Vladislav Chorniy

Welcome to a different installment of our Preferreds Market Weekly Assessment, the place we talk about most well-liked inventory and child bond market exercise from each the bottom-up, highlighting particular person information and occasions, in addition to top-down, offering an outline of the broader market. We additionally attempt to add some historic context in addition to related themes that look to be driving markets or that traders must be aware of. This replace covers the interval via the third week of July.

You should definitely take a look at our different weekly updates masking the enterprise growth firm (“BDC”) in addition to the closed-end fund (“CEF”) markets for views throughout the broader revenue house.

Market Motion

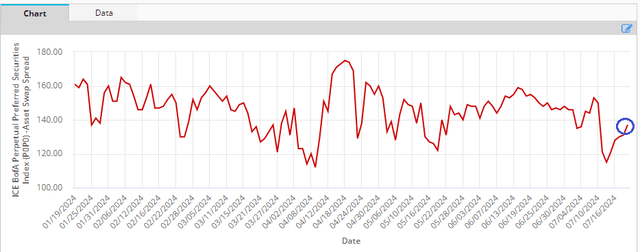

Preferreds had been flat to barely decrease on the week because the drop in Treasury yields was largely offset by the rise in credit score spreads amid common risk-off sentiment. Month-to-date, practically all sub-sectors stay within the inexperienced.

ICE

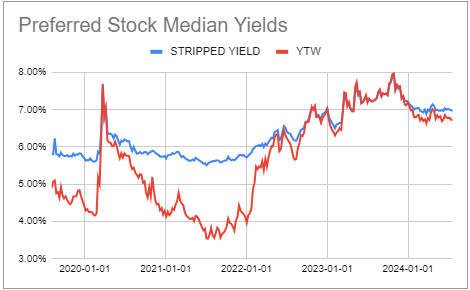

Preferreds yields haven’t moved a complete lot not too long ago, because the adjustments in Treasury yields and preferreds credit score spreads have been largely offsetting.

Systematic Earnings Preferreds Software

Market Themes

We have a tendency to make use of the phrase “yield” when discussing bonds or time period preferreds and this has created some confusion, judging by the feedback. One query was merely what taste of yield are we referring to when discussing securities with outlined maturities?

There are many totally different yields in markets, and we use many variations as effectively in our discussions and repair instruments. This contains stripped yield, present yield, yield-to-call, yield-to-maturity, yield-to-worst, reset yield, pull-to-NAV yield, and many others.

Each time there may be potential doubt about which model of yield we take note of, we specify it. When there isn’t any doubt, we simply use “yield”. In discussions of time period preferreds and bonds, there needs to be little doubt about which model of “yield” is being utilized in a common context as a result of there is just one wise use of the phrase yield within the context of securities with a maturity and that’s yield-to-worst. Yield-to-worst is the “worse end result” or, sometimes, the minimal of yield-to-maturity and yield-to-call. Yield-to-worst shouldn’t be assured to be the precise yield of a given safety into its maturity (the safety is probably not redeemed as anticipated, for instance), however it’s the one definition that’s used throughout the board to check time period securities to one another.

One view has it that “yield” in frequent parlance actually means “ongoing yield” or “present yield” i.e., stripped yield, i.e., coupon/value. This view is uninformed, so we will put it apart. For one, “ongoing yield” shouldn’t be a monetary time period. And two, nobody within the skilled fixed-income investing house means present yield once they say bond yield.

Present yield shouldn’t be a wise metric for bonds and would by no means be utilized in any context. Retail traders who grew up with CEFs might imagine that “yield” within the context of bonds additionally refers to present yield because it does within the CEF context, however that is incorrect.

If something, folks ought to keep away from utilizing the phrase “yield” within the context of CEFs too, and say, “present yield” or, higher, “distribution charge” since for almost all of CEFs, the distribution charge of the fund is much from its underlying portfolio yield. The phrase yield within the context of bonds or time period preferreds is completely wonderful utilization, and will all the time seek advice from yield-to-worst.

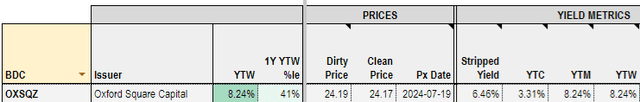

The second supply of yield confusion has to do with preferreds buying and selling at above “par” and previous their first name date. We will illustrate it with the next BDC child bond – OXSQZ. We present the bond’s yield-to-call as 3.3% and its yield-to-maturity as 8.24%. The query is then why bond’s yield-to-worst is the same as 8.24% reasonably than the decrease yield-to-call of three.3%.

Systematic Earnings Preferreds Software

On this case, we do not use the standard rule of yield-to-worst being the minimal of yield-to-call and yield-to-worst. The reason being that the yield-to-call for a bond that may be redeemed instantly at any level shouldn’t be correctly outlined, as it is a one-off return, reasonably than an ongoing yield.

