designer491

I just lately penned an article on the Simplify Brief Time period Treasury Futures Technique ETF (TUA), calling the TUA a hedge in opposition to an financial downturn with a optimistic carry. The TUA could also be a superb hedge in opposition to an financial downturn as a result of the Federal Reserve will seemingly loosen financial coverage to stimulate the financial system, which ought to decrease short-term charges and profit the TUA.

For traders involved about TUA’s comparatively larger volatility, can they get the identical type of safety by shopping for 2-year treasury notes by way of investments just like the US Treasury 2 12 months Be aware ETF (NASDAQ:UTWO)?

In my view, UTWO’s potential advantages from decrease short-term rates of interest could also be too modest to be helpful as a hedge. UTWO is extra suited to conservative traders who imagine short-term rates of interest have peaked and are keen to just accept modest length threat for doubtlessly larger complete returns in comparison with treasury payments.

Fund Overview

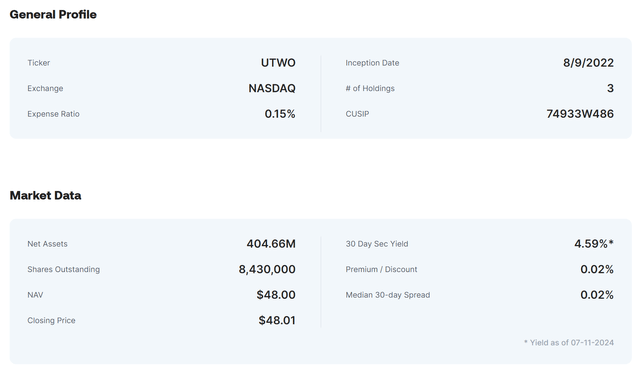

The US Treasury 2 12 months Be aware ETF supplies traders with publicity to 2-year treasury notes by monitoring the ICE BofA Present 2-12 months US Treasury Index. The index fashions the returns of a rolling place in 2-year treasury notes. The UTWO ETF has $405 million in belongings and fees a comparatively low 0.15% expense ratio (Determine 1).

Determine 1 – UTWO overview (ustreasuryetf.com)

Fund Holdings

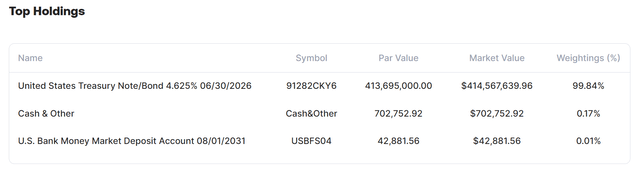

UTWO’s technique and holdings are quite simple to grasp. The UTWO ETF holds an unlevered place in 2-year treasury notes that’s rolled month-to-month (Determine 2).

Determine 2 – UTWO portfolio holdings (ustreasuryetfs.com)

UTWO Delivers Modest Returns…

With such a easy technique, UTWO’s returns are equally modest. Since inception, the UTWO ETF has delivered 1.9% common annual returns, with 4.1% returns up to now yr (Determine 3).

Determine 3 – UTWO delivers modest returns (ustreasuryetf.com)

…And Passes Via Distributions

In my view, the primary advantage of the UTWO ETF is it saves traders the trouble of proudly owning 2-year treasuries and having to roll their positions each month to keep up their maturity at 2 years.

The UTWO ETF additionally passes by the curiosity earnings earned from the underlying treasury notes to traders by a month-to-month distribution. UTWO’s most up-to-date distribution was $0.18876375 / share, which annualized to a 4.7% yield.

2-12 months As A Hedge Towards Financial Downturns

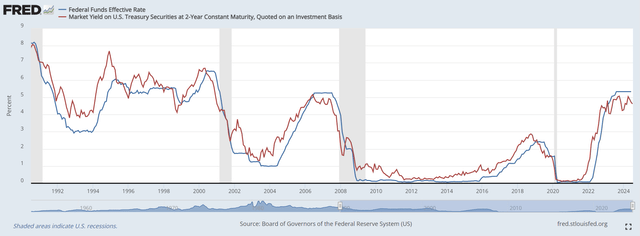

In prior articles, I’ve written that betting on decrease short-term rates of interest just like the 2-year treasury yield could also be a superb hedge in opposition to financial downturns. It’s because when the financial system turns bitter, the Federal Reserve has traditionally lowered its coverage charges to stimulate the financial system, and decrease Fed Funds charges feed by to short-term yields just like the 2-year yield (Determine 4).

