part of an general funding program, not an entire program. The Fund is topic to dangers which can embrace, however aren’t restricted to, dangers related to energetic administration, shopper discretionary sector, direct investments, rising market issuers, ESG investing technique, financials sector, international forex, international securities, industrials sector, data know-how sector, market, operational, restricted securities, investing in different funds, small- and medium-capitalization corporations, particular objective acquisition corporations, particular danger issues of investing in Chinese language, Indian, and Latin American issuers, and Inventory Join dangers, all of which can adversely have an effect on the Fund. Rising market issuers and international securities could also be topic to securities markets, political and financial, funding and repatriation restrictions, totally different guidelines and rules, much less publicly obtainable monetary data, international forex and alternate charges, operational and settlement, and company and securities legal guidelines dangers. Small- and medium-capitalization corporations could also be topic to elevated dangers. Investments in Chinese language issuers could entail further dangers that embrace, amongst others, lack of liquidity and value volatility, forex devaluations and alternate charge fluctuations, intervention by the Chinese language authorities, nationalization or expropriation, limitations on the usage of brokers, and commerce limitations.

Investing entails substantial danger and excessive volatility, together with attainable lack of principal. Bonds and bond funds will lower in worth as rates of interest rise. An investor ought to think about the funding goal, dangers, expenses and bills of a fund fastidiously earlier than investing. To acquire a prospectus and abstract prospectus, which include this and different data, name 800.826.2333 or go to vaneck.com. Please learn the prospectus and abstract prospectus fastidiously earlier than investing.

© Van Eck Securities Company, Distributor, an entirely owned subsidiary of Van Eck Associates Company.

Authentic Put up

Editor’s Be aware: The abstract bullets for this text have been chosen by In search of Alpha editors.