If OXSQZ is redeemed, the more-or-less fast (there will probably be a 30-day discover interval) return to bondholders is +3% (i.e., $25 principal return / $24.17 clear value – 1). This fast +3% return shouldn’t be a worse end result than an ongoing 8.24% yield-to-maturity – it is a greater end result as a result of on an annualized foundation it is a lot increased than 8.24%. This is the reason the “worse” end result on this case is the 8.24% yield-to-maturity, and that’s the reason that is the yield-to-worst quantity for this bond.

If OXSQZ had been buying and selling at a $25.50 stripped value, the more severe end result right here could be the redemption and an instantaneous 2% hit. In that case, the yield-to-worst could be -2%.

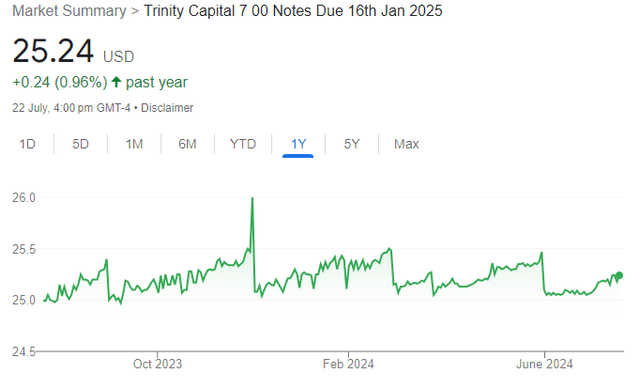

A last yield confusion has to do with whether or not to make use of the soiled value or clear / stripped value in yield calculations. Child bonds, not like OTC bonds, commerce soiled, i.e., the value contains the accrued dividend which then drops out of the value on the ex-div date. This is the reason you usually see quarterly sharp drops in child bond costs comparable to the next. To correctly calculate the bond’s yield, we have to take away the accrued dividend. For that, we additionally must know the beginning of the accrual interval, which usually coincides with the dividend cost date (not the ex-div date as could be anticipated). This final level has a reasonably minor impression.

Monitoring child bond yields is trickier than it appears to be like at first look, nonetheless, attending to grips with the suitable calculations places traders in one of the best place to gauge worth available in the market.

Market Commentary

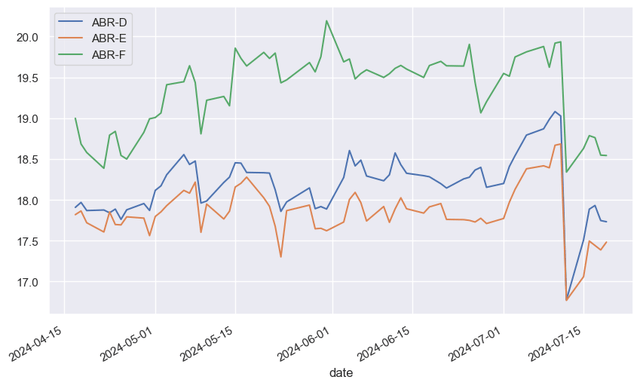

Mortgage REIT Arbor Realty Belief (ABR) shares fell sharply late final week on disclosure of a probe by the DOJ and FBI into the corporate’s mortgage portfolio, presumably the marks at which the loans are carried. Final Friday, the preferreds fell round 10% earlier than recovering considerably this week.

Systematic Earnings

Recall that a few short-sellers Viceroy and NINGI have been alleging for an extended whereas that the worth of the corporate’s mortgage portfolio is overstated. Viceroy has numerous specifics in its commentary (which have to be taken with a grain of salt as there are some assumptions baked into the “details”) nonetheless it’s laborious to know what the total mortgage e book appears to be like like – there are all the time going to be particular person issues, notably within the present market with important points within the multi-family section and a provide overhang.

The lengthy excellent criticism of ABR is its comparatively low stage of CECL stability (mainly the quantity of losses they anticipate within the portfolio) within the context of a lot of mortgage modifications. The consensus appears to be that e book worth is overstated, although maybe not egregiously so, as auditors have been signing off. ABR’s energy is probably going its $1bn+ money place, which supplies it numerous choices when confronted with problematic loans. This implies they received’t have to fireplace sale problematic belongings midway via renovation or development.

An eventual drop in short-term charges might then enhance liquidity and financing choices, no less than that’s the hope. Financing through CLOs can also be a robust non-recourse mitigant because it protects the remainder of the corporate’s portfolio from particular person issues. It appears unlikely the DOJ goes to ship prison convictions right here given its observe document throughout the GFC, and ABR might all the time level a finger on the auditor for signing off on the marks. On the similar time, value weak spot is more likely to persist given the uncertainty across the probe.