Determine 4 – 2-year yield is carefully tied to Fed Funds charges (Creator created with knowledge from St. Louis Fed)

Nonetheless, for an unlevered short-duration fund just like the UTWO, the optimistic impacts from decrease short-term yields could also be modest.

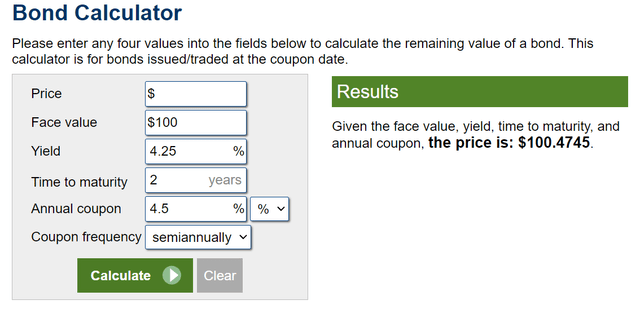

For instance, a 2-year treasury bond has a length of ~2 years and can acquire roughly 0.47% in worth when rates of interest decline by 0.25% (Determine 5).

Determine 5 – Hypothetical MTM acquire of a 2-year bond from a 0.25% decline in rates of interest (calculator.web)

Have a look at SHY For Steerage

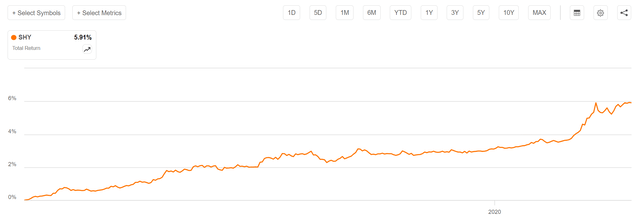

Though the UTWO ETF doesn’t have a protracted working historical past, so we can not inform the way it will behave in an curiosity rate-cutting cycle, we will have a look at comparable funds for steerage. For instance, the iShares 1-Three 12 months Treasury Bond ETF (SHY) has an analogous technique of rolling short-term treasury notes with a portfolio length of 1.eight years.

From March 2019 to March 2020, when the Federal Reserve reduce the Fed Funds charge from 2.25% to zero, the SHY ETF returned 5.9% (Determine 6).

Determine 6 – SHY complete returns from March 2019 to March 2020 (In search of Alpha)

This may be defined as roughly 4.5% in MTM beneficial properties from decrease rates of interest, and 1.5% return from the typical yield.

Except traders have a big place within the UTWO ETF, its modest returns in a possible rate-cutting cycle will unlikely have an excessive amount of of an affect to offset portfolio losses elsewhere.

Twos Vs. Payments, Which One To Choose?

Nonetheless, for traders who imagine the present curiosity rate-hiking cycle is over, the UTWO ETF does have utility. Whereas the UTWO ETF is barely yielding 4.7% in comparison with treasury invoice funds just like the US Treasury Three Month Invoice ETF (TBIL) which is yielding 5.1%, if we begin to issue within the potential mark-to-market (“MTM”) beneficial properties from decrease short-term rates of interest, the UTWO ETF might have larger complete returns going ahead.

Nonetheless, on the flip aspect, if short-term rates of interest don’t decline, for instance, if inflation reaccelerates and traders improve bets on the Fed elevating rates of interest, then the UTWO ETF might undergo MTM losses.

The important thing consideration is that treasury payments are riskless securities, whereas 2-year treasury notes have a really modest quantity of length threat. Selecting between UTWO and TBIL requires one to have a view on short-term rates of interest. If one believes short-term rates of interest have peaked and are moderating, then UTWO ought to outperform TBIL.

Conclusion

The US Treasury 2 12 months Be aware ETF is an easy ETF giving traders publicity to 2-year treasury notes.

In contrast to the TUA ETF, I don’t imagine the UTWO ETF is beneficial as a portfolio hedge as a result of its beneficial properties in an opposed financial state of affairs could also be too modest to offset portfolio losses elsewhere.

In my view, the UTWO ETF is greatest suited to conservative traders who imagine short-term rates of interest have peaked and are keen to just accept very modest length threat for doubtlessly larger complete returns than treasury payments. I charge the UTWO ETF a maintain.